EM portfolio inflows fall m-o-m in July, but equity + debt flows are continuing to recover -IIF

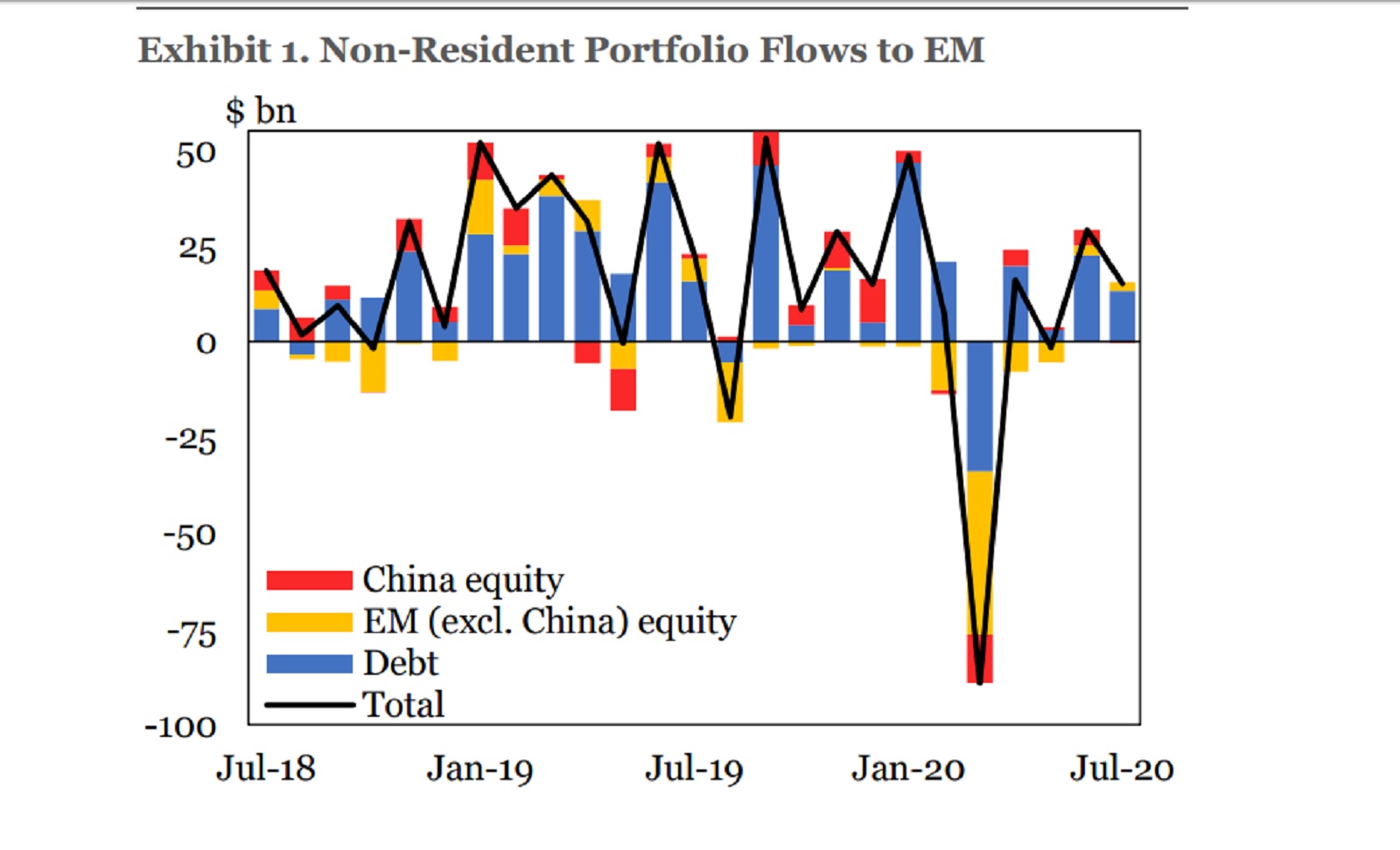

Net emerging markets portfolio inflows nearly halved in July to USD 15.1 bn from USD 29.2 bn in June, according to the Institute of International Finance’s (IIF) monthly capital flows tracker. The m-o-m decline comes as “hard data are still lagging behind” a recovery in investors’ sentiment on the outlook for EMs, the IIF says.

On the flipside, equity and debt flows continued to recover, posting a positive performance for the second consecutive month. Equity flows to EMs excluding China during July hit USD 2.3 bn, while debt flows were at USD 13.2 bn. According to the report, the positive performance came as “investor appetite [was] underpinned by a falling USD and an accommodative Federal Reserve” but the “dim” outlook for global economic growth and persistent concerns about fresh outbreaks of covid-19 weighed on performance.

Sovereign debt issuances are also showing a “shift in sentiment” as many EMs show “deeply discounted valuations” and attractive maturities. The IIF also says that “some of the more beaten down parts of the capital markets” are now picking themselves back up, and investors are keeping an eye on the sustainability of the upwards trend.