Covid-19 shows investment risks and rewards in individual EM economies vary more than ever

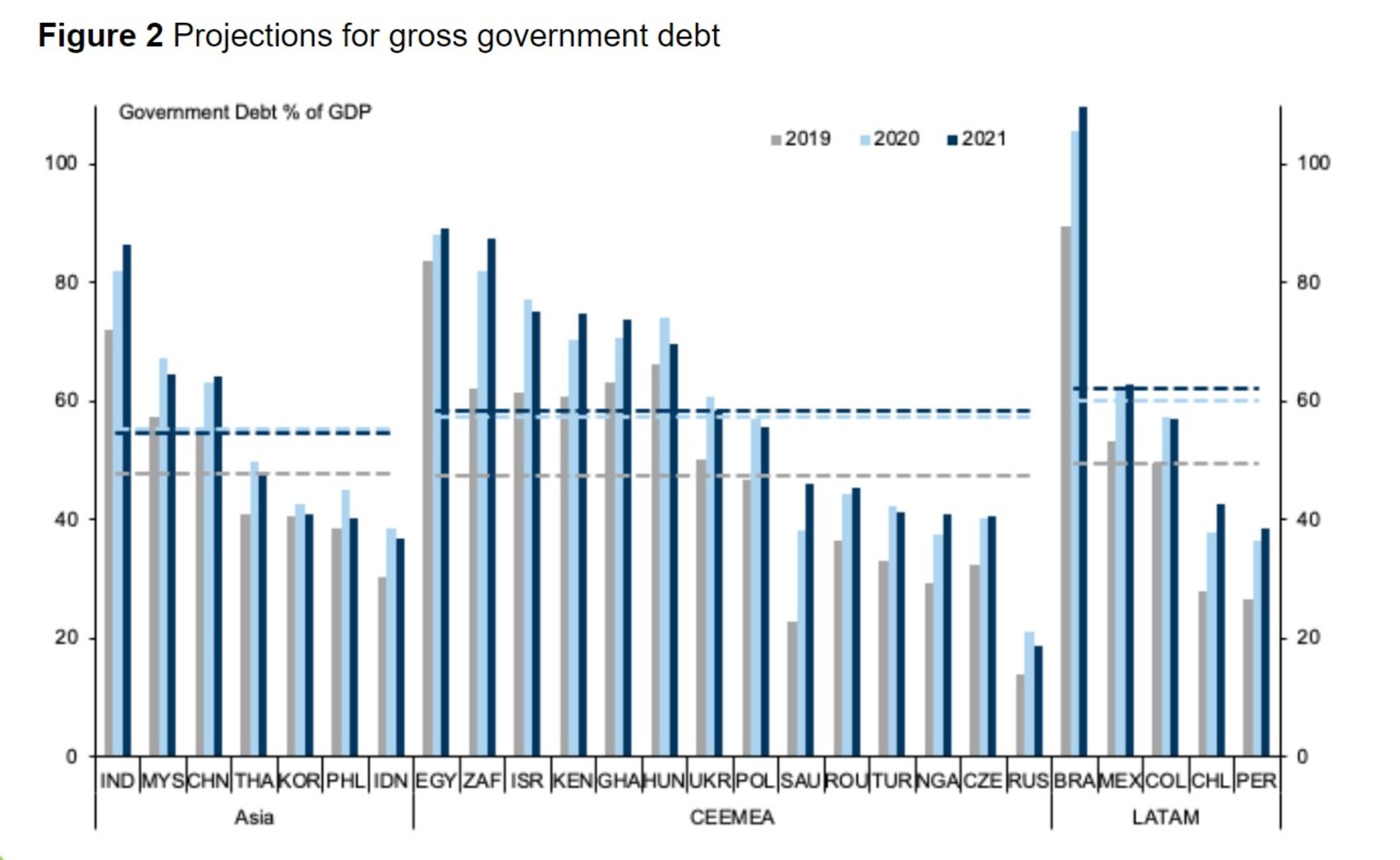

Covid-19 underlines the home truth that you can’t just lump EMs together in a homogeneous asset class — and the extent to which investment risks and rewards in individual EM economies vary. Recovery in different emerging market economies is being determined by (the vastly different) approaches taken to tackling the pandemic, putting individual countries on different economic trajectories that makes them less homogeneous, Robeco’s global head of fundamental equities Fabiana Fedeli writes in the Financial Times. And with the variation in recovery paths come disparities in the impact of three core EM economic vulnerabilities, Fedeli says. For example, South Africa — whose gross external debt to FX reserves ratio is at 300% — is significantly more exposed to credit default risks than Taiwan, where the ratio is just over 40%.

For long-term rewards, investors should decouple EMs from each other and assess them as individual countries — not as a collective asset class. The potential impact on investment returns will be felt even by the North Asian countries that are closer to economic recovery, especially China. Governments currently pouring money into economic stimulus packages could up the regulation around returns in a bid to increase their inflows. Global supply chains are likely to face continued disruption, as localization increases and companies seek less reliance on a single overseas supplier. And consumption habits will remain low, impacting domestic demand for leisure and travel especially, until a covid-19 vaccine is widely available. This means it’s essential that risks and possibilities for outsized returns are assessed on a country-by-country basis.