Gov’t fiscal measures fail to slow EGX sell-off

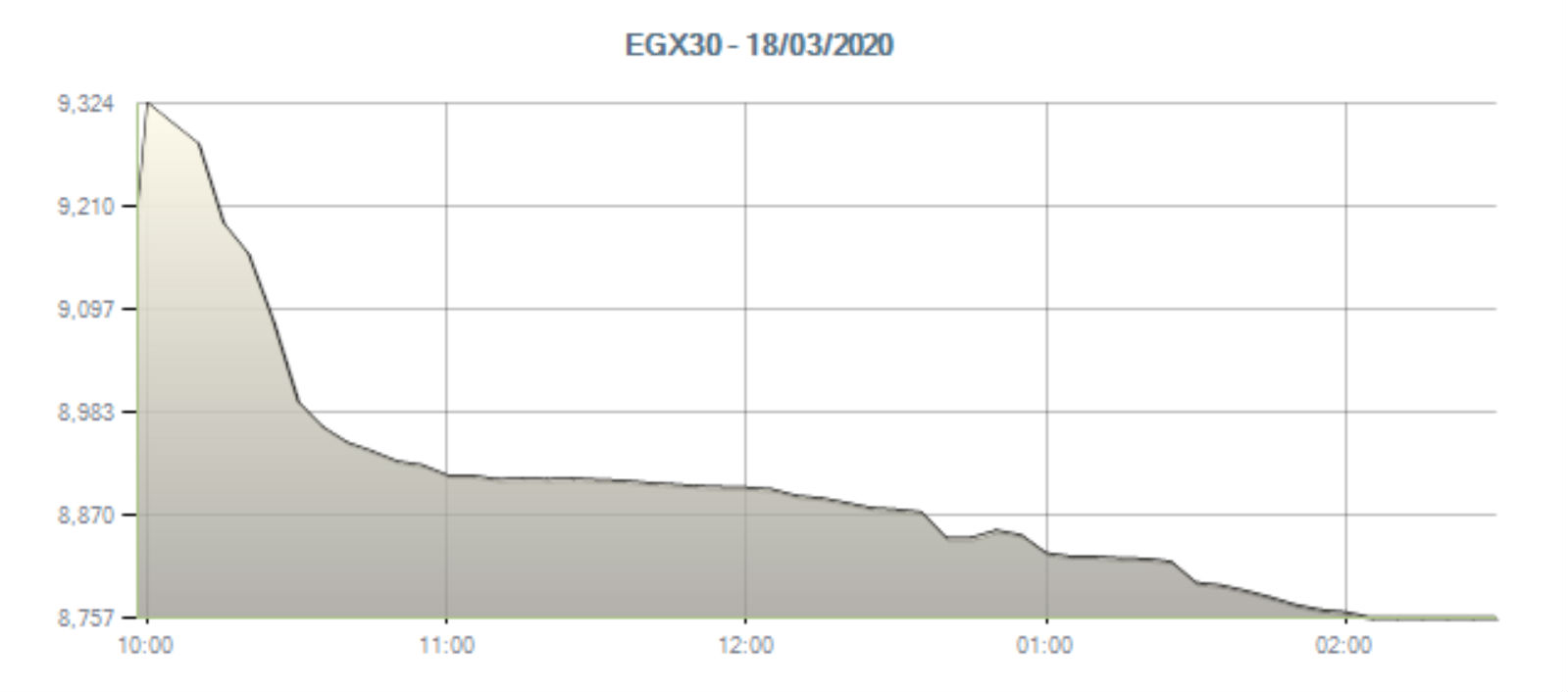

The EGX30 index closed in the red yesterday for the fourth consecutive day as concern among investors over the economic impact of the covid-19 outbreak and turbulence in global markets showed no sign of lifting. The benchmark EGX30 index fell 3.8% in the first hour of trading, before extending its losses to close down 4.8%. Circuit breakers were triggered for the fifth time this month toward the end of the session after the broad-based EGX100 index fell more than 5%. The drop came despite the government announcing on Tuesday a raft of new measures to support the economy which included energy price cuts, a real estate tax holiday for the industrial and tourism sectors, and stamp and dividend tax breaks for EGX investors.

Juhayna and Cleopatra Hospitals Group were the only two EGX30 constituents to see gains: Juhayna gained 1.4% and CHG was up 0.5% at the close of play. Orascom Development Egypt, Dice, and GB Auto all finished deeply in the red, down 9.7%. Index heavyweight CIB lost 4.4%.

Yesterday’s slide means the EGX is now the worst-performing index in the region YTD: The EGX30 has plunged almost 22% this week alone and is now down 37% YTD, a bigger fall than the Abu Dhabi and Dubai exchanges which both saw modest gains yesterday. The EGX30 has

Stock buybacks are all the rage right now: GB Auto said yesterday (pdf) it is purchasing 2.1 mn treasury shares, Egyptians for Housing and Development purchased 20.6 mn shares (pdf), while Egypt Kuwait Holding (EKH) bought back 423k shares (pdf). Arabia Investments Holding is also purchasing another 5.65 mn in treasury stock, in addition to the 1.4 mn bought on Monday. The company has plans to continue purchasing shares pursuant to the 10% max threshold outlined by the FRA, according to an EGX disclosure (pdf).

Background: A growing number of EGX companies have resorted to buying back stock in recent weeks after the Financial Regulatory Authority eased rules to support share prices through the current market volatility.