Egypt’s banking sector offers interesting prospects for international investors

Egypt’s banking sector offers solid prospects for international investors: Egypt’s favorable interest rate climate, the relatively small market capitalization of some of the country’s largest banks compared to emerging market peers, and a largely unbanked population are all draws for international investors, Dylan Waller writes in Seeking Alpha. Indicators are moving in the right direction after the 2016 float of the EGP: falling inflation, an increase in foreign exchange reserves, a reduction to the current account deficit, and an increasingly stable EGP are backed by robust economic growth, which banks are now set to capitalize on, Waller argues.

Know this: Bank loans in Egypt grew 13.6% y-o-y and deposits grew 12.3% y-o-y in FY2018-2019, while the total number of debit and credit cards in use has nearly doubled since FY2010-2011.

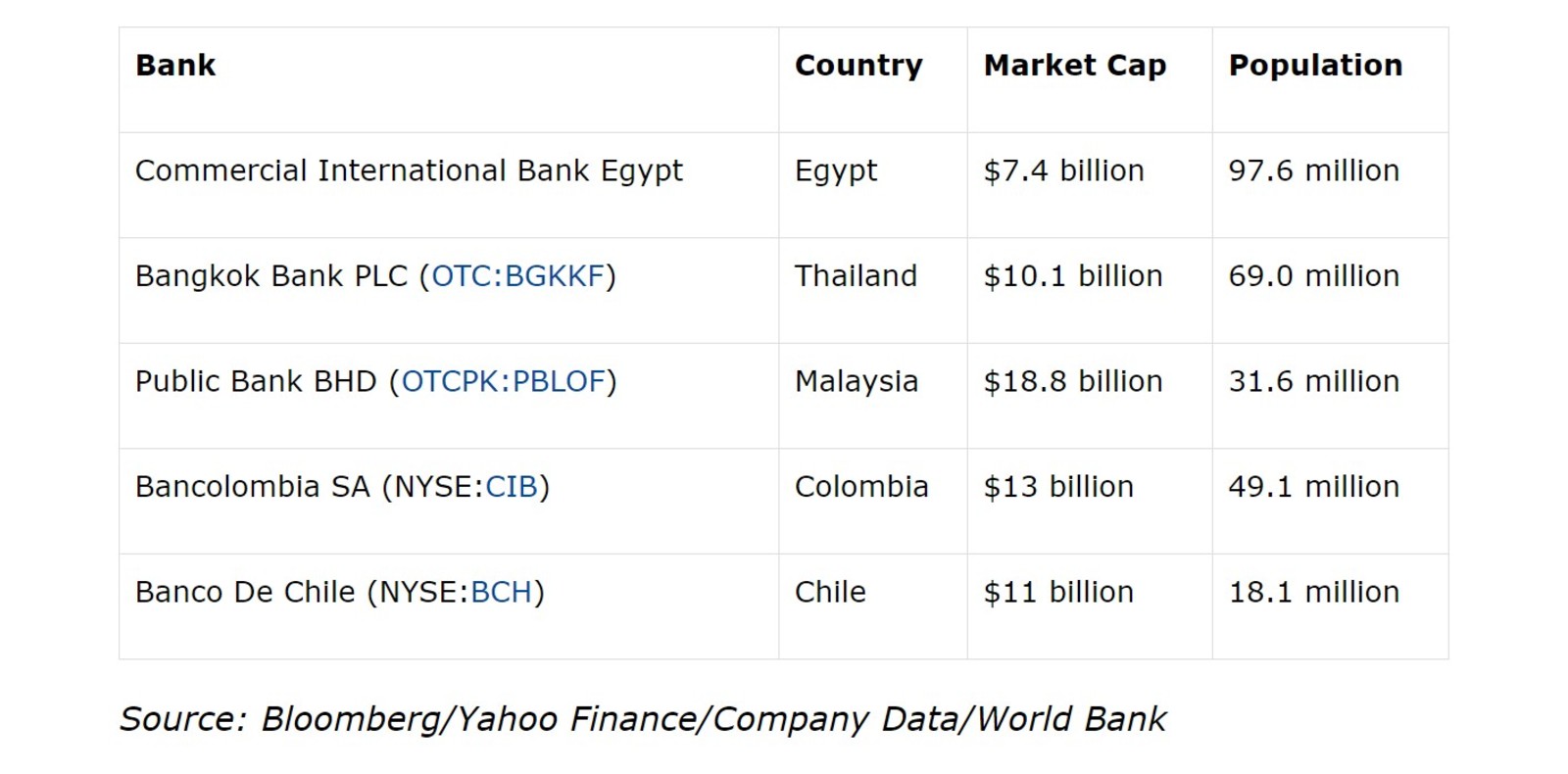

Interest rates continue to outperform EM peers despite easing cycle: Declining interest rates have allowed banks to enjoy healthy net interest margins, but the benchmark rate in Egypt remains higher than many other EMs. And reductions in the cost of capital will support local businesses, as well as banks such as CIB that provide loans to them. Meanwhile, factors including the relatively small market capitalization of some of the largest banks in Egypt, compared with their EM peers (CIB has a market capitalization of USD 7.4 bn), and the country’s large unbanked population (only an estimated 32.8% of Egypt’s population currently has access to a bank), shows how much room there is for growth.

What’s Seeking Alpha tipping? Start with CIB, Waller’s go-to option for international investors to gain exposure to Egypt’s banking sector. The largest bank in Egypt in terms of net income and assets, CIB has “an exceptional retail footprint in Egypt” and has delivered bottom-line growth of 450% between 2009 and 2019, Waller says. The bank’s stock price also remained relatively strong during Egypt’s last economic downturn, he notes.

Then look at Global X MSCI Egypt ETF, which offers broad exposure to the stock market, investing over 20% of its assets in the financial services sector in Egypt, while also offering exposure to some of the country’s top consumer and healthcare companies, including Cleopatra Hospitals, Eastern Tobacco, Juhayna, and Telecom Egypt. The ETF is trading at a near three-year low, Waller argues.