What we’re tracking on 18 December 2019

Talking point of the morning: The flu. At least one Cairo-area private school has closed early for the Christmas holiday and two others have sent updates to parents amid warnings that this year’s flu season could be particularly nasty. New Cairo British International School (NCBIS) said it was sending students and staff on holiday early “on advice from the Ministry” and would re-open as planned on 12 January 2020. The decision was made for “the health and safety of everyone,” the note said. The American International School in Egypt (AIS) reportedly told parents earlier this week that it had found its first “reported case that tested positive for H1N1 virus” (that’s the so-called “swine flu”). Cairo American College (CAC) said last night that it doesn’t currently see the need to close early, but urged everyone to “take everyday preventive actions to help stop the spread of the flu virus.”

Have more than a couple of people in your workplace? Take basic precautions, folks. Remind staff to cover their mouth and nose when they cough, to wash their hands often, and to stay home if they have flu-like symptoms.

Should you be freaked out? Not yet. But you need to pay attention. The US Center for Disease Control warns that flu season could peak earlier this year, with the apex of the annual outbreak possibly coming this month. Kids and the elderly are particularly vulnerable to complications. WebMD has lots more about the flu and Ars Technica has a good rundown on CDC’s warnings as well as on reports that this year’s flu includes an “unusual type” that’s dominating the early start to the season.

Look for the EGP’s rally this week against the greenback to continue getting attention in the press as analysts line up to explain what the currency’s improved performance means for the future. There are diverging opinions on where the EGP will be next year, with Naeem Brokerage’s Allen Sandeep telling Reuters the FX rate could hit EGP 15.75 / USD 1 in 1Q2020, while Renaissance Capital’s Ahmed Hafez tells the newswire the currency could weaken in 2020. RenCap sees lower inflows from fixed income portfolios and reduced Egyptian treasury purchases, and expects the current account deficit to push a depreciation in the EGP, “which is already trading at a premium to its long-term average REER [real effective exchange rate].”

*** Tell us what you think will happen in 2020 and maybe we’ll send you an Enterprise mug and our very own coffee: Your view on where the EGP will be next year is one of the key questions in our 2020 Enterprise Reader Poll, which also asks you if your company is hiring, how optimistic you are about the economy in the new year, and other questions designed to take the pulse of our community. Tell us, and we’ll share the results with the entire community in early January to help you shape your view of the year. The survey is quick, we promise.

You can take the Enterprise Reader Poll here.

As a token of our thanks, we’re going to send 40 readers their very own Enterprise mug and a bag of our special coffee blend, produced in association with our friends at 30 North. Want a chance to get a mug of your own? Make sure you give us your name and complete contact information at the bottom of the survey.

Finance nerds should keep their ear to the ground today: The market for corporate paper looks like it’s about to get a shot in the arm. Word on the street is that EFG Hermes is about to take to market a short-term bond issuance for a high-profile real estate outfit in what could be the first offering of its kind under a new regulatory framework introduced by the Financial Regulatory Authority (FRA) last year. The FRA said yesterday that it had greenlit an offering, but did not name the issuer, saying only that EGP 2 bn-worth of short-term bonds would be issued, with the proceeds earmarked to finance working capital. If it goes through, it would be the first issuance of corporate paper in Egypt (other than securitized bonds) in almost a decade.

Sound smart: The new FRA rules allow joint-stock and limited liability companies, banks, financial institutions and SMEs to sell short-term debt instruments with maturities of less than two years to retail and institutional investors. Issuers must have two years’ worth of financial statements audited by an FRA-approved auditor, be investment grade themselves (at least a BBB- credit rating), and appoint a FRA-approved lead manager.

Assistant secretary for the US State Department’s Bureau of Near Eastern Affairs David Schenker arrived in Egypt yesterday for a trip that will see him meet unnamed “senior Egyptian officials” and officials from the Arab League, according to a State Department statement. Schenker, who is in town until Friday, will also visit Sinai to visit the multinational force and observers in the peninsula.

Oil prices eased from a three-month high on the back of a report that showed “surprise builds” in the US’ crude inventories, Bloomberg reports. “Oil futures ended Tuesday’s session just 6 cents shy of the USD 61 mark, buoyed by rebounding U.S. factory production and progress between [the] world’s two largest economies on trade,” the business information services says.

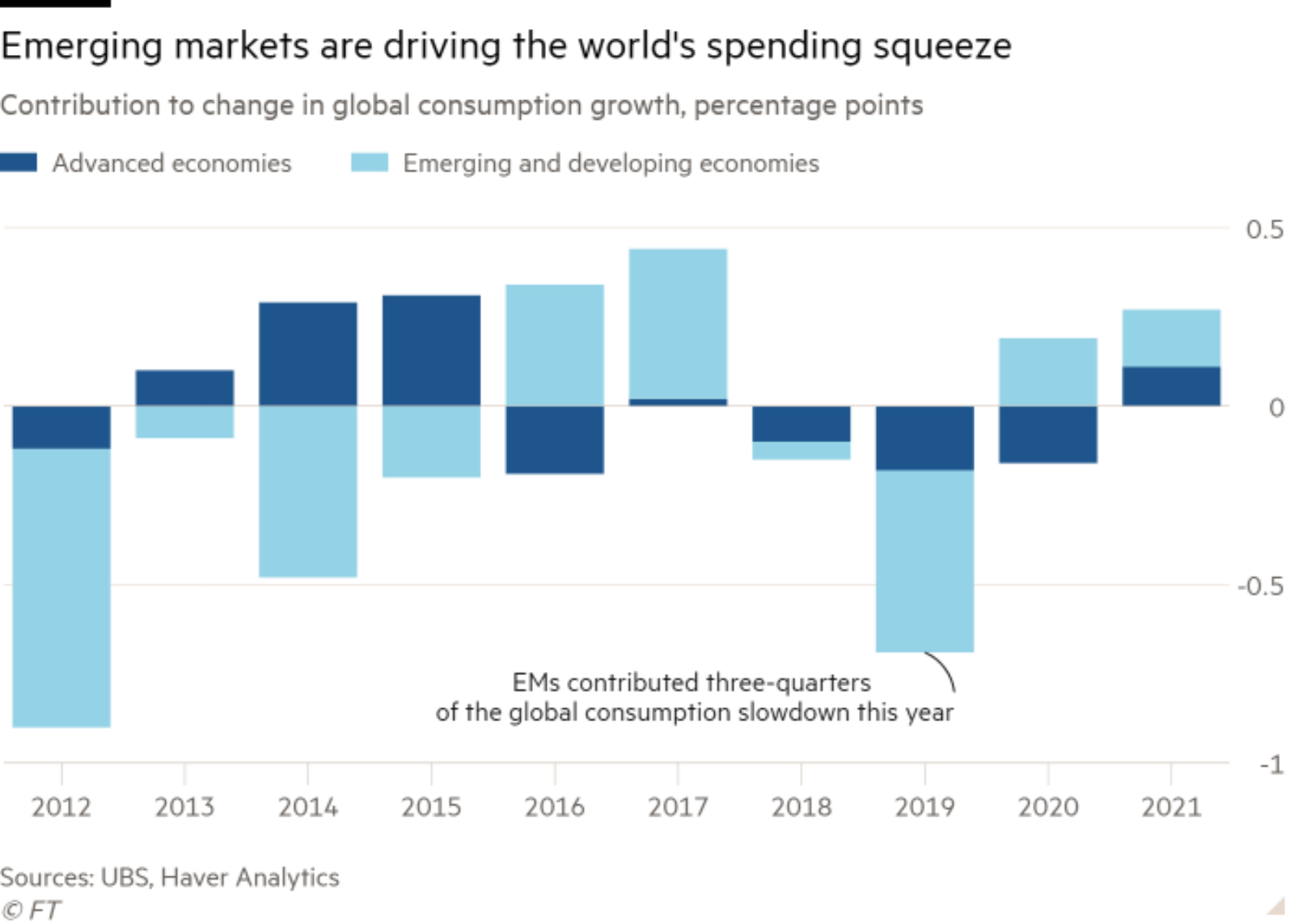

Fingers pointed at emerging markets as global consumption slows: UBS economists say that falling spending in emerging markets has been largely responsible for a slowdown in global consumption this year, the Financial Times says. Growth of global consumer spending and GDP are on course to hit decade lows this year, with EMs accounting for around 80% of the slowdown.

It has been a tough year to be a fintech unicorn: Amid the record equity prices and plunging bond yields, 2019 has seen many a fintech unicorn fall on its face. The Wall Street Journal looks at the headwinds fintech companies face, including unreliable technology, small consumer bases and business models that focus more on finance and less on tech.

Mideast-focused healthcare chain under fire from short seller: Shares of UAE-based NMC Health tumbled 27%, the London-listed company’s sharpest-ever decline, on the back of a report by short seller Muddy Waters alleging that the company’s “financial statements hint at potential overpayment for assets, inflated cash balances and understated debt,” according to Bloomberg. Shares of LSE-listed Finablr, which shares a founder with NMC and which went public this year, fell yesterday on the NMC news, Bloomberg reports.

Other business and international news you should know:

- Boeing will suspend production of its 737 MAX passenger jet in January in the wake of crashes in Indonesia and Ethiopia that claimed 346 lives, according to the Wall Street Journal.

- Saudi Aramco’s shares dipped slightly yesterday for the first time since their debut on the Tadawul, shedding 0.7% to reach SAR 37.75 apiece, according to Bloomberg.

- Trump impeachment gathers momentum as vote nears: Several Democratic lawmakers have come out in support of impeaching President Trump days before the House votes on whether to take him to trial, Agence France-Presse reports.

- The GBP fell 1.4% against the EUR yesterday on fears that Boris Johnson will push the country towards a hard exit from the EU, according to the Financial Times.

- Algerians elected former prime minister Abdelmadjid Tebboune as their new president, according to the Financial Times.