Deforestation in the Amazon underwent a massive reduction in the early 2000s. But can it happen again?

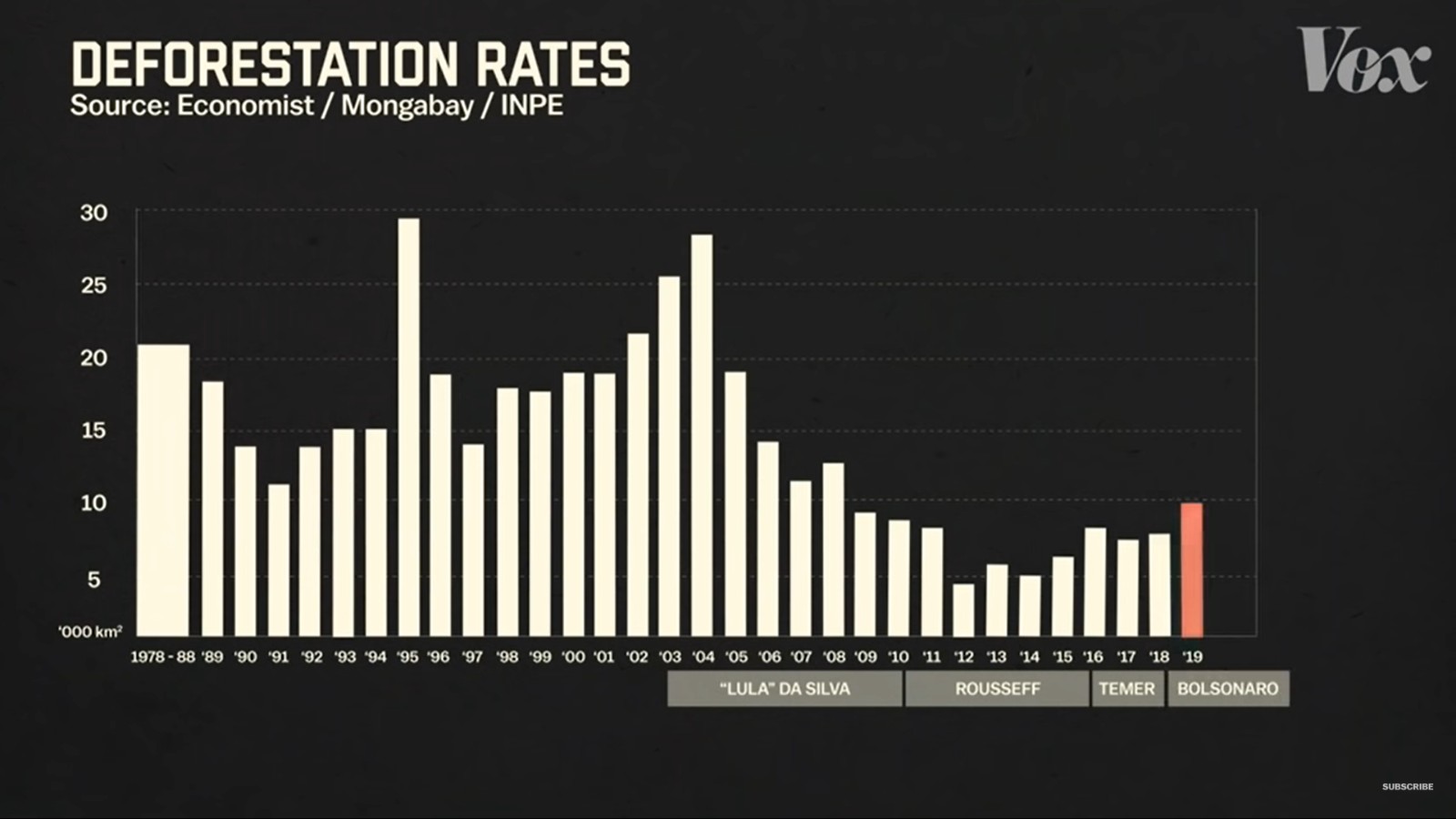

Deforestation in the Amazon underwent a massive reduction in the early 2000s. The deforestation of the Amazon rainforest, which started in the 1970s, was driven by ranchers who used the land to rear cattle and grow soybeans, fueling rapid economic growth, this Vox video shows (watch, runtime: 11:44). Environmental measures put in place by the Brazilian government in the early 2000s included the expansion of protected rainforest from about 28% in 2003 to 47% in 2012. Land not under protection was subject to the forest code, a law that said landowners could only clear 20% of their private land. This was enforced by Ibama, a police agency that could track and fine people for illegal deforestation. At the same time, a global activist movement pressed for greater accountability within the agricultural industry, and countries gave Brazil money to help protect the Amazon. With these measures in place, deforestation rates plunged to a historic low in 2012.

But with key environmental reforms now being rolled back, can it happen again? Starting in the early 2010s, many of these measures have been reversed in a movement driven by the increasingly influential conservative Ruralistas political group, and greatly exacerbated by Jair Bolsonaro, elected president in 2018. Bolsonaro weakened the forest service (which monitors the forest code) by putting it under the jurisdiction of the Agriculture Ministry. He also slashed funding to Ibama, passed a law making it easier for people who illegally seize land to keep it, and has been systematically undermining the environmental ministry. In August 2019, over 30,000 fires were burning in the Amazon — three times as many as in August 2018.