Egypt’s non-oil business activity falls slightly in October, but sentiment is up

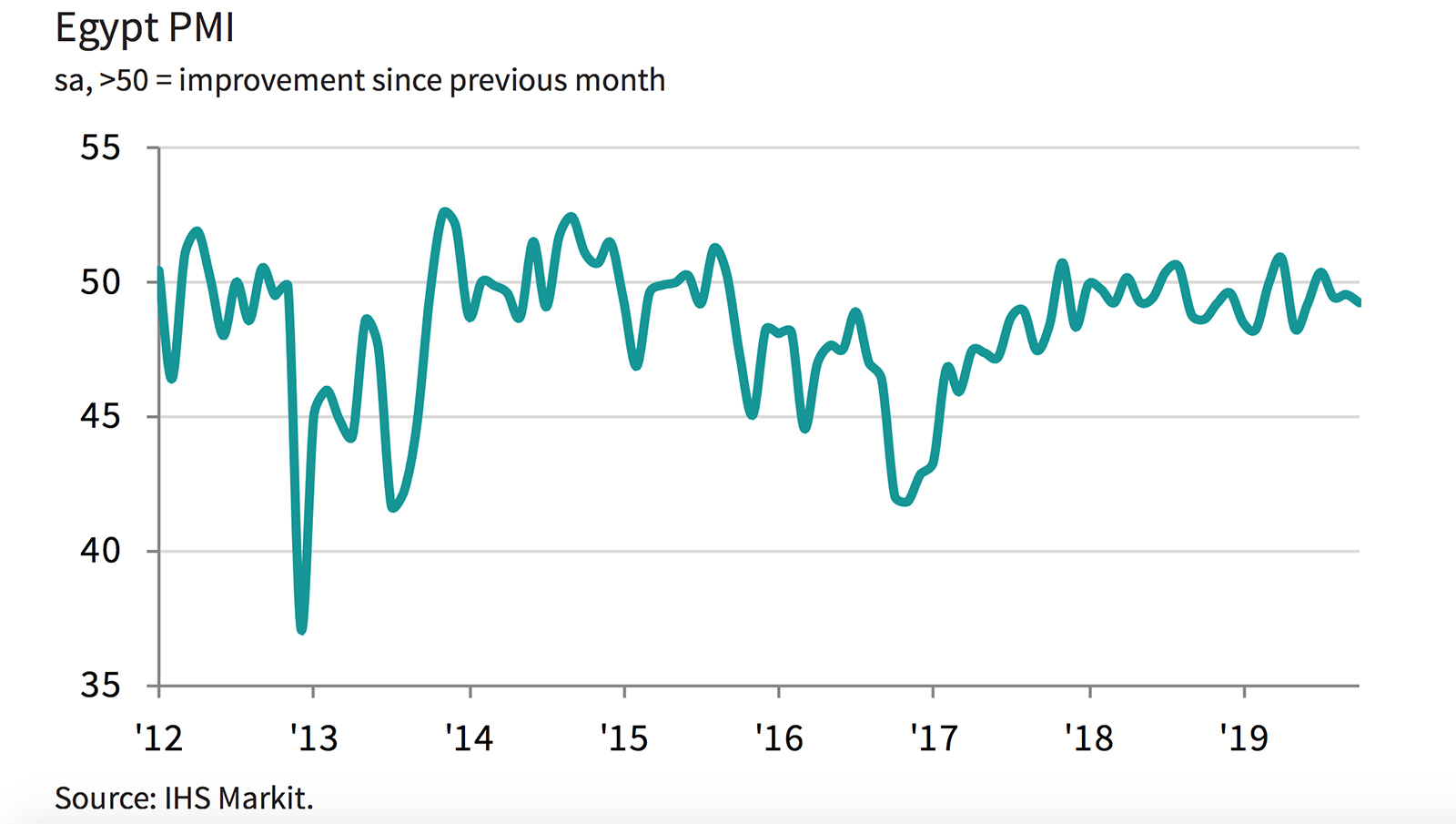

Non-oil business activity falls slightly in October, but sentiment is showing strong improvement: Egypt’s non-oil private sector remained in contraction territory in October, with output and new orders falling moderately, according to the Markit / Emirates NBD purchasing managers’ index (PMI) (pdf). The PMI gauge dipped marginally to 49.2 in October from 49.5 in September, making October the third consecutive month of contraction. However, October’s reading is “stronger than the average for the series (48.4).” A reading above 50.0 indicates that activity is expanding, while a reading below that mark means it is contracting. So far, Egypt’s PMI has been in expansion territory only twice this year.

New orders fell for the third consecutive month, and output also declined. The report notes that new domestic orders fell at the fastest pace since May, and sales to foreign clients also took a hit as survey respondents pointed to “poor market conditions.”

The decline in new orders led businesses to rein in their input buying in October, as inventories remained sufficient as a result of weak demand. The upside is that vendors were able to shorten their delivery times, “extending the current sequence of improvement to four months.” Output charge increases were also kept to a minimal, with some firms even cutting their fees in hopes of attracting new business.

Input cost inflation was at its weakest level since June, the report notes. Salaries seeing a “sharp rise” to compensate for higher living costs was the main driver of input cost increases. “On the flip side, purchase prices grew at a softer pace, as higher bills and customs fees were offset by lower raw material prices and an improvement in the exchange rate against the USD.”

Continued hiring activity points to positive sentiment for the year ahead: Business sentiment was widely positive, with 48% of survey respondents saying they expect a pickup in activity over the next 12 months. The generally positive outlook marks a rebound from September, when sentiment was at a near three-year low.