What we’re tracking on 19 September

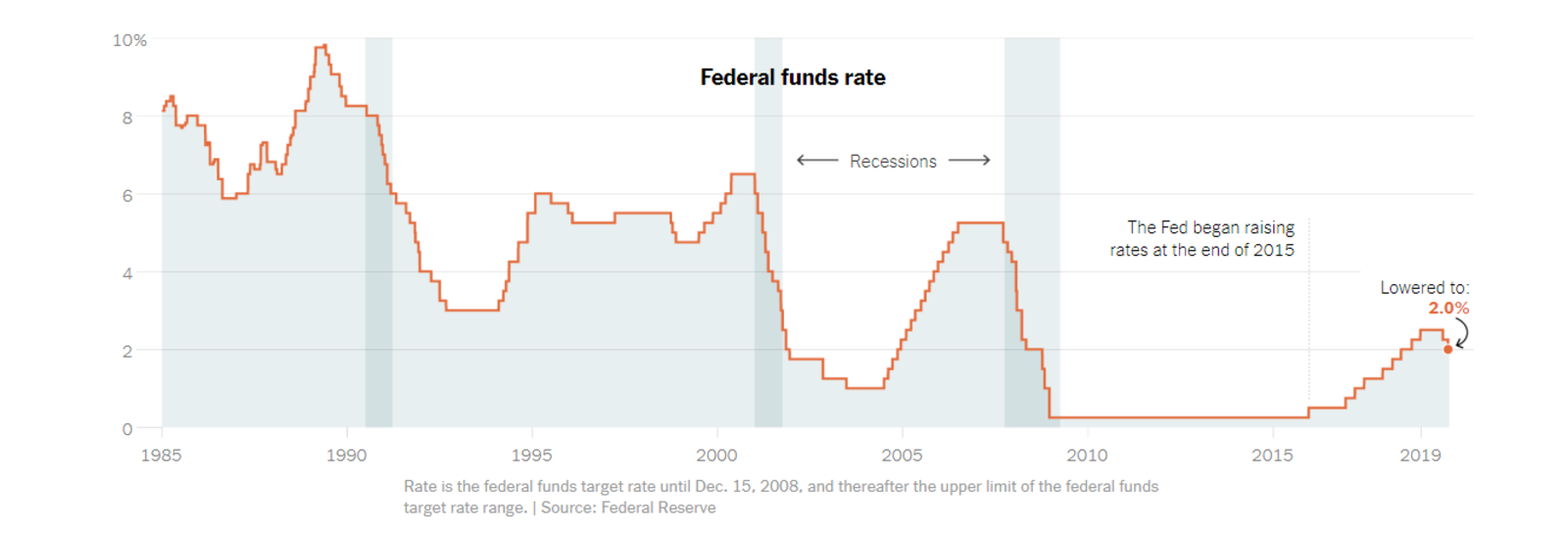

As expected, the Fed gave the market what it wanted: The US Federal Reserve Open Market Committee decided yesterday to enact its second interest rate cut of the year with a 25 bps reduction to 1.75-2%, citing “uncertainties” about the economic outlook, according to a statement. While the decision came in line with market expectations, it also highlighted growing dissent within the Fed on its monetary policy moving forward: One committee member wanted to push through a deeper cut, while two wanted to keep rates where they were. “Sometimes the path ahead is clear, and sometimes less so,” Fed Chair Jerome Powell said at a presser following the meeting, according to the Financial Times. “This is a time of difficult judgments, as you can see, disparate perspectives. I really do think that’s nothing but healthy.”

The decision is a reflection of the pessimism over the global economic growth outlook, of which the inverted yield curve is one of the symptoms, the New York Times explains. Manufacturing activity has been weakening, political tension is “creating uncertainty for business,” and sentiment among consumers — who have been driving the economy forward — “may be wavering.”

You can all but pencil in a rate cut here at home when the CBE’s Monetary Policy Committee meets a week from today. Analysts already saw low inflation figures for August providing the MPC with breathing room to move ahead with further monetary easing. Look for our comprehensive interest rate poll next week for an in-depth analysis of the factors at play.

Foreign Minister Sameh Shoukry is heading to New York today ahead of the United Nations General Assembly high-level meetings, which get underway on 24 September, according to a ministry statement. Shoukry is set to lay the groundwork for President Abdel Fattah El Sisi’s arrival in New York in a few days’ time.

Conference season continues here at home, with the Egyptian Private Equity Association having kicked off its venture capital event (pdf) yesterday at the Conrad Hotel. Events coming up this month, include:

- “The future of investment in Egypt” conference organized by the Egyptian Businessmen Association, will take place next Monday, 23 September at the Aida Ballroom, Cairo Marriott Hotel.

- The Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS) will run for three days on 23-25 September at the Kempinski Royal Maxim.

- 24 September (Tuesday): A roundtable discussion titled “investing in renewable energy and sustainable development” organized by Media Avenue, Nile Ritz Carlton, Cairo.

- The Mediterranean Business Angels Network’s launch will take place in the international investment and entrepreneurship event, Techne Summit 2019 on 28-30 September in Bibliotheca in Alexandria.

The Gouna Film Festival also kicks off today, and is set to wrap next Friday, 27 September. The eight-day event will feature around 80 narrative films, documentaries, and short films from Egypt, Morocco, Lebanon, Poland, France, Bulgaria, Greece, Belgium, Algeria, Guatemala, and Sudan, among others, according to the festival guide (pdf).

Anwar El Sadat congressional gold medal design unveiled by US Mint: The US Mint unveiled yesterday the designs for the Anwar El Sadat Congressional Gold Medal, in a ceremony attended by members of Sadat’s family as well as representatives from Egypt and other nations held in the Department of the Treasury’s historic Cash Room, according to a US Treasury Department press release. “President Sadat took countless personal risks to achieve a society grounded in peace and diplomacy – an endeavor that ultimately cost him his life,” said Isaac Dabah, National Chairman of the Anwar Sadat Congressional Gold Medal Commission.

We aren’t competing in weightlifting events for two years: The Egyptian Weightlifting Federation has been barred from participating in all International Weightlifting Federation (IWF) events for two years as a result of the 2016 doping scandal involving seven Egyptian weightlifters, according to Ahram Online. The Egyptian federation has also been slapped with a USD 200k fine. The Independent Member Federation Sanctions Panel had earlier this week banned Egypt from the 2019 World Championships.

Egypt is participating in World Clean-Up Day on Saturday, 21 September, with four mega events to take place in Sharm El-Sheikh, Dahab, the Red Sea Governorate, and Minya in an attempt to clean bodies of water from plastics and other waste, according to Ahram Online.

US President Donald Trump named Robert C. O’Brien as his new national security advisor in a tweet yesterday. O’Brien is perhaps best known for being sent to Sweden by The Donald to negotiate the release of detained rapper ASAP Rocky (infer from that what you will about the current state of American politics), but is also a founding partner of an LA-based law firm, and was previously a representative to the UNGA. He succeeds John Bolton, who was fired by Trump last week.

Meanwhile, Saudi, Iran, and the US are still in a war of words over Aramco attack: The attacks on Saudi Aramco’s Abqaiq facility were “unquestionably sponsored by Iran,” Saudi Arabia’s Defense Ministry spokesman Turki al-Maliki said in a news conference yesterday. While he stopped short of directly accusing Tehran of launching the assault, al-Maliki said that evidence from drones and cruise missiles launched in the assault show they could not have come from inside Yemen. Iran continues to deny any involvement in the attack, and told the US it would retaliate immediately if Tehran was targeted in response. Houthi rebels, meanwhile, have reiterated their claim of responsibility. Before the Saudi news conference, US President Donald Trump said in a tweet that he had ordered tighter sanctions on Iran, but without giving any details about what the new measures would entail.

Meanwhile, 50% of the oil production cut by Saturday’s attacks has been restored, Saudi Energy Minister Prince Abdulaziz bin Salman said at a news conference in Jeddah on Tuesday evening. Finance minister Mohammed al-Jadaan later told Bloomberg that the attacks had zero impact on the kingdom’s revenues. But the impact of the attacks shines through elsewhere: Saudi has also joined the US-led International Maritime Security Construct coalition, designed to secure sea lines vital to oil shipping in the Middle East. And the country’s biggest customers in Asia have indicated that they are considering diversifying their supplies of oil.

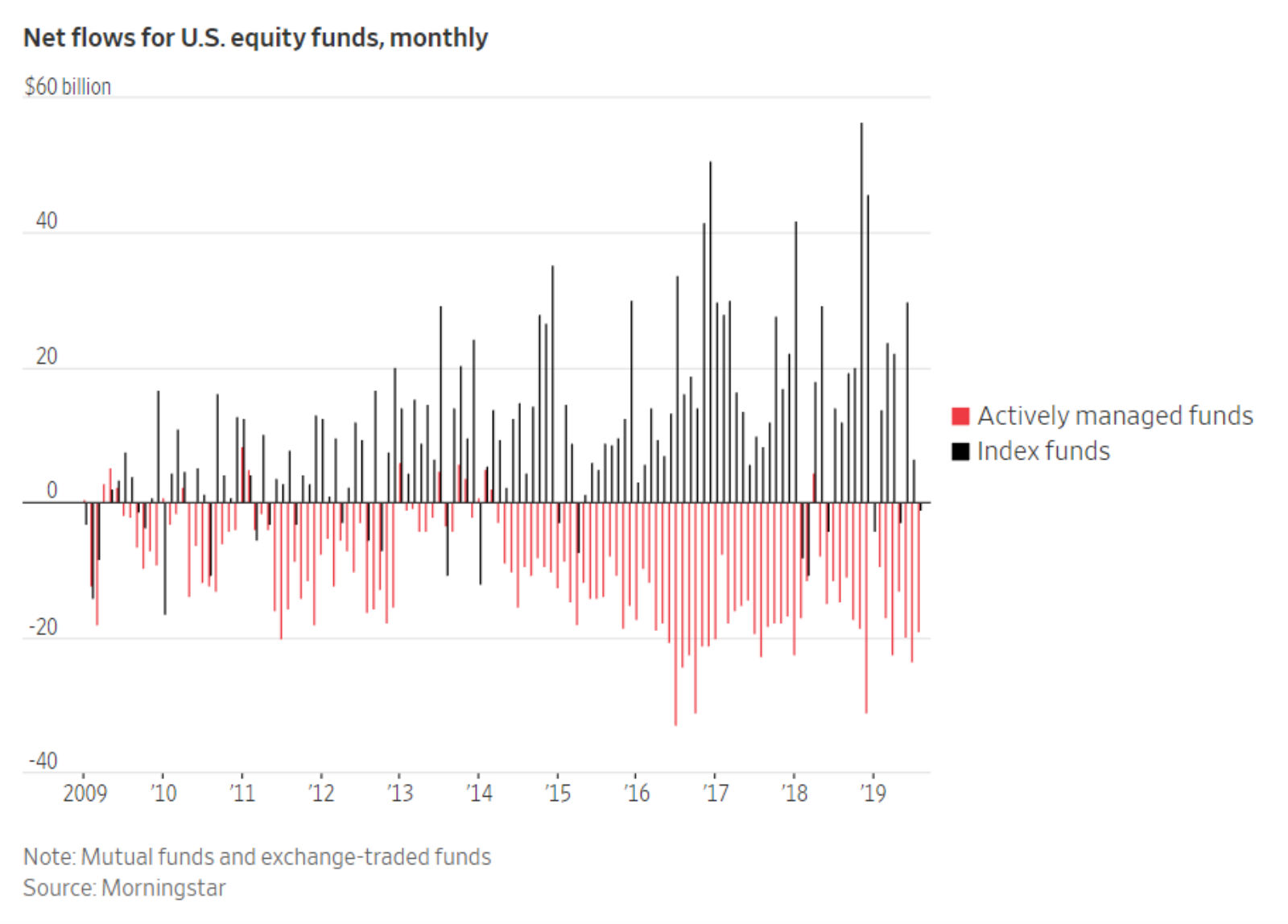

The robot takeover cometh for Wall Street: Index-tracking funds are beating their actively-managed rivals for the first time on Wall Street,according to the Mornigstar data, which nonetheless only “covers a slice of the mutual fund and ETF world,” says the WSJ. Broad US equity-tracking funds recorded USD 4.27 bn in assets on 31 August, surpassing the assets of funds “that try to beat the market,” which had USD 4.25, according to the data. This shift is turning the likes of BlackRock, Vanguard, and State Street Corp into power brokers and prompting concerns the “market-mimicking funds” could distort stock prices.

The case for central bank-backed digital currencies: Having central banks back digital currencies would be a very good step towards preventing outdated financial regulations to stifle financial innovations, writes Vikram Pandit in an opinion piece for the Financial Times. He argues that current financial regulations were drawn up in the 20th century, and are unsuited for new financial innovations, including digital and crypto-currencies. He posits that by putting central banks in the driver’s seat, regulations would follow that will allow these innovations to function as intended, without limiting their growth.

Cryptocurrencies have been moving up the priority list of central bankers. Regional central bankers met this week in Cairo for the Council of Arab Central Banks and Monetary Agencies Governors to discuss cryptocurrencies. Meanwhile, 26 other central banks, including the European Central Bank, have begun grilling representatives of Facebook over its planned Libra cryptocurrency project this week.