Moody’s maintains Egypt’s outlook at B2 stable

Moody’s confirms Egypt’s credit rating at B2, outlook stable: Credit rating agency Moody’s has maintained its Egypt rating at B2 with a stable outlook, citing its large debt load and persistently weak albeit improving government finances.

Public finances to continue improving: Moody’s expects the government’s fiscal deficits to continue narrowing as it pushes ahead with removing energy subsidies and applying the fuel indexation mechanism. The government’s interest bill will also fall in line with slowing inflation and lower debt levels, although this will be offset slightly by the transition to longer maturities, the ratings agency says.

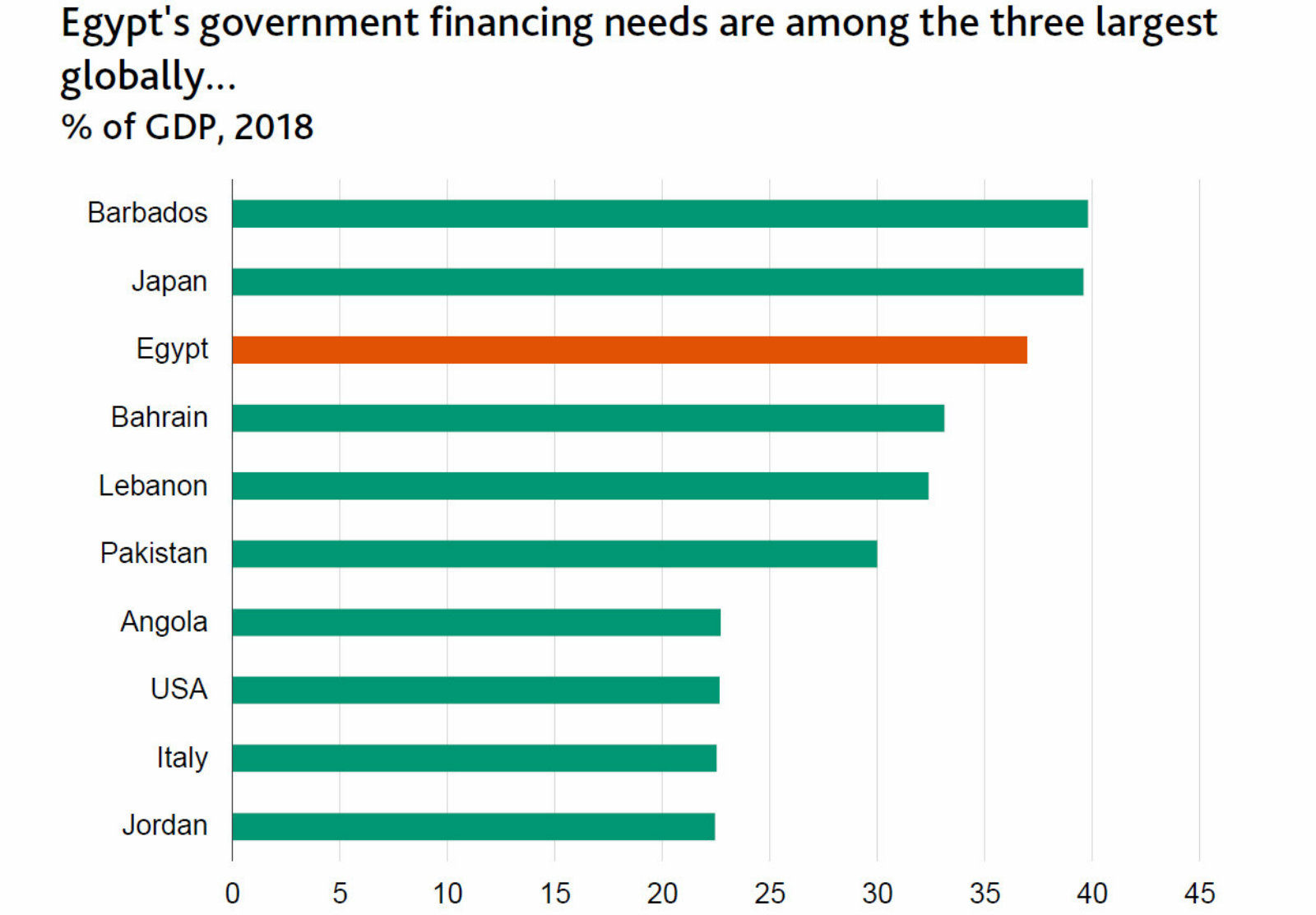

Debt sustainability to remain “very weak”: The affordability of Egypt’s debt will “remain very weak” and its financing needs “very large” (between 30-40% of annual GDP) in the coming years. Egypt will continue to be susceptible to tightening financial conditions, but its declining debt-to-GDP ratio means that it is able to cope with external shocks. Domestic debt levels are expected to decline as the effects of energy price hikes dissipate.

Labor market “improving” but sizeable challenges remain: Moody’s notes that conditions in the Egyptian labor market have recently improved, with the unemployment rate falling to 7.5% in 2Q2019 from 8.1% in 1Q2019. Despite this improvement, the economy is not creating an adequate number of jobs for the rising working-age population and this will continue to pose a challenge in the long term.