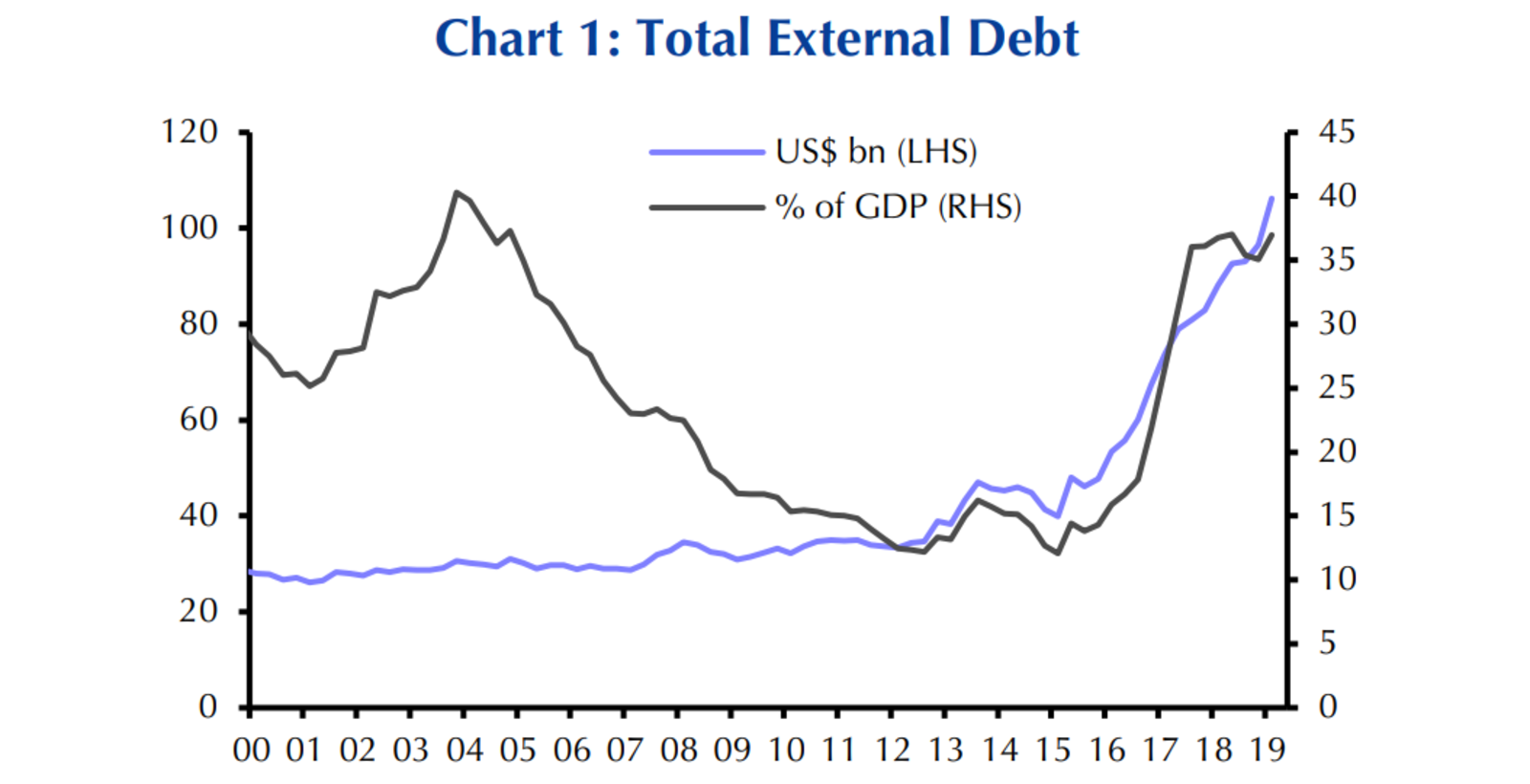

The risks on Egypt’s sharply rising external debt are “currently manageable,” says Capital Economics

The “sharp rise” in Egypt’s external debt since 2015 could be cause for alarm but “the risks are currently manageable,” Capital Economics says in a research note. There are obvious downside risks to external debt, including “roll-over risks — if risk appetite deteriorates, it can become much more difficult to access new financing from abroad to roll over maturing debts,” Capital Economics says. FX-denominated debt (which accounts for the majority of Egypt’s debt) can become particularly problematic if the currency depreciates. However, the research house says that the central bank’s efforts to shore up the country’s FX reserves mean that it can now cover external financing needs for the next year. Egypt’s foreign reserves inched up to USD 44.91 bn at the end of July.

Fair EGP value, narrowing current account deficit also keep debt risks contained: The EGP’s recent appreciation has made the currency “relatively fairly valued,” remaining 15% lower than its pre-devaluation value, Capital Economics says, adding that a large drop in currency value that would drive up debt service costs in EGP terms is currently a low risk. The research house also points to the country’s current account deficit narrowing to around 1% of GDP, which lends further credence to the low risk of a significant adjustment in the FX rate. “The upshot is that, unless external borrowing is ramped up much further, Egypt’s external debt shouldn’t pose a significant risk,” the note says.