What we’re tracking on 20 August 2019

We’re just two days away from the Central Bank of Egypt’s Monetary Policy Committee meeting. The general consensus among economists we polled in our survey this week is that the MPC will push ahead with the first rate cut since February, with most anticipating a 100 bps cut.

Naeem Holdings’ Yara El Kahky is among those who see the MPC keeping rates on hold for now. “We are adopting a conservative point of view that they want to assure that any inflationary pressures are contained in the August reading,” she said. Naeem expects the MPC to make 100-300 bps worth of rate cuts between September and December.

The Central Bank of Egypt sold EUR 610 mn worth of one-year euro-denominated treasury bills yesterday, according to official data. The t-bills were sold at an average yield of 1.49%.

A delegation from the World Bank is in town today to visit several Egyptian ports to take note of the ports’ financing needs to improve infrastructure and its naval fleets.

PSA- The Financial Regulatory Authority published a guide (pdf) on the rules and regulations governing companies under the Capital Markets Act.

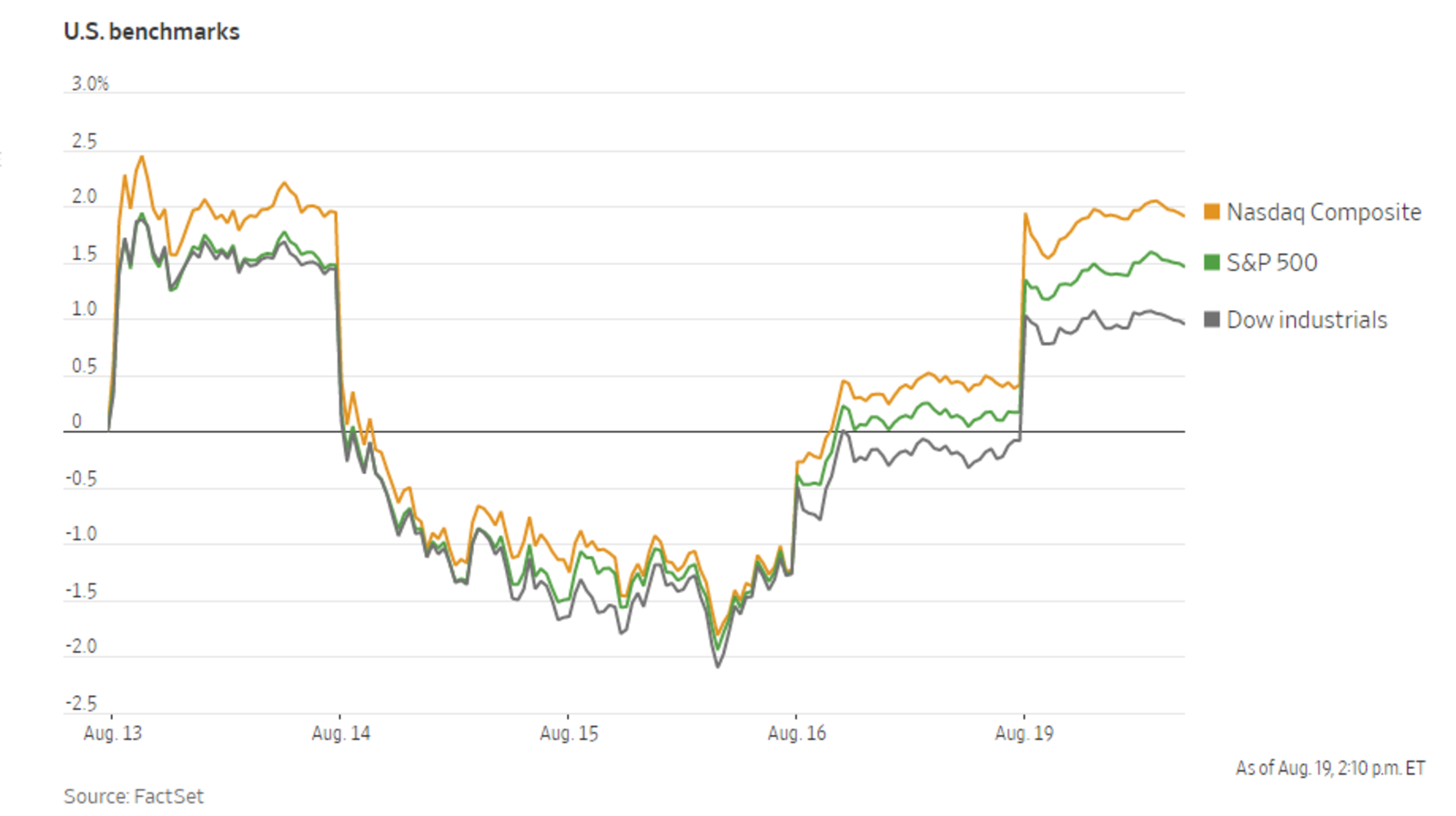

US bank and tech stocks rose at the beginning of the trading week yesterday, helping the Dow Jones, S&P 500, and Nasdaq recoup some of last week’s losses, according to the Wall Street Journal. Shares breathed a sigh of relief as the Trump administration signaled it is working on a new round of trade talks with Beijing, and expectations grow for a rate cut at next month’s Federal Reserve meeting. Bond yields also rebounded from recent lows. The yield on US 10-year bonds rose to 1.598% yesterday from 1.540% Friday.

The continuing strength of the USD looks set to “deepen an emerging markets selloff” and send commodity prices soaring, the WSJ says. The greenback is defying the odds and has kept rising this year, with the USDX up nearly 11% from its 2018 lows. This makes it more expensive for countries to service USD-denominated debt, which stood at USD 6.4 tn at the end of 1Q2019, compared to USD 2.7 tn a decade ago, according to the Institute of International Finance.

German recession likely -Bundesbank: Germany is likely to enter a recession in the third quarter amid a slump in exports and industrial output, the country’s central bank said yesterday. Bundesbank economists wrote in the bank’s monthly update that the economy could continue to decline for the second consecutive quarter in 3Q, warning that there are currently no signs of an end to the industrial slump. “This could also gradually start to weigh on a number of services sectors,” they wrote. Data last week showed that output fell by 0.1% in 2Q.

But the US may be off the hook this time: Strong retail performance, monetary easing, and a robust services sector are all reasons why the US should avoid a recession next year despite the recent equity sell-off and the yield curve inverting, analysts have said, according to CNBC. An inverted yield curve, coupled with slowing global growth, have increased market jitters over a possible recession. But economists note that the fundamentals remain strong, and have cast doubt on the reliability of the yield curve for predicting recessions. “The curve inversion might be more an indicator of extreme market nervousness at present, of increasing central banks action, skewed bond ownership, and of global search for yield, rather than a sure sign that US is about to enter a recession,” JPMorgan equity strategist Mislav Matejka wrote in a note yesterday.

Crude oil futures rose 2.2% to trade above USD 56 a barrel, as a Houthi rebel drone attack on Saudi Arabia’s Shaybah oilfield tapped into market fears over supply risks. Meanwhile, a lull in US-China trade tensions is giving a push to oil and other risk assets, Bloomberg reports.

CEOs look to redefine the purpose of a corporation: CEOs from almost 200 US companies have indicated that the emphasis on shareholder value may be a thing of the past. The Business Roundtable — a pro-business lobbying group comprised of executives from some of the biggest US corporations — pledged in a statement yesterday to “deliver value” to all stakeholders, including employees, suppliers and wider society, rather than just shareholders. “While each of our individual companies serves its own corporate purpose, we share a fundamental commitment to all our stakeholders,” the group said, committing to invest in employees, fairly treat suppliers, and protect the environment.

Crypto giant plans to rival Zuck’s Libra: The world’s largest cryptocurrency exchange Binance is planning to compete with Facebook’s Libra by launching its own “regional version of Libra,” Venus, Bloomberg reports, citing a Chinese statement on Binance’s website. The Malta-based company is looking to partner with governments and other key players on its “open blockchain project,” which it says is intended to “empower developed and developing countries to spur new currencies.”

Apple is upping its game in the streaming war: Apple will spend USD 6 bn to produce original TV shows and movies as it looks to compete with Netflix, Amazon, HBO and Disney, sources tell the FT. This is a significant budget increase from the USD 1 bn initially allocated for the company’s foray into TV, but still well below the USD 15 bn Netflix is spending this year. Apple’s TV+ subscription service is set to launch in the next two months, but has not yet revealed details on pricing or content.