EMs look to lure remittances into “diaspora bonds” to finance economic growth

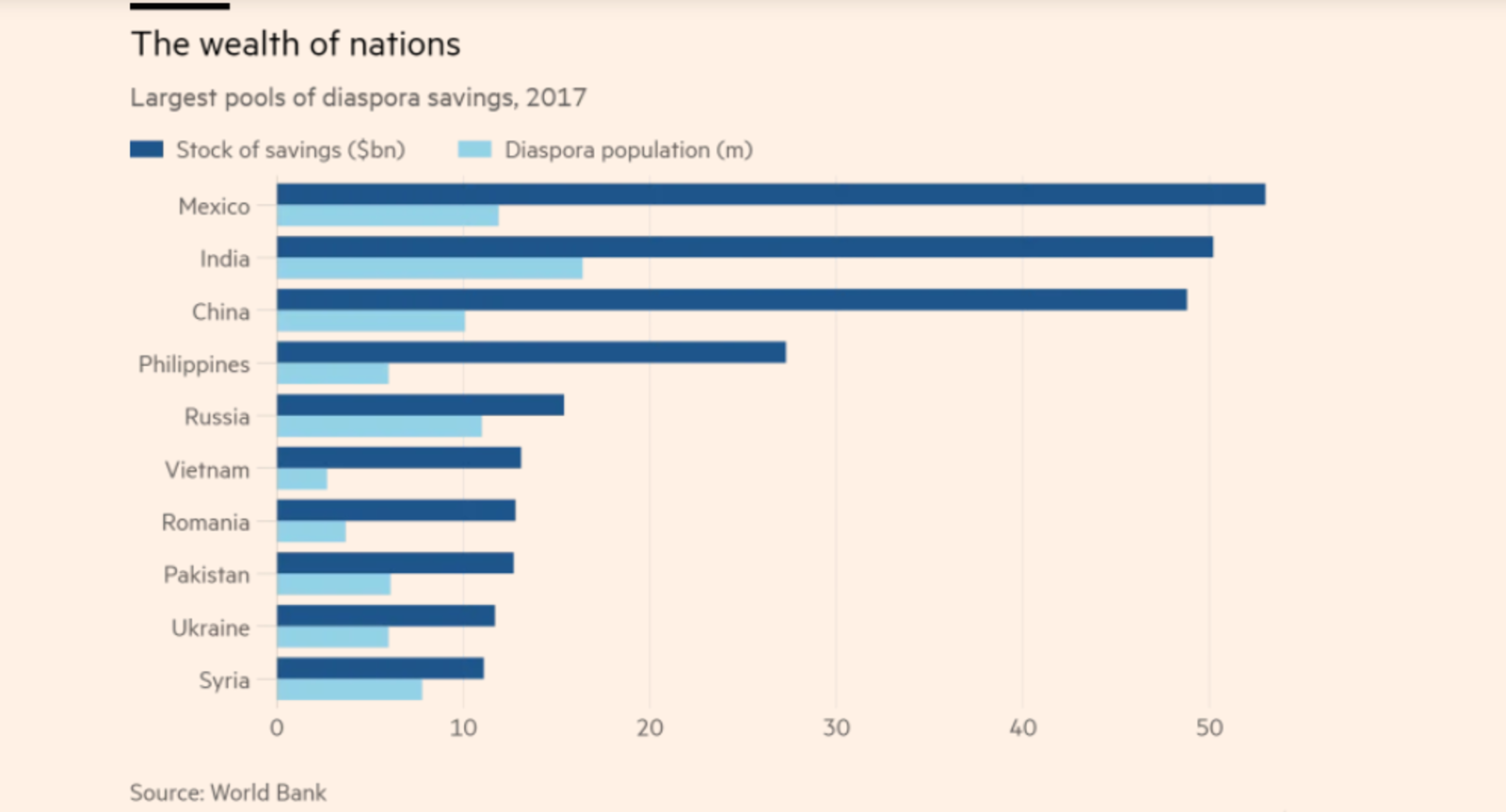

EMs look to lure remittances into “diaspora bonds” to finance economic growth: As emerging markets struggle with historically low FDI, a growing number of countries are looking to convince their expatriate workers to channel their savings and remittances into “diaspora bonds” for productive investment, Steve Johnson writes for the Financial Times. Whereas sending money home to their families is a one-off transaction and many bank deposits in EMs offer low interest rates, diaspora bonds can help migrants save “a significant amount,” according to World Bank economist Dilip Ratha. “The advantages of this approach are, in theory, manifold. With foreign direct investment into emerging markets having fallen to historic lows, bond financing is less volatile than the alternatives of cross-border portfolio flows, bank deposits and bank lending, all of which can be withdrawn at any time,” Johnson says.

So…why aren’t diaspora bonds a huge thing in EMs yet? Cross-border remittances in emerging markets add up to around USD 500 bn each year, but only a small amount of that has successfully made its way to diaspora bonds. Although the likes of India and Israel have benefited from these bond issuances, they remain “a niche part of financial markets.” According to Ratha, the issue is on the supply side: “Investment banks ‘don’t have a lot of appetite for innovation,’ and are happier selling plain vanilla paper, he said. Furthermore, diaspora bonds are classed as ‘retail bonds,’ and so require more regulation than those aimed at professional investors, with higher retailing and marketing costs.”