Sovereign investors shift towards emerging markets, Asia

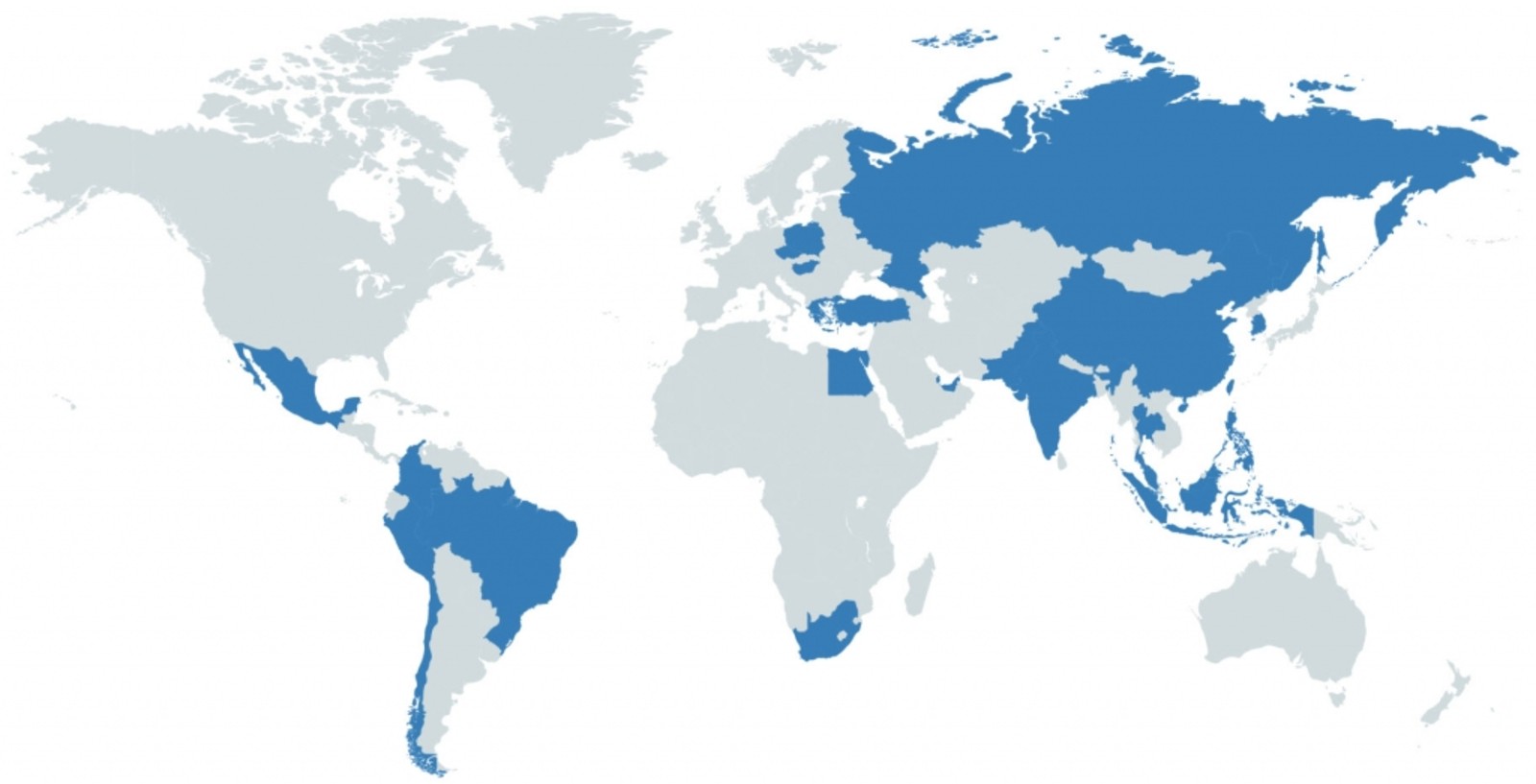

Sovereign investors shift towards emerging markets, Asia: Sovereign investors increasingly see the largest EM economies as being more attractive investment destinations than their developed market counterparts, in a sharp turnaround from 2017 sentiment, according to a study (pdf) by investment management company Invesco. The report, based on interviews with 139 sovereign investors and central bank reserve managers, finds that 36% intend to raise allocations to EMs, compared to 40% for Asia and just 13% for Europe. The fact that investors are increasing allocations in spite of the challenges faced by developing economies indicates the long-term appeal (or “growing stickiness”) of EMs, the report notes.

Europe’s loss is our gain: Slowing economic growth and heightened political risk, including the impact of Brexit and the rise of populist movements, are contributing to the shift away from sovereign investment in Europe. “A large chunk of Europe has negative bond yields and growth forecasts are relatively low compared to emerging markets, so from an investment perspective it’s less attractive,” said Alex Millar, head of EMEA institutional at Invesco, told Reuters.

China is seen as particularly attractive: Despite its trade tensions with the US weighing on investor decisions, China’s appeal among sovereign investors has increased more than any other EM this year. Sovereign investors cited a new investment law passed in 1Q2019 that prohibits the forced transfer of technology from foreign-invested businesses as a particularly positive step.

Fixed income allocations are up as equity volatility rises: The number of sovereigns planning to increase investment in bonds has increased to 33% while equity allocations have fallen to 30%. The move towards more defensive portfolios follows a year of increasing turbulence on the equity markets.