Egypt FDI falls in 2018 amid global investment drop-off

Foreign direct investment into Egypt fell 8.2% in 2018 amid global investment drop-off: Egypt retained its position as the largest recipient of foreign direct investment in Africa last year despite inflows falling 8.2% to USD 6.8 bn, according to UN figures. UNCTAD’s 2019 World Investment Report shows that inflows mostly went to the oil and gas sector, but large projects in other sectors — including Nibulon’s USD 2 bn grain infrastructure investment and Atraba’s USD 1 bn medical city — helped to diversify the country’s sources of foreign investment.

This is the second consecutive year FDI has declined. Investment rose to a peak of USD 8.1 bn in 2016, before falling to USD 7.4 bn in 2017. Outflows have been more sporadic over the past two years, slowing slightly from USD 207 mn in 2016 to USD 199 mn in 2017, but accelerating last year to USD 324 mn.

When will FDI growth return? Expectations differ: EFG Hermes’ Mohamed Abu Basha told us in April that Egypt could see a return to year-on-year growth in 2020 as inflation continues to fall and the CBE pushes ahead with its easing policy. Naeem Brokerage’s Allen Sandeep was less optimistic, telling us that we might have to wait until the economic reform program is 5-10 years-old before seeing annual growth in non-oil FDI.

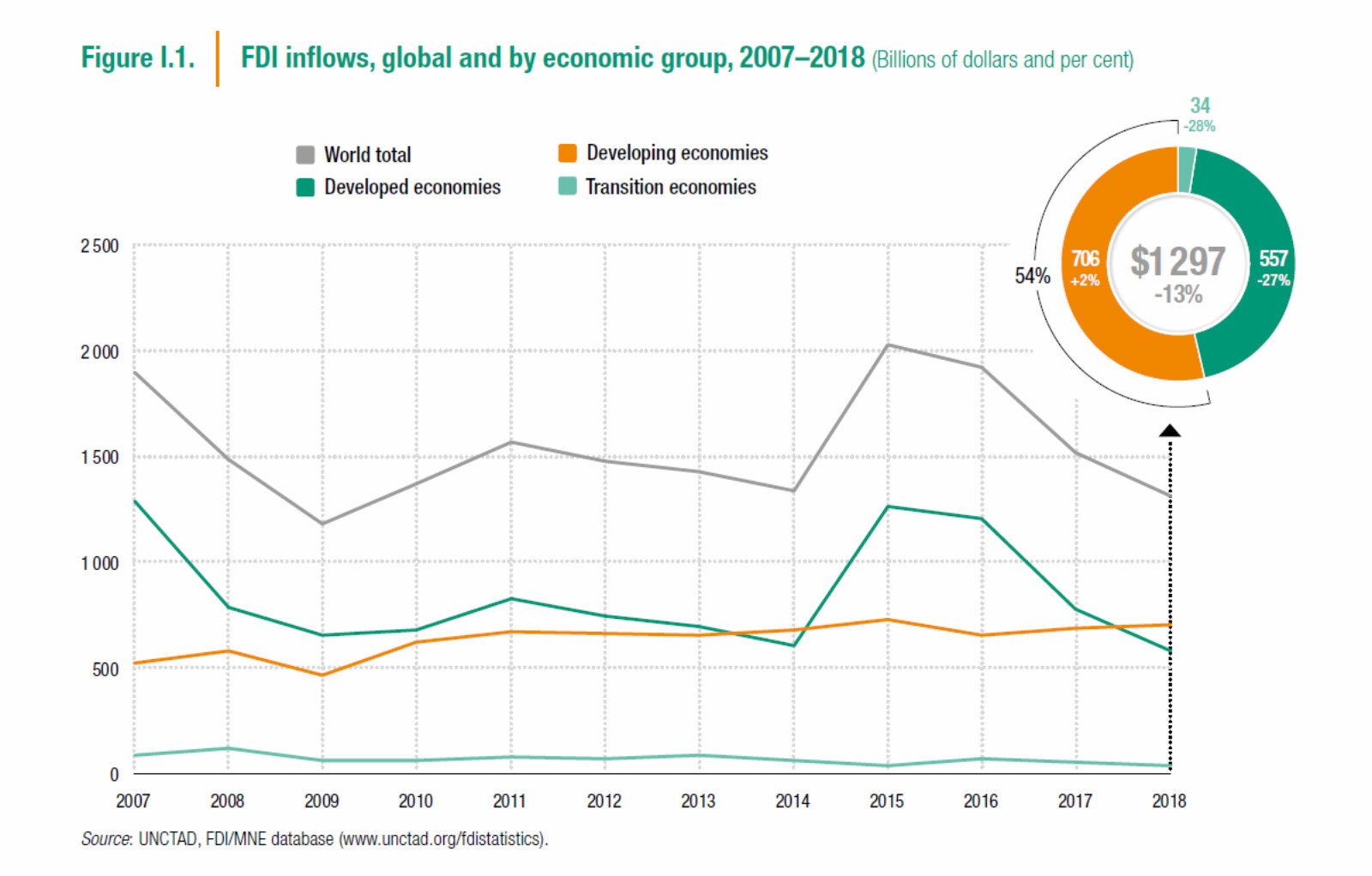

Global inflows hit lowest level since the 2008 financial crisis: Global FDI declined for the third consecutive year in 2018, falling 13% to USD 1.3 tn. The report attributes a large part of this drop-off to the US tax reforms passed in 2017, which provided tax incentives to US multinationals to repatriate their foreign-held capital and invest it in the US economy.

Developed countries were hit hardest: FDI flows into developed countries plunged to 14-year lows last year as US companies pulled investment. Investment fell by 27% to USD 559 bn despite the value of cross-border M&A agreements rising by more than a fifth. This was driven largely by a halving of investment into European countries, but the US also saw a 9% drop-off. Australia meanwhile achieved a record USD 60 bn of inflows as foreign companies reinvested profits into the economy.

This might sound bad but…: The OECD’s analysis (pdf), which suggested in April that global FDI declined by a massive 27% last year, makes the latest UN figures look tame by comparison.

The rest of the world was less affected by Trump’s tax reforms: Given the relative lack of US investment outside of advanced economies, developing countries were largely unaffected by the repatriation of US capital — FDI into emerging markets actually rose 2% to USD 706 bn. The vast majority of this was concentrated in Asia, which accounted for USD 512 bn of all inflows into developing countries. Africa, while constituting only a small share of global investment, bucked the global trend as inflows rose 11% to USD 46 bn. This was driven in part by a huge rise in interest in South Africa, which more than doubled its FDI to USD 5.3 bn.

Is a “modest recovery” the best we can hope for? Unctad predicts that investment flows will improve slightly this year as the effects of the US tax reforms abate. Green shoots can be seen in the uptick of greenfield project announcements, which rose 41% last year. Unctad’s secretary-general, Mukhisa Kituyi, suggested though that is unlikely to be a dramatic pick-up in investment, particularly given the deteriorating trade situation, warning that “FDI continues to be trapped, confined to post-crisis lows.”

Want more stats? Read the full report here (pdf).