Emerging markets risk widening infrastructure gaps as public investment falls to record low

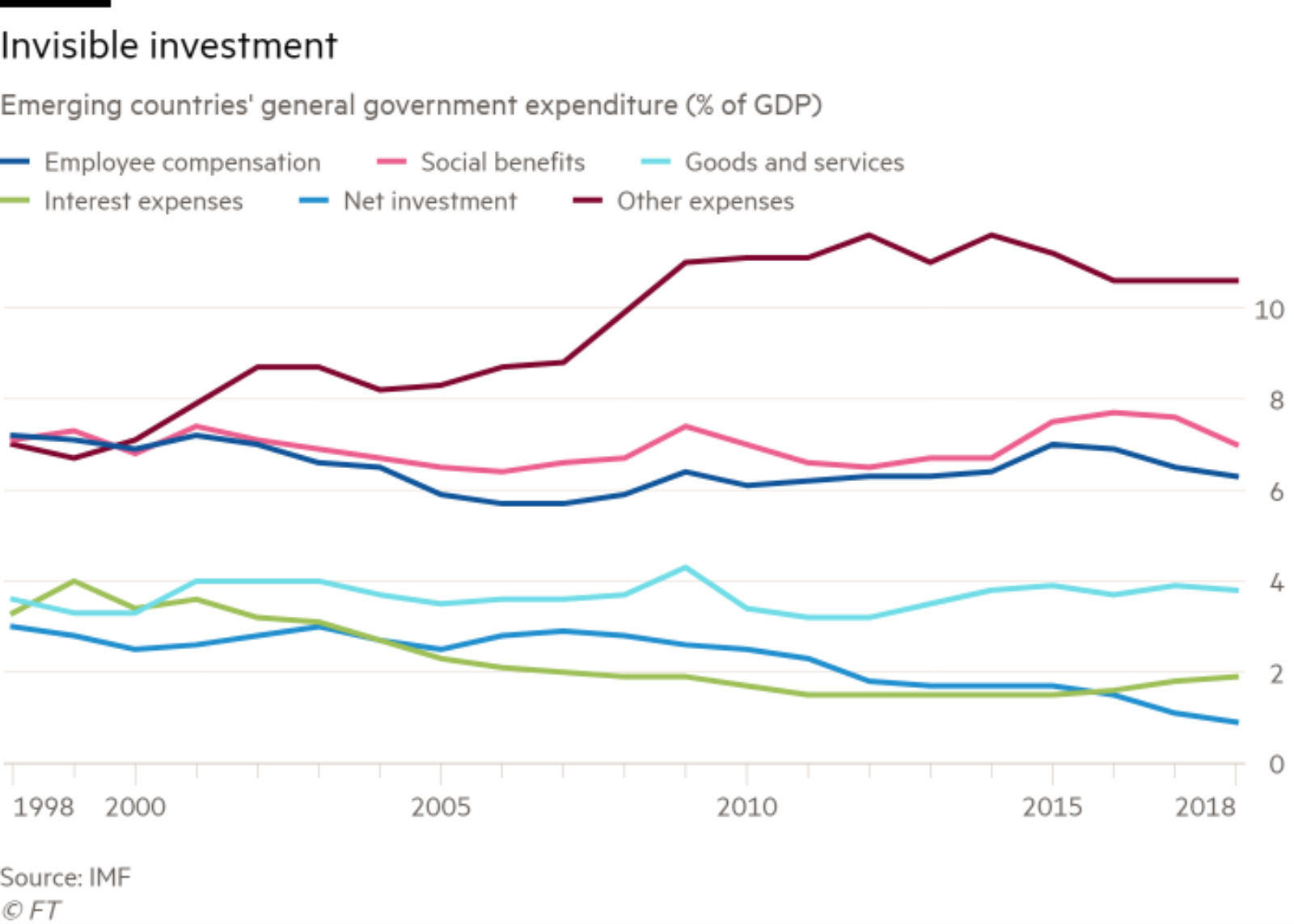

Emerging markets risk widening infrastructure gaps as public investment falls to record low: Emerging market governments are spending less than 1% of GDP on public investment for the first time ever, marking a historic low, according to IMF data cited by the Financial Times. Infrastructure such as transport, hospitals, schools and power currently receive just 0.9% of national output in emerging markets, down from 3.3% in 1997, the data indicates. This is raising fears in policy circles that growing infrastructure gaps could stifle the development of emerging economies. “Whether you look at [public investment] in gross or net terms you are talking about a decline,” Paolo Mauro, deputy director of fiscal affairs at the IMF, told the FT. “This is something that should be reversed. Emerging economies, as they develop, need to build infrastructure.”

Egypt isn’t over-investing in infrastructure — in fact, we’re not yet investing enough: The World Bank said last year that Egypt’s infrastructure gap is set to grow to USD 230 bn over the next 20 years. The country’s transport sector will require an extra USD 145 bn in the coming two decades while water infrastructure will need a further USD 45 bn. Putting this into perspective, total investment into transportation in FY2016-17 came in at around USD 3 bn, USD 1.9 bn of which came from the state and USD 1.1 bn from the private sector. Just USD 339 mn was invested into water infrastructure that year, none of which came from the private sector. The World Bank recommended priorities including seeking USD 10 bn worth of investment for the nation’s railways and USD 10 bn for refinery upgrades.

Global targets: IMF figures estimate that EM governments are required to put a further 4.1% of GDP (USD 2.06 tn) into public investment each year until 2030 in order to perform well against the UN’s development goals. Mauro meanwhile claims that emerging markets will need to spend an extra USD 2.2 tn each year on transportation alone until 2035 in order to close the funding gap. “These require big increases in revenues, but with good policies there are reasons to think that it can be done,” he said.