Deeper structural reforms are needed for increased investment: BNP

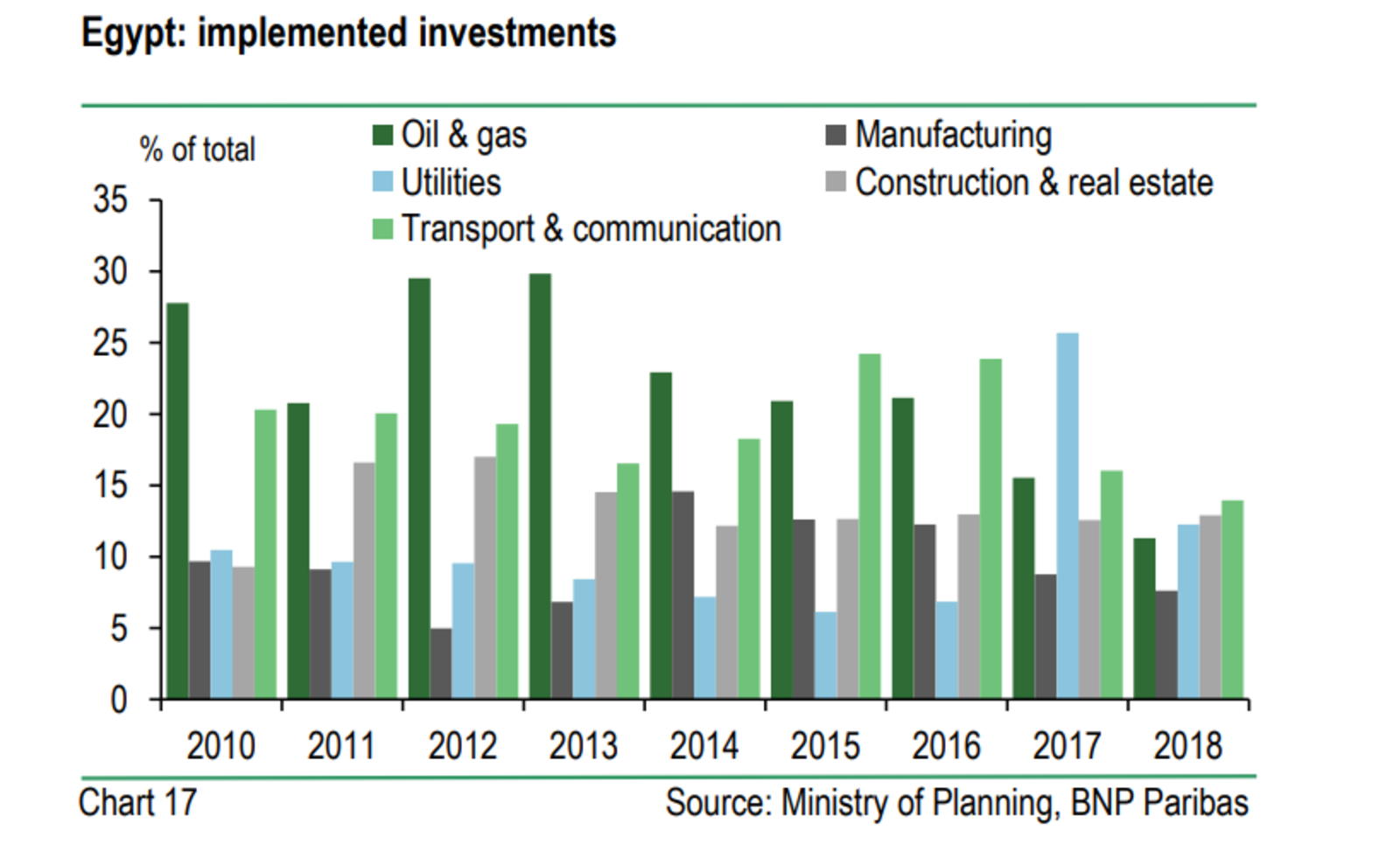

Egypt needs to deepen structural reforms if it wants to spur private-sector investment and job creation, BNP Paribas said in a recent report (pdf). While macroeconomic imbalances have largely been corrected, structural issues such as the informal economy have not yet been fixed, BNP says. High government debt, insufficient job creation, and capacity constraints to absorb a high-growth population were also listed as potential growth impediments.

We’re going to become a net gas importer again by fiscal year 2020-21, the report suggests. That will put some pressure on the current account deficit, the bank suggests, noting that “only the start-up of new gas fields would enable the country to cover its domestic consumption needs, which are growing rapidly (+14% in 2017).” (The ramp up in imports, we note, will come as Egypt locks in imports not just for domestic consumption, but for processing and onward sale.)

The current account improvement is the “most significant outcome” of the reform program. This improvement was primarily driven by a sustained growth in expat remittances, tourism revenues, and Suez Canal returns since the government initiated the program in 2016. The current account balance should continue to improve over the next two years, although remaining in negative territory, the report says.