Egypt’s non-oil business activity closely misses growth mark in March

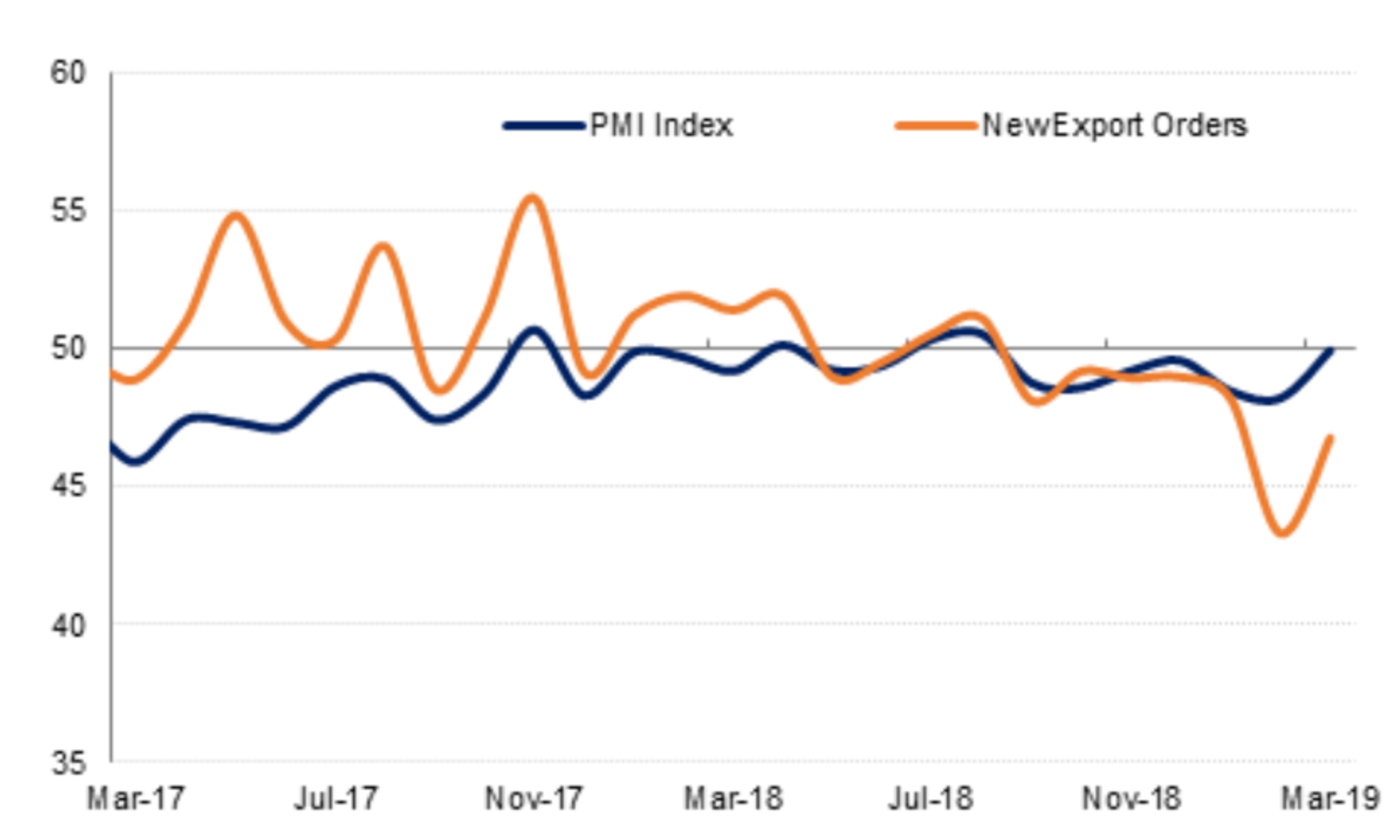

Non-oil businesses sees rise in orders and output prices — and improvement in margins: The Emirates NBD Egypt purchasing managers’ index (pdf) rose to 49.9 in March, marking “a significant improvement from the 17-month low of 48.2 recorded in February,” said Daniel Richards, MENA economist at Emirates NBD.

What does that mean? A reading above 50.0 indicates that activity is rising, while a reading below that mark means it is contracting. The March figure is the seventh consecutive month that the gauge has been in contraction territory.

What drove the month-on-month improvement? It came as orders increased for the first time since August of last year — and as companies were “able to raise output prices for the first time this year, while input prices were at a series-low, reducing pressure on firms’ margins,” Richards said.

Employment continued on its downward trajectory for the sixth month in a row amid retirements and staff members changing jobs.

Survey respondents were generally positive, expecting PMI to improve over the rest of the year and to hit the growth territory more frequently than in 2018 on the back of lower interest rates and an uptick in tourism. Future output expectations were revised downwards, however, amid concerns over economic stagnation over the coming year.

The caveat (beyond the fact that the gauge is still in contraction territory): “The continued negative performance of the private sector reaffirms our decision to downgrade our 2018-19 real GDP growth forecast from 5.5% to 5.3%.” Emirates NBD writes.