Emerging-market volatility set to increase as elections approach

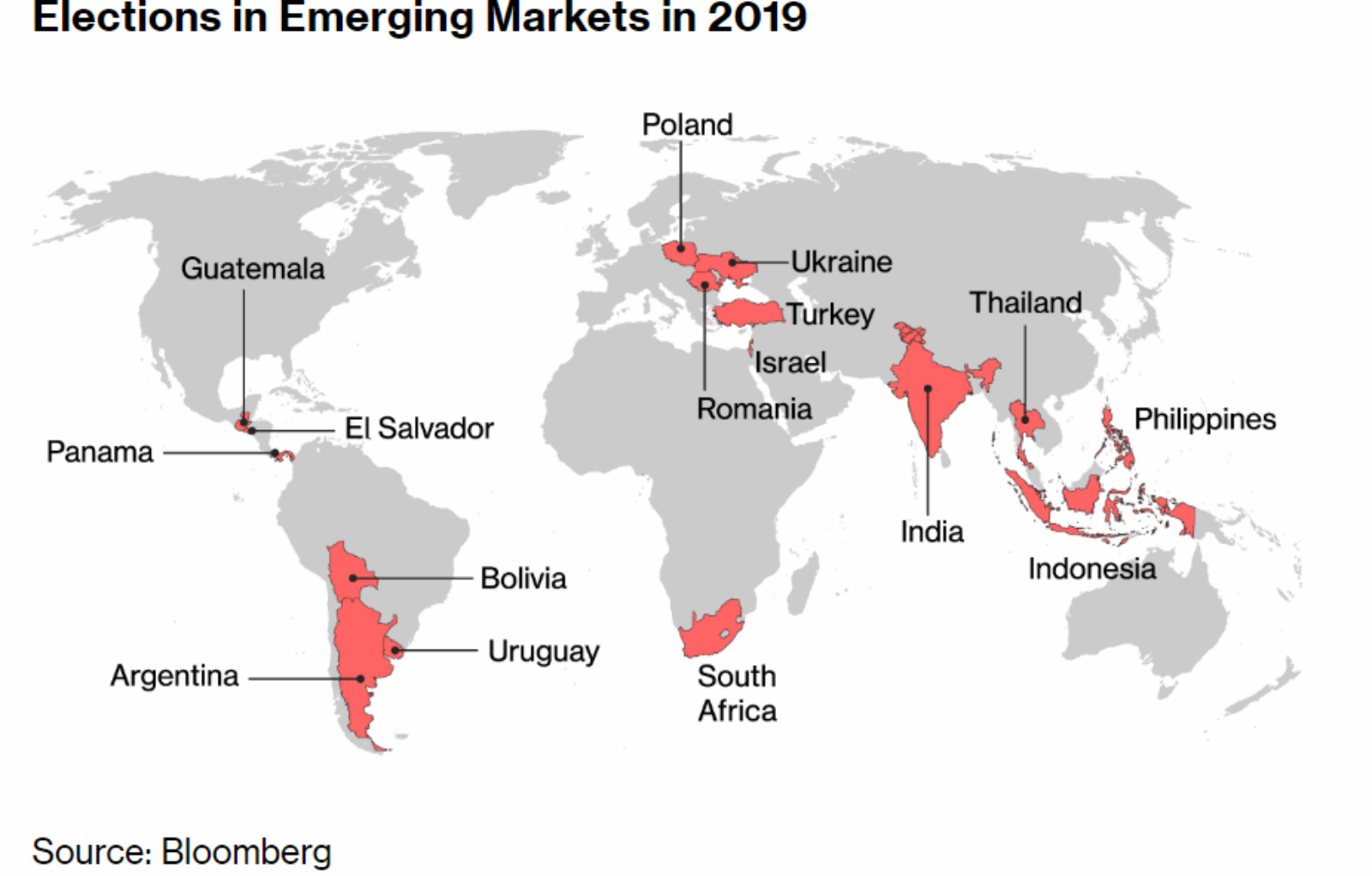

Emerging-market volatility set to increase as elections approach: It’s election season in several key emerging markets, and volatility is likely to increase as a result, according to Bloomberg. India, the world’s sixth-largest economy, will go to the polls in April, while South Africa, the continent’s largest economy, will vote in May. Other notable economies heading into elections include Indonesia, Israel, Thailand and Turkey, all of which will take place over the next month.

Surprises are unlikely, but never assume that the polls and political analysts are accurate — especially with political volatility delivered by popular votes recently in developed economies and emerging markets alike. “With the way emerging markets have been moving this year, investors need to be more selective based on a variety of factors including economic fundamentals and political risks,” Takeshi Yokouchi, senior fund manager at Daiwa SB Investments in Tokyo, told Bloomberg. “The expectation is for the ruling party to win in major elections such as South African and Indonesia, with [Indian PM] Modi’s party also extending support recently in India, but this doesn’t mean investors can remain care-free about these elections.”

Nigeria as a case study: A potential case study for election-induced EM volatility took place just last month when Nigeria held its presidential election. The electoral commission’s decision to postpone the vote caused a sell-off in the stock market and government bonds, and brought considerable pressure on the Naira.