EM should be prepared for an incoming storm

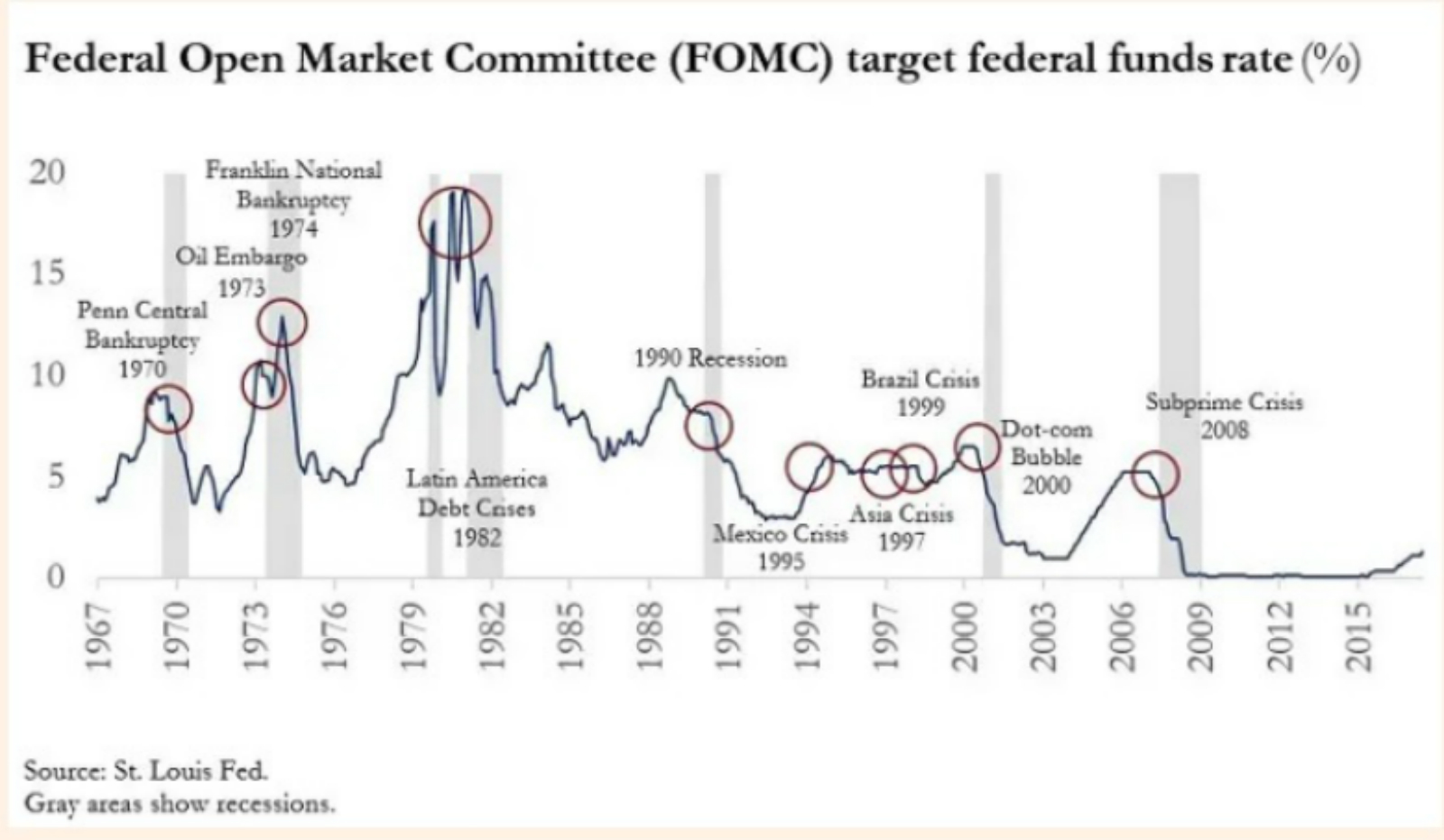

Emerging markets should brace for an incoming storm: History tells us that every monetary tightening cycle by the US Federal Reserve is followed by something getting broken in the global economy. With a storm currently brewing, emerging markets should take the necessary precautions to avoid being the victims, former Mexican finance minister José Antonio González writes for the FT. The Fed began a tightening cycle in 2015 that has so far involved nine hikes — and more may be on the horizon. Higher US interest rates have preceded several financial crises in the past. “A looming recession or deceleration in advanced economies will lower export demand, which, coupled with trade tensions, will probably cause commodity prices to fall, hurting export-dependent emerging market economies,” González writes. “Rising interest rates in the developed economies will cause capital flow reversals.”

So what should EM do to ward off a potential shock? “There are no magic bullets. The best course of action is to make sure the basic macroeconomic indicators are in order,” González says. He suggests that governments should narrow (or eliminate altogether) fiscal deficits, shift to local borrowing, borrow with longer maturities and fixed rates, and balance their external accounts.