Moody’s maintains positive outlook on Egypt’s banking system

Moody’s maintains positive outlook on Egypt’s banking system: Moody’s Investors Service said in a report on Monday (pdf) that it has maintained its positive outlook on Egypt’s banking system amid “an improving operating environment.”

Stable funding and liquidity in EGP, FX to remain under pressure: The ratings agency said banks will continue to enjoy access to stable funding as well as sizeable volumes of liquid assets, especially in EGP. It pointed, however, to the decline in banks’ foreign assets over the past year, saying FX funding and liquidity — although stable — will remain under pressure partially due to global monetary policy tightening. Banks’ net foreign assets registered EGP 72 bn in September, down from EGP 73 bn in March. "We expect balance sheet growth of around 15% in 2019 and for banks to maintain ample local currency funding, high liquidity, and strong and stable profitability,” says Constantinos Kypreos, senior vice president at Moody's Investors Service.

Bad loan levels stable, but vulnerable: Moody’s sees non-performing loan (NPL) levels remaining generally stable amid strong economic growth, but said “a future turn in the economic cycle due to large of volumes of untested new loans and ongoing security risks” is a concern.

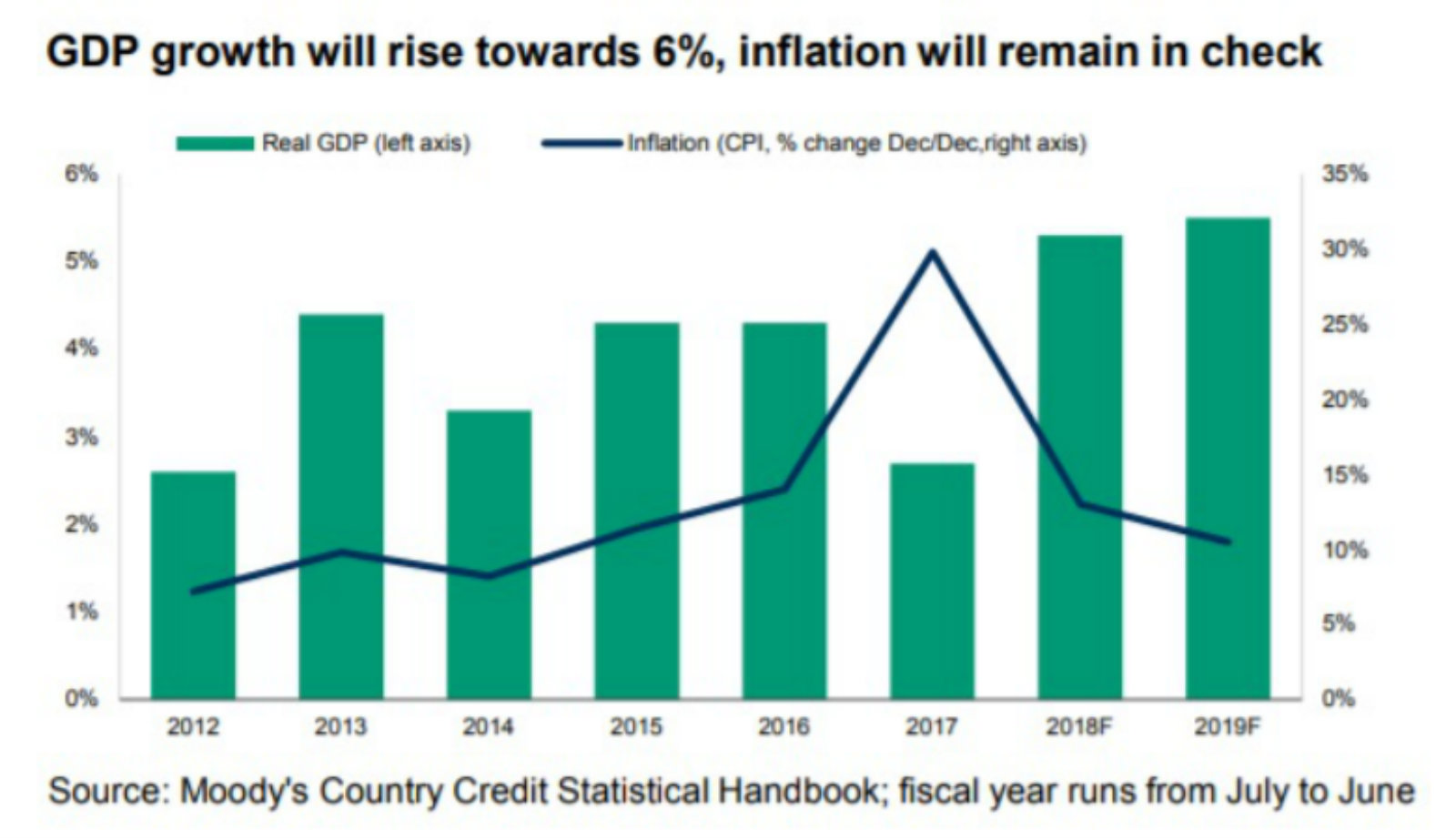

GDP growth expected at 5.5% in FY2019-20: Moody’s expects Egypt’s real GDP growth to reach 5.5% in FY2019-20 and 5.8% in FY2020-21, citing private and public investment, higher exports and the country’s recovering tourism industry. “Accelerating growth in Egypt reflects increased public and private-sector investment, higher exports and a recovery in tourism,” Kypreos said.

Potential risks: The firm cites high interest rates and inflation as two factors that could hamper growth. Moody’s also said the EGP could suffer due to global financial tightening as well as a decline in investment inflows. Security risks could also harm the recovering tourism industry, it said.