Is the nine-year bull run coming to an end?

** #3 Wall Street went on a wild ride yesterday as investors “anticipate the end to a nine-year bull run” amid trade and tech fears: US equities closed lower again yesterday after the “wildest session since February’s plunge” the Financial Times says. Traders are “fleeing the shares that were the stronger performers earlier this year,” the WSJ adds. The S&P 500 swung more than 4% within the day (from high to low) before closing down 0.7%, while Nasdaq 100 “tumbled to its lowest level since May.” Both indexes “are on track for the steepest monthly declines of the record-long bull market.” The MSCI world equity index slid c. 0.7%, while China’s main index lost more than 3.3% at the end of trading yesterday, according to Reuters.

The EGX30 closed up 0.7% yesterday on slightly lighter turnover than the trailing 90-day average.

Fears of tech and trade are at play in the US sell-off as traders worried about the health of the nine-year bull run given “concerns about the global economy and a trade war with China as well as the outlook for technology companies and pace of interest rate rises.” Weighing heavily: A suggestion that the US could slap “all remaining Chinese imports” with additional tariffs if the two countries fail de-escalate tensions when President Donald Trump and his Chinese counterpart Xi Jinping meet next month in Buenos Aires. The new tariffs would be announced in December if talks prove unproductive, sources told Bloomberg.

Silver lining #1 (if you’re in Egypt): Oil took a little hit yesterday as concerns about the global economy sent Brent crude futures down USD 0.34 to USD 77.28 / bbl, Reuters reports. That’s good news for Egypt as the government starts projecting oil prices for the FY2019-20 budget. We have more on that subject in this morning’s Speed Round, below.

Silver lining #2 (if you think you can pick ‘em): Global stocks haven’t looked this cheap since 2016, the Wall Street Journal notes, pointing out that major indexes in Europe, Japan, China, Argentina and Canada are all “languishing in correction territory.”

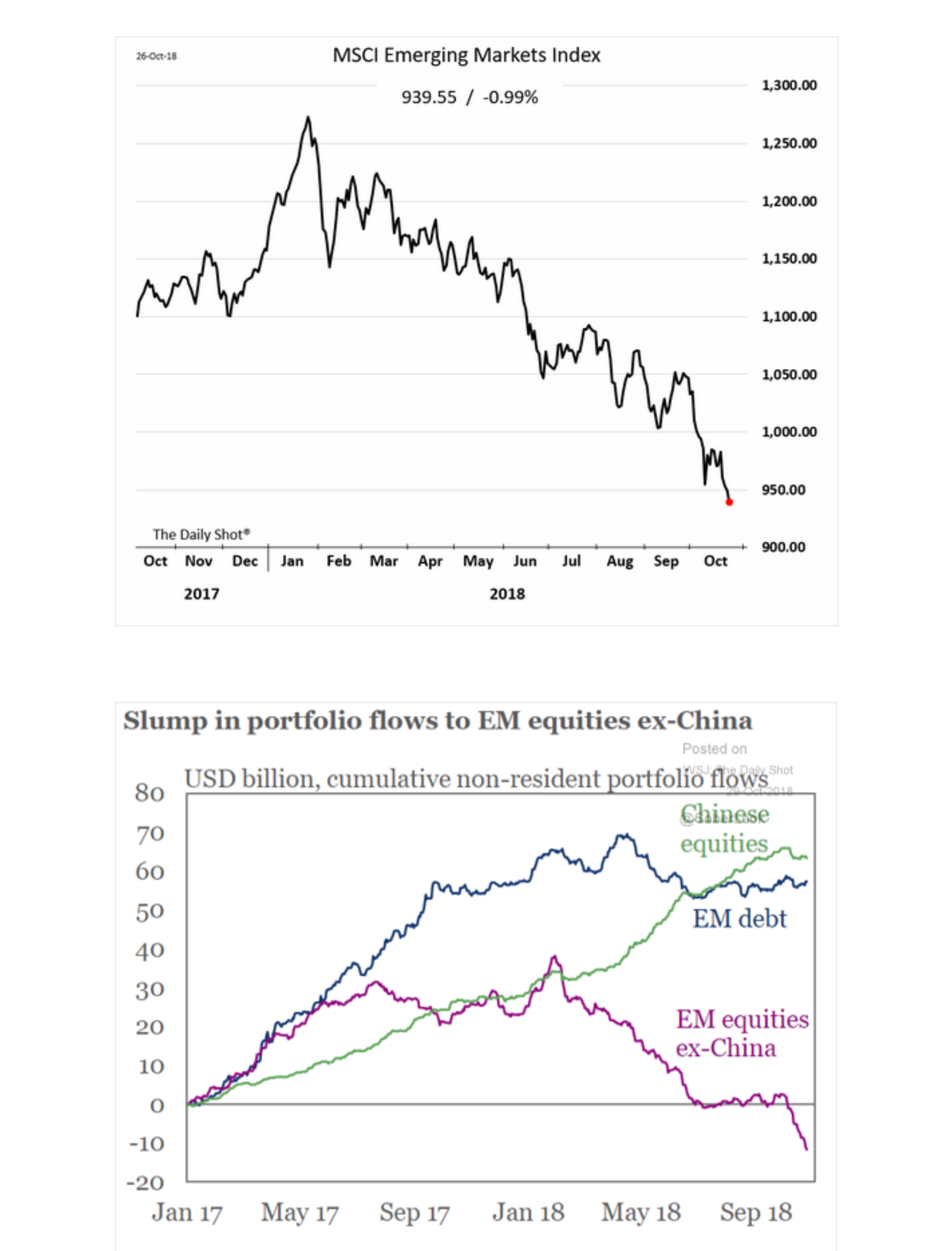

How ugly do things look for EM right now? The Emerging Markets Zombie Apocalypse is still chewing on us all, whether you’re looking at flows or index performance. Have a look: