Egyptian Exchange slumps as global share selloff sees US markets erase the year’s gains

** #4 We look set to end the week on a reasonably quiet note here at home — the EGX excepted. The benchmark EGX30 shed nearly 2.5% yesterday on moderate turnover, bringing its year-to-date return to -11.8%. Wednesday’s performance came as a global share sell-off sent the Nasdaq into correction territory (it’s down 12% from its September peak) and saw both the Dow and the S&P 500 wipe out their gains for the year. A sell-off in tech shares led the decline, the Financial Times notes.

Asian shares are also down sharply this morning, with major indexes in China, Japan, South Korea and Australia slumping 2-4% at dispatch time (see Bloomberg for color on Asian markets).

What’s going on? The nearly decade-long bull market took it on the chin yesterday as investors freaked out about everything under the sun. The Financial Times, the Wall Street Journal, Bloomberg, Reuters and the New York Times all cite combinations of some or all of the following:

- The poor outlook on global growth outlook;

- The health of the Chinese and Italian economies;

- The prospect that earnings growth in the US has peaked;

- How trade tensions (thanks, Donald) will impact economies large and small;

- Rising interest rates in the United States;

- The political drama that is the ongoing US midterm elections;

- A faster-than-expected fading of the so-called Trump stimulus of tax cuts and government spending.

Oh, and like a golden retriever watching a tennis match, oil fell 1% yesterday, with Brent crude closing the day at USD 75.42 under “extreme selling pressure … as the steep selloff across stock markets fueled fears over a possible drop in oil demand growth,” Reuters quotes an analyst as saying.

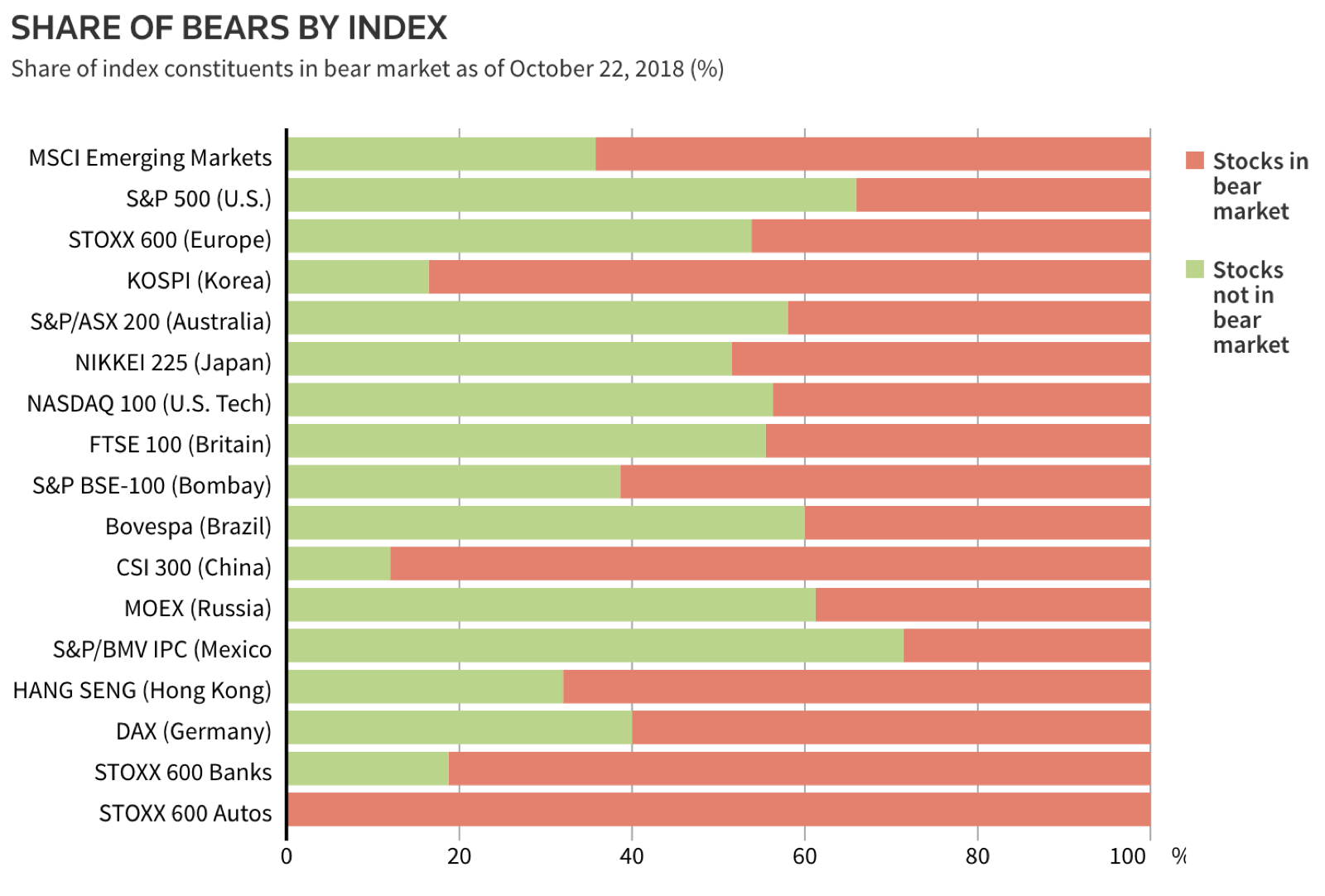

It’s starting to look rather bearish out there, folks: