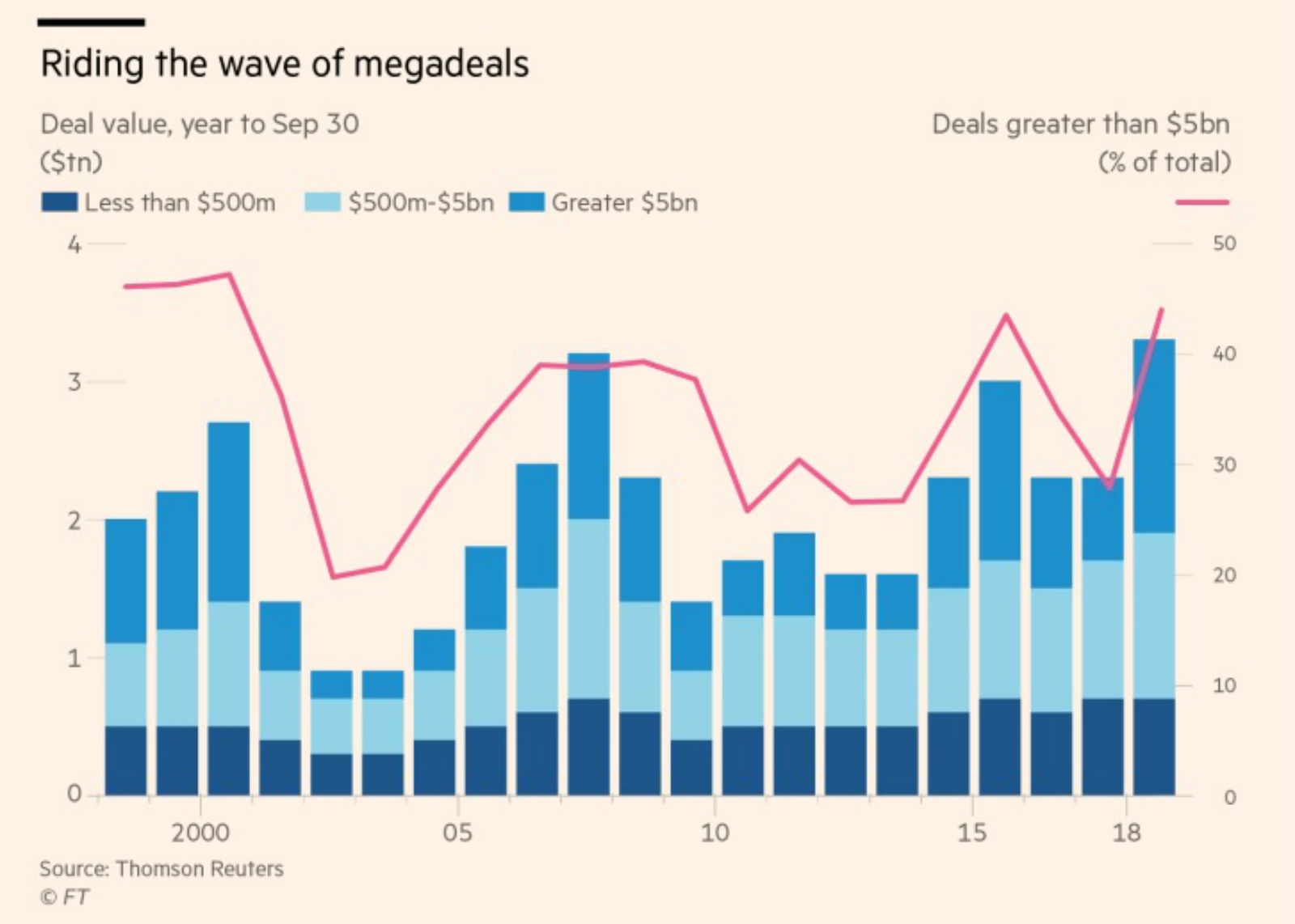

Global M&A in 9M2018 beats pre-financial crisis record

Global M&A in 9M2018 beats pre-financial crisis record: Global M&A activity during the first nine months of 2018 has crossed the USD 3.3 tn mark, “eclipsing a previous high reached on the eve of the financial crisis more than a decade ago,” according to the Financial Times. Energy, healthcare, and technology transactions have led the way. If M&A continues at the same pace through year’s end, total M&A activity could reach USD 4.3 tn, the salmon-colored paper notes. Announced transactions during the period were up 39% y-o-y, propelled by “a string of mega [transactions], defined as takeovers worth more than USD 5 bn.”

Pity the investment bankers: Investment bankers’ cuts, however, have taken a 4% dip, partially as a result of lower IPO fees and those generated by M&A advising.

The grass is always greener: Investment bankers want to be commercial bankers. And now commercial bankers want to run investment banks, according to this Bloomberg piece on Barclays boss Jes Staley, arguing that he has “staked Barclays’ future on investment banking.” Best line? Staley “plucks out his Barclays credit card and holds it up: ‘This card is the biggest risk in the bank.’”

In miscellany this morning:

- The latest from the EM Zombie Apocalypse: We’re all going to take it in the teeth on USD 80+ oil. (Wall Street Journal)

- Elon Musk will resign as Tesla chairman but remain CEO in a settlement with the SEC that will see him stay in the public-markets game. (Reuters)

- Canada and the US are expected to reach accord on the terms of a new North American Freetrade Agreement as early as today. (Bloomberg)

It’s Nobel week, but the best prize of them all — for the dismal science — won’t be unveiled until next week. You can expect:

- Physiology or medicine: Monday

- Physics: Tuesday

- Chemistry: Wednesday

- Peace: Friday

- Economics: A week from tomorrow

You can follow the announcements on the Nobel website as they roll out.