Egyptian citizens are “footing the bill” for Egypt’s energy hub ambitions

First they ignore you, then they laugh at you, then they fight you, then you win: Setting aside that Gandhi never uttered those words: You know one of your pet economic policies is getting traction when the international business press does a drive-by on it. And so it is with Egypt’s dream of emerging as the region’s premier energy hub, where the natural-gas side of the model gets scrutiny this morning from the Wall Street Journal.

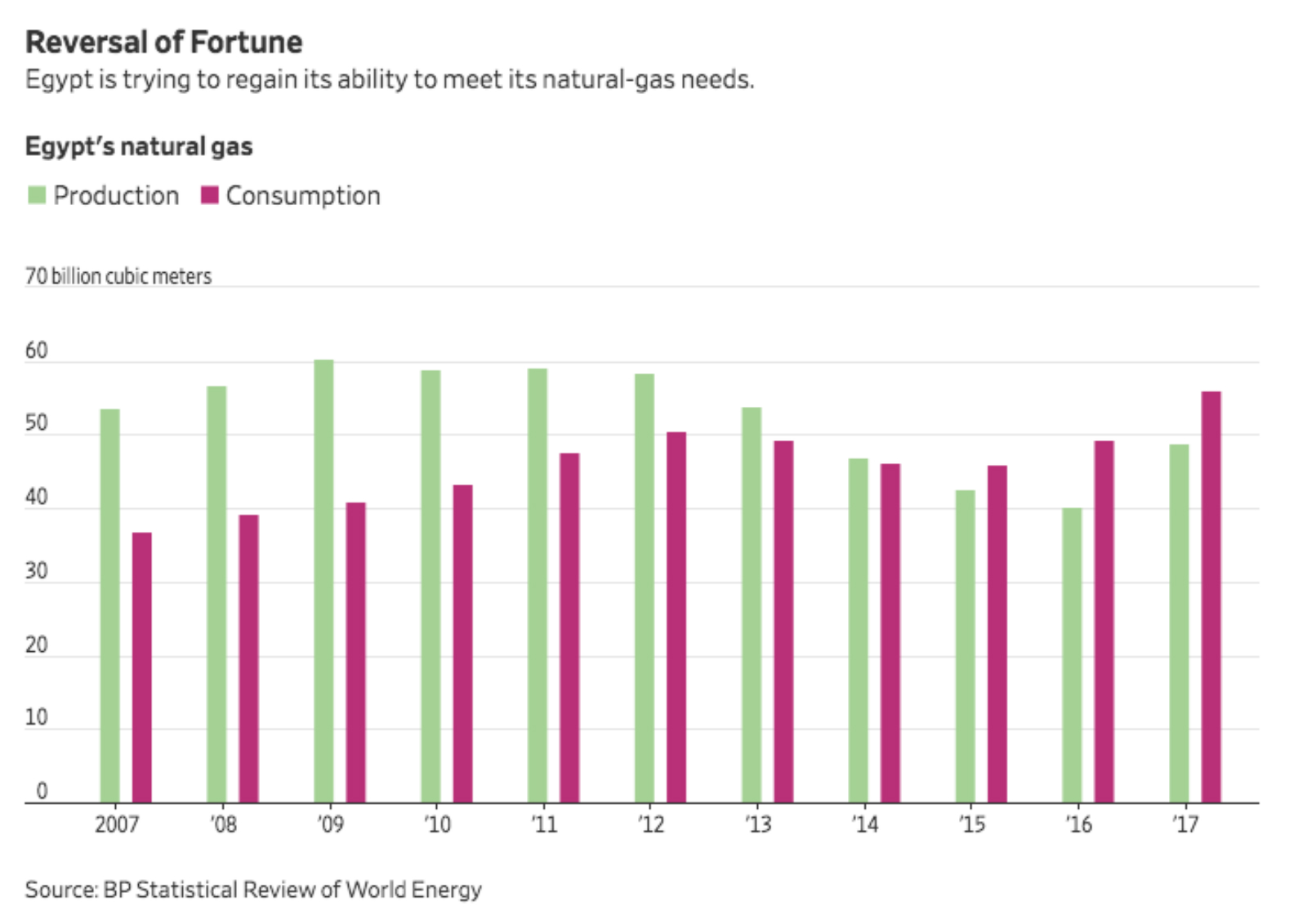

The crux of the WSJ’s argument: Egyptian citizens are “footing the bill” for the country’s bid to become an energy exporter. The paper writes that the Sisi administration has “coaxed” major international oil companies to return to Egypt by paying them higher prices for natural gas and putting the burden of payment on consumers by raising electricity and gas prices. The strategy has attracted investment from the likes of Royal Dutch Shell, BP, and Eni, but some citizens are resentful: News of major hydrocarbon discoveries has come with rising costs of living.

One tiny problem: Nowhere does the story mention that those rising prices to consumers (and industry, let’s not forget) have come as the state phases-out ruinous energy subsidies that were (a) a key factor in our economic slump post-2011 and (b) disproportionately benefited not the poor, but rich folk whose energy-hungry businesses, SUVs and A/Cs, et cetera, were all subsidized at the cost of spending on social welfare and infrastructure.

But hey: Our energy dreams have made the front page (digital) of the Wall Street Journal, complete with a single-sentence kick in the pants to close it out from veteran analyst Robert Springborg, who has won attention in Egypt post-2011 for his views on the military’s involvement in the economy. Go read In Egypt’s Vision of Energy Independence, Egyptians Pay More.

Meanwhile:

There wasn’t a peep yesterday about Foreign Minister Sameh Shoukry and Egyptian intelligence chief Abbas Kamel, who were both due to have arrived in Addis Ababa for talks with Ethiopian Prime Minister Abiy Ahmed on the Grand Ethiopian Renaissance Dam (GERD). The biggest news of late out of Ethiopia of late: Ahmed has lined up USD 1 bn in direct budget support from the World Bank and continues to make nice with China, where he will be meeting with top officials during a September 3-4 visit to Beijing. China is Ethiopia’s largest trading partner and biggest foreign investor, according to Abiy’s chief of staff.