Saudi’s MSCI EM classification gives GCC expansive position in the index

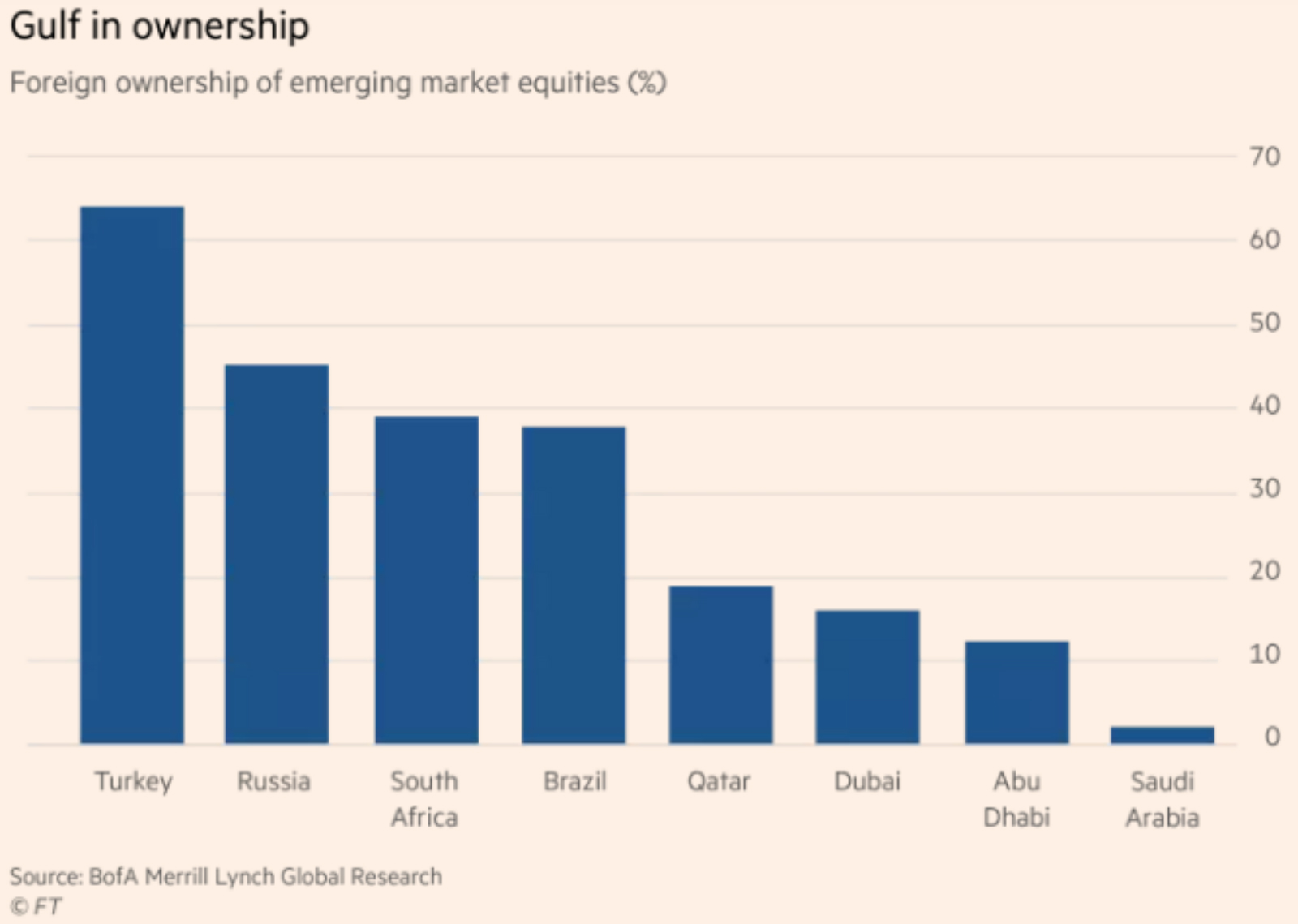

Saudi’s MSCI EM classification gives GCC a significant position in the index: Saudi Arabia’s entry last week to the MSCI Emerging Markets equity index had given the GCC an outsized role in the index and increased GCC ownership stakes in EMs, writes Steve Johnson for the FT. This is especially true when taking into account the low foreign ownership in GCC stocks. “All told, the Gulf could conceivably account for about 7%of the index by 2020, more than index stalwarts South Africa, Brazil and Russia and behind only China, South Korea, Taiwan and India,” he writes. Saudi is the biggest new entrant to the MSCI index since Malaysia was readmitted. Analysts estimate that based on current prices, the USD 520 bn Tadawul bourse will constitute 2.6% of the index when it assumes its full weight in August 2019. That coupled with the UAE and Qatar’s combined 1.4% and Kuwait’s expected classification in 2020, should give the GCC a dominant position in the index, says Johnson.