IMF’s regional economic outlook sees gas production propping up Egypt’s GDP growth

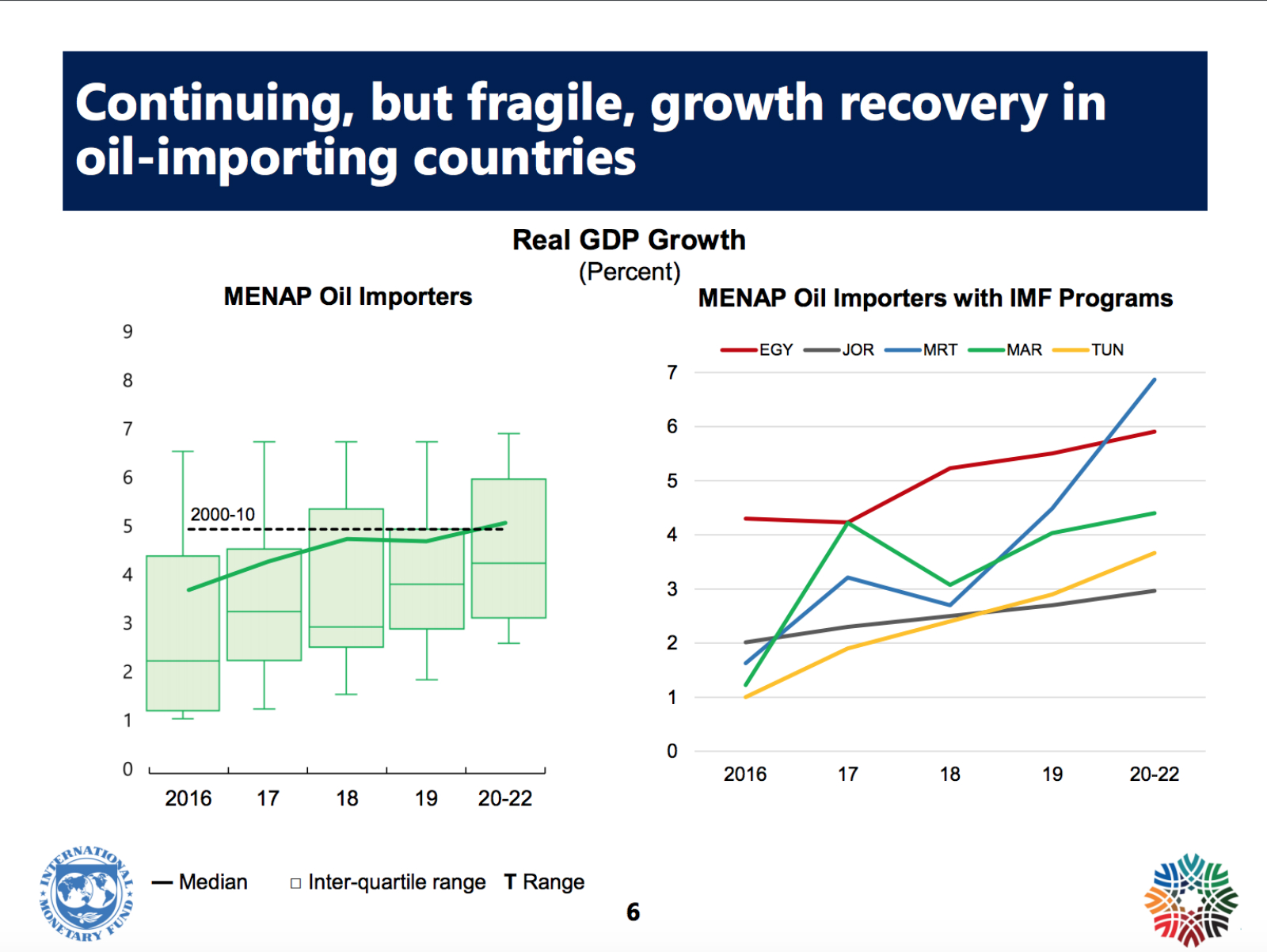

Rising natural gas production in Egypt will help bump GDP growth to 5.2% this year and 5.5% in 2019, the IMF said in its Regional Economic Outlook May 2018 report. “The outlook for Egypt has improved relative to the October 2017 forecast. In the context of its IMF-supported program, improving confidence is boosting private consumption and investment, adding to the increase in exports and tourism.” This forecast puts Egypt ahead of most other net oil importers in the Middle East, North Africa, Afghanistan, and Pakistan (MENAP) region, which the report expects to record growth rates between 1.5% and 4.5% this year. Across MENAP, Pakistan alone outstrips Egypt with an estimated GDP growth rate of 5.6% this year.

Debt levels remain high in Egypt, the report notes, with significant debt-service burdens that “crowd out growth-enhancing expenditures.” Tightening monetary policies in high-deficit countries including Egypt are expected to drive up financing costs and further increase the debt burden, according to the report.

Growing economies aren’t creating jobs fast enough to make a dent in youth unemployment: Growth levels across the region “remain too low to effectively reduce unemployment, particularly for young people.” According to the report, oil-importing countries — including Egypt, Jordan, Lebanon, Morocco, and Syria — must reach growth levels of 6.2% just to keep unemployment at its current average of 10%.

For Egypt, this means creating 700k to 1 mn new jobs every year, which is only attainable with private sector involvement, the IMF’s Middle East & Central Asia Department Director Jihad Azour tells the Associated Press. “Allow the private sector to be in the leading role and for the state to move from being an operator to an enabler, and give more room for the private sector to invest,” he said.