African economies lag behind in renewable energy

African economies are “lagging behind” in the renewable energy domain due largely to a lack funding needed for infrastructure development, Steve Johnson writes for the Financial Times (paywall). Emerging markets as a whole are still miles behind the developed world where green energy is concerned, but Africa in particular suffers from a specific problem: “Even if energy companies are able to enter into long-term agreements with utility companies to supply renewable power, there can still be uncertainty as to whether the latter will ultimately be able to afford to pay the agreed tariffs throughout the life of the contract,” according to the International Energy Agency’s (IEA) Heymi Bahar.

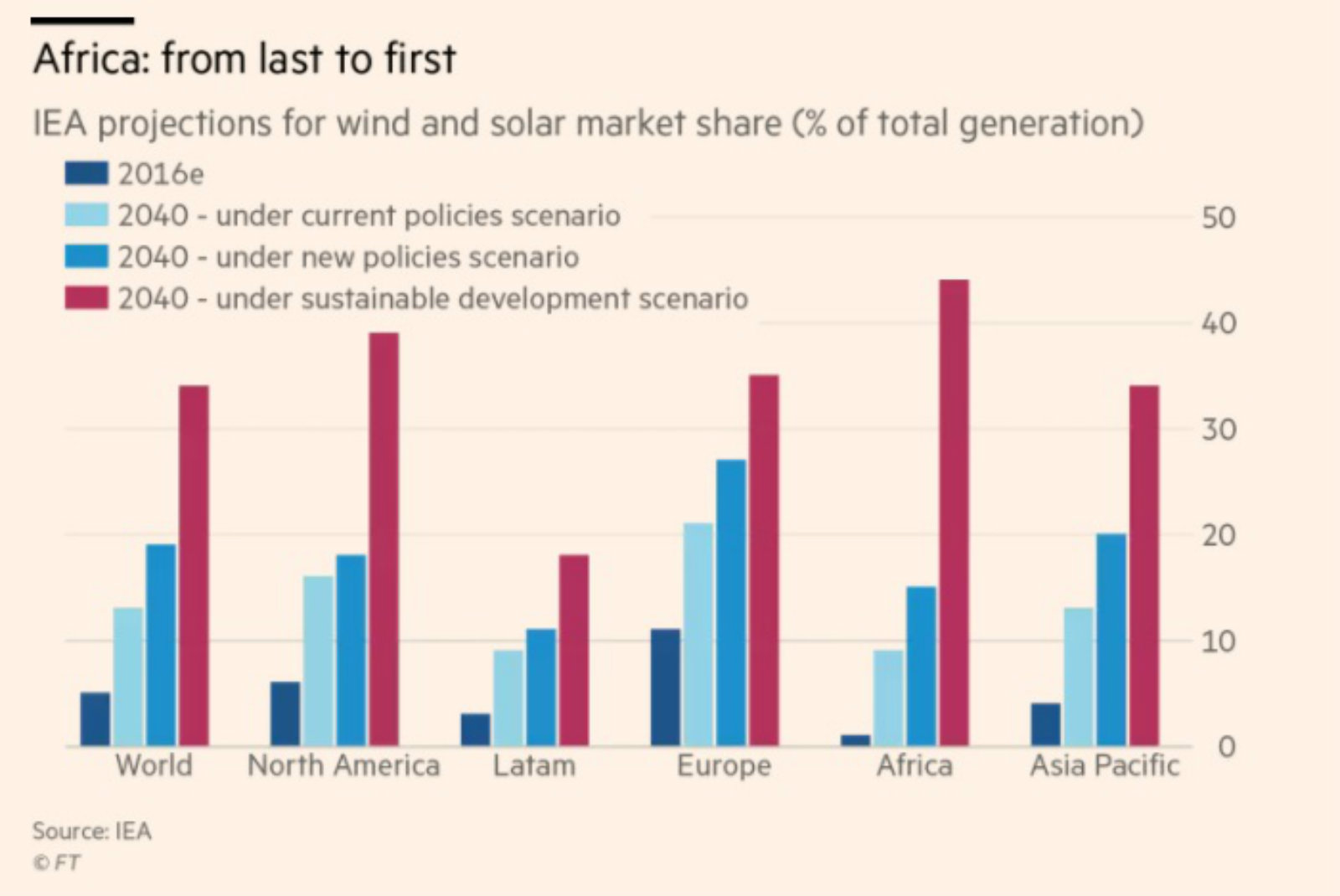

Africa could become the world’s top producer of wind and solar power by 2040: Although wind and solar power accounted for only 1% of the continent’s power generation in 2016, Bahr believes that “significant progress [is] possible because the demand for increased power across Africa is so great, and the continent’s latitude means solar, alongside wind, could be the cheapest way of meeting this demand.” Research from the IEA shows that Africa will continue to trail behind other developed and emerging economies by 2040 unless it adopts a sustainable development scenario, which could also work to mitigate the effects of global warming. Under that scenario, “wind and solar would need to account for 44% of Africa’s production by 2040, the highest proportion of any region in the world.”