Are we staring into the abyss of another global market correction?

It’s looking like it could be an interesting week for equities around the world: A slump in tech stocks sparked by a backlash against technology companies gained steam yesterday, putting more pressure on markets already weighed down by fear of a global trade war. The S&P 500 lost 2.2% yesterday and the tech-heavy Nasdaq tumbled 2.9%, prompting a sell-off in Asia today: Shares from Australia to Japan, Korea and China were uniformly down in trading today.

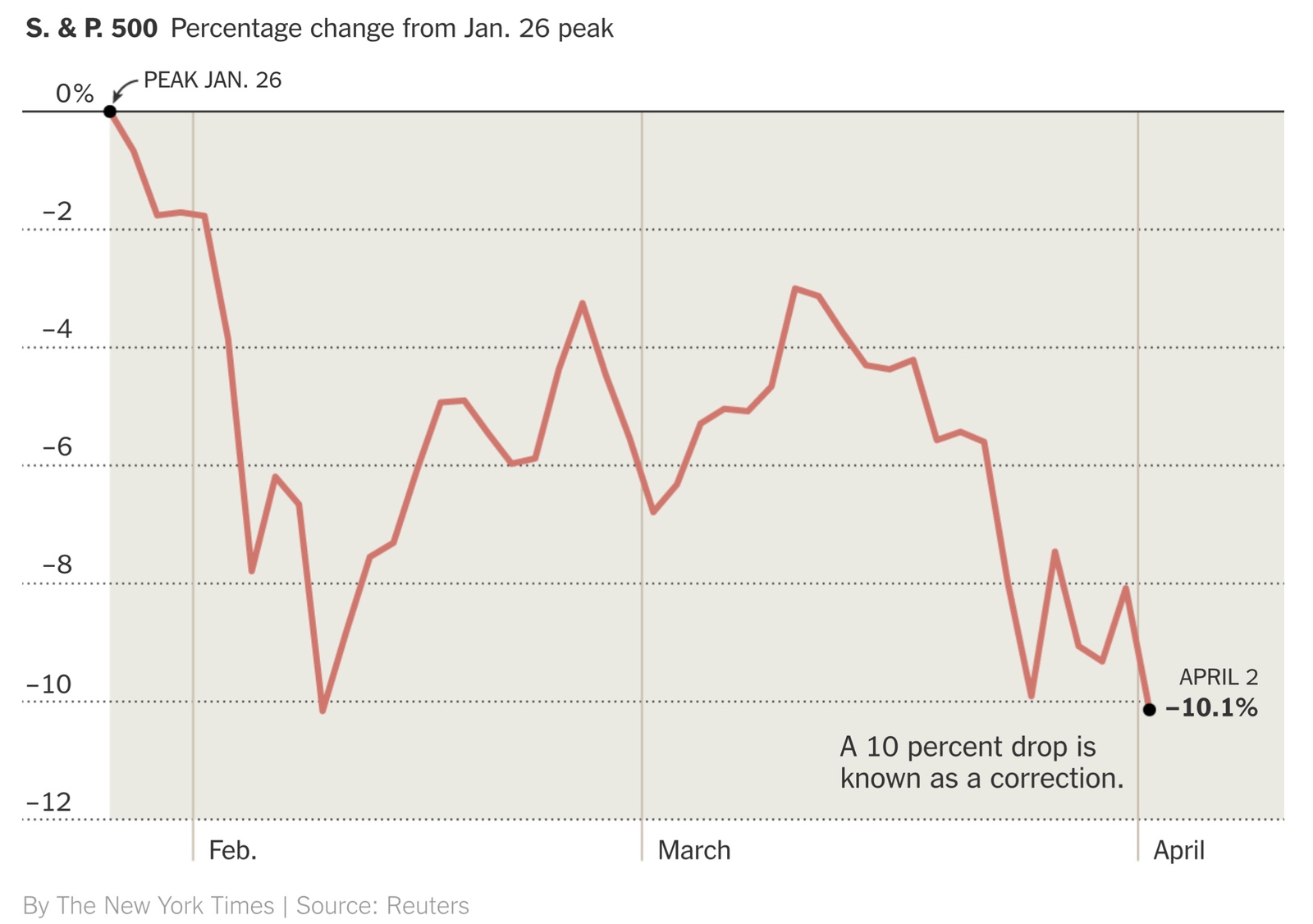

Yesterday’s selloff in Amreeka puts US shares into correction territory as the second quarter of the year begins (see graph, above). In fact, it’s the second time shares have gone into correction territory so far this year. Check out this Reuters market report to get oriented. The story is getting sufficient traction in western markets that it’s now front-page news on the New York Times as of dispatch time. (A correction is when shares are 10% from a recent market peak.)

The EGX 30 bucked the trend, closing up 0.5% yesterday.

The VIX is up 18%, Bloomberg reports, referring to the CBOE Volatility Index, while gold and the Japanese yen have gotten a boost.

Why are stocks tumbling? US shares are taking it on the chin amid a backlash against technology and a the prospects of a trade war between the US and China. Tech stocks are being hammered by everything from the world waking up to the fact that Facebook’s approach to privacy is evil, to Trump attacking Amazon on social media and electric car maker Tesla’s handling of a fatal crash of a self-driving car.

Why are journalists suddenly writing as if shocked to wake up and find that most emerging tech companies aren’t yet profitable? From the Financial Times: “Tesla, like Amazon and Uber, has been heavily dependent on investors’ willingness to fund expansion without profits, said Jeffrey Pfeffer, a management professor at Stanford University. ‘It’s sort of a confidence game — as long as people believe, the companies can raise money,’ Mr. Pfeffer said. ‘So image is everything.’”

What should you expect? Nobody knows. Equities strategists are all over the board, with some saying the selloff is largely a US-only phenomenon, while others pointing to a wider problem because of the prospect of a global trade war. Others still feel that the current selloff is, “too bad, because I think underlying this market, the fundamentals are very strong.”

This much is clear: It’s going to be a bit messy for a while longer. Sabre-rattling over trade got louder as China increased tariffs by up to 25% on 128 US products, from frozen pork and wine to certain fruits and nuts, in response to US duties on imports of aluminum and steel, Reuters reports. And it looks like it’s not going to cool down anytime soon, as the Trump administration looks set to announce on Friday a list of China tech products it plans to slap with tariffs worth as much as USD 60 bn.

Oil is taking it on the chin with stocks: This appears to be contributing to a 2% drop in oil prices to USD 67.60 per barrel, says Reuters. “Increasing trade friction between China and the U.S. is likely to rock global markets and tarnish bullish sentiment in crude oil markets,” said Wang Xiao of Guotai Junan Futures.