EM bonds may have lost their flavor, but EM equities hit new highs

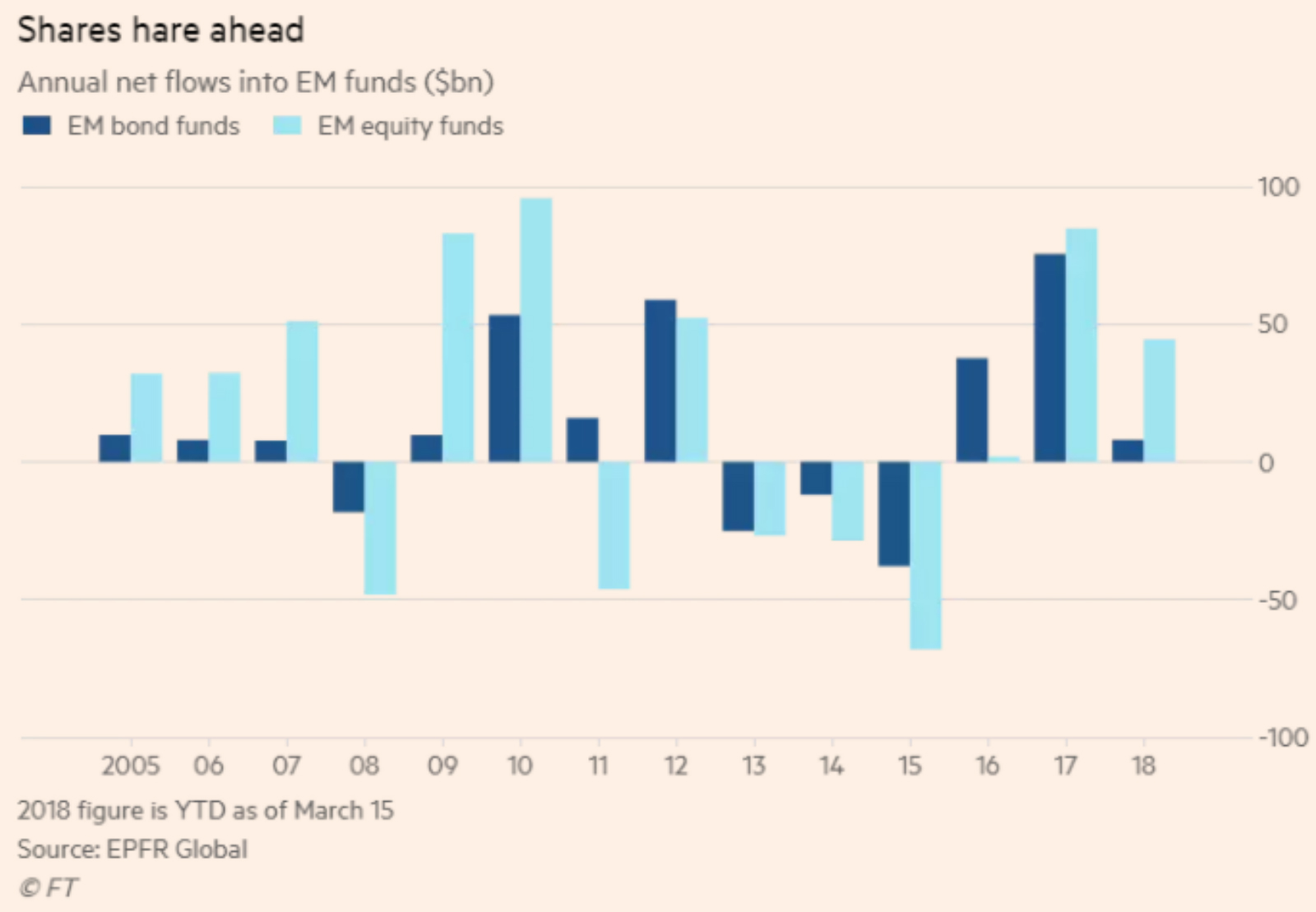

EM bonds may have lost their flavor, but EM equities hit new highs: Emerging market equity funds have made a record-breaking start to the year, with net inflows of USD 44.5 bn as of mid-March, according to figures from EPFR Global picked by the Financial Times. EM equities are up 34% y-o-y, said the head of global emerging market equity strategy at UBS, Geoff Dennis, who likes the outlook for the rest of the year. Cameron Brandt, director of research at EPFR, says that the enthusiasm for EM equities in general had been lifted by greater optimism about the health and growth prospects of the Chinese economy.

US policies appears behind the diminishing appeal of EM bonds. “Bond funds are definitely starting to come under pressure,” after a “great run” since the beginning of 2017, said Brandt. Data from the Institute of International Finance pointed to “a near halt in inflows to EM bond funds” in recent weeks, potentially driven by the Trump administration’s protectionist policies. Both hard and local currency EM bond funds suffered net outflows in February and the first half of March, according to EPFR, with “big” outflows from Asia ex-Japan bond funds and USD 200 mn pulled from Colombian funds.

This comes as the US looks to be ratchet up its brewing trade war with China. US Treasury Secretary Steven Mnuchin said on Wednesday his agency has prepared US investment restrictions on China for President Donald Trump to consider as part of his upcoming announcements on intellectual property actions against Beijing, Reuters reports.