EMs can weather a more hawkish Fed

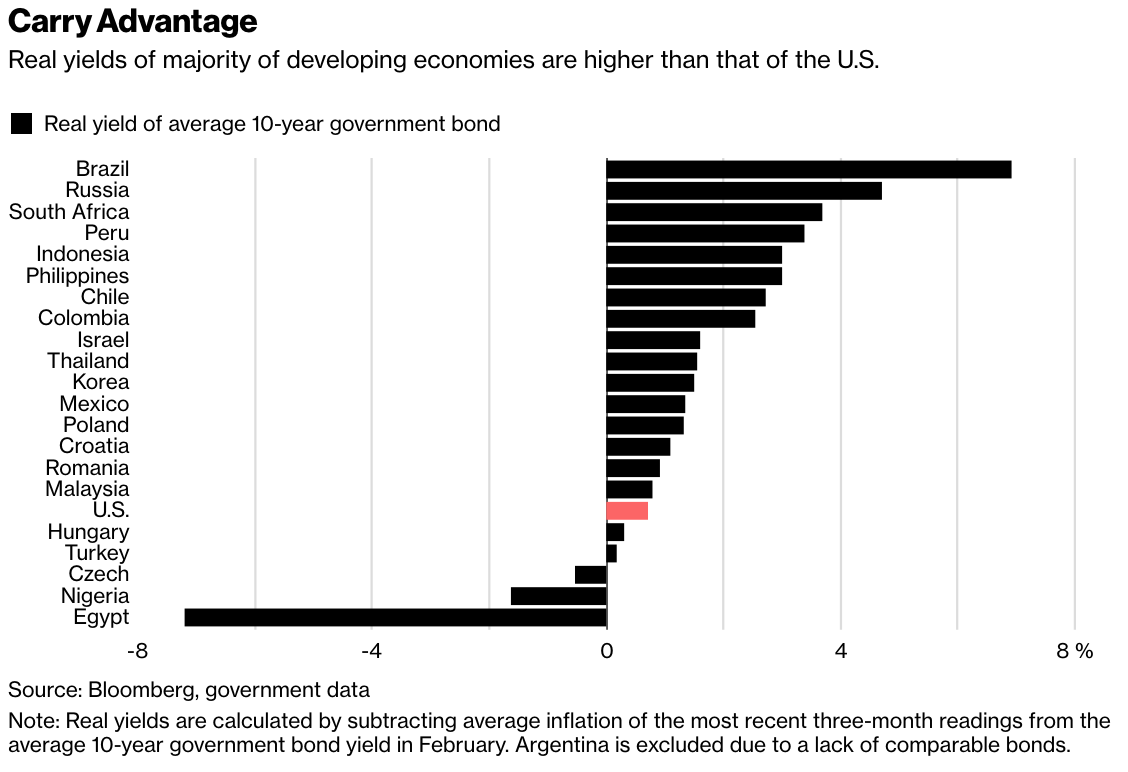

From the department of missing the point: “Investors nervous about whether the bull case for emerging-market assets can weather a more hawkish Federal Reserve can take solace in the outlook for consumer prices,” Yumi Teso and Masaki Kondo write for Bloomberg. Despite listing EMs as a good investment overall, by their token, the inflation rates in Egypt make it a poor investment as they return negative yields. Bloomberg got its results for the real yields by subtracting average inflation of the most recent three-month readings from the average 10-year government bond yield in February. While the general sentiment surrounding EM investment is sound, Teso and Kondo are missing the point: EM investors looking for exposure to Egyptian debt through the carry trade pay little to no attention to inflation and the “real” return. Inflation plays no direct part in your returns from trading — what dictate returns are the nominal yields on the instruments, the financing costs, and the exchange rates. The negative real yields are bad news for domestic banks and savers, but not for foreign funds.

Want a primer on what a carry trade is? Bloomberg’s Natasha Doff and Marton Eder got you covered, but it doesn’t look like they shared the note with all their colleagues.