IMF advises Middle East to cut back on public wages bill

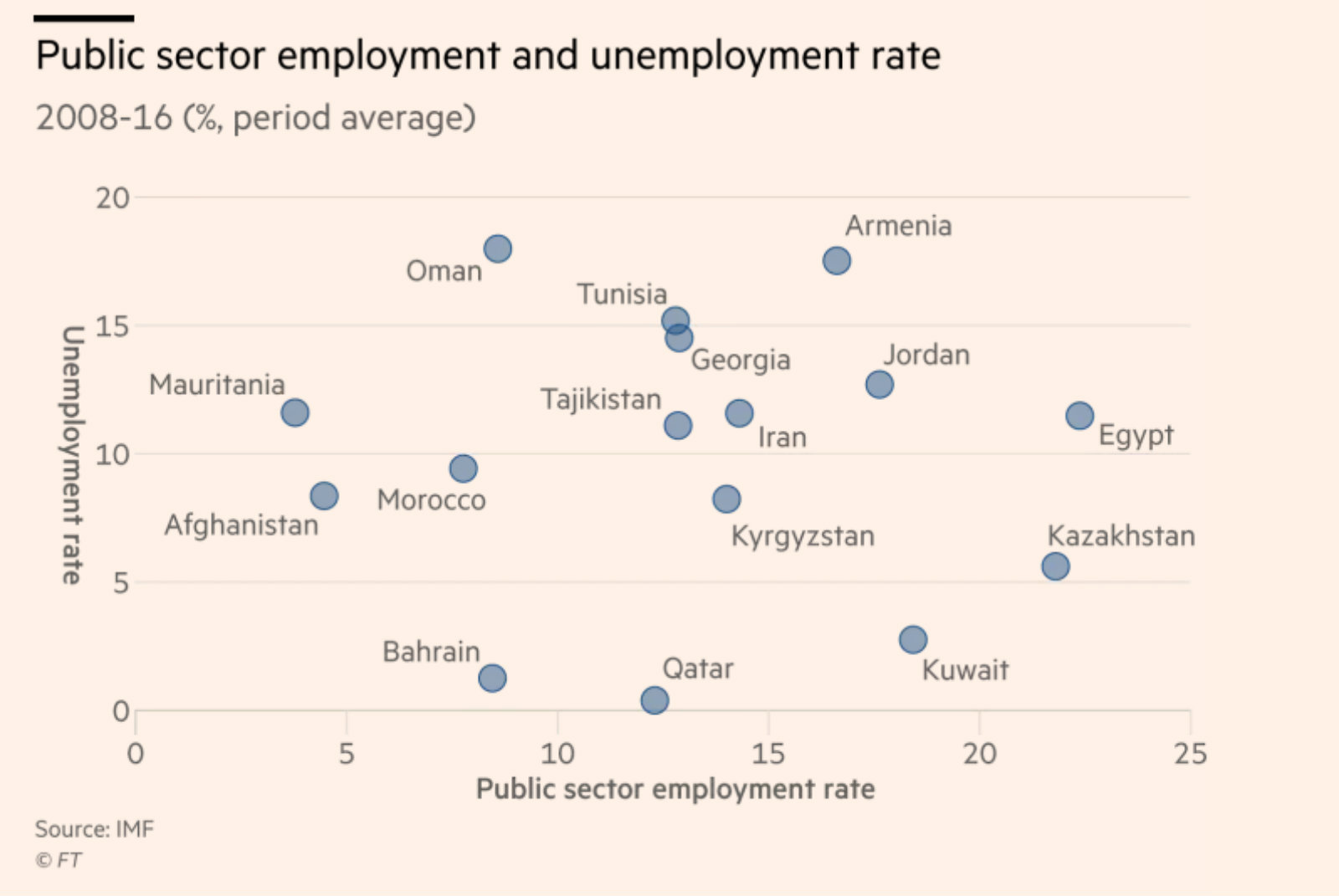

The IMF is advising Middle Eastern countries to work on cutting their public wage bills as “attempts to contain unemployment by creating bloated public sector workforces have completely failed,” says the Financial Times (paywall). In its latest report, Public Wage Bills in the Middle East and Central Asia, the IMF finds that countries across the MENA region, as well as Pakistan and Afghanistan, spend an average 6% of their respective GDP on public sector wages, despite there being no evidence to suggest that public sector employment can help boost overall employment levels. In fact, rather than create jobs, the existence of a large public sector workforce only translates to a smaller number of private sector jobs, the report also finds. “Countries such as Egypt, Armenia, Jordan and Tunisia all have high jobless rates despite having large public sector workforces, while Bahrain and Afghanistan each have low unemployment and small public sectors.”

The IMF says that by slashing their wage bills, governments in emerging economies would be able to spend more on development and social welfare, which “are crucial for inclusive growth and poverty reduction.” The report notes that “reforming public wage management is already on the policy agenda of several countries in the region,” including Egypt, Iraq, the GCC, and Tunisia, seeing it as “an important component of fiscal consolidation.”