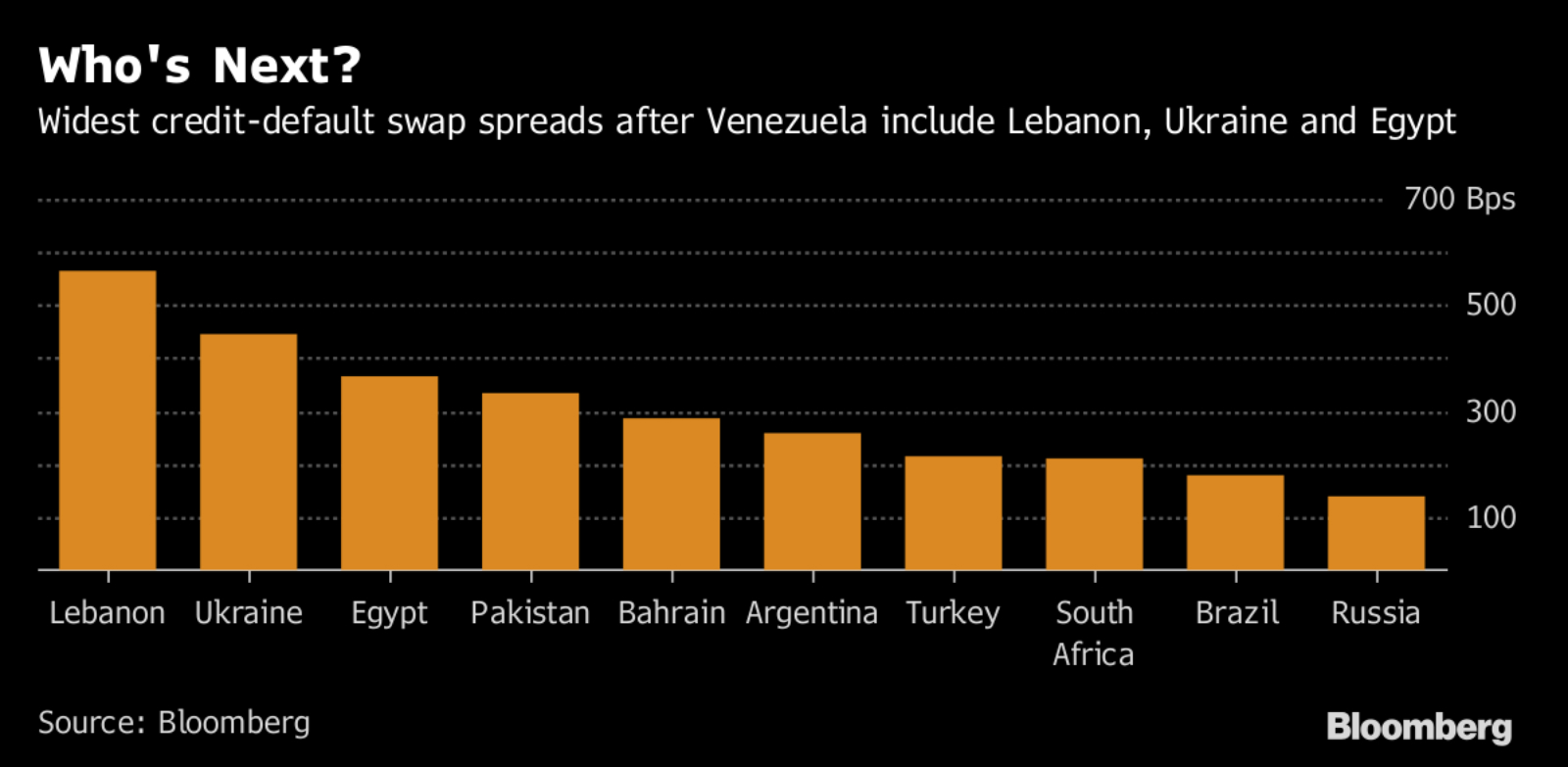

Egypt being eyed as among riskiest bonds by EM money managers after Venezuela default

Egypt is one of several “risky” sovereign bonds being looked at more closely by emerging markets money managers as Venezuela defaults on loans and the Lebanon crisis unfolds, write Ben Bartenstein and Justin Villamil for Bloomberg. Egypt, along with Lebanon, Pakistan and the Ukraine, have the widest credit default swap spreads after Venezuela. Egypt’s credit-default swaps are hovering near their highest since September. The cost for protection surged in June as regional tensions heated up amid a push by the Saudis to isolate Qatar. “While Egypt has been able to boost FX reserves and is on course to repay USD 14 bn in principal and interest in 2018, its foreign debt has climbed to USD 79 bn from USD 55.8 bn a year earlier.” Finance Minister Amr El Garhy had long downplayed the rise in Egypt’s foreign debt, saying that they were in acceptable and manageable margins.