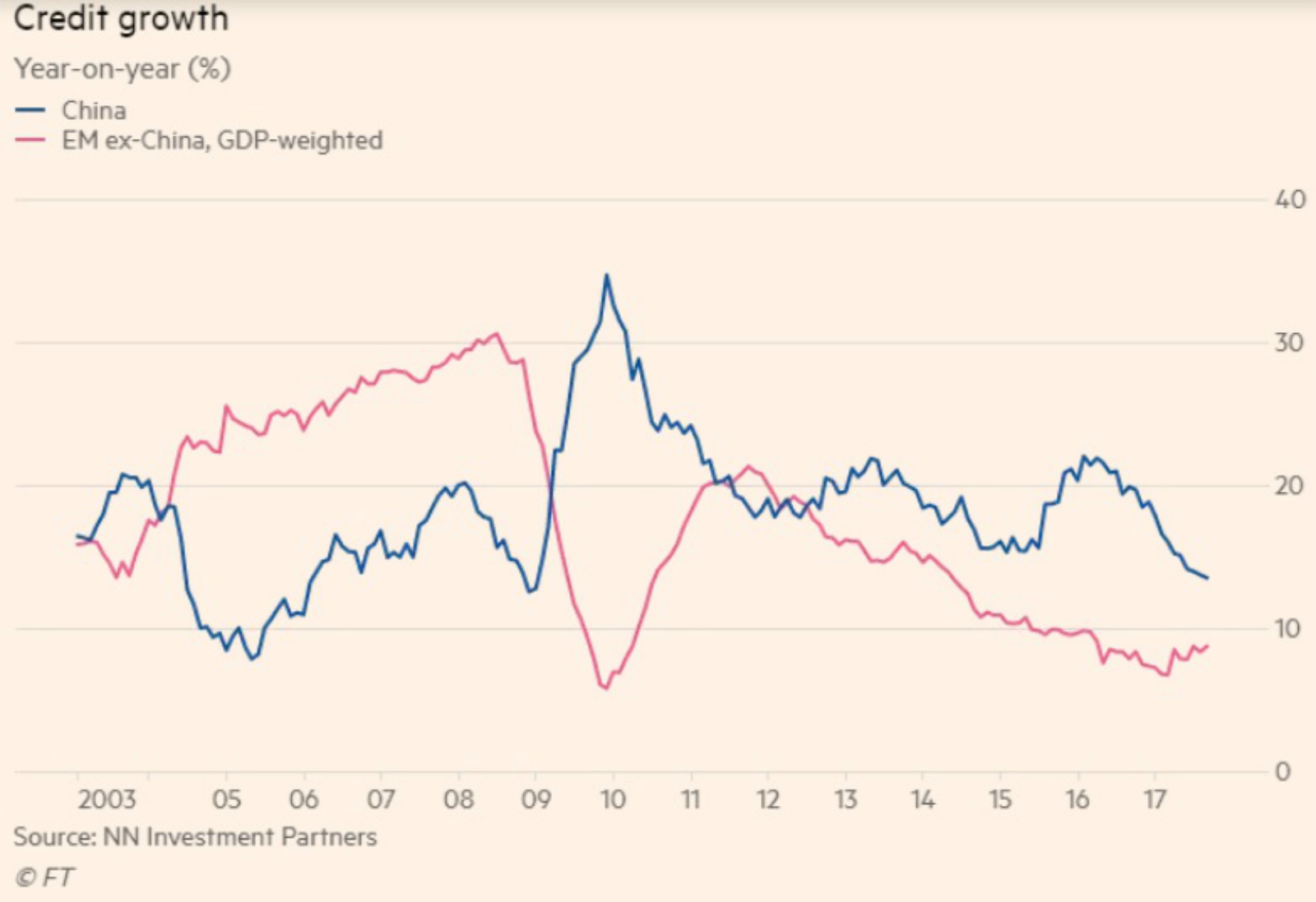

Credit growth in emerging markets is accelerating for the first time since 2011

“Credit growth in non-Chinese emerging markets is accelerating for the first timesince 2011, buoying expectations of stronger economic growth,” writes Steve Johnson for the Financial Times. Credit growth hit an annual rate of 8.7%, according to data compiled by Dutch asset manager NN Investment Partners, which tabulates the GDP-weighted average of 19 EMs. This comes after a slump which saw the y-o-y credit growth rate stuck at 6.7% between 2011 and February 2017. “[Cross-border] capital flows are not as negative as before, currencies have recovered and central banks have been able to cut rates and, after a long period of lost confidence in these countries, that has bottomed out so people and companies are more confident about borrowing money,” said Maarten-Jan Bakkum, senior emerging markets strategist at NNIP. These improved economic metrics jive with the IMF’s forecast that GDP growth in emerging and developing countries will hit 4.6% 2017, up from 4.3% in 2016, and will even reach 4.9% in 2018.

The growth is in more than just credit, but in EM liquidity as a whole, which encompasses credit, savings and net foreign capital flows.