Egypt makes “good start” with reform program -IMF

The IMF thinks Egypt is on track with the economic reform program, according to the Associated Press. Egypt has made “a good start at reining in public spending, boosting investor confidence, and addressing the surging inflation generated by the new policies,” the Fund says in its first review since signing the funding agreement with Egypt. Egypt has so far received USD 4 bn out of the USD 12 bn agreed on. Egypt’s “good start” came despite “seeking waivers for missing some targets in June and a deeper-than-expected currency depreciation,” Reuters notes. The IMF says “it had agreed to a request for a waiver after Egypt missed primary fiscal balance and fuel subsidy bill requirements for end-June. The waiver was granted in part because of planned strong fiscal adjustments in the next two years.”

The full report is here in pdf for download, and we have key highlights below:

Inflation remains the main risk to macroeconomic stability, the IMF believes. “Entrenched, high and persistent inflation could pose a threat to macroeconomic stability. It may also impede credibility of the new monetary policy framework.” However, it noted that “the transition to a flexible exchange rate went smoothly. The parallel market has virtually disappeared and central bank reserves have increased significantly.” The Fund sees that “energy subsidy reform, wage restraint, and a new value-added tax have all contributed to reducing the fiscal deficit and helped free up space for social spending to support the poor.” Very ambitiously, also sees inflation falling to just over 10% by the end of FY 2017-18.

The IMF appeared supportive of amendments to the Central Banking Act that stirred controversy in the banking sector when they were announced in July. “Among other provisions the amendments envisage strengthening its governance structure, improving the recapitalization and profit distribution rules, normalizing the financial relationship with the government and commercial banks, enhancing transparency, and separating the emergency liquidity assistance and bank resolution frameworks.”

In its review of Egypt’s monetary policies, the report notes that the CBE will continue to tightly monitor inflation rates and that subsequent policy adjustments will depend on inflation dynamics and its assessment of inflation expectations. On the FX front, the CBE appears to have gone against the IMF’s recommendations by not phasing out the profit repatriation mechanisms as it believes it plays an important role in attracting investment. The CBE intends to manage reserves to be in line with investment goals, the report notes. The report writes that by December 2017 the CBE will also remove the USD 50,000 cash deposit cap for non-priority goods.

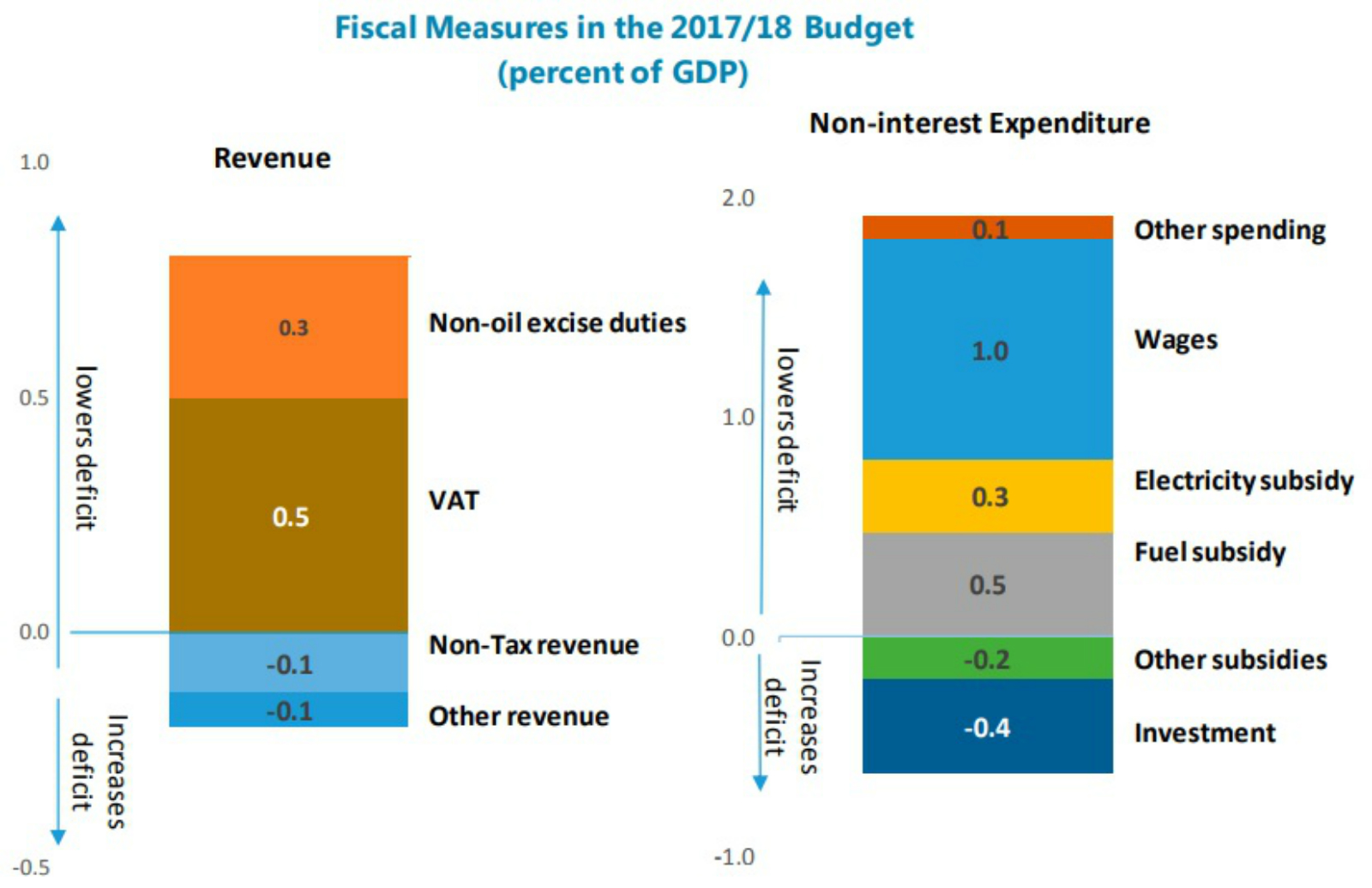

The IMF says that the FY2017-18 budget is consistent with the government’s medium-term objectives and that the expenditure framework reflects policies as agreed under the program. The primary surplus is projected at 0.4% of GDP, which would constitute fiscal consolidation of 2.2% of GDP. The overall deficit is projected to decline by 1.8% of GDP as monetary tightening will temporarily raise debt service costs. Tax revenue is projected to increase by 0.7% of GDP due to the increase in the VAT rate. The structure of expenditure will improve by lowering wage spending and energy subsidies, while increasing investment and strengthening targeted social protection, the report reads. The wage bill will decline by 1% of GDP, while energy subsidies are expected to decline by 0.8% of GDP.

So, when is the next round of funding coming? The IMF says to expect a third installment of around USD 2 bn in funding to disbursed to Egypt after a second review at the end of this year, Reuters notes.