MENA startups increasingly turn to offshore havens to avoid regulatory hurdles

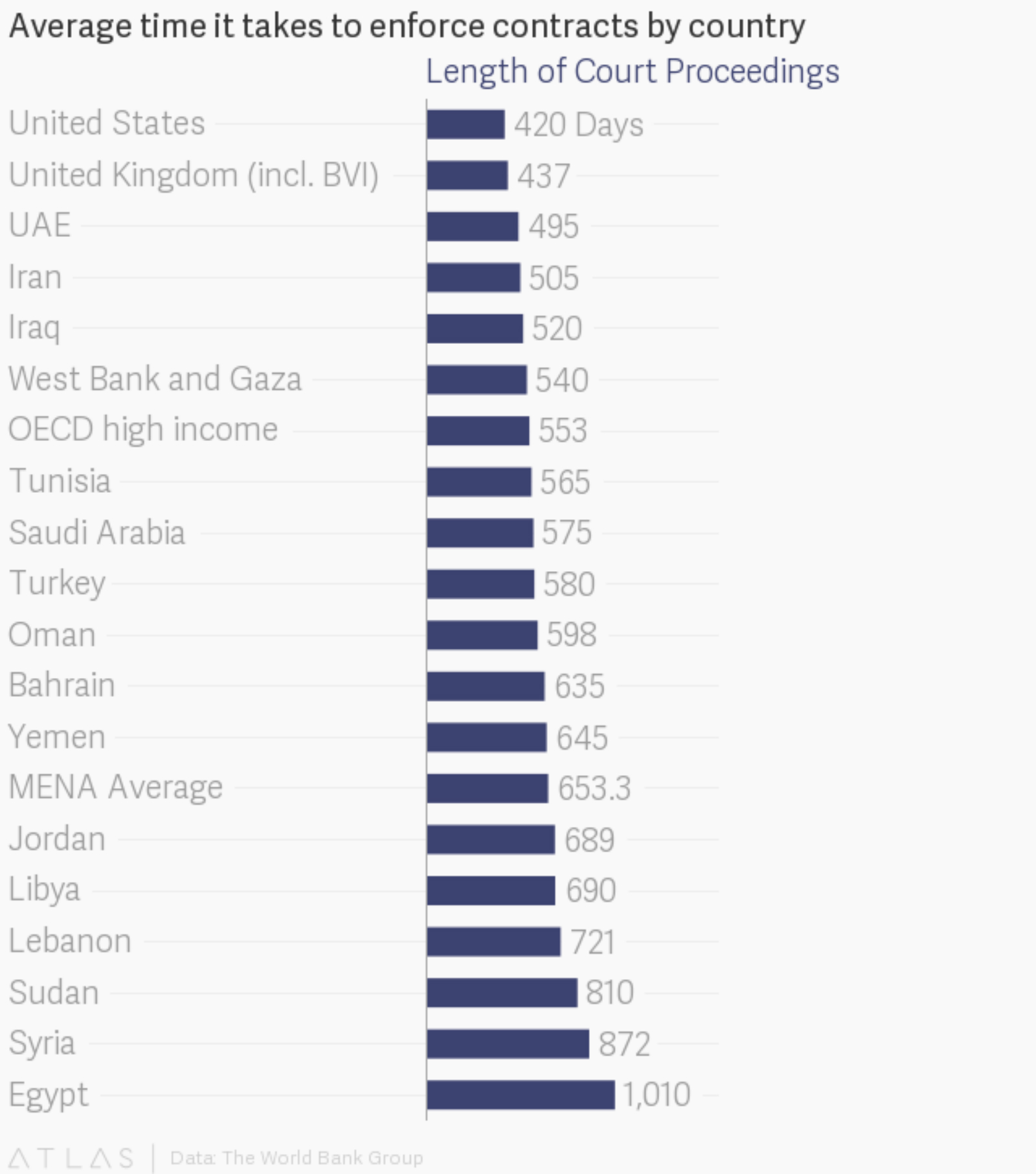

MENA startups increasingly turn to offshore havens to avoid regulatory hurdles: The first order of business for new startups in the Middle East appears to be registering in an offshore haven, writes Dennis Quinn in a piece for Quartz. Taxation is far from the only reason why companies are looking offshore: Regulatory hurdles are the prime motivator, the story claims. Investors in Careem, for example, were not concerned when Jordan clamped down on drivers when the service launched there because the company was registered in the BVI. On the whole, MENA countries have failed to advance their regulations to meet with the demands of entrepreneurship: from a lack of bankruptcy laws that protect individuals from liability of companies to outdated shareholder laws that make it difficult for investors to exit. While there has been efforts to reform legislation in the region, these have largely been addressing the symptoms and not the systems as a whole, with the results at times being detrimental for the investing climate, says Quinn.