Egypt in the news on 14 May 2017

It’s a mixed bag of coverage for Egypt in the international press this morning, with coverage being led by the discovery of a cache of 17 mummies and, separately, of the 3,700 year-old tomb of a pharaoh’s daughter. Reuters reports that the finds are the latest in a string of discoveries that represent “a helping hand from the crypt for [our] struggling tourism sector.” Elsewhere, an Associated Press piece on the “ballet bubble” in Cairo is also getting increasingly wide pickup.

Archaeology and ballet are drowning out pickup of stories from Reuters and Bloomberg on Egypt reaching a staff-level agreement with the IMF to disburse the next tranche of the USD 12 bn extended fund facility. Also flying below the radar: AP’s story noting that President Abdelfattah El Sisi is “calling on the international community to lift an arms embargo on Libya so that weapons can be delivered legally to a powerful general he backs in the fractured country’s east.”

The Economist takes positive note of the passing of the new investment act, correctly adding that the devil is in the details of its implementation at the sub-ministerial level. The story also mixes in the moribund one-stop shop and the industrial permits act for good measure — and springboards off our “dismal” 122nd-place ranking on the World Bank’s ease-of-doing-business index. H/t Youssef B.

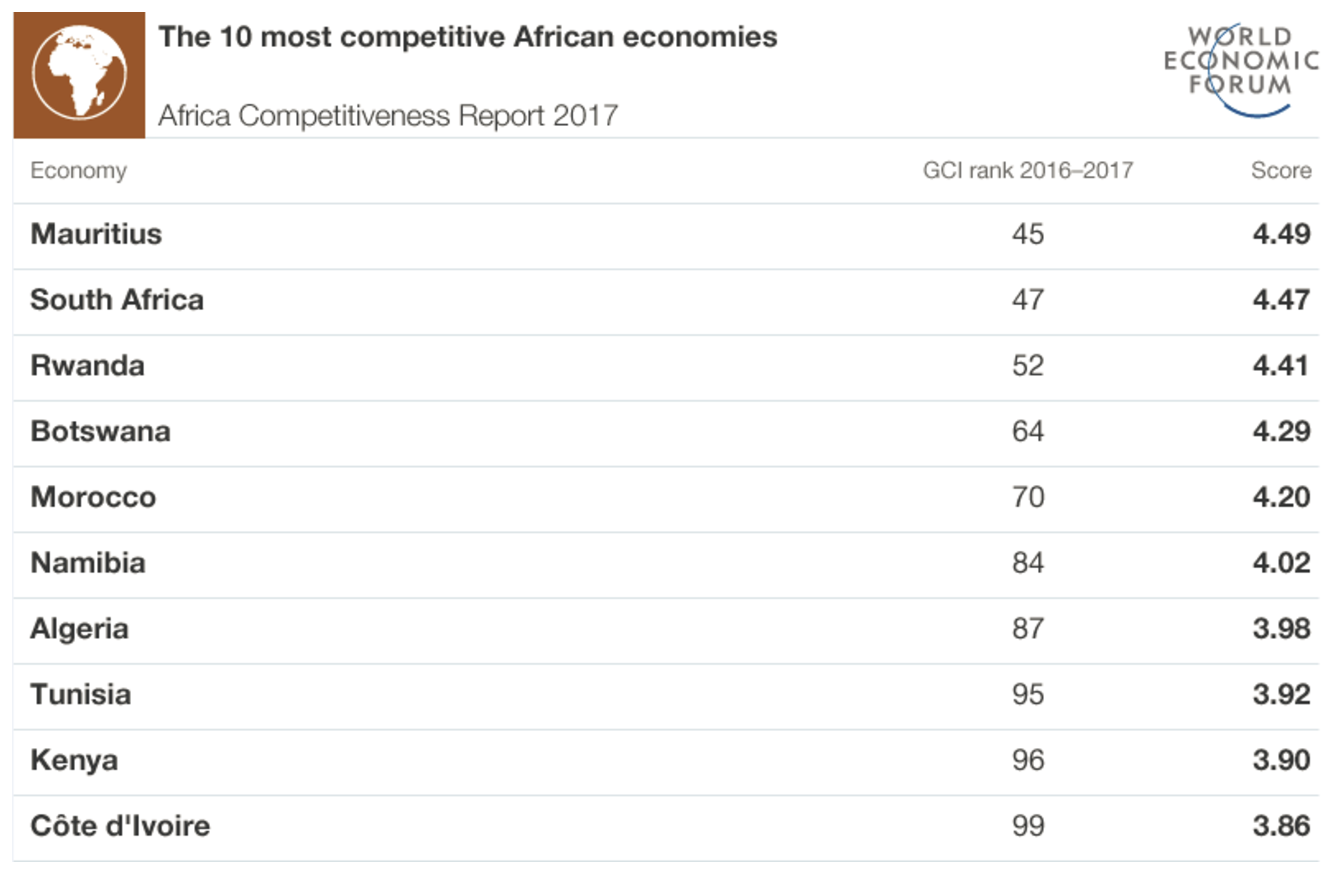

The World Bank and World Economic Forum also spring-boarded off the Ease of Doing Business index in partnership with the African Development Bank for the 2017 edition of the Africa Competitiveness Index (pdf), wherein the disaster zone that is Algeria (for anyone who has ever tried to be a non-oil foreign investor there) is said to be among the 10 most competitive African economies. The five most competitive African economies, per the report, are Mauritius, South Africa, Rwanda, Botswana and Morocco. Check out the table below, which accompanies this story on the WEF blog.

The Egypt section (pp. 106-107) notes “Egypt remains stable at 115th position this year. To create growth and employment, Egypt could build on its large market size (25th); its business sector, which by some accounts appears more sophisticated than those of neighboring countries (85th); and its geographical proximity to the large European market.” We get particularly low marks for “government instability / coups” and “foreign currency regulations,” which makes us wonder when the bloody thing was written. H/t Haitham A.

From there, hop over to the Wall Street Journal (paywall), where Maria Abi-Habib has a long take this morning headlined “Christians, in an Epochal Shift, Are Leaving the Middle East.” Sadly, Egypt features heavily in the story, which notes that, “By 2025, Christians are expected to represent just over 3% of the Mideast’s population, down from 4.2% in 2010, according to Todd Johnson, director of the Center for the Study of Global Christianity at Gordon-Conwell Theological Seminary in Hamilton, Mass. A century before, in 1910, the figure was 13.6%.”

Finally, Hassan Khan, the Cairo-born artist, has won the Silver Lion at the Venice Biennale as “the most promising young artist in the central exhibition,” the New York Times notes in passing. More on Khan here.

Other coverage worth a skim:

- David Schenker says it is unclear that Egypt is “actually an asset” in the fight against Daesh in a piece for Foreign Affairs (paywall).

- Egypt could mediate a political settlement in Iraq, Joelle El-Khoury writes in Al-Monitor. This follows a meeting between President Abdel Fattah El Sisi and Ammar Al Hakim, the head of the ruling Shiite Iraqi National Alliance.

- Alexandria is one of the cities that could disappear off the map by 2070, according to The Science Times.