Positive reversals in banking sector’s earnings hint at lower political risks in Egypt

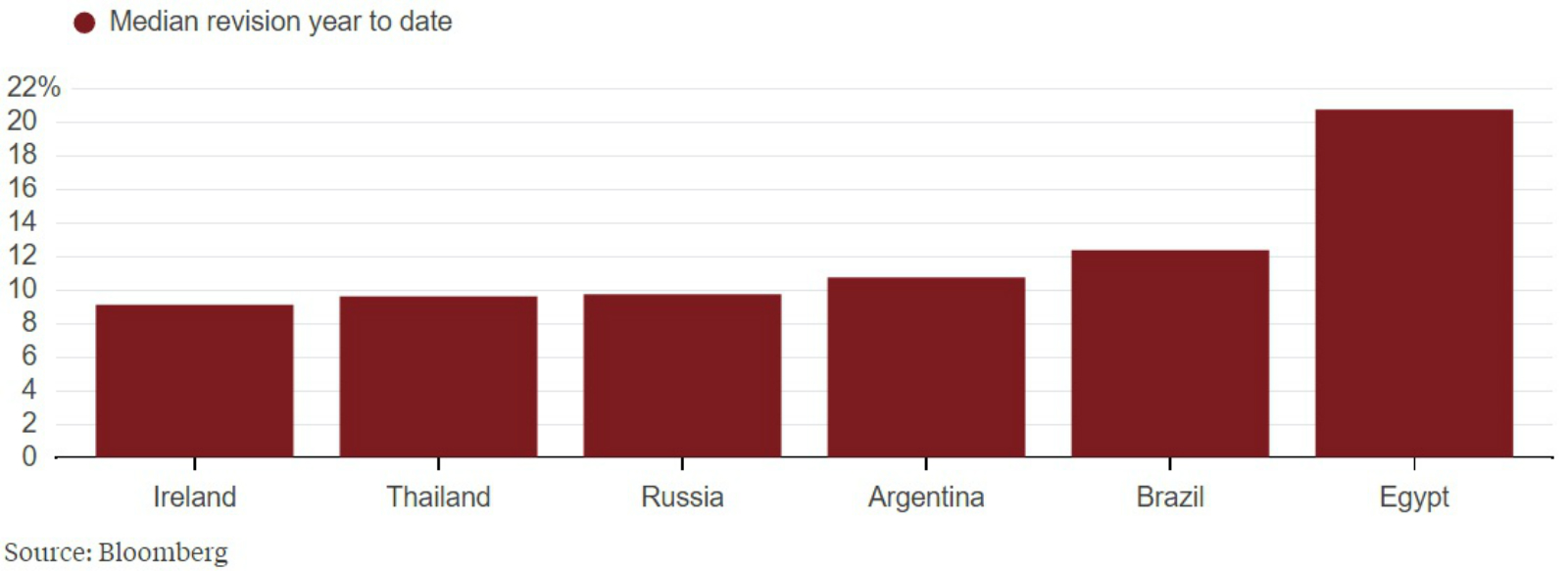

Do bank shares point to reduced political risk in Egypt? That’s the contention of BloombergGadfly’s Christopher Langer, who writes that “Financial institutions in countries with high political risk have seen some of the steepest positive earnings revisions so far this year. In Egypt, for example, the median bank is now expected to make 20.7 percent more in the next 12 months than was the case when 2017 started.” Langer cautions that while Egypt looks better now than it did six months ago, the recent bread protests are a sign that there may be more turbulence to come.

On a side note, the banking sector is reportedly gearing up to play musical chairs, reports Daily News Egypt, which cites unnamed industry sources as noting that a number of MDs and board members are due to step down by 15 April. The story reminds readers that the Central Bank of Egypt has to sign off on any change of management or appointment to a board at an Egyptian bank.