Global growth to be broader, but remain steady in 2017 -GS

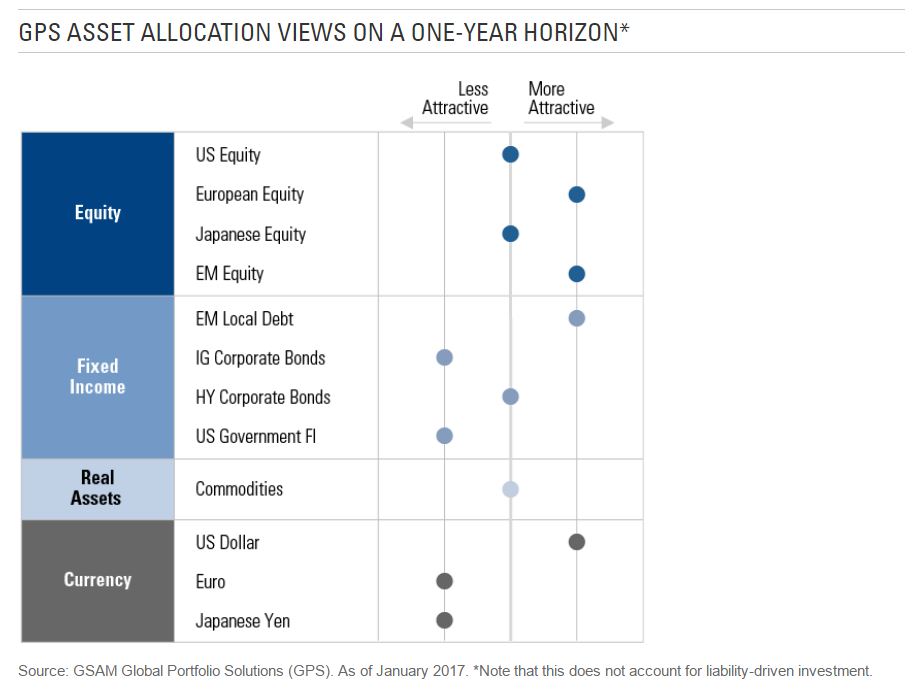

Goldman Sachs Asset Management’s Global Portfolio Solutions (GPS) Co-CIO Neill Nuttall thinks 2017 will have a steady but broader global growth. Nuttall says he does not expect global growth to be much higher this year, “but we see positive contributions from more countries. We are focusing particularly on emerging markets among this broadening base, notwithstanding trade dynamics, which will have individual winners and losers. We think a potential rewidening of growth rates between emerging- and developed markets, plus depressed sentiment and valuations and improved external balances, are supportive for our current overweight to emerging market equities. The main counterbalancing risk is China, where very high and rising debt levels increase the chances of a policy error or hard landing that could have a material impact on global growth. However our analysis suggests the real estate market is in reasonable health and, even allowing for the growth in shadow financing, non-performing loans are unlikely to reach a scale to threaten the broader Chinese economy.” GPS’ asset allocation for 2017 sees emerging marketing equities and local debt, European equity, and the USD as more attractive investments and is less bullish on US government fixed income, the EUR, and JPY. Nuttall says that while policy uncertainty and increasing populism pose risks across global markets, they are not necessarily a threat to global growth.