What we’re tracking on 22 February 2017

Mohamed El-Erian is not buying the concerns raised on the EGP potentially “correcting” in the piece by the Financial Times we led with yesterday. “This sharp appreciation of 14% is leading some — including the financial institution quoted in the article — to warn of a subsequent depreciation. But do such predictions take into account what, by most measures, was a large initial overshoot back in November?” he asks in a Facebook post. “Rather than point to the high probability of renewed currency depreciation,” he explains, “what may well be taking place is a process of price discovery in which the Pound is iterating closer to its ‘equilibrium level.’” El-Erian is still unhappy with the fixation on the currency. “It is also important to stress that the currency is neither the cause of, nor the unique solution to Egypt’s economic challenges.” What matters most, he says, “is a policy reform approach that unleashes the country’s considerable growth potential and improves the focus on social sectors, including protecting the most vulnerable segments of society.” Hear, hear, sir.

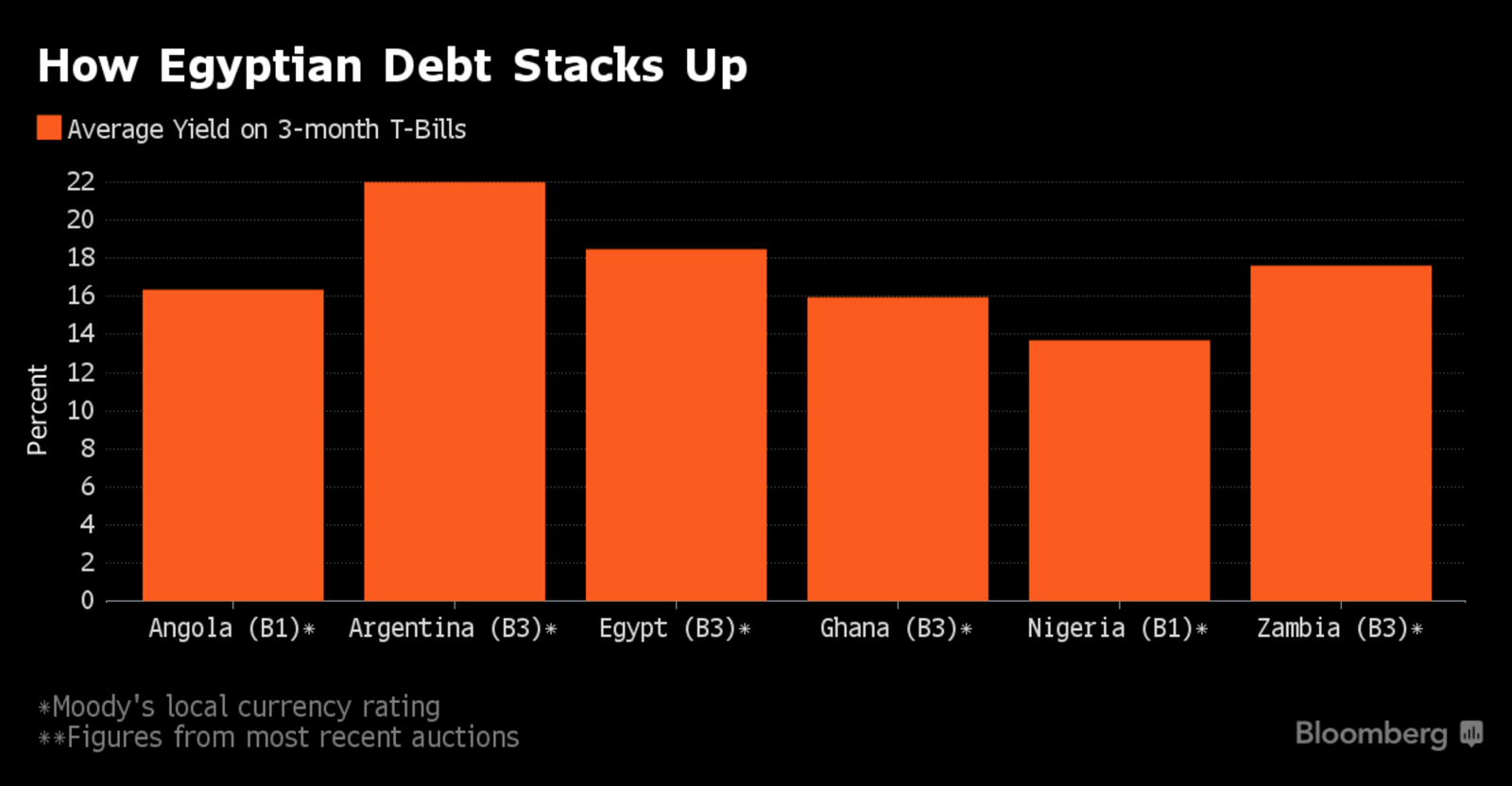

…That said, the end of the “honeymoon period” for the EGP might be nigh, Ahmed Namatalla and Ahmed Feteha write for Bloomberg. They say Egypt could be burdened by its own success as “foreign investors, who had been almost the sole buyers at Egypt’s local treasury bill auctions earlier this month, were absent for two straight sales.” While some fund managers remain wary of current treasury yields and the EGP’s latest surge, Capital Economics’ Jason Tuvey expects the EGP to appreciate to EGP 14 per USD 1. He says “yields on treasury bills are very attractive, especially since there does seem to be a shift within the government toward more orthodox policy making.” Still, with mostly Egyptian banks buying treasuries on Sunday and Thursday, yields climbed by more than 100 bps.

The EGP’s strengthening also makes a brief appearance in the graph-heavy Daily Shot newsletter, which was recently acquired by the Wall Street Journal.