What we’re tracking on 01 December 2016

We kick off the month of December with a blessedly slow news day, and what news there is focuses largely on IPOs and M&As, suggesting the float of the EGP on 3 November may have finally ended the drought prompted by the FX overhang that has long overshadowed the market.

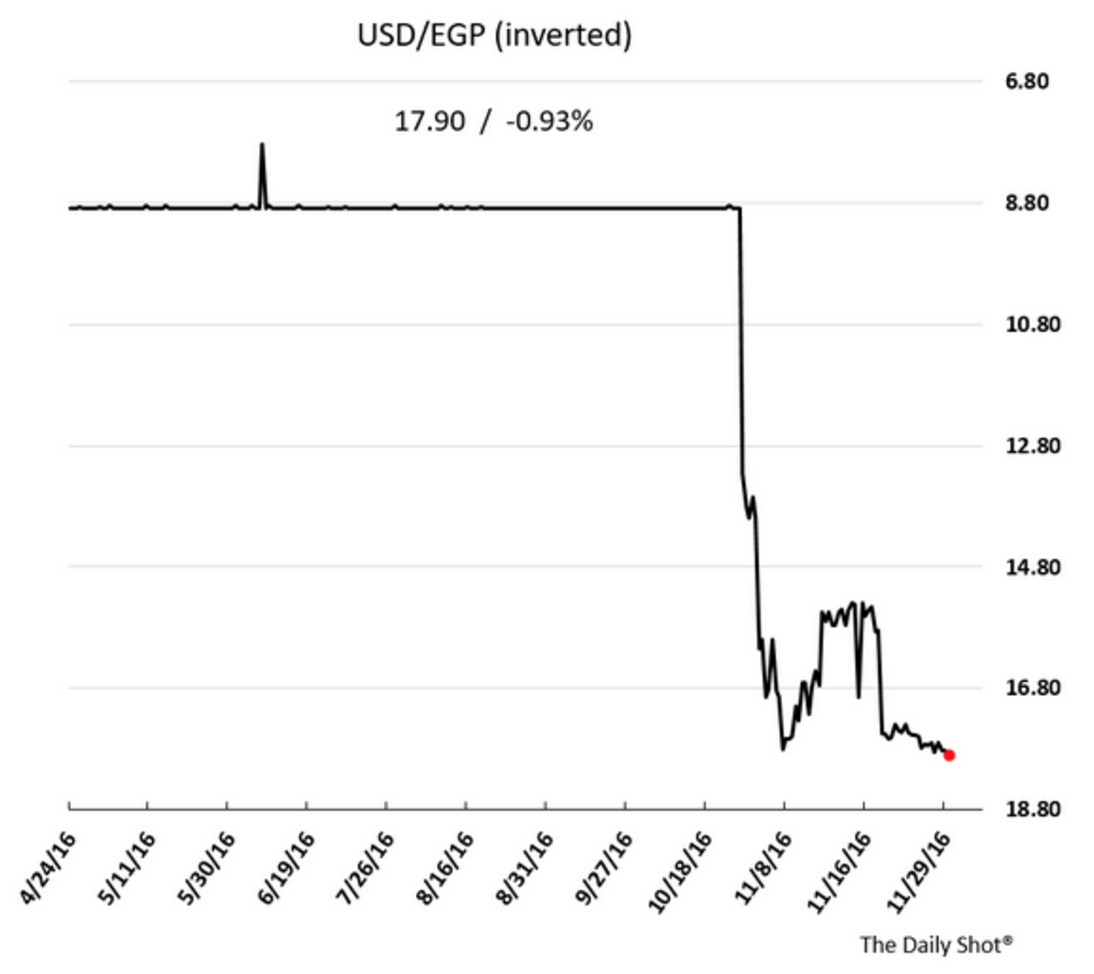

The uptick in M&A activity (our lawyer friends are looking at a very, very busy month of December) and the run of IPO announcements are among the many reasons why we’re not horrified that the EGP hit a fresh low against the greenback yesterday, falling to a market average yesterday of 17.77 (buy) and 18.16 (sell), per the CBE’s website. That rose to the attention of the Wall Street Journal’s newly acquired, chart-heavy The Daily Shot blog, which notes, “Speaking of African currencies, the Egyptian pound hit a new record low after the free-float. There is trouble ahead for Egypt as inflation is likely to spike in the months ahead. Higher food prices (much of which Egypt imports) could bring back widespread social unrest.”

That’s exactly the risk, as Sudan reminded us yesterday: Sudanese police fired teargas on some 300 people protesting high prices of food and medicine amid ongoing subsidy cuts. But after a two-day interview with one of the nation’s more senior policy makers (we’ll have all the details for you next week), we’re increasingly optimistic the economy is on the right track. The catch is that the moral hazard has transferred from the Central Bank of Egypt to Cabinet. The float of the EGP has created a base on which the Ismail government can build a sustainable economy, and that’s what appears to be happening as they lay the groundwork for welfare reform, continue to build infrastructure, make all the right noises about tax policy stability, and look at what meaningful investment incentives will prompt domestic and foreign investors to pull the trigger. As Capital Economics’ Jason Tuvey noted in remarks to the Associated Press yesterday on the challenges and opportunities ahead: "Egypt has all the ingredients to become a manufacturing hub. To the extent that a weaker pound and economic reforms could spark a move in that direction, we’d certainly see job prospects stem from prospects of growth, and wages as well should pick up."

The stock market isn’t alone in cheering the CBE’s move to allow profit repatriation: The Central Bank of Egypt marked a key milestone in Egypt’s nascent campaign to win foreign direct investment yesterday. As we noted yesterday morning, sources told Bloomberg that the CBE is now allowing commercial banks to sell USD to clients looking to repatriate profits and, as Bloomberg’s Ahmed Feteha and Ahmed Namatalla note, “stocks surged.” But businesses with M&S transactions in the pipeline cheered even louder. Why? As one c-suite executive at a larger manufacturer who has had an M&A transaction with a foreign counterparty sitting on the sidelines since earlier this year told us yesterday, “If my guy can only bring money in, with no guarantee of getting his dividends out, why would he do the deal, even at EGP 25 to the USD?” Feteha and Namatalla are back with a reax piece that also provides some market color from EFG Hermes’ Simon Kitchen.

No rift here: As we move forward, we will need to remember (a) who our friends are and (b) that handouts are corrosive, but real investment is always welcome. In view of the rift with KSA, it’s in that light that we’re pleased to see President Abdelfattah El Sisi will be flying to the UAE today for a two-day visit. The visit follows UAE Crown Prince Mohamed bin Zayed Al Nahyan’s surprise visit to Egypt last month. Notably, the Emiratis invited El Sisi to visit over their UAE National Day weekend; the president is expected to participate in national day events tomorrow.

Shoukry, Kerry to sign pact restricting import of Egyptian artifacts: Foreign Minister Sameh Shoukry and US Secretary of State John Kerry signed late yesterday an agreement designed to make it more difficult to import Egyptian artifacts to the US. The pact, billed by the State Department as the first cultural property protection agreement the US has signed with a MENA country, will see the US “impose import restrictions on archaeological material representing Egypt’s cultural heritage dating from 5200 B.C. through 1517 A.D. Restrictions are intended to reduce the incentive for pillage and trafficking,” State said in a statement yesterday.

Shoukry also met yesterday with US vice-president-elect Mike Pence, Al Masry Al Youm reports.