- Good news: The 0.25% healthcare tithe could be levied on net profits, not revenues. (Speed Round)

- US private equity funds TPG and Carlyle Group are considering investing in Egypt. (Speed Round)

- Nissan and El Nasr Automotive to build 100k cars in Egypt every year. (Speed Round)

- Gov’t targets 6.1% economic growth in its next fiscal year. (Speed Round)

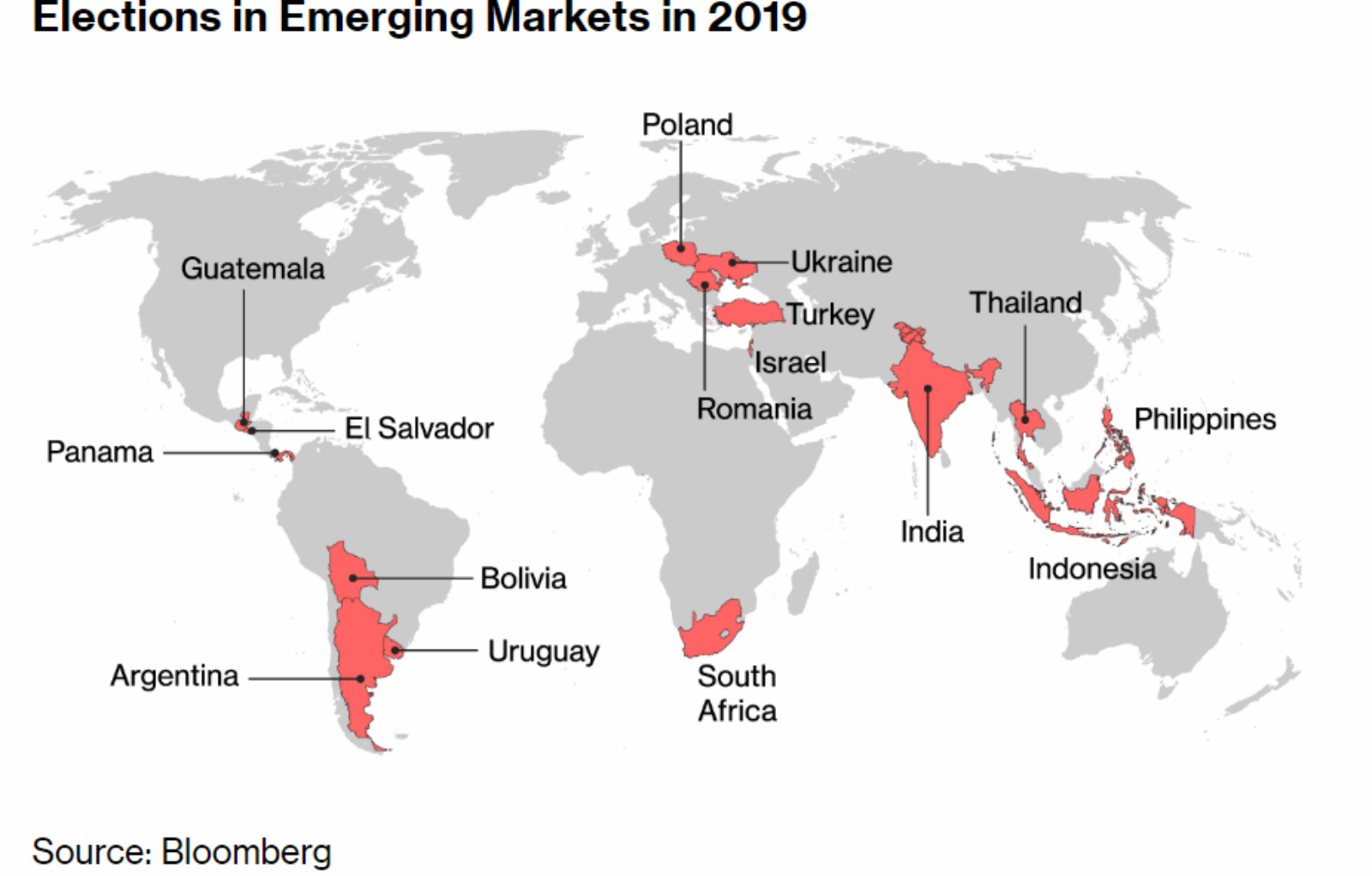

- It’s election season in emerging markets: Watch for increasing volatility. (The Macro Picture)

- Careem tuk-tuks may be coming to a neighborhood near you. (Speed Round)

- Parliamentary hearings on the constitutional amendments get underway today. (What We’re Tracking Today)

- Cairo is one of the least expensive cities in the world… (Speed Round)

- …and one of the most densely populated. (On Your Way Out)

- The Market Yesterday

Wednesday, 20 March 2019

Good news on healthcare tithe?

TL;DR

What We’re Tracking Today

It’s interest rate day in the US of A. Expect the Fed to leave rates on hold, much to the relief of emerging and frontier markets. The key element of the Fed’s statement (from where we sit in EM) is the central bank’s outlook, where analysts will be parsing chairman Jay Powell’s words for any sign there is “deep concern lurking behind [his] patient approach,” the FT writes in its rundown of the four things to look for when Powell speaks this evening (CLT).

The bond market will be paying close attention this evening to Powell’s statement on how the bank will proceed with unwinding its asset portfolio. The Fed began reducing its USD 4.5 tn portfolio in 2017 — mainly made up of long-term Treasurys and mortgage-backed securities purchased post-2008 — and has signaled that it will end later this year. Some commentators say the run-down has increased market volatility, and Fed economists now face a “crucial decision” about how they will balance the bank’s Treasury portfolio going forward. The Wall Street Journal has more.

The House of Representatives will begin hearings today on proposed amendments to the country’s 2014 constitution. The hearings will continue tomorrow and then resume next week. The domestic press reports that more than 100 people will participate today, among them academics, students, media personalities, members of civil society, and clerics from both Al Azhar and the Coptic Church. Ahram Online has the rundown.

Dame Minouche Shafik speaks this evening at AUC’s Tahrir Square campus. A former deputy governor of the Bank of England and once the youngest-ever vice president at the World Bank, Shafik is the serving director of the London School of Economics and will give the Nadia Younes Memorial Lecture at Ewart Memorial Hall tonight. Speaking on “global leadership in a changing world,” Shafik will “share reflections from her career spanning global finance, development economics and academia.”

Trade show: The Trade Ministry will open a trade show today featuring products from countries including Sudan, Kuwait, Uganda, and Burkina Faso.

Your morning dose of doom and gloom, courtesy of FedEx and Samsung: FedEx flagged “serious concerns in the global economy” as the company reported weaker-than-expected 3Q earnings yesterday — and cut its full-year guidance. “The multinational package delivery service reported declining international revenue as a result of unfavorable exchange rates and the negative effects of trade battles,” CNBC notes. Samsung’s co-CEO, meanwhile, is quoted in a separate story as saying: “We are expecting many difficulties this year such as slowing growth in major economies and risks over global trade conflicts.”

Hong Kong brokerage CLSA is losing its three top people amid a “growing culture clash between a western-style investment banking culture and a state-owned financial conglomerate,” the FT reports. CSLA has nibbled at Egypt on a couple of occasions through partnerships with local brokerages.

Can Bitcoin recover? The Wall Street Journal asks what it would take to turn winter to spring with the cryptocurrency having fallen 80% from its trading high of USD 19,800 in December 2017 to USD 4,000 today.

Random note: One of the lead builders of the Bibliotheca Alexandrina has designed an underwater restaurant in Norway, the Wall Street Journal notes this morning. The first seating is on 2 April and is sold out for the next six months.

In international news worth knowing this morning:

- Saudi Arabia’s sovereign wealth fund has hired New York PR firm Karv Communications on a USD 120k / month retainer to buff its image. (FT)

- The longtime president of Kazakhstan has unexpectedly resigned. Nursultan Nazarbayev, 78, in power for some 30 years, gave no reason for the decision. (NYT)

There’s plenty of tech product news out there this morning:

Apple is expected to unveil its streaming TV service today at 7pm CLT. A news bundle is also possible. You can watch the event live here, and everyone from the FT to Recode and iMore has more.

Apple introduced updated iMacs, an updated iPad Air and an iPad Miniahead of the event. The iPads support the first generation Apple Pencil.

Google also introduced a cloud gaming service yesterday at the Game Developers Conference in San Francisco. Learn more here or catch the promo (watch, runtime: 0:58).

Instagram has launched an in-app online shopping feature in the US with 20 fashion brands on board for starters, including Adidas, Burberry, H&M and Zara, Reuters reports.

Bonus content for iSheep: The Verge’s exclusive look at an original iPhone prototype.

Bonus content for Stranger Things nerds: Netflix released yesterday not a trailer, but a seven-second teaser for the trailer of the third season of its hit show. Season Three debuts on 4 July.

Coming up this week: AmCham’s monthly luncheon meeting, at which Planning Minister Hala El Said was scheduled to speak, has been postponed to a later date. UNIDO’s Global Manufacturing and Industrialisation Summit takes place on Thursday

Enterprise+: Last Night’s Talk Shows

The EGP continued strengthening on Tuesday, trading at around 17.29 to the USD — and that has absolutely captured the imagination of the talking heads.

For the EGP to stay strong, we need to focus on real economy growth — FDI, tourism, remittances and exports, etc, must all pick up, economist Hany Tawfik told Masaa DMC’s Osama Kamal (watch, runtime, 04:10). Tawfik said shoring up reserves through borrowing isn’t sustainable — the key factor is to see real economic growth. The economist urged the government to continue cutting red tape and curbing corruption to improve the investment climate.

Meanwhile, CI Capital’s senior economist Hany Farahat explained on Hona Al Asma how the central bank’s decision to scrap its repatriation mechanism towards the end of last year led to an increase in inflows in the banking system that gave the EGP a push (watch, runtime: 09:31). Farahat said the decision came at just the right moment — when appetite for emerging markets began recovering after last year’s EM Zombie Apocalypse.

Why aren’t prices going down? Asked why he thinks the price of goods has yet to reflect the recent appreciation of the EGP, Farahat pointed to the fact that there’s no system that effectively tracks commodity prices. He also highlighted that Egypt tends to adjust to market changes slower than other countries. And then there’s the fact that current inventory of imports came in at the higher rate…

The local price of gold has dropped an average of EGP 5, Nady Naguib, secretary general of the gold traders division at the Cairo Chamber of Commerce, told Hona Al Asema. Naguib said the drop is directly related to the strengthening of the EGP over the past week (watch, runtime: 03:17).

Speed Round

Speed Round is presented in association with

EXCLUSIVE- FinMin considers making the 0.25% healthcare tithe on net profit, not revenue: The government is mulling whether to amend the national levy on revenues that companies are required to pay to finance the new national healthcare system to make it 0.25% of companies’ bottom lines, rather than revenues, a government official tells Enterprise. Officials working through a bill that could introduce amendments to the Universal Healthcare Act to implement the change in the taxation formula after a committee mandated with reviewing issues with the tax system concluded that imposing a high levy would be detrimental in the bigger picture. According to our source, the committee is concerned that the high tax rate would eat away at companies’ capital, reducing GDP and ultimately hampering the government’s macro goals. This is all preliminary, though, so don’t go back and re-do your budget just yet.

Background: The state’s EGP 600 bn health insurance plan mandated under the Universal Healthcare Act will be rolled out incrementally throughout Egypt over the course of 11-13 years, but the Finance Ministry is expected to start collecting special taxes (including the 0.25% tithe) designed to fund the scheme during the current fiscal year. As it stands, all companies are to pay the 0.25% flat tax this year except under certain circumstances and in some sectors, a senior government source told Enterprise in January. As it stands, the levy does not count as an expense that would reduce a company’s pre-tax profit. The Finance Ministry will set a tax formula for outliers on a case-by-case basis. Among those eligible for some relief for the tax are companies making losses, joint venture projects, and services or commissions in which both a client and service providers make shared revenues from the same project or activity.

US-based private equity outfits TPG and Carlyle Group are looking at investments in Egypt amid the void left by the collapse of Abraaj, according to Al Mal. TPG, with more than USD 103 bn in AUM, is currently looking at a possible acquisition of a stake in a hospital owned by Lebanon’s Euro MENA Fund and us in talks on several other potential transactions. The PE outfit plans to close its inaugural transaction in Egypt before the year is out, according to sources close to the matter.

Carlyle is also keen on entering the Egyptian market, but has yet to find the right transaction. The private equity heavyweight previously attempted to acquire cheesemaker Greenland, a subsidiary of Americana Group, but was ultimately edged out by Lactalis-Halawa. Carlyle has previously expressed its interest in investing through its USD 700 mn Africa fund in Egypt. Managing Director Eric Kump said at the time that the MENA region has “gone through a painful dislocation and done the right things on the macro level.”

M&A WATCH- Gemini taps Beltone to advise on Nile Sugar acquisition: Gemini Holding has hired Beltone Financial as its financial advisor on the potential acquisition of Nile Sugar by Orascom Investment Holdings (OIH), sources with knowledge of the matter tell Al Mal. OIH had hired BDO Corporate Finance to conduct a fair value assessment on the company ahead of the transaction, which Naguib Sawiris had expected to close by the end of 2018.

Nissan, El Nasr Automotive to manufacture 100k cars a year: Nissan and state-owned El Nasr Automotive have signed a memorandum of understanding (MoU) to produce 100k cars a year in Egypt, according to a Public Enterprises Ministry statement (pdf). The government has been in on-again-off-again talks with various foreign companies in the last few years in hopes of resurrecting the defunct Nasser-era car manufacturer. This comes as Nissan’s chairman in Africa, the Middle East, and India Peyman Kargar told Bloomberg that the company is looking to increase its output from its factory in Egypt to 28,000 vehicles, from 22,000 units, in the coming fiscal year. The Japanese carmaker is the third best-selling brand in Egypt, behind Chevrolet and Hyundai, with a market share of 11%. Reuters also has the story.

Careem is trialing its tuk-tuk service in 10 Cairo neighborhoods, sources tell Al Mal. The ride-hailing app, which launched tuk-tuk services in December of last year, rolled out the service in neighborhoods including Boulaq al Dakrour, Haram, and Hadayek El Kobba, with customers limited to hailing from and traveling to those areas only.

Gov’t is targeting 6.1% economic growth in its next fiscal year: The government is targeting a budget deficit of 7.2% of GDP and a GDP growth of 6.1% in FY2019-20, Finance Minister Mohamed Maait said yesterday, according to Reuters. The figures cited by Maait differ slightly from those included in the ministry’s mid-year review of the FY2018-19 budget, which set the deficit and growth targets for next fiscal year at 7.1% and 6.2%, respectively. A senior government official had also given us slightly different figures, saying the ministry is targeting a 7% budget deficit. Our source had also cited the target GDP growth figure at 6.1%.

LEGISLATION WATCH- Gov’t wants to subject real estate payment plans to FRA oversight: Installment-based payment plans for real estate could soon be regualted by the Financial Regulatory Authority (FRA) under a legislative change now being mulled by the Madbouly government, unnamed government sources told the domestic press. The report suggests that officials believe real estate companies are under-reporting sales. Don’t expect the move to be popular with the industry.

Background: The parliament has been working out a new law that would regulate the real estate industry by clamping down on wildcat developers, creating a state-sponsored federation for home builders, and setting up a fund to hedge against sector-related risks. Real estate developers have previously voiced objections to any provision that would impose fines and prison terms for developers who miss delivery deadlines.

EARNINGS WATCH- EFG Hermes is proposing an EGP 0.65 / share dividend for FY2018 pending approval of the financial service corporation’s shareholders, the company said as it announced its 2018 earnings (pdf). The group reported net profit of EGP 1 bn on revenues of EGP 4.3 bn. Notably, its non-bank financial services arm contributed more than EGP 1 bn of the firm’s total revenues. “Revenue from core operations … grew 32% Y-o-Y in FY18, buoyed by the growth in revenue reported by all lines of business on the back of the Group’s strategy of expanding its product offerings, extending its geographical presence, and serving a wider client base,” the firm said in a statement. EFG Hermes’ investment bank closed its “largest number of transactions in a single year” in 2018 with “19 equity, M&A, and debt transactions worth an aggregate USD 2.5 bn.”

Outlook: EFG Hermes’ priorities for 2019 include the continued growth of its NBFI platform, where Group CEO Karim Awad pointed specifically to its consumer finance and factoring arms, as well as a drive to “further improve our market position across the frontier emerging markets in which we currently operate.” The firm is “actively screening new growth opportunities in other high-potential markets,” he added.

Al Ezz Dekheila Steel reported net profits of EGP 647.4 mn in 2018 compared to EGP 362.4 mn a year earlier, the company said in a bourse filing. Revenues came in at EGP 41.3 bn in 2018, compared to EGP 34.4 bn in 2017.

Cairo is one of the least expensive cities in the world, according to the Economist’s Intelligence Unit’s 2019 Worldwide Cost of Living Survey (paywall). The findings are based on the comparative cost of 160 products and services in each location, including housing, transportation, utilities, clothing, private schooling, and domestic help, among others. The nation’s capital was ranked 125 out of 133 global cities ranked on this year’s report, making the cost of living in Cairo more expensive than Karachi in Pakistan, India’s New Delhi, Chennai, and Bangalore, and Almaty in Kazakhstan. Caracas, Venezuela’s capital city, was named the world’s least expensive city to live in — a title previously held by Damascus in Syria.

Geographic trends: The world’s most expensive cities are mostly centered in Europe and Asia, with Singapore, Hong Kong, and Paris tying for the number one spot. Other cities sitting around the top of the ranking include non-EU western European cities, including Switzerland’s Zurich and Geneva, and Denmark’s Copenhagen. On the flipside, many Asian countries also rank among the cheapest cities in the world, alongside a few in South America and Africa.

A low cost of living does not a happy city make: “As Damascus and Caracas show, a growing number of locations are becoming cheaper because of the impact of political or economic disruption. Although South Asia remains structurally cheap, political instability is becoming an increasingly prominent factor in lowering the relative cost of living. This means that there is a considerable element of risk in some of the world’s cheapest cities.

CORRECTION- We incorrectly said earlier this week that the annual football tournament between law firms was organized solely by Zulficar & Partners. The event was organized through the joint effort of the law firm community. The story has been updated in our web edition.

** WE’RE HIRING: Inktank Communications is the region’s leading investor relations and financial communications firm. We’re growing and we’re looking for executives to join our client relations and strategy team. Our ideal candidate is:

- Energetic and eager to learn;

- Passionate about corporate communications and dealing with high-profile clients;

- A strong believer in the power of the written word and visual concepts;

- A people’s person; comfortable with working in an informal environment while managing clients coming from formal industries;

- A team player who can comfortably work with several parties, internally and externally;

- Fluent in English and Arabic.

Interested? Send your CV along and a solid cover letter to ssultan@inktankcommunications.com.

The Macro Picture

Emerging-market volatility set to increase as elections approach: It’s election season in several key emerging markets, and volatility is likely to increase as a result, according to Bloomberg. India, the world’s sixth-largest economy, will go to the polls in April, while South Africa, the continent’s largest economy, will vote in May. Other notable economies heading into elections include Indonesia, Israel, Thailand and Turkey, all of which will take place over the next month.

Surprises are unlikely, but never assume that the polls and political analysts are accurate — especially with political volatility delivered by popular votes recently in developed economies and emerging markets alike. “With the way emerging markets have been moving this year, investors need to be more selective based on a variety of factors including economic fundamentals and political risks,” Takeshi Yokouchi, senior fund manager at Daiwa SB Investments in Tokyo, told Bloomberg. “The expectation is for the ruling party to win in major elections such as South African and Indonesia, with [Indian PM] Modi’s party also extending support recently in India, but this doesn’t mean investors can remain care-free about these elections.”

Nigeria as a case study: A potential case study for election-induced EM volatility took place just last month when Nigeria held its presidential election. The electoral commission’s decision to postpone the vote caused a sell-off in the stock market and government bonds, and brought considerable pressure on the Naira.

Egypt in the News

Egypt’s stringent new media regulations are the talk of the international press this morning: The AP reports that the Supreme Media Council published late yesterday new regulations for media and social media platforms that would permit the government to block, without a court order, media sites and social media accounts with over 5k followers if they are deemed a threat to national security, Critics of the regulations say they overstep the bounds of the Press and Media Act passed in July 2018. The new regulations stipulate blocks and fines of up to EGP 250k for websites and accounts found guilty of spreading “fake news.” The nine-page document described a broad list of offensive topics, including “anything inciting violating the law, racism, intolerance, violence, discrimination between citizens or hatred.” The news is being picked up widely, with both The Hill and RT noting it.

Other headlines worth a brief skim:

- Egyptian ports were struggling to handle the 3 mn tonnes of thermal coal we imported last year, according to energy markets information provider Montel (paywall).

- More Belt and Road (BRI) promotion in Chinese state media: Xinhua picks up comments made by Planning Minister Hala El Saeed, who told a conference that the Suez Canal Economic Zone is “fully integrated” with the BRI.

- Alaa Al-Aswany: The charges brought against novelist Alaa Al-Aswany of insulting the president, the army and the judiciary is receiving attention in the foreign press, with both the Guardian and Deutsche Welle covering the story.

- The Anti-Terrorism Law: Al Monitor delves into the proposed amendments to the Anti-Terrorism Law.

- Human rights: Human Rights Watch called on Egyptian authorities to “reveal the whereabouts” of former MP Mostafa al-Nagar, who has been missing for five months.

- Egypt’s “historic Wafd party” has been “eclipsed” under the Sisi administration, French wire service AFP writes.

On The Front Pages

El Sisi urges youth to put stability on top of their priority list: President Abdel Fattah El Sisi said stability and protecting the state should be the youth’s first priority, Al Ahram reported this morning. The remark came during the ongoing Arab-African Youth Forum that kicked off in Aswan earlier this week. Both Al Gomhuria and Al Akhbar focused on the government’s initiative to test a million Africans for Hepatitis C.

Worth Watching

How has the GDP of top economies changed over the years? The US, the UK, France and — with the exception of a few turbulent years — Germany have dominated the global economy in the modern industrial age. But in this dynamic chronological chart by WawamuStats showing changes in GDP by country from 1960-2017, it is the Asian economies that have stood out over the past four decades (watch, runtime: 3:07). Japan skyrocketed past Germany in 1972, sustaining its position as the world’s second-largest economy for over three decades, only to be overtaken by another Asian powerhouse: China. Despite having to transition out of its command economy and overcome Mao’s hugely damaging Great Leap Forward, Beijing has achieved record growth rates, joining the US as the only country in world history whose GDP has surpassed the USD 10 tn mark.

Energy

Rosatom visiting Egyptian steel companies for Dabaa partnerships

Senior executives from Russia’s Rosatom have begun talks with several Egyptian companies, including Orascom Construction, Elsewedy Electric, and Ezz Steel, ahead of possible partnerships on the Dabaa nuclear power plant, reports Al Mal. We had previously reported that Schneider Electric is in talks with Rosatom to provide electric equipment for the plant. Egypt’s Nuclear Power Plants Authority last year nominated 200 local companies to supply components for the plant.

Infrastructure

EETC, EGEMAC sign four contracts worth EGP 1.7 bn to develop electricity transmission networks

The Egyptian Electricity Transmission Company (EETC) and the Egyptian German Electrical Manufacturing Company (EGEMAC) have signed four contracts worth a total EGP 1.7 bn to develop electricity transmission networks across the country, according to local reports. The projects will see new transformers and adaptor connectors installed in the Delta, the Nile Valley, Fayoum and 10 of Ramadan City. The EETC will self-fund two of the contracts while the European Investment Bank and the Arab Fund for Economic and Social Development will finance the other two.

Egypt to establish industrial complex in Fayoum

Egypt is working to establish the country’s second largest industrial complex in northern Fayoum, said Industrial Development Authority (IDA) boss Magdy Ghazi. No further details were provided on the planned project.

Basic Materials + Commodities

US office expects Egypt to import 12.6 mn tonnes of wheat in MY2019-20

Egypt is expected to import 12.6 mn tonnes of wheat in marketing year (MY) 2019-20 to fill in the demand gap, up 0.8% from 12.5 mn this MY, according to a report from the US Foreign Agricultural Service (pdf). Wheat grown at home is expected to record 8.77 mn tonnes in the MY, up 4% y-o-y from MY2018-19. Corn and rice imports, meanwhile, are expected to register 9.5 mn tonnes (up 1% y-o-y) and 500k tonnes, respectively. The MY in Egypt runs between July-June.

Tourism

Time Hotels expands into Egypt

UAE-based Time Hotels has opened a central reservations office in Cairo and is planning to inaugurate a four-star resort in Ras Sedr in 3Q2019, as part of their greater MENA expansion plan, according to Mubasher.

Automotive + Transportation

Egypt’s government hikes indirect passenger levies on outbound planes by USD 5

The Civil Aviation Ministry has increased by USD 5 a levy it collects indirectly from passengers departing from Egyptian airports on international and domestic flights, according to a ministry statement. The increase will take effect in November 2019. The original value of the levy was not disclosed.

Banking + Finance

Global Lease to borrow USD 10 mn from EU-based funds to diversify sources

Global Lease is planning to borrow USD 10 mn from two unnamed European lenders this year to diversify its financing sources, CEO Hatem Samir said, according to Al Mal. Global Lease previously secured USD 5 mn from the EBRD’s Green for Growth Fund to finance its projects in the renewable energy sector. The company will also soon launch Global Finance Company, an arm specialized in factoring services, Samir separately told the newspaper.

Egypt’s NUCA names managers of planned EGP 10 bn bond securitization

The New Urban Communities Authority has selected EFG Hermes, CIB, National Bank of Egypt, and Arab African International Bank to manage the first tranche of a EGP 10 bn bond securitization of receivables that will be worth about EGP 6 bn, sources tell Al Mal. Sarwa Capital and Banque Misr will manage the remaining EGP 4 bn tranche. The first tranche is expected to take place in 1H2019.

Misr Capital Investments looks to launch first direct investment fund by year-end

Banque Misr’s investment arm Misr Capital Investments is planning to launch its first private equity fund before year-end and is mulling investing in the technology sector, CEO and Managing Director Khalil El Bawab and COO Omar Radwan tell Al Mal. The new management is embarking on a project to turn Misr Capital into a full-fledged investment bank by acquiring financial advisory and brokerage licenses, and expanding existing businesses. In the long term, the company plans to expand in Africa and the Middle East.

Legislation + Policy

Cabinet to discuss final draft of SMEs Act next week

The Cabinet will discuss the final draft of the SMEs Act next week, Finance Minister Mohamed Maait said. The government has been working on raising the VAT registration threshold with the aim of taking more SMEs out of VAT, a government official told Enterprise earlier this month.

Egypt Politics + Economics

Yemen defence advisor dies in Giza road accident

Maj. Gen Abdel Kader Al-Amoudi, advisor to Yemen’s defense minister, died in a road accident in Giza after he was hit by a car, Ahram Gate reported. Investigators found the incident was an accident and not politically motivated. The driver has since been arrested.

Giza courts hand jail terms to 40 people convicted of human trafficking

A criminal court in Giza yesterday handed out jail sentences ranging between three and 16 years to 40 people found guilty of human trafficking, Reuters reports. AMAY noted that the accused were also given fines ranging between EGP 2k and EGP 500k. The defendants can appeal the sentences to the Court of Cassation, the highest court in the country.

On Your Way Out

Robot camel races: A traditional bedouin camel racing event in Ismailia last week saw 150 camels cover distances of between five and 15 km, cheered on by more than 1,000 spectators, Reuters reports. But several Gulf countries have bowed to pressure from rights groups to ban the child jockeys who would typically keep the meandering mammals on course, meaning that Egyptian camel owners must follow suit if they are to remain competitive. Enter the robots: “child-sized devices with a whipping arm that can be triggered at a distance.” Some of the real children, however, seem to see the robots as usurpers, rather than saviors, with one remarking rather pointedly that they are much better than robots at steering.

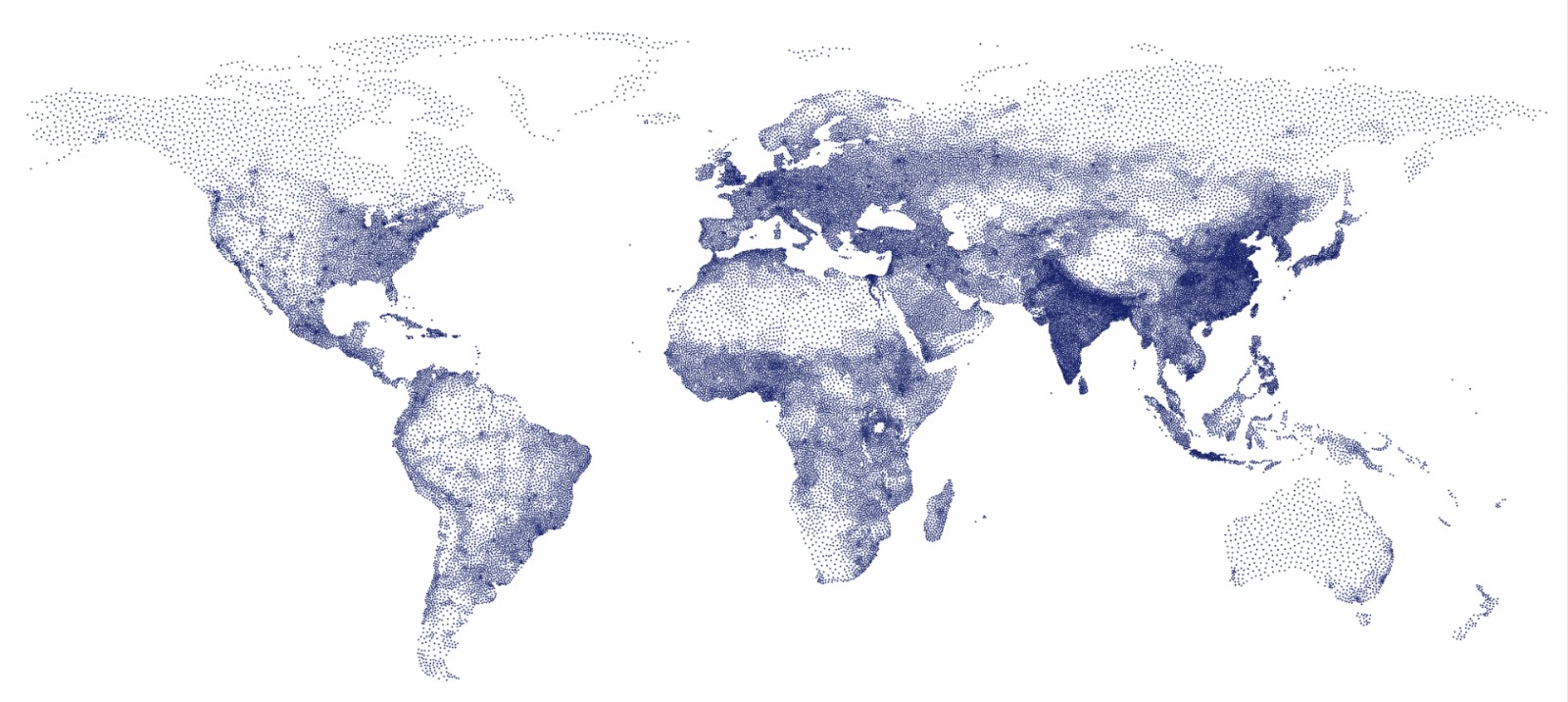

Which global cities have the highest population densities? These population density maps showing the number of people living in each square kilometre in cities around the world were created by the LSE Cities Urban Age Programme.

How to read them: The higher the spike, the greater the density.

And which city comes top? (Hint: it’s in Egypt).

The Market Yesterday

EGP / USD CBE market average: Buy 17.25 | Sell 17.35

EGP / USD at CIB: Buy 17.23 | Sell 17.33

EGP / USD at NBE: Buy 17.25 | Sell 17.35

EGX30 (Tuesday): 14,646 (-1.8%)

Turnover: EGP 969 mn (2% above the 90-day average)

EGX 30 year-to-date: +12.35%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 1.8%. CIB, the index heaviest constituent ended down 1.8%. EGX30’s top performing constituents were Orascom Development Egypt up 0.3%. Yesterday’s worst performing stocks were Global Telecom down 4.1%, Arab Cotton Ginning down 3.7%, and Palm Hills down 3.6%. The market turnover was EGP 969 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -103.8 mn

Regional: Net Long | EGP +52.9 mn

Domestic: Net Long | EGP +50.9 mn

Retail: 55.0% of total trades | 57.5% of buyers | 52.5% of sellers

Institutions: 45.0% of total trades | 42.5% of buyers | 47.5% of sellers

WTI: USD 59.03 (-0.10%)

Brent: USD 67.68 (+0.21%)

Natural Gas (Nymex, futures prices) USD 2.87 MMBtu, (+0.84%, April 2019 contract)

Gold: USD 1,306.50 / troy ounce (+0.38%)

TASI: 8,658.95 (+0.07%) (YTD: +10.63%)

ADX: 5,079.38 (+0.25%) (YTD: +3.34%)

DFM: 2,641.43 (+0.82%) (YTD: +4.41%)

KSE Premier Market: 5,749.92 (+1.07%)

QE: 9,957.03 (-0.16%) (YTD: -3.32%)

MSM: 4,156.49 (+0.69%) (YTD: -3.87%)

BB: 1,420.32 (+0.50%) (YTD: +6.21%)

Calendar

19-20 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19 March (Tuesday): Portfolio Egypt Conference for non-banking financial services, venue TBD, Cairo, Egypt.

20 March (Wednesday): Trade Ministry opens trade show of products from 6 countries, Egypt International Exhibition Center, Nasr City, Cairo.

20 March (Wednesday): Dame Minouche Shafik will give the Nadia Younes Memorial Lecture, Ewart Memorial Hall, AUC Tahrir Square.

21 March (Thursday): The Global Manufacturing and Industrialisation Summit (GMIS), American University in Cairo, New Cairo Campus.

20-22 March (Wednesday-Friday): Egypt International Green Building Conference, Egypt International Exhibition Center, Nasr City, Cairo.

20-22 March (Wednesday-Friday): Watrex, Egypt International Exhibition Center, Nasr City, Cairo.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28-30 March (Thursday-Saturday): International Conference on Advanced Machine Learning Technologies and Applications, Venue TBD, Cairo, Egypt.

30 March (Saturday): Traders Fair, Nile Ritz Carlton, Garden City, Cairo, Egypt.

30-31 March (Saturday-Sunday): International Conference on Architecture Engineering and Technologies, Grand Nile Tower Hotel, Cairo, Egypt.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe said.

April: A World Bank delegation will be in town to review current investment legislation, economic policies and administrative reforms as part of the preparations for next year’s Ease of Doing Business Report. Egypt jumped eight spots to rank 120th out of 190 countries in the 2019 Doing Business report.

April: Russian companies will receive the first 1 square-km plot in the 5.2 square-km Russian Industrial Zone within the Suez Canal Economic Zone

April: The EUR 250k first phase of Egypt’s national waste management program will kick off.

1-3 April (Monday-Wednesday): Infra Africa & Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

2-5 April: APPO Cape VII petroleum and energy conference, Malabo, Equatorial Guinea.

4 April: Egypt’s Emirates NBD PMI for March released.

4-6 April: LafargeHolcim Forum for sustainable Construction, American University in Cairo.

10 April: Egyptian Retail Summit (ERS 2019), Nile Ritz Carlton, Garden City, Cairo, Egypt.

9-11 April (Tuesday-Thursday): International Conference on Aerospace Sciences & Aviation Technology, Military Technical College, Cairo.

9-12 April (Tuesday-Friday): International Conference on Network Technology, The British University in Egypt, Cairo.

9-12 April (Tuesday-Friday): International Conference on Software and Information Engineering, The British University in Egypt, Cairo.

16-17 April (Tuesday-Wednesday): North Africa Iron and Steel Conference, Four Seasons Nile Plaza, Cairo.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna, Austria.

21 April (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen. The lawsuit, seeking EUR 150 mn in damages, was postponed from 17 March.

21 April (Sunday): RT Imaging Summit & Expo-EMEA, InterContinental City Stars, Nasr City, Cairo, Egypt.

21-22 April (Sunday-Monday): Egypt CSR Summit, InterContinental City Stars, Nasr City, Cairo, Egypt.

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

04-05 June (Tuesday-Wednesday): Global Entrepreneurship Summit, The Hague, the Netherlands

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

16-17 June (Sunday-Monday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

11-13 February (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.