- Don’t expect the EGP to continue to strengthen this year — in fact, it could slip a little. (Speed Round)

- Eurobond issuance to take place within the next two months. (Speed Round)

- Driven by energy, mining and construction, Egypt’s GDP growth is still accelerating. (Speed Round)

- Reforms alone may not be enough to wean Egypt off the IMF. (Speed Round)

- AlGioshy mulls 4Q listing on EGX. (Speed Round)

- Insurance companies object to high capital requirements in Insurance Act. (Speed Round)

- US Fed leaves interest rates unchanged in “about-face.” (What We’re Tracking Today)

- My Morning Routine: Victoria Diachkova, Founder, Sincerely V

- The Market Yesterday

Thursday, 31 January 2019

Don’t expect the EGP to continue to strengthen this year

TL;DR

What We’re Tracking Today

Our popular My Morning Routine section is back today after going on hiatus over the Christmas-New Year vacation period. This morning: The person whose business has seen a number of us (happily) eating less meat. Not that any of us have gone vegan, but…

Foreign Minister Sameh Shoukry is in Jordan for a ministerial consultative meeting today. Shoukry arrived yesterday and held talks on regional affairs with King Abdullah II.

In a “sharp about-turn,” the Fed left interest rates unchanged: The US Federal Reserve kept its benchmark interest rate unchanged overnight at a range of 2.25-2.5% after its two-day FOMC meeting ended, the Fed said in a statement (pdf). The move was widely expected after the Fed telegraphed that the pace of hikes could slow this year amid concerns about the outlook for growth in the US and beyond. “In light of global economic and financial developments and muted inflation pressures, the Committee will be patient,” the statement said.

The story leads the global business press this morning. The best coverage so far is from the Financial Times and the Wall Street Journal (news | analysis). The New York Times is also worth a read.

So what’s next? After the turmoil in financial markets we saw late last year, the US Federal Reserve’s main mission now is to steady the ship, the FT writes. Yesterday’s decision signals that Powell is making good on his pledge to “listen carefully” to market concerns. This was the view shared by economists polled by Bloomberg, predicting two rate hikes this year, with a majority believing the Fed will act between June and December (instead of March and September as predicted in last month’s survey).

Are EM fears of a stronger USD a thing of the past? Stronger emerging economies such as India, Russia and Chile look to be safer EM investment destinations going forward,as worries about slumping global growth replace the greenback and rising US interest rates as the chief threats to EMs, according to Amundi Asset Management, Bloomberg reports. The investment fund also highlighted China, Indonesia, the Czech Republic, Brazil and Peru as attractive markets because of their high-yielding currencies, solid earnings growth and sustainable debt levels. The fund (which manages USD 45 bn in EM assets) meanwhile flagged Turkey, South Africa and Argentina as posing particular risks going forward due to their poor fiscal positions.

Sales of international bonds from emerging markets and junk-rated companies were down by as much as 43% year-on-year in January. “Debt sales by governments and companies in emerging markets fell to USD 49.1 bn in the period to Jan. 25, compared to USD 86.2 bn over the same period in 2018, data from Refinitiv showed. The number of deals declined to 69 from 125,” Reuters reports

Why that matters: January is usually one of the busiest months of the year for EM sovereign issuers, according to Morgan Stanley, accounting for about 17% of annual debt sales.

Has there ever been a better time to be an M&A banker in the GCC? Bloomberg thinks not as it runs down who’s buying what amid a mergers and acquisition boom in the Mideast — a boom that has so far shown no signs of crossing the Red Sea to Egypt.

High drama in high tech: The Fed’s decision not to hike rates yesterday may be the lead story in the global business press, but far more ink is being spilled on the problems of the tech industry. Here’s a sampling:

- Facebook and Apple are openly clashing in a “dramatic escalation of tension between two of the world’s biggest tech companies.” (FT | The Verge)

- Samsung’s profits are down nearly 30% on weak phone and chip sales. (CNBC)

- Microsoft missed revenue forecasts as the PC market appears to be slowing down. (CNBC)

- The FT’s Lex says it is crunch time for Apple, which faces new urgency to push into services. (FT)

- A former Apple employee has been arrested for allegedly stealing self-driving car technology for China. (Apple Insider)

WEEKEND READS- The UAE allegedly hired a “secret hacking team of American mercenaries” including former intelligence operatives, Reuters reports in a two-part investigative series (here and here). And if you, like us, have struggled to get your brain around China’s “road and belt” global infrastructure drive, the best starting point we can think of is Can China turn the middle of nowhere into the center of the world economy? in the New York Times Magazine.

Enterprise+: Last Night’s Talk Shows

With no single topic to unify the conversation on the airwaves, the talking heads busied themselves with a range of issues.

A hike in foreign holdings of Egyptian treasuries was highlighted by Al Hayah Al Youm’s Lobna Assal, who noted that foreign holdings in Egyptian debt rose to USD 12 bn in January after losing as much as USD 10 bn over the past year (watch, runtime: 01:00). We have more on this in this morning’s Speed Round, below.

Echoes from Macron’s trip to Egypt: Masaa DMC’s Osama Kamal highlighted France’s Le Figaro quoting French President Emmanuel Macron as saying that Egypt plays a strategic role in combating terrorism (watch, runtime: 04:54), while Al Hayah Al Youm took note of Egypt’s Public Prosecution slamming a 2017 Human Rights Watch report after Macron brought up Egypt’s human rights record (watch, runtime: 03:50).

Also on the airwaves last night:

- An agreement Egypt signed last week with financial advisory firm Lazard at Davos came up on Al Hayah Al Youm (watch, runtime: 09:08);

- Tens of families have been resettled after yet another Manshiet Nasser rockslide (watch, runtime: 04:48 and runtime: 09:03);

- Sherif Amer lambasted social media campaign “Let her be a Spinster,” whose allusion to the “Let it Rust” automotive campaign essentially compares women to cars as commodities (watch, runtime: 00:30).

Speed Round

Don’t expect the EGP to continue to strengthen this year — in fact, it could slip a little. The EGP was more or less stable against the USD on Wednesday, closing at 17.57 from 17.58 at close the previous day as the currency held its ground after gaining around 2% against the greenback earlier in the week. Central Bank Governor Tarek Amer had told Bloomberg last week that some volatility in the EGP-USD exchange rate was to be expected.

The EGP gained this week as foreign holdings of Egyptian debt rose to USD 12 bn this month as investors regained their appetite for local securities, government sources told Al Mal. The Finance Ministry said on Tuesday that foreigners, who had pulled about USD 10 bn out of Egypt during the emerging markets selloff, scooped all 5-year bonds offered this week in a sign of Egyptian debt regaining attractiveness. Sources tell the newspaper that foreigners bought EGP 400 mn in treasuries this week alone.

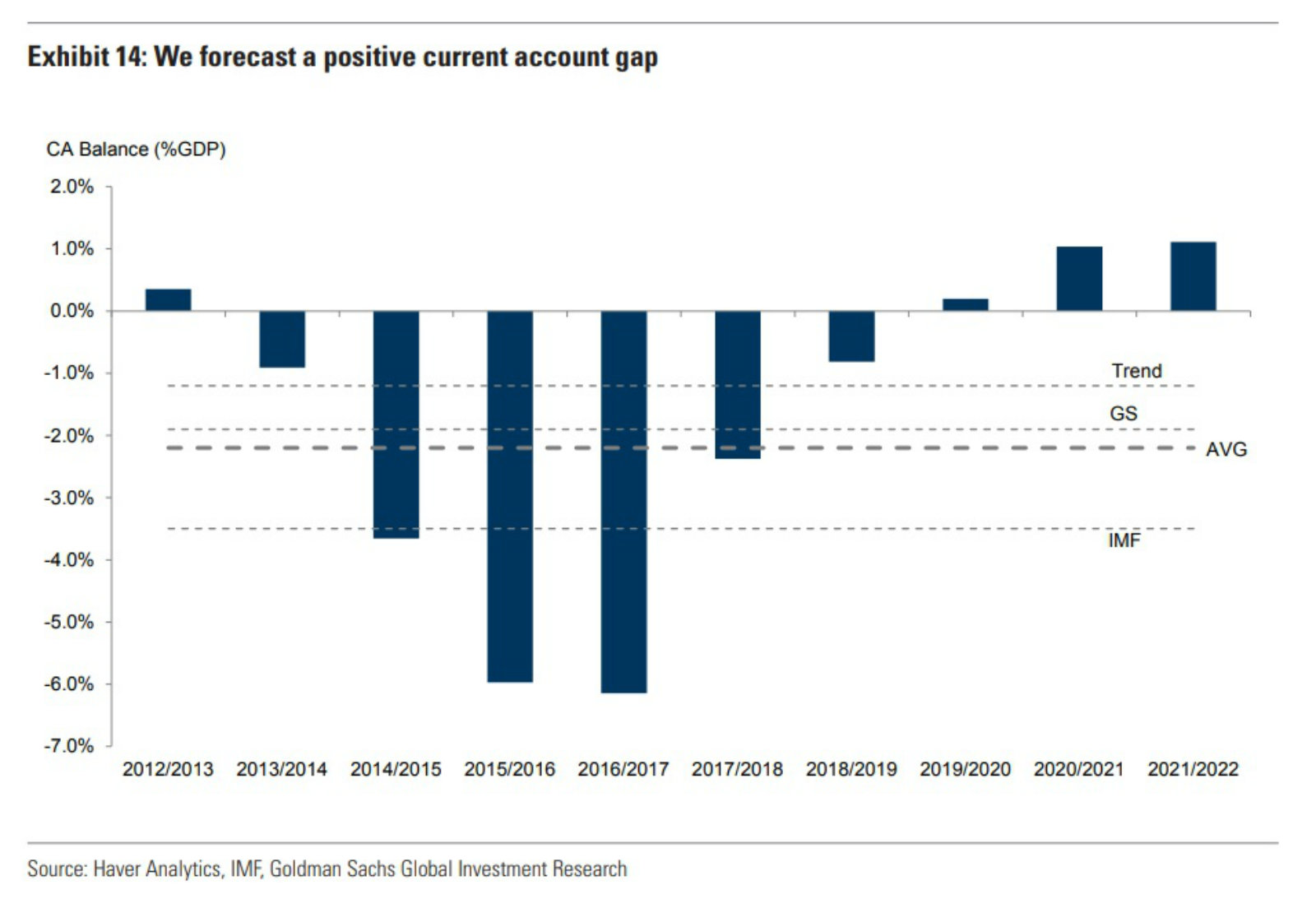

Don’t count on much volatility in the EGP this year, says Goldman Sachs: Writing in a research note, the investment bank says it doesn’t see much volatility in the USD-EGP exchange rate going forward. An improving current account position will help to support the EGP against downward pressures over the medium term, according to analysis from Goldman. Falling fuel imports, a gradual recovery in the tourism sector and steady remittance inflows will push the current account into surplus territory in FY2019-20, “removing any downside pressure on the nominal exchange rate,” the investment bank writes.

But expect a steady REER appreciation: Although the current account movement should keep the EGP on track, the real effective exchange rate will appreciate as inflation in Egypt continues to exceed that of its trading partners. Goldman’s model suggests the EGP “is now fairly valued and, under our inflation projections, should weaken from here by around 8% per year over the next three years.”

Weak FDI could put pressure on the currency, says our friend Ahmed Badr at Credit Suisse: The EGP could come under pressure if foreign investment levels do not pick up, Ahmed Badr, Middle East managing director at Credit Suisse, told Bloomberg. “We’ve reached a new cycle where we need to shift from the T-bill trade into actual investments, but that hasn’t happened yet,” he said. “If that continues, will it actually affect the currency? The answer is yes.” You can catch Badr’s full appearance in the last 15 minutes of the show (watch: 1:26:56), where he dives deep into Egypt, Saudi and the UAE.

EXCLUSIVE- Are yields on EGP debt being driven down by banks buying before a new tax treatment goes into effect? A senior government source we spoke with suggests that a significant portion of the demand for EGP debt is being driven by an upcoming change in the tax code. The measure will force banks and companies to separately account for income derived from their holdings of government debt and could see their effective tax rate rise. The source said domestic banks are accelerating their buying of treasuries to lock in profits before the tax measure comes into effect. High domestic and international appetite has helped drive down the cost of borrowing for the government, but the source expects that demand at auctions will decline slightly after the new tax treatment comes in effect.

The new tax treatment could be ratified in “days,” the source said. The change will be introduced to the executive regulations of the Income Tax Act, which does not require a vote from the House of Representatives.

Eurobond issuance to take place within the next two months: The Finance Ministry is planning to take its international issuances to the market in February or March, Minister Mohamed Maait was quoted as saying by Reuters. The ministry is planning to sell between USD 3-7 bn in USD- and EUR- denominated bonds, Maait noted. The government is also looking to make the first Yen-denominated bond issuance and green bond issuance sometime in 2019.

Advisers: JP Morgan, HSBC, Goldman Sachs and Citibank will advise on the USD-denominated eurobond issuance, while BNP Paribas, Natixis, Bank of Alexandria, and Standard Chartered were tapped to manage the EUR-denominated portion of the issuance. The National Bank of Egypt and Banque Misr will be “assisting with the offerings.” The ministry also picked Al Tamimi & Co. as domestic legal counsel and Dechert LLP as international legal counsel for all the offerings.

Egypt’s GDP growth is still accelerating: Economic growth accelerated to 5.5% in 2Q2018-19, up from 5.3% in 1Q2018-19 and 5.3% in 2Q2017-18, Planning Minister Hala El Said told cabinet yesterday, according to a government statement. GDP growth in the first half of the 2018-19 fiscal year reached 5.4%, she added. The government sees the economy growing at a 5.6% pace in 2H2018-19 with an overall GDP growth rate of 5.8% anticipated for the full fiscal year, up from 5.3% in FY2017-18, she said, according to the statement.

Growth is being driven by energy, mining and construction: Energy and mining (labeled together as “extraction”) contributed 25% of total growth in 2Q2018-19, followed by construction (11%), wholesale and retail (11%), telecoms (8%), and hotels and restaurants (7%).

Inflation in 1H2018-19 averaged 14.4%, down from an average of 30.2% during the same period last year, El Said stated.

Egypt’s budget deficit shrank to 2.3% in 1Q2018-19, down from 2.7% in 1Q2017-18, she noted. Earlier this month, Ittihadiya revealed that Egypt’s budget deficit shrank to 3.6% of GDP in 1H2018-19, down from 4.2% the previous year. Finance Minister Mohamed Maait noted at the meeting that the drop in the budget deficit for the period came on the back of a 28% y-o-y growth in state revenues in the first half of the fiscal year, and a 22.2% y-o-y growth in tax revenues. He also said Egypt achieved a primary surplus of EGP 21 bn in 1H2018-19.

Reforms alone may not be enough to wean Egypt off the IMF: The government’s economic reform program won’t address Egypt’s underlying economic imbalance, AUC assistant professor Amr Adly (bio) writes in a contrarian opinion piece for Bloomberg. Only a concerted effort to revive the country’s industrial base will prevent the country from once again having to go cap in hand to the IMF, he argues. Our manufacturing base is heavily dependent on imports of raw materials, intermediate goods and capital goods. “By some estimates, production inputs made up more than 50 percent of the import bill in 2017,” he writes. “Exports have historically been less than half of imports; so, to raise the hard currency necessary to meet its external commitments, Egypt depends on workers’ remittances, tourism and, to a lesser extent, foreign direct investment.”

So, what do we do? Adly argues that sustainable growth will be built on a healthy industrial base that is less reliant on imports to support production. Metals, plastics, and chemicals have all shown potential for growth, and the government should stimulate activity in these sectors by offering credit guarantees and technology-transfer subsidies to manufacturers.

IPO WATCH- AlGioshy Steel is considering listing 40% of its shares on the EGX in 4Q2019 to fund its local expansion plans, a top company exec tells Amwal Al Ghad. The company is currently working on adding a second production line at its steel rebar factory in Sixth of October and expects to have it up and running this quarter. The cost of the new line will ring in at EGP 300 mn, he said, ahead of the EGP 500 mn the company had previously signaled it would demand.

INVESTMENT WATCH- Al Nowais, EETC to sign coal power plant agreement in 1Q2019: Al Nowais will sign a contract with the Egyptian Electricity Transmission Company (EETC) for the proposed USD 4 bn Oyoun Moussa coal-fired power plant in 1Q2019, Chairman Hussain Al Nowais told Zawya. The head of the Emirati investment group said that the company will construct the 2.65 GW facility in three phases over the next four years, with the first phase generating 1.32 GW of electricity. Al Nowais is putting up 70% of the capital for the project. The company is talking to backers in Singapore, South Korea, China and Egypt to fund the remaining 30%.

OC, Hassan Allam among five contractors working on NAC light railway: Our friends at Orascom Construction and Hassan Allam are among the five local contractors selected to begin working on the China-funded light railway between 10th of Ramadan City and the New Administrative Capital, Al Mal reported. Arab Contractors, Hassan Allam, Petrojet and the Holding Company for Roads, Bridges and Land Transportation Projects will also be working on the project, making Hassan Allam and OC the flag bearers for the private sector on the project.

LEGISLATION WATCH- Insurance companies object to high capital requirements in Insurance Act: The industry association representing the nation’s insurance company appears displeased with a number of aspects of the Insurance Act, and has prepared its notes on the legislation. The Insurance Federation of Egypt said it will file its notes with the Financial Regulatory Authority, a senior member of the group told Al Mal. The main gripe appears to be the capital requirement minimum for insurance companies, which raise the issued and paid-in capital of life and property insurance companies by 150% to EGP 150 mn and the minimum capital requirements for reinsurance companies by 733% to EGP 500 mn. The source noted that the federation sees these as very steep and will urge that they be reduced. They also reportedly oppose the raising of licensing and incorporation fees, which could reach EGP 20,000 for any new branch. The group also objects to the mandatory policy payout figures for car insurance set in the law, which have been doubled in the law to EGP 80,000 from EGP 40,000 saying that these need to be reviewed.

REGULATION WATCH- Bank boards can meet a little less frequently now, central bank says: The CBE issued new regulations that mandate that the board of directors at banks must now meet regularly at least eight times a year, down from a previous requirement that they meet once a month, according to a new regulation by the central bank (pdf). Board members can attend meetings virtually through video conference or by phone a maximum two times per year for each member, down from four.

CABINET WATCH- Madbouly Cabinet tightens trafficking laws: Apart from discussing key economic indicators (as noted above), the Madbouly Cabinet approved yesterday amendments to the Illicit Substances Act, which would tighten penalties for violators and update the schedule 1 substances list. Under the amendments, all those caught importing or exporting illicit substances will be given the death penalty, while those caught peddling them would face a life sentence and as much as EGP 500k in fines. Those caught using them would face prison time and a fine of up to EGP 200k, according to a cabinet statement. Other decisions taken by the cabinet include approving a USD 289 mn funding agreement with the Arab Monetary Fund to help finance SMEs.

EARNINGS WATCH- Eastern Tobacco profits fall in 1H2018-19: Eastern Tobacco saw net profits after tax for 1H2018-19, which ended in December, fall by about 13% to EGP 2 bn compared to EP 2.3 bn a year earlier, the company said in a filing with the EGX (pdf). Revenues were up 4% to EGP 7.1 bn from EGP 6.8 bn in the same period a year ago.

Up Next

On Sunday, a Cairo court will hear the EUR 150 mn lawsuit against Peugeot Citroen.The case, in which a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. is suing Peugeot after the French automaker ended their 40-year partnership, had been delayed in mid-December.

Egypt’s Emirates NBD PMI is expected on Tuesday.

The unified tax procedures will be introduced to the House of Representatives in the coming days, Mubasher reports, citing a Tax Authority statement. The law aims at simplifying tax procedures by unifying filing of income taxes and VAT.

Image of the Day

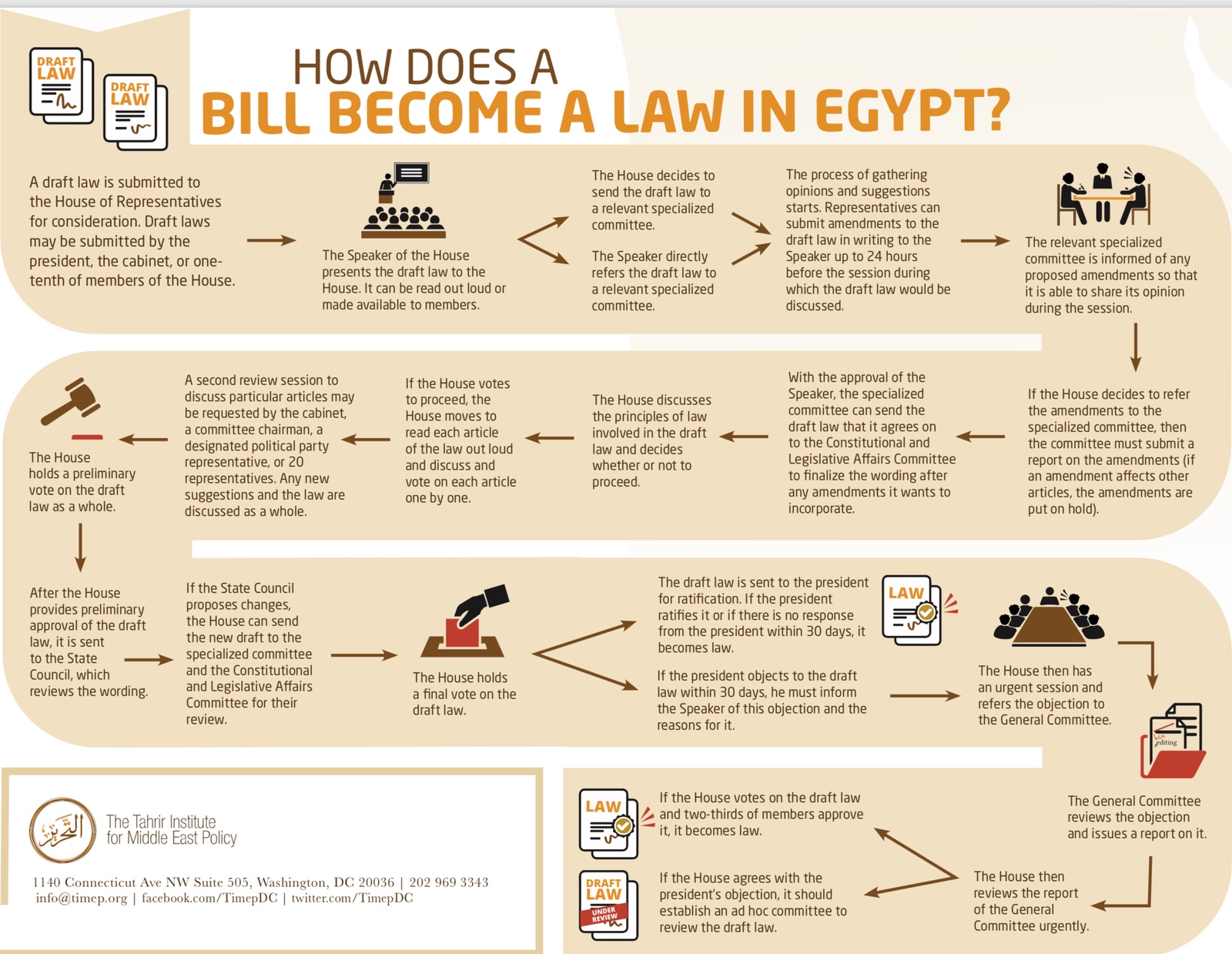

How a bill becomes a law in Egypt: We’ve written rather a lot about bills becoming laws in Egypt in the past couple of decades, and this morning’s Image of the Day is the best explanation of the process that we’ve seen in the English language, courtesy of the folks at the Tahrir Institute for Middle East Policy. Not included: What happens when MPs forget to send a bill to the State Council, but that’s a story for another day… Also worth a look: Their infographic Navigating the House of Representatives (pdf).

Egypt in the News

Human rights in Egypt made headlines again. Six secular activists, including members of opposition parties, were arrested earlier this week for commemorating the 25 January revolution, according to the AP. Also making headlines is the crowdfunding campaign by prominent atheist video blogger Sherif Gaber, who says that the government won’t let him leave Egypt despite several attempts over the years.

“Let it Rust” campaign is hitting the auto market: The “Let it Rust” social media campaign to boycott new car purchases as a sign of protest against high prices has succeeded only in causing the market to stagnate, without really impacting prices, according to a piece by China’s Xinhua News.

Also worth a skim:

- The UK tabloids are still harping about Laura Plummer’s time in Qanater women’s prison.

- Former Alexandria Deputy Governor Souad El Kholy has been handed a one-year suspended sentence on corruption charges, the AP reports.

- A court has sentenced 17 people to three years in prison for forming an illegal militant group and joining a terrorist organization, MENA reports.

On The Front Pages

Econ and business news dominate the front pages of the country’s three main state-owned dailies this morning. The government has signed 51 agreements that are expected to bring in some USD 27.2 bn in investments in the oil industry in the coming phase, Oil Minister Tarek El Molla said, according to Al Ahram. Meanwhile, Al Akhbar and Al Gomhuria carry stories on the use of electric vehicles in Egypt and the country’s primary surplus in 1H2019-20.

Worth Reading

Fintech boom moves beyond Silicon Valley: A European fintech company is giving household names like Facebook and Twitter a run for their money when it comes to wealth creation, in a clear indication of the power of the rapidly-growing payments market. Dutch company Adyen NV went public in June of last year and since then its stock has nearly tripled and its CEO, CTO and former innovation director have all become bn’aires, Bloomberg reports. The former innovation director reportedly holds a 4.65% stake worth USD 1 bn.

Fortune favors the bold: With annual digital payments worldwide projected to grow at least 10% per year and approach 1 tn by 2021, there can be no doubt as to the importance of the market for consumers and investors alike. Adyen’s value proposition, that it saves merchants mns of USD by streamlining card-payment transactions, was further underscored by early collaborations with Uber and Airbnb. Now, it is one of four tech firms (the others being US-based Paypal, Stripe and Square) that have cornered over three-quarters of the market. All have had explosive growth trajectories in a sector that will clearly continue to boom.

Diplomacy + Foreign Trade

Foreign Minister Sameh Shoukry met with Russian Deputy Foreign Minister Mikhail Bogdanov to discuss cooperating on Syria, Libya, and Palestine, according to a ministry statement.

Energy

Schneider Electric in talks over 35 MW solar plant

Schneider Electric is in talks with the Electricity Ministry over a 35 MW solar plant in Sharm El Sheikh, reports Al Mal. The plant is expected to feed 7 MW into the national grid, and provide electricity for more than 2,000 homes.

Apex Africa signs contracts worth EUR 80 mn in Guinea Bissau

Apex Africa signed contracts for three contracts worth EUR 80 mn for developing a solar power plant and supplying electric meters and solar street lighting poles in Guinea Bissau, according to industry trade journal Power News.

Basic Materials + Commodities

Local wheat production forecasted at 9.5 mn tons

The Agricultural Ministry has announced that it expects Egypt to produce 9.5 mn tonnes of wheat in the 2018-2019 season, up from 9 mn tonnes the previous year, reports Reuters. Egypt’s strategic wheat reserves are enough to cover consumption for more than five months, the Supply Ministry said Wednesday, according to the newswire.

Manufacturing

Egypt to launch new non-cash incentive program for exporters in March

A new non-cash incentive program for exporters that the Trade Ministry is working on will be launched in March, export council members tell Masrawy. Federation of Egyptian Industries boss Mohamed Elsewedy has suggested that the new program only apply to products that are at least 40% locally made, according to Masrawy. Export councils will hold talks on Monday over the program, which Trade and Industry Minister Amr Nassar is drafting, Al Shorouk reports. The government had been looking at alternative solutions amid delayed export subsidy funds and complaints from traders.

Automotive + Transportation

NTA and RATP to form JV for Cairo Metro Line 3

The Transport Ministry has established a joint venture with French company RATP to oversee the operation and maintenance of Cairo Metro Line 3, reports Al Mal. RATP will hold 80% of the JV, with the National Tunnel Authority holding the remainder. We had reported on the initial contract between the two sides as part of French President Emmanuel Macron’s visit to Cairo.

Banking + Finance

EGX approves issued capital increase for CIB, Orascom Development

The EGX has approved CIB’s c.EGP 2.92 bn issued capital increase, according to a bourse statement (pdf). The EGX also signed off on a EGP 22.16 mn issued capital increase for Orascom Development Egypt (pdf) and a EGP 500 mn authorized capital increase by 500 mn for Oriental Weavers (pdf).

Egypt signs agreement with EBRD for EUR 79 mn Kitchener drain loan

The Local Development Ministry signed yesterday an agreement to release a EUR 79 mn tranche of the EUR 148 mn loan from European Bank for Reconstruction and Development (EBRD) for the Kitchener Drain depollution project, according to a Cabinet statement. The project received a total of EUR 400 mn from international financiers thus far.

Egypt Politics + Economics

Egypt’s public prosecutor orders detention of 25 people over violence accusations

Egypt’s Public Prosecution has ordered that 25 people be detained for 15 days pending investigation into accusations of plotting to commit violence in January and February, MENA reported, according to Ahram Online.

My Morning Routine

My Morning Routine looks each week at how a successful member of the community starts their day — and then throws in a couple of random business questions because we simply can’t help ourselves. This week’s interview is with Victoria Diachkova, founder of Sincerely V. Edited excerpts from our conversation:

Who are you? Victoria Diachkova, a Russian (as my name clearly suggests) living in Egypt since 2003. I moved here when I married my husband, Helmy, an Egyptian-American, so we’re a very diverse family, mixing in the best sides of all three cultures. We have two boys: Taymour, 12, and Adam, 9, who make sure to keep me busy.

What do you do / what’s your day job? I’m a plant-based nutritionist and lifestyle blogger, recipe and menu developer, consultant, and health coach. In addition to running my blog, Sincerely V, and recipe development, I consult on plant-based menu development for hospitality and F&B businesses in Cairo.

What’s your morning routine? I wake up at 6 am with the kids. I drink my glass of celery juice (a relatively new addition to my morning routine) while getting them out the door. After sending them off to school, I have my coffee with homemade almond milk and a green apple. (You’re probably rolling your eyes by now: Celery juice, homemade almond milk, apple — who has time for that? I promise it’s all worth it.) I usually post something on my social media accounts, check my email, read Enterprise, and confirm my plans for the day, which are usually set well in advance. I consider my exercise routine a priority, so I do work out every morning. Then, I have my big breakfast and start my day, either with meetings and errands, or working at home.

What’s the best thing you’ve watched / read lately? I’m a bookworm by nature. “The Food Revolution” by John Robbins is a phenomenal eye opener on the impact our food choices have on our health and the environment. I also recommend “Proteinaholic” by Garth Davis on our obsession with protein and its consequences, and “The Longevity Diet” by leading longevity scientist Valter Longo on optimal nutrition for a long, healthy, and active life. I also love to listen to podcasts; my favorite is Rich Roll.

What’s the origin story of Sincerely V? I started Sincerely V on social media a little over a year ago when I was studying at the Institute for Integrative Nutrition (IIN), which led me to take multiple other courses specifically on plant-based nutrition. I became very passionate about the topic and grew frustrated that it is not common knowledge that our meat-, chicken-, and cheese-heavy diets are the leading factors of growing rates of chronic diseases and obesity. Egypt is among the top 20 countries with the highest rates of obesity, coming in at 30% of the population. I started sharing nutritional information, tips, and recipes to back up what I preach. My photography skills help me a lot with delivering the message: Vegetables can be more than just fries or a sad pile of bland, overcooked sauté, and salads go beyond iceberg lettuce with Caesar dressing.

What do people not understand about your business? Nutrition as a science is relatively new. There is a lot of confusion, misleading information, fad diets, and dietary theories. But most of it is just that — fad diets that don’t work and theories that have no scientific backing. People hear different things from multiple, usually unreliable sources, get frustrated, and then accept a mantra like “everything in moderation” to make themselves feel better about their bad habits. Moderation means different things for different people, so that doesn’t work. I do not prescribe diets, detoxes or plans for weight loss. These are all byproducts of a plant based lifestyle, which is the least restrictive and most inexpensive and sustainable way of eating. Clean, wholesome, sustainable food shouldn’t be a luxury, specialty, or niche. I’m in the business of making it a mainstream. My goal is to introduce plant based menus throughout Cairo — at restaurants, hotels, coffee shops, and schools. I want to provide options for people who are not necessarily entirely vegan or plant based, but are looking to give their body a break from a diet overly saturated with animal products.

I just launched my first 100% plant based menu in Cairo at Frank & Co in Maadi. The restaurant’s own menu couldn’t be further from plant based: It heavily features meat, chicken, and cheese. However, the restaurant’s founder Frank Heinen, who has a long career in F&B, saw the potential in and benefits of introducing a plant based menu in addition to the original and it’s paying off. We’ve been getting absolutely phenomenal feedback from vegetarians and omnivores alike. I’m extremely excited about that because I know that it’s just the beginning of our food scene transformation in Cairo.

How is the “business of food” changing? Food trends are changing dramatically. As people learn the benefits of consuming most of their calories from plants, there is a big dietary shift toward vegetarian food. This is not another trend or fad diet; it’s been around for generations and is here to stay. Restaurants, hotels, schools, hospitals and airlines are introducing plant based menus around the world. Food manufacturing in Egypt is getting there too; there are more and more clean brands appearing on our grocery shelves.

What one internal or external force will create the most change in your industry? Creating demand for clean, sustainable, health promoting food through education. Providing information about food sources, demanding transparency in food manufacturing and educating ourselves and our kids about real, wholesome, sustainable food choices. Not to sound overly dramatic, but it’s not personal anymore; we need to consider our environment. Global food production, specifically animal agriculture, is the single largest driver of environmental destruction, water depletion and climate instability. By eating lower on the food chain, you will be giving both your body and our planet a break. Once demand for these so-called “specialty foods” picks up, the food industry will make them affordable and accessible to everyone.

What do you do in your free time? I read up on nutrition, watch conferences on YouTube, and listen to podcasts. I still read fiction before bed, though, to give my brain a break. When I really need to disconnect, I travel. We travel frequently as a family, but I also often travel alone, which I enjoy very much and consider as a form of therapy. I like to add a little adventure to my solo trips with activities like skydiving, bungee jumping and long hikes.

How do you stay organized? I’m not the most organized person, but I do like order — both digital and physical. I like labeling and decluttering both my kitchen and office. My routine takes quite a bit of planning, so I try to schedule my week in advance. I live 40 minutes from Maadi, where I spend most of my days before picking the kids up from school and spending the rest of the day with them. Then it’s homework, dinner, and everyone is in bed by 9 pm. This routine works for our family and we only break it when we travel.

The Market Yesterday

EGP / USD CBE market average: Buy 17.57 | Sell 17.70

EGP / USD at CIB: Buy 17.60 | Sell 17.70

EGP / USD at NBE: Buy 17.60 | Sell 17.70

EGX30 (Wednesday): 14,093 (+0.8%)

Turnover: EGP 1.3 bn (59% above the 90-day average)

EGX 30 year-to-date: +8.1%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 0.8%. CIB, the index heaviest constituent ended down 0.6%. EGX30’s top performing constituents were Global Telecom up 7.5%, Heliopolis Housing up 5.1%, and QNB Alahli up 3.6%. Yesterday’s worst performing stocks were Orascom Construction down 2.4%, Egypt Aluminum down 1.4% and Elsewedy Electric down 1.2%. The market turnover was EGP 1.3 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -97.0 mn

Regional: Net Short | EGP -2.6 mn

Domestic: Net Long | EGP +99.5 mn

Retail: 55.6% of total trades | 59.1% of buyers | 57.4% of sellers

Institutions: 42.6% of total trades | 40.9% of buyers | 44.4% of sellers

WTI: USD 54.82 (+2.83%)

Brent: USD 62.42 (+1.79%)

Natural Gas (Nymex, futures prices) USD 2.88 MMBtu, (-0.93%, Mar 2019 contract)

Gold: USD 1,316.00 / troy ounce (+0.06%)

TASI: 8,583.63 (+0.03%) (YTD: +9.67%)

ADX: 5,004.85 (-0.56%) (YTD: +1.83%)

DFM: 2,538.56 (-1.07%) (YTD: +0.35%)

KSE Premier Market: 5,438.10 (+0.43%)

QE: 10,719.40 (-0.03%) (YTD: +4.08%)

MSM: 4,215.76 (+1.04%) (YTD: -2.50%)

BB: 1,392.46 (+0.48%) (YTD: +4.13%)

Calendar

03 February (Sunday): Cairo court to hear lawsuit against Peugeot Citroen.

05 February (Tuesday): Egypt’s Emirates NBD PMI for January released.

07 February (Thursday): Egypt Building Materials Summit, Nile Ritz Carlton, Cairo, Egypt

11-13 February (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

14 February (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

19 February (Tuesday) The Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

23 February (Saturday): The Supreme Administrative Court will rule in an appeal by Uber and its competitor Careem against a lower court ruling ordering the suspension of their operations.

24-25 February (Sunday-Monday): EU-Arab League summit, Sharm El-Sheikh, Egypt

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral

Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

March (date TBD): Traders Fair, Nile Ritz Carlton, Cairo, Egypt.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg)

18-19 March (Monday-Tuesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna (Bloomberg)

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

29 August (Thursday): Islamic New Year (TBC), national holiday.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Cairo, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.