- Egypt non-oil business activity is basically flat in October, PMI suggests. (Speed Round)

- Beltone puts capital increase on ice amid fallout from suspension of investment banking arm. (Speed Round)

- HC launches private equity arm; sector-agnostic, midcap-focused firm will raise on transaction-specific basis. (Speed Round)

- Matouk Bassiouny expands to the UAE. (Speed Round)

- OC adds USD 520 mn in new awards to its 3Q2018 backlog, 60% of it in Egypt. (Speed Round)

- No raises for civil service this year, cuts coming to ministries, El Sisi suggests. (What We’re Tracking Today)

- Israel may struggle to deliver gas to Egypt in contracted volume. (Speed Round)

- Your next office is the edge of a sofa. (What We’re Tracking Today)

- The Market Yesterday

Tuesday, 6 November 2018

Your next office is the edge of a sofa

TL;DR

What We’re Tracking Today

No raise for you? President Abdel Fattah El Sisi hinted yesterday that there may be no raises for civil servants this fiscal year. Pointing to the EGP 130 bn his administration will need to build as many as 250k new classrooms, El Sisi said yesterday: “That’s a big challenge. Tell me what to do. How do I solve this? I’m going to say something difficult. Make cuts in all the ministries. I’m going to say something even more difficult. We’re not going to give raises this year to employees in Egypt.”

See this in the context of civil service reform: The president’s remarks came little more than a week after Prime Minister Moustafa Madbouly told the business community that (a) he would consider downsizing his cabinet and (b) that he was going to cull the civil service, predicting that 38% of government employees will retire within 10 years — and that many of them will not be replaced, particularly as more government services are moved online. With at least 5 mn employees, the Egyptian government is the largest employer in Africa.

It’s election day in America as Democrats look to wrest control of the House away from the party of President Donald Trump. Start with this piece in the New York Times and then get ready to open Politico / the NYT / the Washington Post / CNN tomorrow morning and hit “refresh” non-stop. Polls generally close on the east coast at 9pm, so exit poll results (and actual race results) will begin trickling in at around 4am CLT on Wednesday.

Want to get really nerdy about the US election? Go read Mike Allen’s newsletter from this past Saturday, wherein he (a) identifies the “Axios 8”: Eight races to watch to judge how well the Dems will do and (b) six factors that will shape a 2020 presidential contest — one that he writes will that will “make this one seem civil.” A distant second: The Upshot’s rundown of how the Dems could win or lose control of the House.

The 2018 Institute of International Finance MENA Financial Summit will kick off today in Abu Dhabi. The two-day event will bring together global finance industry leaders and policymakers to discuss economic development, investment, and fintech and innovation in the MENA region.

The US reimposed economic sanctions on Iran yesterday, hitting more than 700 entities, including 50 Iranian banks and 200 individuals, Bloomberg reports. Tehran said on Monday it would defy Washington and continue selling oil on global markets, the BBC reported. Egypt is not among the eight countries getting waivers that will allow them to temporarily continue buying crude from Iran, Bloomberg notes. On the list: China, India, Italy, Greece, Japan, South Korea, Taiwan and Turkey. Oil prices were largely stable yesterday as traders bet that the eight-country waiver program would keep demand in check.

Speaking of sanctions: Aluminum tycoon Oleg Deripaska is a fixture of Davos and London — and practically PNG in Amreeka. His years-long bid to avoid US sanctions and ensure he has regular access to the United States is a fascinating tale of influence peddling by the global elite in this morning’s New York Times.

Emerging markets made their best one-week gain since 2016 last week, Bloomberg writes, suggesting stocks advanced as prospects of an all-out China-US trade war have eased. The next checkpoint: Chinese President Xi Jinping is set to meet The Donald at the G20 summit in Argentina on 30 November and 1 December.

Six charts that signal the approach of the (US) bear market: “Nine years, seven months, four weeks and one day into the current bull market, some investors are asking whether a bear is on the horizon,” the WSJ writes. “The S&P 500 is up 305% since the bull market began in 2009,” and while there’s no single indicator that suggests US equities are headed into a bear market (20% down from a recent peak), you’ll want to keep an eye on everything from the steepness of the yield curve to investor sentiment and jobs claims. The best part of the story: It’s told in “indicator – what it is – what to watch” style that breaks it down even for newbs (or rubes like us).

In miscellany this morning:

Your next office is the edge of a sofa — with an airline-style laptop tray if you’re among The Elect. The office of the future has no desks and no chairs, but lots of sofas, Fast Company tells us. Office furniture is preoccupying us as we prepare to move into roomier digs, and we’re longing for the once-dreaded cubicle lifestyle when we consider how the agonies of open plan offices have given way to this. That said, as anyone who has recently visited us may have noticed, at least one of us has developed a habit of working from a couch with laptop, ipad, notebook and phone at hand. So maybe Couchland isn’t a complete disaster?

Speaking of iPads: Are you drooling over the new Pro? MacRumors has a roundup of all the major reviews now out there ahead of the device’s Wednesday launch date in most western markets. Or you can check out the Apple propaganda department’s favorite quotes from reviews. The Washington Post still wishes it had a mouse or trackpad, the Wall Street Journal wishes it didn’t run iOS and hates the built-in browser, but Fast Company is all-in on the iPad Pro-only lifestyle. No news yet on when the device hits Egypt.

Some money managers are proposing they take a pay cut if they can’t beat the market. It’s the latest salvo in the actively-managed war against exchange-traded and index funds, the Wall Street Journal writes.

Shocking suggestion of the day: More thinking time for staff will result in better ideas, writes Andrew Hill for the Financial Times.

It’s Stranger Things Day, Netflix tells us. What that means, nobody knows. Keep an eye on your Netflix and social media feeds. You can follow Stranger Things’ twitter here.

Enterprise+: Last Night’s Talk Shows

As expected, the airwaves were still chock-full of coverage of the World Youth Forum last night. President Abdel Fattah El Sisi’s speech at yesterday’s session was again the main point of interest for Hona Al Asema (watch, runtime: 56:31).

El Sisi’s decision to look into amending the controversial NGOs Act received praise from National Human Rights Council member Hafiz Abu Saada, who told El Hekaya that the law has been problematic since its inception. Abu Saada stressed that any amendments should be agreed upon by all relevant parties, including the government and civil society organizations, and should strike a balance between security concerns and granting NGOs the space to operate effectively (watch, runtime: 2:08).

Another rallying cry for the country’s opposition from Mohamed El Baradei had El Hekaya’s Amr Adib tapping his inner Sherlock Holmes in an attempt to understand El Baradei’s underlying intentions. Adib also renewed his request that opposition groups begin preparing from now to field a viable candidate for the 2022 presidential elections (watch, runtime: 2:26).

Authorities are probing the death by electrocution of a doctor at the Matareya Teaching Hospital, which may have been a result of administrative negligence, Administrative Prosecution Authority spokesman Mohamed Samir told Hona Al Asema. Prosecutors have referred four hospital officials to court over the case and a committee has been tasked with inspecting the facility, according to Samir (watch, runtime: 8:50).

Speed Round

Purchasing managers’ index basically unchanged in October: Private sector business conditions were largely unchanged in October, according to the Markit / Emirates NBD PMI gauge (pdf), which dipped to 48.6 from 48.7 in September. While the drop is effectively immaterial, it was the second consecutive dip in confidence after the confidence measure briefly broke the 50 point mark in July and August. October’s reading is the lowest in 2018.

New orders did decline, but purchasing sees rebound: The decline came in response to a further fall in new orders and output during October. But the fall in output and orders was milder than in September, while purchasing activity improved and inflation continued to ease.

The private sector is still pressured by reform: The decline in suggests that private sector activity is still weighed down by the economic reform program. One third of the companies surveyed said they are confident that output will rise and business activity will expand over the next 12 months.

Beltone puts capital increase on ice amid fallout from suspension of investment banking arm: Beltone Financial Holding has said it will put on hold its planning EGP 1 bn capital increase, the firm said in a disclosure to the EGX (pdf) on Monday. Beltone’s decision to scrap the capital increase comes days after the Financial Regulatory Authority (FRA) suspended the firm’s investment banking arm for a six-month period. A senior FRA official had said the suspension was a result of “irregularities” in the Beltone-run IPO of consumer and structured finance player Sarwa Capital. Beltone shares rose nearly 2% yesterday.

HC launches private equity arm: HC Securities & Investment launched on Monday a private equity arm that will invest in mid-cap companies across a range of industries, the company said in a press release (pdf). HC will invest its own funds and will raise outside capital from limited partners on a transaction-by-transaction basis, it said. The new PE arm will focus on “exceptional entrepreneurs and great management teams that are looking to accelerate growth in their businesses,” the statement noted. “I am delighted to announce the firm’s foray into private equity. We are hopeful in not only creating long-term value for our partners and our investors but also supporting the Central Bank of Egypt’s initiative to back thriving medium sized Egyptian companies,” said HC founder, chairman, and managing director Hussein Choucri.

The new firm will be headed by Wall Street veteran Ahmed Dessouky (LinkedIn), a seven-year veteran of Deutsche Bank who crossed over to private equity with Lone Star and Silverpeak Partners in the United States. Dessouky worked on project finance and then investment banking at Deutsche.

Matouk Bassiouny expands to the UAE: Law firm Matouk Bassiouny has officially opened up shop in Dubaiunder the banner Matouk, Bassiouny & Ibrahim, according to a press release picked up by Zawya. The firm brought onboard Ahmed Ibrahim, “one of the UAE’s top corporate and ECM lawyers,” as a name partner, the release said, and will focus on equity capital market transactions on both the ADX and the DFM “in addition to supporting clients with an array of commercial services including negotiations, shareholder and share purchase agreements, corporate governance, and acquisitions.”

Orascom Construction (OC) added USD 520 mn in new awards to its 3Q2018 backlog, the company said in a statement on Monday (pdf). Consolidated backlog as of 30 September 2018 stood at USD 4.1 bn. Egypt accounted for approximately 60% of new awards, which were mainly across the infrastructure and wastewater treatment sectors. US sales delivered 40% of new awards, with OC signing new projects across the private-sector commercial and light industrial sectors. BESIX, OC’s Belgium-based subsidiary, added approximately EUR 380 mn of new projects in 3Q2018, bringing its total new awards to EUR 1.9 bn and backlog to EUR 3.2 bn, the company noted.

Israel may struggle to deliver gas to Egypt in contracted volume. Israel’s domestic pipeline network reportedly does not have the capacity to carry all the natural gas the Tamar and Leviathan partners have contracted to sell to Egypt, according to a report by israel’s TheMarker, picked up by Haaretz. Neither the Tamar nor Leviathan fields have been connected to the domestic network. The report comes after Tamar and Leviathan partners Delek Group and Noble Energy bought in September a 39% stake in the East Mediterranean Gas (EMG) pipeline with Egyptian partner East Gas. The parties aim to sell Tamar and Leviathan gas to Egypt through EMG.

INGL capacity problems: In the meantime, deliveries of gas to Egypt must use the pipeline belonging to national gas network operator Israel Natural Gas Lines (INGL), which is currently capable of carrying between 2-3 bcm of gas annually, sources close to the matter said. Noble and Delek, however, have committed to selling around 7 bcm of gas annually from both fields as early as next year to Alaa Arafa’s Dolphinus Holdings in an agreement signed in February. So far, the INGL pipeline has enough capacity to move gas from the Tamar field and will begin deliveries to Dolphinus in 1H2019. However, it will have to stop exports once Leviathan comes online, unless a solution to the capacity problem is found.

Delek and Noble say not to worry, they’re working on it and they have “no doubt that the Dolphinus agreements will be fully implemented and that gas will be delivered to Egypt as it is supposed to.”

Options on the table: One option suggested by Haaretz is to send some gas through another length of the INGL network to the Pan-Arab pipeline, which connects to EMG. Other options include widening the existing INGL pipeline, build a second parallel pipeline, or build an undersea pipeline.

Is it possible that we will rely on Israeli gas by 2030? While gas discoveries including Zohr have paved the way for Egypt to both meet its domestic needs and turn into a regional export hub, some analysts suggest Egypt could become reliant on gas from Israel by 2030. Production from the existing Egyptian fields could fall off sharply starting in 2020, according to an assessment of Egypt’s gas reserves and infrastructure conducted by McKinsey & Co and picked up by Israeli newspaper Globe. The company found that gas from Zohr will compensate for declining production in maturing in the early years, but afterwards, this will also be insufficient. “In 2030, total production from Egyptian fields will fall below 50 bcm a year, compared with more than 60 bcm at present,” making shortages a very real possibility for Egypt.

Meanwhile, Israel’s Energy Ministry announced on Sunday that it will tender off 19 new offshore blocks to oil and gas companies, according to Reuters. It will publish details of the tender by the end of the month and select the winning companies in six month’s time, said Udi Adiri, the ministry’s director general. This is Israel’s second attempt to open the blocks up after a tender last year failed to stoke the appetite of international oil and gas companies. Some analysts are seeing that the gas export agreement with Egypt may help make this second tender attractive.

The Oil Ministry is in talks with Spanish-Italian JV Union Fenosa Gas (UGS) to reduce a USD 2 bn settlement it has been ordered to pay over gas supply interruptions at the Damietta liquefaction plant, an unnamed ministry source said, according to Al Shorouk. According to the source, the ministry is also expected to resume gas shipments to the plant “in small quantities” in 2H2019 as part of the settlement agreement, which the World Bank’s International Centre for Settlement of Investment Disputes ordered in September. The ministry had said that Egypt is taking steps to settle the amount, without disclosing details on what the steps entail. UGS had filed the case against Egypt some years ago, complaining that the government had cut off flows to its Damietta liquefaction plant, of which it owns 80%. Settling the dispute could expedite the resumption of LNG exports and help put Egypt on the map as a regional energy export hub. Naturgy and Eni are also in “advanced talks” to re-launch operations at the Damietta facility, Eni CFO Massimo Mondazzi said last month.

Egypt’s net foreign reserves rose marginally to USD 44.501 bn at the end of October, up from USD 44.459 bn a month earlier, the central bank said on Monday.

M&A WATCH- Helwan Cement EGM signs off its white plant sale: The extraordinary general assembly of the Helwan Cement has signed off an agreement to sell its white cement plant to Emaar Industries, parent company Suez Cement said in a disclosure to the EGX on Monday (pdf) on Monday. Helwan Cement will split off the company owning the plant, which will then be sold off to Emaar. The transaction was announced in September.

Advisers: Suez Cement was advised by EFG Hermes (financial advisor) and Zulficar and Partners (legal counsel).

LEGISLATION WATCH- Gov’t to introduce proposed E-commerce Act to the House on 15 November: The government will introduce its proposed E-commerce Act to the House of Representatives on 15 November when the House CIT Committee starts hearings, committee chair Rep. Ahmed Badawi told Amwal Al Ghad.

Background: Local press had noted that the law was primarily concerned with establishing a tax framework for the industry. Government sources had told us back in June that the Finance Ministry was looking to impose a VAT on e-commerce.

Major players feel left out: Jumia CEO Hisham Safwat complained to the newspaper that the private sector was not consulted when the government was drafting the law. He did note that the company is now in talks with the Information Technology Industry Development Agency (ITIDA) to discuss the bill. Jumia and Amazon subsidiary Souq.com had previously said they expect ot be regulated.

REGULATION WATCH- The Financial Regulatory Authority issued corporate governance guidelines for factoring and leasing companies on Monday. The regulations govern everything from the constitution of boards and meetings to governance committees and guidelines on conflict of interest. You can read them all here (pdf).

A visit this week to Egypt by Brazil’s foreign minister has been canceled in protest of Brasilia’s plan to recognize Jerusalem as the capital of Israel. “Aloysio Nunes Ferreira was set to fly to Cairo for a Nov. 8-11 visit, during which he was to meet with President Abdel Fattah el-Sisi and his counterpart Sameh Shoukry,” according to Reuters.

***

WE’RE HIRING: We’re looking for smart, talented, and seasoned journalists and editors to join our team at Enterprise, which produces the newsletter you’re reading right now. We’re looking for people who can work on this product and help us launch exciting new stuff. Applicants should have serious English-language writing chops, a strong interest — and preferably some professional experience — in business journalism, and solid analytical skills. The ideal candidate for us is a native-level-writer of English with the ability to read and understand Arabic. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. If you’re interested, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Please direct your applications to jobs@enterprisemea.com.

***

Up Next

The government will announce by mid-November the date of its first auction of ‘unused’ state land, Public Enterprise Minister Hisham Tawfik has said. As many as 10 mn sqm of state-owned land in 10 governorates will be up for sale to developers.

Interest rate watch: The central bank’s monetary policy committee meets on Thursday, 15 November to review interest rates. The emerging consensus is that the bank will leave rates on hold.

Egypt in the News

Topping coverage of Egypt in the foreign press this morning is an odd-looking statue of Mohamed Salah unveiled on Saturday at the World Youth Forum. Foreign news outlets and tabloids exhausted the list of synonym words for ‘odd’ to describe the monstrosity. Consider it the latest in a wave of unfortunate statues of Cristiano Ronaldo, Diego Maradona, and Luis Suarez, Sky Sports suggests.

On last night’s talk shows, El Hekaya’s Amr Adib took it upon himself to defend the piece by saying that the statue does not need to be an exact copy of the footballer to be of value, and claiming that people would have felt differently had it been created by a well-known artists, rather than a “regular” Egyptian citizen (watch, runtime: 4:16).

It may not be Salah, but the statue really does look like 1970s British musician Leo Sayer (pictured below).

Other headlines worth noting:

- The Maspero Triangle, which has for decades been a key part of Cairo’s heritage, is now “reminiscent of photographs of many a city after war,” Yasmine El Rashidi writes for the New York Times.

- International rights group Reporters Without Borders condemns Egypt’s new media law, which requires independent media outlets to pay for permits, calling it “tantamount to extortion” and a sign of independent media’s probable extinction in Egypt. The story was picked up by the NYT.

- Egyptian squash player Omar Mosaad was seeded number one and went straight to the second round of the PSA World Tour Bronze tournament, which will kick off between November 10-14, according to the tournament’s website.

- Former funnyman and ex-El Bernameg host Bassem Youssef will be performing at the New York Comedy Festival this Saturday and Sunday, Sopan Deb writes for The New York Times.

On Deadline

The nation’s columnists were squarely focused on Friday’s terror attack in Minya, and the relevance of its coinciding with the World Youth Forum. Al Shorouk’s Emad El Din Hussein maintains that the forum should not have been canceled, as some suggested, saying that this would have lent credence to the terrorists. Al Masry Al Youm’s Amr Hashem Rabie and Amr El Shobaki suggest relying on youth empowerment and reformed religious discourse to tackle violent extremism. Meanwhile, former Kuwaiti Information Minister Sami Abdel Lateef El Nasr suggests that religious minorities should receive a formal apology from the Arab League and the Organization of the Islamic Conference for failing to protect their rights.

Worth Watching

Cutting food consumption can solve climate change: The Climate, Land, Ambition, and Rights Alliance (CLARA) is suggesting we start targeting the USD multi-tn food industry to stop temperatures from rising more than 1.5°C. Breeding animals for food is responsible for c. 14.5% of gas emissions, so we should eat significantly much less meat and limit consumption to a maximum of two weekly five-ounce servings. CLARA is even going so far as to advocate for global vegetarianism (watch, runtime: 1:21).

Real Estate + Housing

Porto Group signs agreement to co-develop Porto City with El Mostakbal

Porto Group has signed an agreement with El Mostakbal for Urban Development to co-develop a mixed-use project, Porto City, in Mostakbal City. The new development is expected to offer residential and recreational facilities. No details on the investment value or timeline were provided.

Decision to grant Egyptian residency to foreign homebuyers will not be applied retroactively

The Housing Ministry’s recent decision to grant residency to non-Egyptian homebuyers will not be applied retroactively, deputy minister Khaled Abbas said, according to Al Mal. Foreigners who have bought and paid for homes in full prior to the issuance of the decision will not be eligible for residency under the program. Buyers of finished homes can claim immediate permits, while those who buy planned homes are required to have made down payments of at least 40% of the unit’s value or USD 100k, Abbas added.

Tourism

Luxor receives first charter flight from Frankfurt

Luxor International Airport saw the arrival of its first charter flight from Frankfurt Airport yesterday, Al Shorouk reports. The plane landed with 162 tourists onboard.

Other Business News of Note

IDA to re-tender land plots seized from 1,000 factories project investors

The Industrial Development Authority (IDA) is set to re-tender 15 land plots seized from investors in the New Cairo 1,000 factories project, IDA sources tell Al Mal. The authority has reportedly withdrawn land from 600 factories investors after failing to meet several consecutive deadlines to begin construction or production, according to the sources. Under IDA regulations, investors must break ground on their facilities within a year of obtaining the land and must begin production within three years. A second batch of seized land plots will also be tendered in two months’ time.

Sports

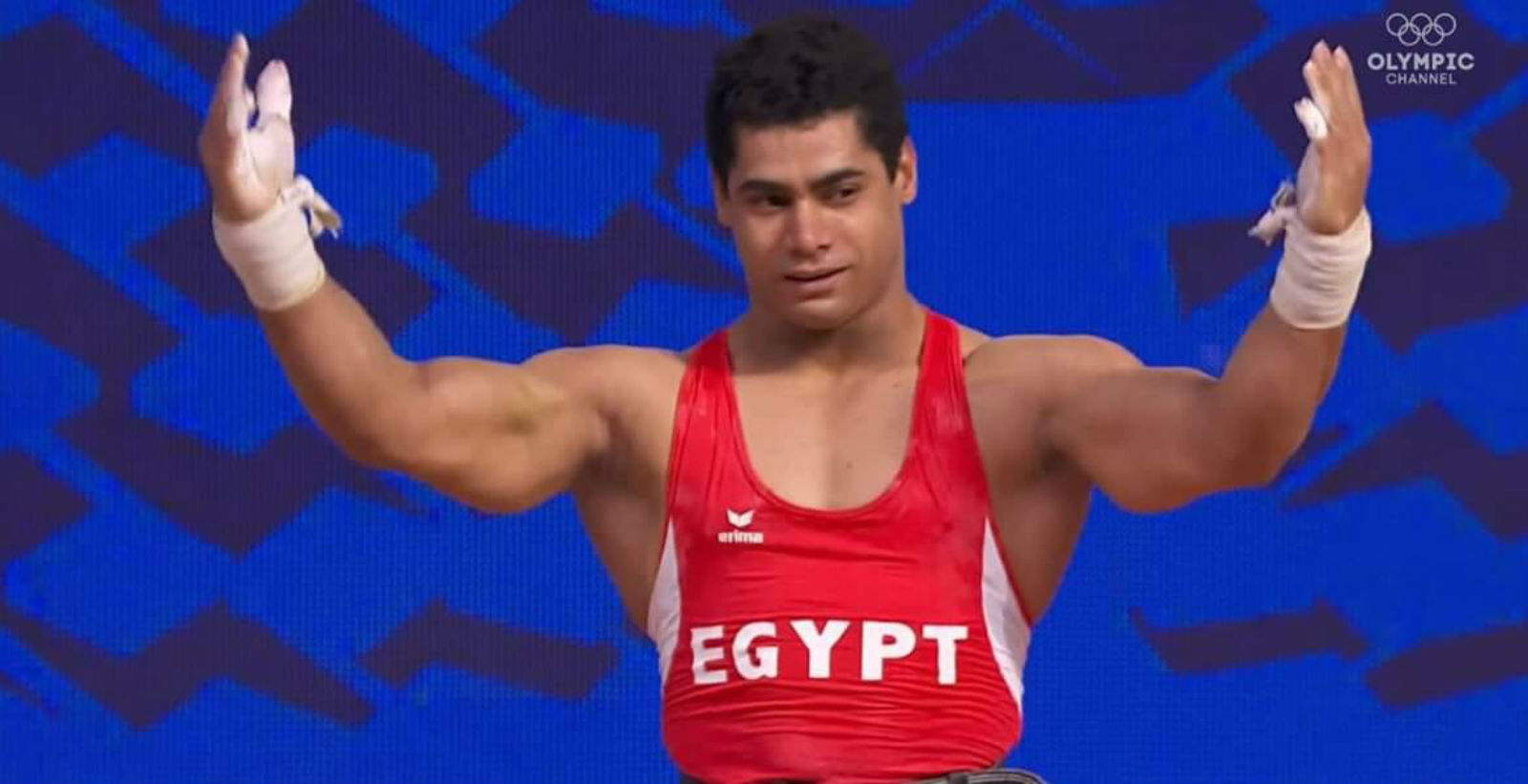

Egyptian weightlifter Mohamed Ihab breaks world record in men’s 81 kg category

Egyptian weightlifter Mohamed Ihab broke the world record for the highest weight lifted in the men’s 81 kg category at the World Championship in Turkmenistan, according to Ahram Online. Ihab’s lifting of 173 kg — 3 kg heavier than the previous world record — earned him a gold medal in the snatch event. Separately, the weightlifter also snagged the bronze in the clean and jerk after lifting 200 kg.

On Your Way Out

Are we about to see a renaissance of open-air cinemas in Egypt? Urban Cinema is looking to bring back to Cairo the open-air cinemas of yesteryear on the roof of the Greek Campus. Once a month, the cinema will hold private screenings of independent films and popular series along with a skyline view of Downtown Cairo.

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Monday): 13,235 (+0.5%)

Turnover: EGP 1.2 bn (70% above the 90-day average)

EGX 30 year-to-date: -11.8%

THE MARKET ON MONDAY: The EGX30 index ended Monday’s session up 0.5%. CIB, the index heaviest constituent ended up 1.1%. EGX30’s top performing constituents were Arab Cotton Ginning up 4.8%, and Egyptian Iron & Steel up 3.3%, and Egyptian Resorts up 2.7%. Yesterday’s worst performing stocks were EFG Hermes down 1.8%, Egyptian Aluminum down 1.7% and QNB Alahli down 1.3%. The market turnover was EGP 1.2 bn, and regional investors were the sole net sellers.

Foreigners: Net Long | EGP +27.2 mn

Regional: Net Short | EGP -32.6 mn

Domestic: Net Long | EGP 5.4 mn

Retail: 64.8% of total trades | 49.6% of buyers | 80.0% of sellers

Institutions: 35.2% of total trades | 50.4% of buyers | 20.0% of sellers

Foreign: 7.5% of total | 8.6% of buyers | 6.4% of sellers

Regional: 36.6% of total | 35.3% of buyers | 37.9% of sellers

Domestic: 55.9% of total | 56.1% of buyers | 55.6% of sellers

WTI: USD 63.10 (-0.06%)

Brent: USD 72.75 (-0.11%)

Natural Gas (Nymex, futures prices) USD 3.57 MMBtu, (+8.62%, December 2018 contract)

Gold: USD 1,233.00/ troy ounce (+0.06%)

TASI: 7,802.27 (-0.57%) (YTD: +7.97%)

ADX: 4,972.28 (+1.07%) (YTD: +13.05%)

DFM: 2,794.80 (-0.01%) (YTD: -17.07%)

KSE Premier Market: 5,263.59 (-0.12%)

QE: 10,458.28 (+1.23%) (YTD: 22.70%)

MSM: 4,415.02 (-0.22%) (YTD: -13.42%)

BB: 1,315.53 (+0.03%) (YTD: -1.22%)

Calendar

03-06 November (Saturday-Tuesday): World Youth Forum 2018, Maritim Jolie Ville Golf Course, Sharm El Sheikh, Egypt.

05-07 November (Monday-Wednesday): World Travel Market London exhibition, London, England, UK.

06-07 November (Tuesday-Wednesday): 2018 IIF MENA Financial Summit, Al Maryah Island, Abu Dhabi, United Arab Emirates.

13-29 November (Tuesday-Thursday): UN Biodiversity Conference, Sharm El Sheikh, Egypt.

14 November (Wednesday): Egypt M&A and Private Equity Forum, Nile Ritz Carlton Hotel, Cairo, Egypt.

15 November (Thursday): CBE Monetary Policy Committee meeting.15 November (Thursday)

15 November (Thursday): The T20 Invest in Healthcare Conference 2018, Nile Ritz Carlton Hotel, Cairo, Egypt.

17-19 November (Saturday-Monday): ElectricX-Energizing The Industry, Egypt International Exhibition Center, Cairo, Egypt.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

End of November: A delegation from the Egypt-Greece Business Council will visit Athens at the end of November to promote investment, the council’s chairman, Hani Berzi, said.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “ The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheik, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.