- SODIC bidding to acquire at least 51% of MNHD in all-share transaction. (Speed Round)

- Marakez repays EGP 2 bn facility for Mall of Arabia, eyes two new malls as it opens phase two of Mall of Arabia by month’s end. (Speed Round)

- No fuel price hike planned this calendar year. (Last Night’s Talk Shows)

- Higher yields on T-bonds could push up debt service bill by c. EGP 50 bn this fiscal year. (Speed Round)

- Sarwa Capital to start trading today under ticker SRWA. (What We’re Tracking Today)

- Are property values on the west side of town about to go up? (What We’re Tracking Today)

- EM bulls are starting to outnumber the bears as contagion risk seen fading in 4Q –Bloomberg survey. (What We’re Tracking Today)

- Applications of artificial intelligence in Egypt to grow at 25.5% p.a. Through 2030. (Worth Reading)

- The Market Yesterday

Monday, 15 October 2018

SODIC bids for MNHD

TL;DR

What We’re Tracking Today

** #5 Our friends at Sarwa Capital will ring the bell at the EGX this morning as their shares make their bourse debut, opening at EGP 7.36 each under the ticker SRWA. A stabilization fund is at work for the first month of trading. Beltone was sole global coordinator and bookrunner for the transaction, while Matouk Bassiouny was legal counsel.

Asian markets opened lower this morning, suggesting “a rebound in global equities Friday saw no traction at the start of the week.” Skim Bloomberg’s Asian markets tables here for the latest. This comes after the EGX30 held its ground yesterday, rallying 1.9%.

** #6 Are property values on the west side of town about to go up? Sphinx International Airport in Giza will begin trial operations today as the facility enters its soft opening phase, state-news agency MENA reports. A functioning international airport could boost appetite for housing in Six October and Sheikh Zayed, among other points to the west, and open them to international companies that require proximity to airports in choosing neighborhoods for headquarters and staff housing.

Today is the last day to pay your real estate taxes without penalty if you own more than one property or a property worth more than EGP 2 mn, Real Estate Tax Authority head Samia Hussein told Hona Al Asema last night. It seems you can expect aggressive enforcement: The authority has collected EGP 1.6 bn in real estate taxes in the last three months out of a targeted EGP 6 bn, she added (watch, runtime: 7:39). The deadline to file for exemptions for those with properties valued at less than EGP 2 mn was extended to 30 June, 2019.

President Abdel Fattah El Sisi arrives in Moscow today for a three-day visit. El Sisi is expected to meet with President Vladimir Putin and Prime Minister Dmitry Medvedev and will also address Russia’s upper house of parliament. We have chapter and verse in Diplomacy + Foreign Trade, below.

The UK’s Minister of State for the Middle East and North Africa is in town to look into ways to increase the UK’s support foreducation and entrepreneurship in Egypt, according to a statement from the British Embassy. Alistair Burt met yesterday with Foreign Minister Sameh Shoukry.

** #7 Is the Emerging Markets Zombie Apocalypse losing steam? EM bulls are starting to outnumber the bears, according to a Bloomberg survey of 26 investors, traders and strategists. Good news: More half of respondents said that the sell-off in EM stocks, FX and bonds has bottomed out. Less good: EMEA opportunities are at the bottom of managers’ regional picks, which were led by Latin America (FX and bonds) and Asia (stocks). What’s going to drive global EM momentum for the rest of this quarter? The Fed’s interest rate path, China and trade tensions, with the EM Zombie Apocalypse ranking a distant seventh (see chart, above). Hit the link for the full breakdown of the survey results and list of participating institutions.

The Wall Street Journal has an interesting counterpoint on prevailing EM orthodoxy, arguing that while emerging markets are “raising interest rates and keeping a lid on spending” to counter falling currencies and fleeing investors, doing so “is likely to hurt their long-term prospects.” Read: The bad trade-offs emerging markets face.

But don’t worry, the end is still nigh if you listen to the pundits. In recent days:

- Bond investors have suggested that Italy could be the “epicenter of the next financial crisis”;

- The world’s biggest hedge fund thinks the US Fed is going to mess it up for everyone, suggesting “the US economy faces a looming deceleration as tighter monetary policy starts to weigh on activity and ratchets up pressure on financial markets.”

- IMF boss Christine Lagarde worries that “simmering trade tensions are already denting global growth and need to be resolved”;

- JP Morgan Chase Jamie Dimon has told us all how worried he is about “geopolitical issues bursting all over the place”;

- The FT’s house view is that the long bull market has now entered its twilight.

Saudi stocks fell as much as 7% yesterday as fallout from the disappearance of Jamal Khashoggi rattled traders. “Investors worried about deteriorating relations with the international community after the disappearance of Saudi journalist Jamal Khashoggi,” Reuters said, noting that the Tadawul trimmed some of its losses to close the day off 3.5%. Reuters’ piece presaged front-page headlines the world over today emphasizing the growing rift between KSA and the United States over the suspected murder of Khashoggi last week in Saudi’s consulate in Istanbul (FT | NYT | WSJ | Reuters). Oil futures closed up 2% yesterday on fears of how the rift could play out.

JPM boss pulls out of MbS’ tea party: JP Morgan Chase boss Jamie Dimon joined Uber’s Dara Khosrowshahi in becoming the second major tech or finance figure to pull out of “Davos in the Desert,” Crown Prince Mohamed bin Salman’s high-profile investment conference. International media figures had already turned their backs on the gathering. The FT has the story.

Egypt’s Foreign Ministry urged transparency in the investigation into Khashoggi’s death and offered cautious support of Saudi as it did so. The issue got some airtime with Amr Adib on El Hekaya last night (watch, runtime: 21:08).

In miscellany this morning:

The FT’s annual global executive MBA ranking is out. Topping the list:

- Kellogg / HKUST, first for the ninth time in 12 years

- Trium (HEC Paris / LSE / NYU)

- Tsinghua University / Insead

Check out the overview of the package, including the fastest risers (U of T’s Rotman and EMLyon) or simply jump to the ranking itself.

Pot becomes legal in Canada this week, but food and beverage companies may not want to tie their wagons to it.

Blood pressure high during or after your morning commute? You need a laugh. One of the smartest people we know endorses SNL’s Olive Garden sketch — a beautiful mesh of the American absurd with a dash of class and race politics, starring the always amazing Kenan Thompson and Scarlett Johansson (watch, runtime: 6:45)

PSA- Flood season is about to begin in the mountains of Sinai. South Sinai Tourism Police are warning tourism companies to exercise caution as they book hiking trips in the weeks to come.

Enterprise+: Last Night’s Talk Shows

It was another night of miscellany on the airwaves, with the conversation shuffling between the denial of rumors about an upcoming fuel price hike, bad tomato seeds, and educational reform.

** #3 The Madbouly Cabinet is not planning to raise fuel prices again this calendar year, spokesperson Nader Saad told Hona Al Asema Reham Ibrahim. The cabinet’s Information and Decision Support Center issued a statement yesterday to debunk rumors circulating in the local press and on social media claiming that the government is getting ready for another round of fuel subsidy cuts this year to help it cope with rising oil prices (watch, runtime: 5:19). Saad then discussed the impact of the surge in global crude prices on Egypt’s subsidy bill with Amr Adib on El Hekaya (watch: runtime: 6:01).

The Agriculture Ministry halted imports of all tomato seeds carrying the code F023 after crops tested positive for yellow curl leaf virus. Agriculture Ministry spokesperson Hamed Abdel Dayem told Masaa DMC’s Eman El Hosary that the company responsible for importing the bad seeds will bear the cost of thousands of feddans’ worth of lost crops. Agriculture Export Council Chairman Abdel Hamid Demerdash also urged the importing company to contact its supplier to determine how the issue came to be (watch, runtime: 22:02).

Some 2.5 mn Egyptian students are now studying under the government’s new education system, Education Minister Tarek Shawki said on Al Hayah Al Youm. He walked hosts Lobna Asal and Khaled Abu Bakr through the ministry’s new K-12 education reform strategy and briefly touched on the resistance it’s being met with (watch, runtime: 8:09). Separately, Masaa DMC’s Eman El Hossary had a chat with deputy education minister for technical education Mohamed Megahed (watch, runtime: 5:26).

Meanwhile, a discussion on the regulation and licensing of private healthcare providers took up significant air time on Hona Al Asema (watch, runtime: 41:57).

Speed Round

** #1 M&A WATCH- SODIC bidding to acquire at least 51% of MNHD in all-share transaction: Upmarket real estate developer SODIC announced yesterday (pdf) it intends to make a mandatory tender offer to acquire at least 51% of Madinet Nasr Housing and Development (MNHD) through a direct share swap. SODIC has preliminarily set the swap ratio at two shares of MNHD for one share of SODIC, and the transaction could allow MNHD to remain listed on the EGX, according to the statement. The transaction is contingent on the completion of due diligence and of a valuation report by an independent financial adviser. MNHD is studying the offer, which will be presented to its board of directors at its next meeting, the company said in a separate statement (pdf). Bloomberg and Reuters both have the story.

The transaction would bring “the combined entity’s total undeveloped land bank to over 15 mn square meters with over 15 years of development visibility, and creates one of the largest real estate developers in Egypt. In a fragmented real estate market, the combined entity would consolidate a wealth of experience, as well as sales and execution capabilities of both companies,” our friends at SODIC said in a statement.

The sell-side so far likes what it has seen. Shuaa Capital notes that the transaction could see SODIC “utilize its know-how in developing the combined land bank” and give the two the “benefit of a larger footprint covering both eastern and western Cairo.” Naeem, meanwhile, cites “MNHD’s rich land bank [and] SODIC’s brand name and execution expertise” and says the transaction would be at a 46% premium to MNHD’s share price prior to the announcement.

Background: MNHD CEO Ahmed El Hitamy had previously said that a share swap agreement would be the easiest and least costly option, as well as “the path of least resistance.” The two companies opened talks on a potential merger or acquisition back in April, which MNHD said would bring together its land bank and strong sales track record with “SODIC’s premium brand name and track record as a prominent real estate developer in Egypt.”

Advisers: Reports had earlier suggested that MNHD had tapped EFG Hermes to advise on the transaction, while Zaki Hashem & Partners are serving as legal counsel. SODIC had previously appointed CI Capital and White & Case as its advisers.

** #2 Marakez repays EGP 2 bn facility for Mall of Arabia: Fawaz Al Hokair’s Egyptian unit, Marakez, has pre-paid in full an EGP 2 bn credit facility for Mall of Arabia extended by CIB and other banks, Marakez announced yesterday (pdf). Marakez took out the facility in 2008, and its pre-payment allows the Mall of Arabia to now operate without debt, Marakez will now push forward with an aggressive expansion plan that includes two residential projects, one each in east and west Cairo, as well as two new malls. The closeout of the facility is “a vote of confidence from [Marakez’s] shareholders in the Egyptian real-estate sector and a reaffirmation of the strength and stability of the Egyptian economy on the back of the government’s recent economic reform program,” the company said.

Phase two of Mall of Arabia will be open by the end of this month, adding another 40k sqm of gross leasable area (GLA) to the facility’s current 110k footprint. Brands opening in the new phase include Ikea, Polo Ralph Lauren and New Balance. The company is simultaneously developing the Mall of Tanta (45k sqm of GLA) and Mall of Katameya (100k sqm of GLA).

** #4 EXCLUSIVE- Higher yields on T-bonds could push up debt service bill by c. EGP 50 bn this fiscal year: Persistently high yields on treasury bonds could add as much as EGP 50 bn to Egypt’s debt service bill during the current fiscal year, a government source exclusively tells Enterprise. The news is not surprising, given the FY2018-19 state budget had initially set debt service costs at EGP 541 bn, based on the expectation that yields on treasuries would hover around 14.7%, down from 18.5% during the last fiscal year. Yields have instead been on the rise, averaging around 19% since the fiscal year started in June, raising the costs of debt service in the budget and prompting the treasury to send a message to investors with the cancellation of four bond auctions.

The news comes after bidders at last week’s T-bond auction demanded yields as high of 19.9% on 10-year bonds, central bank data showed. The next auction is scheduled for today with five- and 10-year t-bonds worth a combined EGP 1.25 bn on offer.

As is typical in such cases, the Finance Ministry could seek House approval for an overdraft on the state budget in the second half of the fiscal year if interest rates and global oil prices remain at their current levels, the source tells us. The ministry sought a EGP 70.3 bn overdraft for the previous fiscal year’s budget, which was in large part necessary to cover higher debt service costs. Debt control has become a cornerstone of the government’s fiscal policy; President Abdel Fattah El Sisi is expected to announce soon a four-year strategy to reduce Egypt’s debt to 70% of GDP, Finance Minister Mohamed Maait previously said.

House wants to discuss budget deficit, fuel subsidies with the gov’t: Meanwhile, members of the House’s planning and energy committees want to sit down with Finance Minister Mohamed Maait and Oil Minister Tarek El Molla to discuss ways to keep the state budget deficit in check in light of rising oil prices, according to a domestic media report. Higher-than-expected oil prices could see Egypt’s fuel subsidy bill in FY2018-19 jump to EGP 100 bn, up from the originally expected USD 89 bn, a government source told us earlier this month. The reps. are wagging their finger at the Oil Ministry for rejecting parliament’s calls to increase fuel subsidy allocations when the state budget was up for discussion earlier this year. A government source had previously told us that Egypt is likely to miss its deficit reduction target this fiscal year, with the gap set to come in at something closer to 8.6% rather than the 8.4% originally forecast.

M&A WATCH- Polyserve to submit MTO for 100% stake in FERC: Fertilizer manufacturer Polyserve Group will submit a mandatory tender offer (MTO) to acquire 100% Ferchem Masr for Fertilizers and Chemicals (FERC) at a cost of about EGP 110 mn, according to a bourse disclosure (pdf). Polyserve is looking to buy 17.5 mn shares in FERC at EGP 6.31 per share. The MTO is pending approval from the company’s general assembly. Polyserve is also considering an IPO on the EGX, according an August announcement from the International Agricultural Products Company (IAPC), which holds a 20.4% stake in Polyserve. IAPC also owns 15.7% of FERC.

A string of news from the energy industry worth your attention this morning:

Italy’s Eni is looking to invest USD 300 mn in building solar power stations with a combined production capacity of 300 MW, Electricity Ministry sources said. According to the sources, the company has requested a license from state utilities regulator Egyptera to build a 50 MW solar station as independent power producer. Eni is also in talks with the Egyptian Electricity Transmission Company to build other stations with a combined capacity of 250 MW under a build-own-operate framework.

ACWA to sign PPA for 500 MW Gulf of Suez wind projects by year’s end: Saudi Arabia’s ACWA Power expects to sign power purchase agreements (PPA) with the EETC for its USD 500 mn, 500 MW wind projects in Gulf of Suez before the year is out, ACWA CEO Paddy Padmanathan said. Construction of the projects will begin within 45 days. ACWA had received sign-off for the projects in September.

Another “international company” will finish constructing its 120 MW Gabal El Zeit 3 wind station before year-end, a source from the New and Renewable Energy Authority said. The source does not disclose the company name, but GE Power had reached an identical agreement with the EETC last year.

Negotiations between the Electricity Ministry and UAE’s Al Nowais over the Oyoun Moussa coal-fired power plant in South Sinai have stalled over the final price of electricity, sources told Al Mal. The ministry apparently also cited the difficulty of identifying a location for a port to receive the coal in Oyoun Moussa as an obstacle to a final agreement, the sources added. The Egyptian Electricity Holding Company expected to reach a final agreement on the USD 4 bn project with Al Nowais by June. Earlier this month, an official reportedly said the construction of the project will be completed in four years’ time.

Hisham Ezz Al-Arab on CIB’s leadership of the banking sector’s tech revolution: Investing in technology and big data is the way forward for the banking sector and Egypt’s financial inclusion drive, our friend CIB Chairman Hisham Ezz Al-Arab tells the Banker. “The bank is likely to benefit from its ongoing investments in technology. With an eye on the longer term, Mr. Ezz Al-Arab has placed innovation at the heart of CIB’s growth strategy under a wide-reaching digital transformation program.” CIB has in recent years prioritized investment in tech with an eye on how it will shape the banking sector going forward, a strategy that has seen the bank delve into blockchain technology, which Ezz Al-Arab expects to “transform the way business is done” within five years.

Using big data to increase efficiency and reduce costs is key to the country’s financial inclusion drive, Ezz Al-Arab tells the magazine. “For financial inclusion the name of the game is transaction costs. If you can reduce the transaction cost to zero or a fraction of a cent, then it will be easier and more efficient. What we are trying to do is use big data to reduce the transaction cost,” Ezz Al-Arab says. CIB is also employing big data analytics to increase its efficiency and for compliance purposes, including detecting fraud with an anomaly detection model with an accuracy rate significantly higher than the global average. “These innovations, among others, are good examples of what Mr Ezz Al-Arab describes as the bank’s ‘competitive metabolism’. Few other lenders in the Egyptian market — or indeed the wider region — are engaging with technology, and big data analytics in particular, to the same extent.”

** WE’RE HIRING: We’re looking for smart, talented, and seasoned journalists and editors to join our team at Enterprise, which produces the newsletter you’re reading right now. We’re looking for people who can work on this product and help us launch exciting new stuff. Applicants should have serious English-language writing chops, a strong interest — and preferably some professional experience — in business journalism, and solid analytical skills. The ideal candidate for us is a native-level-writer of English with the ability to read and understand Arabic. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. If you’re interested, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Please direct your applications to jobs@enterprisemea.com.

Up Next

Egypt will reportedly select a manager for its new sovereign wealth fund “within days,” Planning Ministry sources told Youm7. The executive regulations for the law governing the SWF should be with Cabinet for review any day now, our sources had told us.

An IMF delegation is due in town mid-October for a review of Egypt’s progress on its reform program ahead of the disbursal of the fifth USD 2 bn tranche of the country’s extended fund facility.

The House will convene for its first general assembly of the new session on 21 October.

The 2018 Narrative PR Summit will take place at the Four Seasons Nile Plaza on Sunday, 28 October.

Egypt, Tunisia, and Algeria will hold a meeting in Cairo later this month to discuss efforts to end the civil war in Libya, Xinhua reports. The meeting is part of “periodic consultations” to support Libya, with the last held in Algeria in May.

A delegation of French pharmaceutical and medical equipment companies is set to visit Egypt in November to explore potential investments, according to a Trade Ministry statement. French President Emmanuel Macron is due to visit Cairo by the beginning of 2019, the statement said.

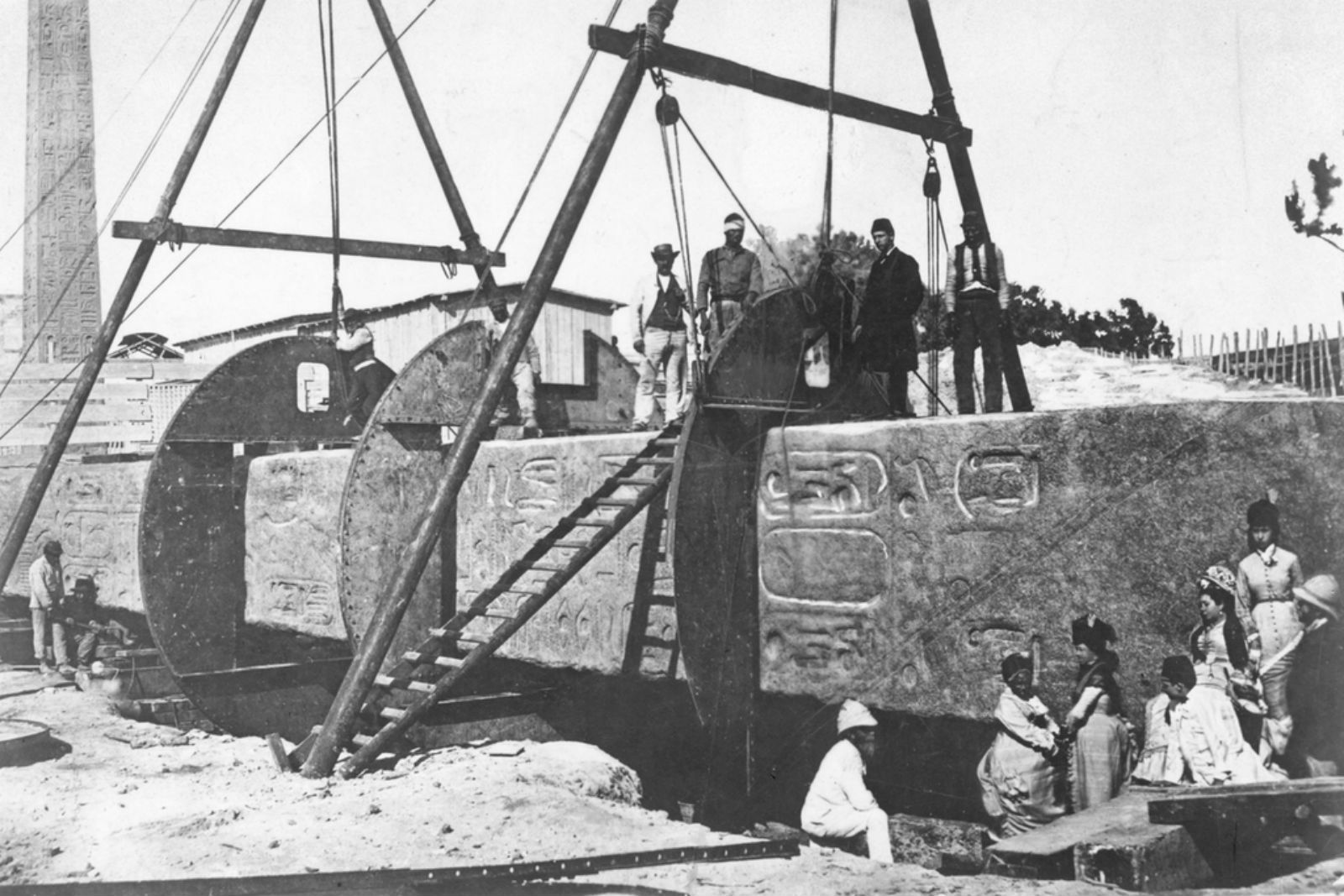

Image of the Day

Zahi Hawass is unhappy. The self-styled “Indiana Jones” of Egypt is complaining that Cleopatra’s Needle obelisk is not being restored or receiving the attention it deserves on the banks of UK’s River Thames, he tells the National. Hawass suggests that the 21-metre high obelisk — which was given to the UK as a gift from Khedive Muhammad Ali Pasha in 1819 — should be the centerpiece of a binational celebration next year. “If they don’t care, they should return it,” the one-time antiquities ministry boss said, adding that he felt “ashamed” when he visited the monument. The obelisk was given to commemorate Lord Nelson and Sir Ralph Abercrombie’s victories over the French in the battles of the Nile and Alexandria during the Napoleonic Wars.

Egypt in the News

An Egyptian court upheld death sentences yesterday for three people accused of establishing and running the terrorist group known as Ansar al-Sharia, Reuters reports. The story is topping coverage of Egypt in the foreign press on what is otherwise a very slow news morning.

Other headlines worth a moment of your time:

- Chinese investments in Egypt are “mutually beneficial” and will not overburden Egypt with debt, Investment Minister Sahar Nasr said, Reuters reports.

- TUI, the world’s largest charter airline operator, could begin servicing more Egyptian destinations once it completes its plan to upgrade its fleet, Bloomberg says.

- Egypt is trying to revive its once-booming cotton industry, which has been struggling to keep up with international competition, AFP reports.

- New Cairo suffers from poor infrastructure despite expensive property prices, with residents complaining of issues such as water shortages, sewage leaks, and poor hospital facilities, Arab News says.

- Israel appears to be giving a chance to UN and Egypt efforts to broker a truce with Hamas, despite meddling from Fatah’s Mahmoud Abbas, Asharq Al Awsat says.

- Egyptian filmmakers could start rolling out spy and war movies after Israel’s adaptation of the ‘The Angel’ renewed interest in the genre, Ahmed Mattarek writes for Al-Monitor.

On Deadline

Egypt needs to promote civil literacy if it ever hopes to develop into a pluralistic, democratic society, Emad Gad writes in a piece for Al Masry Al Youm. Apart from the Al Wafd Party (which is so far past its heyday), political parties in Egypt have come and go over the last several decades but left no notable mark, Gad says. Even those formed after the 2011 uprising have lost their spark, he adds, arguing that a general lack of civil literacy is behind Egypt’s lackluster political performance. He says that a focused plan must be drafted to turn the situation around, beginning by improving living standards.

Worth Reading

** #8 Investment in artificial intelligence in the Middle East and Africa are expected to accelerate over the coming years at both private and publicly traded companies, a GCC-focused Microsoft study found, according to the National. According to the report, nearly one third of the Gulf’s largest corporations are set to adopt AI this year in one form or another, and “banking and finance organizations will lead the AI adoption curve,” says IT services company Dimension Data’s Managing Director, Paul Potgieter.

The UAE is the region’s leading adopter of AI, and its economy is expected to grow at a faster pace than its Gulf neighbors by 2030 “as a result of AI adoption, with this cutting-edge technology expected to contribute up to 14 per cent to the country’s GDP,” according to a study by PwC.

Where does Egypt stand? Applications of AI in Egypt are expected to grow at an average annual rate of 25.5% between now and 2030, trailing behind the UAE (33.5% per annum) and Saudi Arabia (31.3% per annum). AI will ultimately contribute 7.7% of Egypt’s GDP by 2030, according to the PwC report, while the GCC4 (Bahrain, Kuwait, Oman, and Qatar) will see AI contributing 8.2% to GDP, and AI will comprise 12.4% of Saudi Arabia’s GDP. The UAE again leads the pack (14% of GDP), but China is expected to outpace the UAE by a wide margin, with AI accounting for 26.1% of GDP by 2030.

The region has been slow on the uptake, but there is hope yet: “‘Governments and businesses across the Middle East are beginning to realize the shift towards AI,’ says Richard Boxshall, senior economist at PwC Middle East. ‘They are faced with a choice between being a part of the technological disruption, or being left behind.’”

Worth Watching

The Donald invited rapper Kanye West to the White House to discuss — of all things — domestic and foreign policy. Showing up in a red “Make America Great Again” cap, Kanye expressed his strong support for the US president. “When I put this hat on, it made me feel like superman. You made a superman — that’s my favorite superhero,” the rapper said. CNN listed 17 bizarre things that happened during the meeting, including Kanye West calling Trump’s son-in-law Jared Kushner “Jerry” and proposing the abolishment of the 13th amendment (which prohibits slavery). The rapper also called the US president “bro” (watch, runtime: 24:13).

Diplomacy + Foreign Trade

Russia is looking to increase its cooperation with Egypt on air travel security, Russian Foreign Minister Sergey Lavrov said in a piece penned for state-run Al Ahram. Lavrov’s words comes as President Abdel Fattah is scheduled to meet with Russian President Vladimir Putin on Wednesday during a state visit to Moscow, according to an announcement from the Kremlin. The two leaders will touch the usual basket of topics, with military cooperation likely a top priority as they sign a number of so-far unspecified agreements.

Foreign Minister Sameh Shoukry sat down with Russia Today for an interview ahead of tomorrow’s visit, during which he discussed Egypt’s ties with Russia. He noted the economic and political importance of the relationship to Cairo, noting that Egypt and Russia consult on a variety of topics including the situation in Syria. The minister also touched on regional issues, including the spread of terrorism, the Arab quartet’s ongoing spat with Qatar, and the resolution of the Palestinian crisis (watch the full interview, runtime: 27:30).

Elsewhere this morning: The World Bank plans on investing USD 45 bn in Africa over the next three years to support the development of basic services, particularly education, World Bank President Jim Yong Kim said during a meeting chaired by Investment and International Cooperation Minister Sahar Nasr on boosting productivity in Africa, according to a ministry statement (pdf). The investments come as part of the bank’s commitment to supporting investment in human capital, Kim said. The International Finance Corporation (IFC) is also ready to extend fresh funding to support private sector growth across Africa, CEO Philippe Le Houérou said.

Egypt and Israel have resumed cargo traffic via the El Auga border crossing in Sinai, the Associated Press reports. The crossing had previously been shut down due to the militant insurgency in the peninsula.

Infrastructure

Government to announce new comprehensive plan for Sinai development in a month’s time

The Madbouly Cabinet is reportedly due to unveil its new comprehensive strategy for development in the Sinai in a months’ time, unnamed Local Development Ministry sources tell Al Shorouk. The new plan — which is being prepared by the ministries of local development, planning, and investment, as well as the New and Urban Communities Authority — will include a number of development and infrastructure projects in industry, agriculture, education, and sanitation, aimed at attracting as many as 2 mn new residents to the area. The Housing Ministry had announced in February an ambitious plan for the peninsula’s development that includes setting up a new economic center in North Sinai and converting the governorate’s capital city Al Arish to a freezone.

Basic Materials + Commodities

Egypt to begin monthly imports of palm oil from Indonesia

An unnamed Egyptian company will begin importing 16k tonnes of palm oil per month from Indonesian government-owned palm oil producer PT Perkebunan Nusantara (PTPN), the company’s deputy CEO tells Al Mal. The executive made no mention of the value of the contract or the delivery schedule.

Manufacturing

Abu Qir looks to invest EGP 3 bn in FY2018-19

Abu Qir Fertilizers & Chemicals Industries is planning to invest EGP 3 bn this fiscal year in several projects, including setting up an acid and nitrates production facility, he company’s chairman and managing director, Saad Ibrahim Abo El-Maati, told Al Mal. The facility will be funded through a loan the company recently received from a consortium of local and international banks. Abu Qir had invested EGP 2 bn last FY.

Toshiba-Elaraby JV to raise its manufacturing value to USD 100 mn next year

Japanese electronics producer Toshiba is planning to increase the value of products manufactured by its JV with Elaraby Group, Toshiba El Araby Visual & Appliances Marketing Company (TEVA), to USD 100 mn in 2019, TEVA CEO Daisuki Arahata said yesterday.

Banking + Finance

MIDOR to finalize this week USD 1.2 bn loan agreement from three EU banks

State-owned company Middle East Oil Refinery (MIDOR) has reached a final agreement with Crédit Agricole and BNP Paribas and Italy’s CDP over a USD 1.2 bn loan to finance the USD 2.2 bn-worth of expansions at its refinery, MIDOR Chairman Mohamed Abdel Aziz tells Al Mal. MIDOR had reached a preliminary agreement for the loan amount back in 2016. MIDOR had received in August last another USD 200 mn from the African Export-Import Bank (Afreximbank) for the expansion, which will increase capacity to 175k barrels of crude per day from a current 115k.

HSBC Egypt launches virtual credits cards for corporate customers

HSBC has added virtual credit card services to the list of digital payment solutions if offers its corporate clients in Egypt, Al Mal reports. The service allows clients to use digital codes provided by the bank to settle their bills and pay suppliers without the need for a physical card.

Legislation + Policy

Social Solidarity Ministry to finalize exec regs, send them to cabinet before the end of October

The Social Solidarity Ministry expect to send its final draft of the executive regulations for the NGOs Act to the Madbouly Cabinet before the end of October, Minister Ghada Wali said yesterday. The regs have been delayed to allow the committee drafting them time to address a number of issues with the law, which the Supreme Constitutional Court brought to light in a verdict in June that deemed the NGOs Act unconstitutional. The court had said that a clause of the NGOs Act granting the Social Solidarity minister jurisdiction to disband NGO boards was in direct opposition with the constitution. The NGOs Act — which gives the state the power to decide who can set up an NGO and for what purpose and sets restrictions on donations — was signed into law in last year and has since come under fire several times, including from Republican senators and the US Congress’ human rights commission.

Egypt Politics + Economics

EGX mulling new mechanism to calculate shares’ closing price

The EGX is looking into introducing a new mechanism to calculate the closing price of shares, which is currently calculated based on the average price at which a share is traded and the volume of trade over the course of the day, EGX boss Mohamed Farid tells Al Mal. New scenarios under study include using the average price during the last hour of the trading day or only using the volume of trade, according to Farid. The EGX will ship over its proposal to the Financial Regulatory Authority (FRA) for approval.

SIS denounces Human Rights Watch’s report as biased, inaccurate

The Human Rights Watch report alleging that Egypt-born US cab driver Khaled Hassan was forcibly disappeared, tortured, and raped in an Egyptian prison is “biased, politicized, and inaccurate,” the State Information Service said in a statement yesterday.

National Security

Military chief of staff in Washington for meetings with US-allied military leaders

Armed Forces Chief of Staff Mohamed Farid is in Washington to attend a gathering of military leadersfrom countries allied with the US in the fight against radical groups, according to an Armed Forces statement. Farid is also expected to sit down for a one-on-one with the Chairman of the US military Joint Chiefs of Staff, Joseph Dunford, to discuss Egypt-US military cooperation.

Sports

Salma Abdel Masoud wins gold at Buenos Aires 2018 Youth Olympics

Egyptian pentathlete Salma Abdel Maksoud won Egypt’s first-ever pentathlon Olympic medal, snagging gold on Saturday at the Buenos Aires 2018 Youth Olympic Games (YOG), according to the Olympics’ official website. The pentathlon at this year’s YOGs, which wraps up Thursday, combined fencing, swimming, running and shooting. Abdel Maksoud landed Egypt its first-ever pentathlon Olympic medal after bouncing back with solid laser-run.

On Your Way Out

Our friends at Flat6Labs turned seven last week. Since its launch in 2011, Flat6Labs has helped more than 180 portfolio companies raise over USD 15 mn in funding, with with contributions from a list of institutional investors that includes the International Finance Corporation (IFC), BLOM Bank, and the Tunisian American Enterprise Fund, the company said in a press release (pdf). With established seed funds in Egypt, Lebanon, Tunisia, and Bahrain, Flat6Labs’ regional network now includes “400+ local and international mentors and coaches and 100+ corporate, [and] governmental and ecosystem partners.”

Online bargain aggregator EDEALO.com is now live. Egyptian startup Edealo announced yesterday (pdf) that it has launched services on its website, which pools together coupons for online bargains on items including flight tickets, fashion, electronic appliances, and digital courses, to name a few. Access to the coupons comes free of charge. Check out the website here.

The Market Yesterday

EGP / USD CBE market average: Buy 17.85 | Sell 17.95

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Sunday): 13,537 (+1.9%)

Turnover: EGP 543 mn (24% below the 90-day average)

EGX 30 year-to-date: -9.9%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 1.9%. CIB, the index heaviest constituent ended up 0.8%. EGX30’s top performing constituents were Madinet Nasr Housing up 10.0% Ibnsina Pharma up 7.4%, and Heliopolis Housing up 6.3%. Yesterday’s worst performing stocks were Edita down 5.9%, Eastern Co. down 0.1% and Juhayna ended flat. The market turnover was EGP 543 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -46.3 mn

Regional: Net Long | EGP +0.7 mn

Domestic: Net Long | EGP +45.6 mn

Retail: 55.0% of total trades | 58.7% of buyers | 51.4% of sellers

Institutions: 45.0% of total trades | 41.3% of buyers | 48.6% of sellers

Foreign: 16.9% of total | 12.6% of buyers | 21.1% of sellers

Regional: 6.1% of total | 6.2% of buyers | 6.1% of sellers

Domestic: 77.0% of total | 81.2% of buyers | 72.8% of sellers

WTI: USD 71.34 (+0.52%)

Brent: USD 80.43 (+0.21%)

Natural Gas (Nymex, futures prices) USD 3.16 MMBtu, (-1.89%, November 2018 contract)

Gold: USD 1,222.00 / troy ounce (-0.46%)

TASI: 7,266.59 (-3.51%) (YTD: +0.56%)

ADX: 4,931.14 (-0.74%) (YTD: +12.11%)

DFM: 2,713.93 (-1.50%) (YTD: -19.47%)

KSE Premier Market: 5,159.27 (-1.86%)

QE: 9,824.20 (-0.38%) (YTD: +15.26%)

MSM: 4,497.36 (+0.17%) (YTD: -11.80%)

BB: 1,315.73 (-0.02%) (YTD: -1.20%)

Calendar

Second week of October: NI Capital expected to select winning bid in its tender for the management of Alexandria Containers & Cargo Handling’s stake sale.

Mid-October: IMF delegation due in town for its fourth review of Egypt’s economic reform program.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

24-25 October (Wednesday- Thursday) 9th Arab-German Energy Forum, Cairo, Egypt.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

28 October (Sunday): 2018 Narrative PR Summit, Four Seasons Nile Plaza, Cairo.

01-02 November (Thursday-Friday): Annual Middle East Conference on Business Angel Investment, El Gouna, Egypt

03-06 November (Saturday-Tuesday): World Youth Forum 2018, Maritim Jolie Ville Golf Course, Sharm El Sheikh, Egypt.

05 November (Monday): Egypt’s Emirates NBD PMI for October released.

05-07 November (Monday-Wednesday): World Travel Market London exhibition, London, England, UK.

06-07 November (Tuesday-Wednesday): 2018 IIF MENA Financial Summit, Al Maryah Island, Abu Dhabi, United Arab Emirates

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

17-19 November (Saturday-Monday) ElectricX-Energizing the Industry, Egypt International Exhibition Center, Cairo, Egypt

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

04 December (Tuesday): Egypt’s Emirates NBD PMI for November released.

08-09 December (Saturday-Sunday): Business for Africa and the World: The Africa 2018 Forum, Maritim Jolie Ville International Congress Center, Sharm El Sheikh.

12 December (Wednesday): Banking and Finance Congress 2018, Cairo, venue TBD.

13-15 December (Thursday-Saturday): Forum on “The Role of Digital Financial Communication and Solutions in Enhancing Financial Inclusion,” Sharm El Sheik, venue TBD.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

22-25 January 2019 (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 2019 (Wednesday) 50th Cairo International Book Fair.

25 January 2019 (Friday): Police Day, national holiday.

20-22 April 2019 (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.