- Moody’s upgrades outlook on Egypt to ‘positive.’ (Speed Round)

- Can we really expect the EGP to remain stable through year’s end? (Speed Round)

- Domestic bankers invited to pitch for AMOC, Eastern stake sales. (Speed Round)

- It was another night of vague murmurings bereft of meaning on the nation’s airwaves, leaving us pining for Lamees’ return next week from her summer break. (Last Night’s Talk Shows)

- (Non-IPO’ing) Business is on break in Sahel, but diplomacy has started a busy fall season. (What We’re Tracking Today)

- We’ve been listening to the same song on repeat for the past two decades. (Worth Reading)

- The Market Yesterday

Wednesday, 29 August 2018

The slowest news day in recorded history?

TL;DR

What We’re Tracking Today

CI Capital’s annual Egypt equities conference in Cape Town wraps up today. Some 22 Egyptian issuers are attending.

Foreign Minister Sameh Shoukry is set to meet with his Sudanese counterpart Al Dridiri Al Dhaheri in Cairo today. The two were originally scheduled to sit down yesterday, but the meeting was postponed as Shoukry was in Addis Ababa for talks on the Grand Ethiopian Renaissance Dam (GERD), according to a Foreign Ministry statement picked up by Ahram Online.

Italian Deputy Prime Minister Luigi Di Maio is in Cairo today for a three-day visit. He is expected to talk energy, infrastructure and trade with President Abdel Fattah El Sisi, state-run Al Ahram reports. The investigation into the murder of Italian grad student Giulio Regeni is also likely on the agenda.

El Sisi to hold meeting on GERD in China this Saturday? If you, like us, get GERD when thinking when thinking about the GERD, take heart: The next big checkpoint in the story appears to be this coming Saturday. That’s when President Abdel Fattah El Sisi is reportedly scheduled to meet Ethiopian Prime Minister Abiy Ahmed on the sidelines of the China-Africa Cooperation Forum in Beijing. Shoukry was in Addis with intelligence boss Abbas Kamel to lay the groundwork for the meeting, reiterating Cairo’s position that the two countries need to come to an agreement “in a way that guarantees both Ethiopia’s development needs and Egypt’s water security.” We have more on relations with Ethiopia in Diplomacy + Foreign Trade, below.

Contracts for the USD 4.4 bn Hamrawein coal-fired power plant to be inked while the president is in Beijing: That’s when the EEHC reportedly expects to close the contract on the 6 GW facility, which is being built by a consortium that includes Shanghai Electric, Dong Fang and Hassan Allam.

The China-Africa summit runs 3-4 September. You can check out the website for the gathering or dive deeper into how China’s propaganda machine builds up its relationship with Africa.

Busy fall season for diplomacy: The China trip is the first big meeting of El Sisi in what looks set to be a busy fall on the diplomatic front:

- French President Emmanuel Macron will be in town this fall, he confirmed in a speech on Monday. Macron did not specify the exact dates but said that his visit will coincide with our appointment to chair the 2019 African Union summit. The president previously announced that his trip to Egypt will be sometime in November or December 2018. You can watch the full speech here (runtime: 1:30:47), or read the full text in French.

- Indian PM Narendra Modi will also be in town and looks interested in both defense cooperation and growing our USD 3.5 bn trade relationship, according to reports yesterday in the Indian press. Egyptian ambassador to India Hatem Tageldin told reporters there yesterday that Modi’s visit is agreed, it’s just about working out a time. Tageldin also expects India’s defense and environment ministers to visit Cairo before the year is out. The sit-down would be the fifth between Modi and El Sisi, who have worked consistently to grow political and business ties. India’s Economic Times has lots more, as does The Statesman.

The UK wants to become the largest foreign investor in Africa within four years, British Prime Minister Theresa May said yesterday as she kicked off a visit to South Africa, Kenya and Nigeria, the Financial Times reports. May is looking to counter-balance France’s influence in Africa, the newspaper adds.

Abraaj dodges jail term with settlement in bounced-cheque case: Abraaj founder Arif Naqvi reached a settlement agreement in a case over USD 217 mn-worth of bad cheques, his lawyer said two days after a UAE court handed Naqvi a three-year prison sentence, according to Bloomberg. The news was confirmed by attorneys on the opposing side, who said that “all criminal proceedings relating to this case have been discontinued.” The parties will also “apply to the court and the public prosecution to withdraw the cases brought on the bounced checks,” Naqvi’s lawyer Habib Al Mulla said. The case, which was filed by another of Abraaj’s founding shareholders, Hamid Jafar, is the second of its kind to be brought against him. Jafar had previously accused Naqvi of issuing bad cheques worth at least USD 48 mn. Abraaj is in the midst of a court-ordered restructuring and has filed for provisional liquidation after it was implicated in a scandal over misallocated funds.

It’s been a quiet week for emerging markets (Turkey not included): Major EM currencies have recovered or at least stabilized this week, leaving Turkey as an “outlier,” Adam Samson writes for the Financial Times. “MSCI’s broad EM FX gauge has risen 0.63 per cent this week, following a 0.35 rise during the previous five working days.”

Is Germany about to offer Turkey a financial lifeline? Yes, suggests the WSJ, which argues that Berlin is mulling everything “from a coordinated European bailout similar to the kind deployed during the eurozone debt crisis to project-specific loans by state-controlled development banks and bilateral aid.” Germany would prefer to do it without itself offering “emergency financial aid,” Bloomberg adds, suggesting Berlin is looking to broker a wider European response to the brewing crisis in Erdoganland.

The biggest global business news remains whether Canada will reach an agreement with the US to remain part of the North American Free-Trade Agreement before Washington-imposed end-of-week deadline. See coverage from the Wall Street Journal, the FT and CNBC.

Goodbye, Summer of Sleaze: The Wall Street Journal is being polite about it, asking Why Are Male Celebrities Dressing Like Such Slobs? But Esquire said it first, bluntest and best: This has been the Summer of Sleaze in men’s fashion, and we’re very happy it is drawing to a close.

Enterprise+: Last Night’s Talk Shows

So many words spoken, so little meaning delivered: It was another night of vague murmurings bereft of meaning on the nation’s airwaves. The worst of it is that the topics could have been interesting: Ethiopia. Sudan. Oil and gas.

So poor was last night’s performance by the show jockeys that we’re desperately looking forward to the return of Lamees Al Hadidi, who is going to be back in the anchor chair at CBC’s Hona Al Asema as of Saturday after a long break for the summer. Lamees made the announced last night via Twitter. We must admit that we’ve missed her: Like it or not, Lamees is the only one of the talking heads who knows squat about business and the economy. It’s just not the same without her.

On to the news: First, it was about insipid takes on Ethiopia. Shoukry’s visit to Addis Ababa with intelligence boss Abbas Kamel means to secure Egypt’s interests in the region, Al Ahram editor-in-chief deputy Al Ahram Deputy Editor Asmaa Al Hosseiny helpfully Al Hayah fi Masr (watch, runtime: 5:47). It also demonstrates Egypt’s support for Ethiopia as it faces delays in the construction of its Grand Dam, Political science professor Mahmoud Abol Einin told Hona Al Asema’s Dina Zahra (watch, runtime: 8:47). Yahduth fi Misr’s Sherif also covered the story (watch, runtime: 1:51).

Ghost trains to Sudan: Cairo and Khartoum are considering establishing a high-speed rail, line from Alexandria to Abu Hamad in Sudan, passing through 6 October City and Luxor, according to Railway Authority head Ashraf Raslan. He added that Transport Minister Hisham Arafat and his Sudanese counterpart, meeting in Cairo, also discussed the possibility of a 280 km railway line connecting the Aswan Dam to Wadi Halfa (watch, runtime: 4:07). Good ideas, but we figure our great-grandchildren may have the opportunity to ship freight on those lines.

Also in Cairo yesterday, Prime Minister Mostafa Madbouly met with Eni CEO Claudio Descalzi. Surprising absolutely no one, Zohr and Eni’s interest in the Western Desert topped the agenda, Cabinet Spokesperson Ashraf Sultan told Al Hayah fi Misr (watch, runtime: 9:22). Electricity Minister Mohamed Shaker and Oil Minister Tarek El Molla were also at the meeting.

Masaa DMC spent plenty of time talking about the nation’s banking sector, as host Osama Kamal sat down with MP Mohamed Badrawy and Banque du Caire Vice Chairman Hazem Hegazy (watch, runtime: 3:47). The two reassured the nation that good management, economic reforms and supportive policies have together sustained the industry through a difficult period (watch, runtime: 5:18). Groundbreaking, we know.

Mohamed Salah’s ongoing dispute with the Egyptian Football Association (EFA) appears to have intensified overnight. The EFA apparently lodged a complaint against Salah with FIFA on grounds of receiving “threatening” messages from his lawyer, according to sports critic Ihab El Khatib (watch, runtime: 5:51). Salah’s lawyer had threatened in a letter to call for the EFA board’s resignation if they fail to comply with the footballer’s rider when he lands in Cairo for the Africa Cup of Nations qualifier on 8 September, which requests that he have two bodyguards accompanying him at all times.

Falcon Security reportedly said it was prepared to offer its services to the national team free of charge, El Khatib told Zahra on Hona Al Asema, adding the governing body is widely expected to accept the offer. Sports critic Essam Shaltoot confirmed as much (watch, runtime: 4:12). Masaa DMC’s Osama Kamal also asked the EFA to accept Salah’s requests (watch, runtime: 6: 23).

Speed Round

Moody’s upgrades outlook on Egypt to positive as it reaffirms long-term issuer rating at B3: Moody’s Investor Service reaffirmed Egypt’s long-term issuer rating at B3 and upgraded its outlook to ‘positive’ from ‘stable,’ saying the decision reflects improvements in the economic and business environment as a result of the ongoing economic reform program, the ratings agency said in a release (pdf). The agency notes that despite existing challenges — mainly refinancing risks created by a high debt burden and, to a lesser extent, the risk of political upheaval — “early signs of business environment reforms offer the prospect of a sustainable, inclusive growth path capable of improving competitiveness and absorbing the country’s rapidly expanding labor force.”

Egypt is on the right track. Commitment to reform measures — including the float of the EGP and the legislative and structural changes — have already led to a primary budget surplus for the first time in years, higher FX reserves, and improved GDP growth levels that should increase over the coming months. The government’s drive to optimize its finances, by restructuring subsidies and taxes, is also expected to help decrease the debt burden over time, which should help improve Egypt’s credit profile.

While a reversal in Egypt’s current rating seems unlikely, any stalling in the reform program risks changing the outlook back to ‘stable’. Moody’s said it would ”monitor the government’s progress in achieving planned fiscal, monetary and economic reforms; its success in sustaining external investor confidence as reflected in trends in foreign reserves and foreign direct investment; and the social acceptance of the government’s reform program and the absence of pressures that could eventually halt or reverse economic and fiscal reforms.”

Higher FX reserves, decelerating inflation to see EGP stable through the end of the year? The EGP is unlikely to see any major fluctuations through the remainder of 2018 and potentially into 1H2019, Beltone Financial’s Director of Macro and Strategy Alia Mamdouh tells Bloomberg TV. Why? Look no further than record-high FX reserves and the narrowing inflation differential between Egypt and the US’ headline inflation rate, she said. Mamdouh took note of improvements in the supply side of foreign currency on the back of rebounding tourism, which has led to a healthier balance of payments and current account.

Interest rates are also likely to remain stable for the time being, particularly as emerging markets have been raising their rates to offset turbulent market conditions. Mamdouh doesn’t expect any cuts until 1Q2019, when we might see a 100 bps reduction.

External borrowing is still going to weigh on the economy: The government has a USD 5 bn bond issuance penciled in for sometime this fiscal year, but is looking to shift towards relying more on long-term debt, Mamdouh stressed. Finance Minister Mohamed Maait had previously told us his ministry will not begin considering a foreign currency-denominated bond issuance for another two months, at which time market conditions will be an important factor.

You can catch the full interview here (runtime: 3:38).

NI Capital invites 7 local investment banks to bid on managing Eastern Co., AMOC share sales: State-owned NI Capital has invited seven local investment banks to bid to quarterback upcoming stake sales by cigarette-maker Eastern Company and the Alexandria Mineral Oils Company, unidentified sources tell Al Mal. Who got the call? Pharos Holding, EFG Hermes, CI Capital, Beltone Financial, HSBC, HC Securities and Investment, and Arqaam Capital. Under the conditions of the tender, the selected banks are not allowed to team up with each other, but may look outside the selected pool to form consortia — an option that Pharos and HSBC are reportedly looking into. The banks have until Sunday to present their bids.

Background: AMOC and Eastern Company are two of five expected to pilot the state privatization program, alongside Heliopolis for Housing and Development (HHD), Alexandria Container and Cargo Handling (ACCH), and Abu Qir Fertilizers. NI Capital has already been tapped to manage share sales for ACCH as well as HHD. Finance Minister Mohamed Maait had previously told Enterprise that the government will hold tenders for legal counsel and financial advisers for all five of the share sales.

IPO WATCH- CIRA to kick off international IPO roadshow next week: Cairo Investment and Real Estate Development (CIRA) is planning to kick off next week its international roadshow for its upcoming IPO, sources close to the matter said yesterday. The leading private-sector education outfit is specifically eyeing markets in the Gulf, Europe, and South Africa, according to the sources. CIRA had announced on Monday its plans to list a 37.48% stake on the EGX, with the transaction set to include both an international private placement and a retail offering here in Egypt.

Advisers: EFG Hermes is sole global coordinator and bookrunner for the transaction. Al Tamimi & Co. is acting as the issuer’s local counsel, while Zulficar & Partners is domestic counsel to the underwriter. White & Case is international counsel to the issuer, while Gide Loyrette Nouel is doing duty for the global coordinator and bookrunner. Inktank Communications is serving as investor relations advisor to CIRA.

MOVES- Cabinet SecGen to remain in place for another year: President Abdel Fattah El Sisi issued a presidential decree (pdf) extended Cabinet Secretary General Atef Abdel Fattah’s term for an additional year.

CORRECTION: It’s not Hassan Allam (the high-profile privately-owned construction and engineering giant) but Al Nasr Co. that expects to complete work worth EGP 1 bn in East Port Said by year’s end, as we reported. Many media outlets conflate the two companies thanks the the legacy of the Nasser-era nationalization program. Our apologies to the good people at Hassan Allam for the mistake. The story has been corrected on our website.

Up Next

As many as 16 of the nation’s 27 governors will be replaced in a shuffle expected to take place this week. The announcement of the shuffle has been postponed multiple times since since June.

The Euromoney conference kicks off on 4 September, with ministers Sahar Nasr, Mohamed Maait, Tarek Shawki, and Amr Talaat scheduled to participate, according to a statement (pdf).

Egypt will be among seven countries gathering in Geneva next month for talks on Syria’s political process, Reuters reports. UN Special Envoy for Syria Staffan de Mistura has invited Syria’s allies to the negotiating table to push for the drafting of a new Syrian constitution, according to the newswire.

The House of Representatives is in recess until October.

Image of the Day

A 12.5 kg sapphire hidden from the public eye since 2004 is going on tour — thanks a Chinese brick manufacturer. The Millennium Sapphire, which was discovered in Madagascar in 1984, will be snapped up by China’s Yulong Eco-Materials for USD 50 mn in restricted stock in a transaction expected to close within three weeks, says the Wall Street Journal. “Yulong said it plans to take the sapphire on a world tour of museums, to develop documentaries, and to include the gem in the plots of feature films,” with plans to generate cash through branding, royalties, licensing, and ticket sales. Uhm, good luck with that, dudes.

Egypt in the News

The Atlantic Council would very much like you to know that it believes Egypt Leads the Pack in Internet Censorship Across the Middle East. Otherwise, all quiet on the foreign front. Enjoy it while it lasts.

Worth Reading

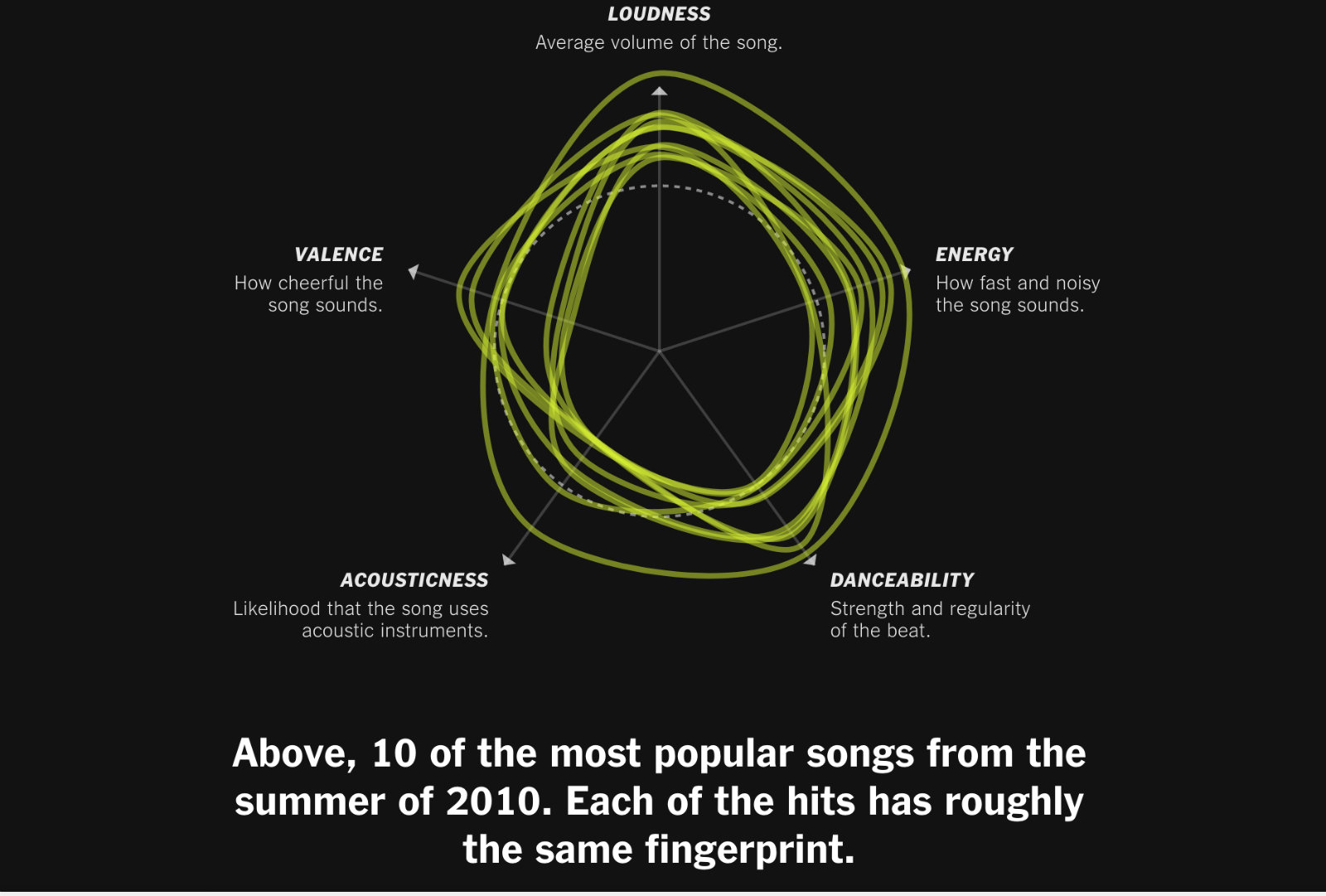

We’ve been listening to the same song on repeat for the past two decades. It appears that popular taste in music forced producers down a narrow single track after the 1990s. A shift in popular demand from rock and R’n’B in the 1980s and 90s toward the more “bombastic sounds” of pop in the 2000s — coupled with a change in the way Billboard magazine tracked record sales — meant that more and more songs of very similar traits were making it to the tops of the charts, “leaving less room for musical diversity.” The New York Times uses the same algorithm used by music streaming service Spotify to generate recommendations — which measures energy, acousticness, valence, loudness, and danceability — in order to create a “sonic fingerprint” for a number of popular summer hits from the late 1980s and 90s and compare them to counterparts from the 2000s.

Unlike the 80s, each of the most popular hits from 2010, which include songs by the likes of Lady Gaga and Katy Perry, “has roughly the same fingerprint.” The director of New York University’s music business program, Larry Miller, explains that the “hit-making process has become less random than it once was,” as music makers have become all too familiar with the “mathematical” formula to pleasing the crowd. 2018 is looking a little different though, suggesting that there may be hope yet for commercial music. Check out the full piece here, complete with sound and video.

Diplomacy + Foreign Trade

Shoukry, Kamel meet Ethiopia’s Abiy Ahmed to discuss GERD, kicking off development projects: Foreign Minister Sameh Shoukry and intelligence chief Abbas Kamel met with Ethiopian Prime Minister Abiy Ahmed in Addis Ababa yesterday to discuss the latest developments in the Grand Ethiopian Renaissance Dam (GERD), according to a ministry statement. The statement does not delve further into the outcomes of these talks. Egypt and Ethiopia had agreed in June on adopting a “joint vision” on GERD’s construction, which would see Ethiopia catering its timeline of filling the dam to Egypt’s needs in exchange for economic cooperation. The two sides also looked into activating a joint investment fund that will be set up alongside Sudan to finance infrastructure projects.

This came as Addis Ababa reportedly cancelled a contract for the installation of turbines at the GERD with the Ethiopian military-run Metals and Engineering Corporation (Metec), citing repeated delays in implementation, David Philling writes for the Financial Times. Abiy had said earlier this week that the delays could push the start of operations at the dam to 2020.

Egyptian-Sudanese ministerial council meets for talks on agri ban, joint railway project: Egypt and Sudan’s agriculture ministers Ezzedin Abu Steit and Abdallah Soliman met yesterday to look into lifting Sudan’s ban on imports of Egyptian agricultural products, Al Masry Al Youm reports. The ban, which has been in place since May 2017, was not a result of “technical problems,” Abu Steit said, urging Soliman to review quality reports and lift the ban. Transport Minister Hisham Arafat also met with his Sudanese counterpart Ibrahim Youssef Mohamed to discuss plans to construct a railway line connecting Egypt and Sudan. The two ministers agreed to hold a technical committee meeting in Khartoum at a later date to look into the details of the project.

The Egyptian-Sudanese Trade Committee is also set to meet in Cairo next month to look into improving economic trade and relations ahead of a planned meeting between presidents Abdel Fattah El Sisi and Omar Al Bashir the following month, Trade and Industry Minister Amr Nassar said yesterday, according to a ministry statement.

Vietnamese ministers, business delegation discuss potential SCZone investments with Mamish: Vietnamese Planning and Investment Minister Nguyen Chi Dung, Agriculture Minister Nguyen Xuan Cuong and their accompanying business delegation met yesterday with Suez Canal Economic Zone (SCZone) Chairman Mohab Mamish to look into potential investments in the SCZone, Al Mal reports.

Egypt is looking to export dates, pomegranates, mangoes, and potatoes to China, head of the Agricultural Quarantine Authority Ahmed El Attar tells Al Mal. The authority is in talks with its Chinese counterpart and has submitted the necessary documents for review. The Chinese had previously accepted Egyptian date and grape imports, and are still reviewing the documents for the other crops. A delegation from the authority and Agricultural Exports Council are also set to visit China next month for further talks.

Energy

Eni said to be in talks with Shell to connect Western Desert well with processing plant in Obayed

Italian oil and gas giant Eni is reportedly in talks with Royal Dutch Shell to begin pumping a daily 23 mcf of gas a well in its Western Desert concession to the company’s processing plant in Obayed, unnamed EGAS officials said yesterday. The Faramit well will be closed until the two sides agree on the terms of constructing a pipeline connecting the field to the facility, they added. No further details were provided.

Negotiations on ACWA Power’s Dairut power plant stalled

Negotiations between Saudi Arabia’s ACWA Power and the Electricity Ministry over the former’s USD 2.2 bn, 2.25 GW Dairut power plant have stalled after nearly several months of negotiations, according to ministry sources. It remains unclear what is behind the stalled talks, but the sources noted that ACWA has yet to receive the allocated land for the plant, despite agreeing to relocate it to Luxor. Last we heard, ACWA had agreed in February to push the plant to the ministry’s 2022-2027 five-year plan instead of the 2017-2022 plan due to the surplus in production currently on the national grid. ACWA had also reportedly been closing in on a power purchasing agreement with the ministry for the plant.

Infrastructure

Egypt’s reuse of drainage water sets example for other countries -UN report

Egypt provides a good example of a country that found unconventional water resources with its drainage management system, according to a joint report from the World Bank UN’s FAO. Egypt, which uses drainage water proved that reusing drainage water is both a cheap and effective way of increasing water efficiency and boosting productivity. “In Egypt, 10% of agricultural water is recycled drainage water, and that success could be matched in other countries where there is large-scale surface irrigation,” the report says. You can view the full document here (pdf).

Basic Materials + Commodities

GASC purchases 350k tonnes of Russian, Ukrainian wheat for October delivery

The General Authority for Supply Commodities (GASC) purchased 350k tonnes of Russian and Ukrainian wheat in an international tender yesterday, Reuters’ Arabic service reports. GASC reportedly paid an average USD 241.31 per tonne, sources told Agri Census (paywall). The bill is 4% lower than the record USD 250 per tonne that Egypt paid for wheat earlier this month, when a drought in Europe and the Black Sea region drove prices up to a three-year high. The new shipments, of which 290k tonnes are Russian, are scheduled for delivery between 11-20 October. On a related note, Russian agriculture holding company Steppe is reportedly interested in joining GASC’s list of approved grain suppliers, a source familiar with the matter told Reuters. The decision is part of Steppe’s forward-looking strategy to boost exports and rise through the ranks of Russia’s grain traders.

Manufacturing

Jushi inaugurates new production line at Ain Sokhna factory

General Authority for Freezones and Investment (GAFI) CEO Mohsen Adel inaugurated yesterday Jushi’s new production line at its Ain Sokhna fiberglass factory, Ahram Gate reports. The Chinese company has invested a total of USD 570 mn in the factory since its construction in 2012. The plant produces 200k tonnes of fiberglass per annum.

Automotive + Transportation

Vehicle protection services provider Ziebart awards master license to Egypt’s NATCO

Michigan-based vehicle protection services provider Ziebart International announced yesterday awarding a new master license to Egypt’s Mercedes-Benz producer and distributor the National Automotive Company (NATCO), according to a company release. “We are very excited for the openings of these locations,” CEO Thomas Wolfe said. “NATCO has a long-standing history of doing business [in Egypt].”

Other Business News of Note

Orange Egypt’s board of directors approves voluntary delisting proposal

Orange Egypt’s board of directors approved the company’s proposal for voluntary delisting during its meeting on Monday, according to a statement to the EGX (pdf). Orange had been facing mandatory delisting since the beginning of the year for failing to meet the EGX’s amendments on the required number of freefloat shares. The company expects to finalize delisting procedures by no later than December.

Legislation + Policy

Trade Minister given powers to exercise PM’s powers under Competition Protection Act

A decision granting the Trade Minister authority to exercise the Prime Minister’s powers under the Competition Protection Act was issued in the Official Gazette yesterday, according to Al Masdar.

Egypt Politics + Economics

Criminal court sentences six to death for attacking security checkpoint

An Egyptian court sentenced six militants to death for a 2016 attack on a security checkpoint that killed a policeman, the Associated Press reports.

Sports

Karim Hafez to join _stanbul Ba_ak_ehir

Egypt defender Karim Hafez is joining Turkish football Super Lig club _stanbul Ba_ak_ehir on loan, according to reports from France Football. Hafez is reportedly already in Turkey for necessary medical checkups, Turkish newspaper Sabah reports. He had returned to Egypt to join Wadi Degla once again after having spent five years in Belgium FC Lierse.

On Your Way Out

Al Azhar publicly denounced [redacted] harassment as a “sin” in a statement yesterday.Al Azhar declared all forms of [redacted] harassment as strictly inadmissible according to both religious tenants and the law, and urged civil society organizations and the media to take a more active stance in raising awareness against the practice. The statement came amid increasing media reports of harassment incidents.

Egypt is among computer technology company Oracle’s best performing markets in the Middle East and Africa (MEA), Senior Director Samira Rizwan told the National in an interview. Saudi and the UAE are also among Oracle’s largest revenue sources in the MEA region.

The Market Yesterday

EGP / USD CBE market average: Buy 17.84 | Sell 17.94

EGP / USD at CIB: Buy 17.84 | Sell 17.94

EGP / USD at NBE: Buy 17.78| Sell 17.88

EGX30 (TUESDAY): 15,606 (+2.4%)

Turnover: EGP 906 mn (6% above the 90-day average)

EGX 30 year-to-date: +3.9%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 2.4%. CIB, the index heaviest constituent ended up 3.9%. EGX30’s top performing constituents were Egyptian Resorts up 6.2%, SODIC up 4.7%, and Egyptian Aluminum up 4.0%. Yesterday’s worst performing stocks were Juhayna down 2.2%, Ibnsina Pharma down 1.5% and Qalaa Holdings down 0.8%. The market turnover was EGP 906 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +18.9 mn

Regional: Net Short | EGP -16.1 mn

Domestic: Net Short | EGP -2.8mn

Retail: 62.6% of total trades | 62.8% of buyers | 62.5% of sellers

Institutions: 37.4% of total trades | 37.2% of buyers | 37.5% of sellers

Foreign: 19.1% of total | 20.2% of buyers | 18.1% of sellers

Regional: 7.9% of total | 7.0% of buyers | 8.8% of sellers

Domestic: 72.9% of total | 72.8% of buyers | 73.1% of sellers

WTI: USD 68.55 (+0.03%)

Brent: USD 75.95 (-0.34%)

Natural Gas (Nymex, futures prices) USD 2.86 MMBtu, (+0.25%, September 2018 contract)

Gold: USD 1,208.30/ troy ounce (-0.50%)

TASI: 8,036.56 (+0.46%) (YTD: +11.21%)

ADX: 4,956.76 (+0.36%) (YTD: +12.69%)

DFM: 2,818.19 (-0.41%) (YTD: -16.38%)

KSE Premier Market: 5,252.86 (-0.95%)

QE: 9,858.34 (+0.57%) (YTD: +15.66%)

MSM: 4,410.25 (+0.65%) (YTD: -13.76%)

BB: 1,346.86 (-0.08%) (YTD: +1.13%)

Calendar

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

17-19 September (Monday-Wednesday): INTERCEM Cairo to Cape Town cement industry conference, Dusit-Thani LakeView, Cairo.

18 September (Tuesday): Cairo Economic Court to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

October: The Madbouly cabinet has until the end of the month to come up with a plan for “the development and restructuring” of public companies” under a directive from President Abdel Fattah El Sisi.

06 October (Saturday): Armed Forces Day, national holiday.

23 October (Tuesday): First Conference on Sukuk (Sharia-compliant bonds), Cairo

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

25-27 October (Thursday-Saturday): 57th ACI World Congress & 43rd ICA Annual Conference 2018, Four Seasons Nile Plaza, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.