- Trade Minister denies that it is scrapping the automotive directive, but says it is reviewing “current policies.” (Speed Round)

- The Finance Ministry has formed a committee to look into drafting a new Income Tax Act. (Speed Round)

- Edita Food Industries records a net profit of EGP 25.1 mn in 2Q2018, with revenues growing 29.0% y-o-y to EGP 789.2 mn. (Speed Round)

- Egypt will repay USD 6.3 bn of its foreign debt obligations in 2H2018, as UAE agrees to roll over USD 4 bn in deposits. (Speed Round)

- Where, oh where, have my new telecoms frequencies gone, MNOs asks telecom regulator. (ICT + Telecoms)

- Egypt dropped 18 places to rank 67th on the World Bank’s 2018 Logistics Performance Index. (Speed Round)

- The debate on whether the US should have released the USD 195 mn in military aid to Egypt intensifies in the foreign press. (Egypt in the News)

- Global banks won’t let age get in the way of a new client by hosting summer programs to get in early with young heirs. (Worth Reading)

- The Market Yesterday —

Tuesday, 31 July 2018

Automotive directive not scrapped but under review

TL;DR

What We’re Tracking Today

Cerberus Capital Management has reportedly withdrawn its offer for the rights to manage the Abraaj Group’s assets after investors rejected the firm’s USD 25 mn bid, sources with knowledge of the matter told Bloomberg earlier this month. Cerberus presented the lowest offer; the Dubai-based private equity firm is currently undergoing liquidation and a court-ordered restructuring following allegations of misuse funds. Abu Dhabi Capital Management was said to have made a USD 55 mn offer for the right to run Abraaj’s assets. Read Bloomberg’s “Behind the Spectacular Collapse of a Private Equity Titan” for a recap on Abraaj’s fall from grace.

Orascom Telecom Media and Technology Holding and Arab Dairy are among the latest companies to disavow ties to Abraaj in disclosures to the bourse yesterday, Al Mal reports.

Optimism in Ethiopia and Eritrea — and a murder mystery. Every Ethiopian and Eritrean we’ve bumped into in the past week (a shockingly large number, oddly enough) has been uniformly optimistic about the prospects for (a) Ethiopia’s warming ties with other regional countries, including Egypt and (b) for lasting peace with neighbor Eritrea. New Ethiopian Prime Minister Abiy Ahmed has proven a breath of fresh air, accepting an aid and investment package from the UAE, working to improve relations with Egypt that have been strained by the Grand Ethiopian Renaissance Dam, and appearing in person with the leader of Eritrea. Cue the murder mystery, which saw thousands of people gather in Addis Ababa on Sunday to mourn the killing of Semegnew Bekele, the project manager for GERD. Bekele was “was found slumped behind the wheel of his Toyota Land Cruiser … at 8:30 a.m. [last Thursday]. He had a gunshot wound to his head,” the New York Times reports. No suspects have yet been identified, and investigators are yet to confirm the killing was connected to Bekele’s work on the dam, but that hasn’t stopped innuendo in some corners that Egypt could have been involved.

Zimbabwe held yesterday its first presidential election after strongman Robert Mugabe’s resignation last November, Bloomberg reports. Results are expected on or before 4 August.

US President Donald Trump said he’s willing to open the door for new talks with Iran to hammer out a nuclear agreement “if they wanted to meet,” according to the Washington Post. The Donald is apparently ready to do the sitdown without preconditions.

Being a foreign investor in China is just about to get a little more difficult after the country’s Ministry of Commerce drafted amendments to investment rules that will see “foreigners seeking ‘strategic’ stakes in listed Chinese companies [facing] broader national security reviews.” The move is a response to the “US, Britain and Germany [moving] to strengthen their merger review systems to make it harder for foreign groups to take over domestic companies deemed to have assets critical to national security,” according to the Financial Times.

The US economy has moved beyond “the new normal” of relatively anemic growth, Bloomberg quotes Allianz chief economic advisor Mohamed El-Erian as saying, suggesting “the world’s largest economy has finally broken out from its post-crisis malaise. ‘The US on a standalone basis has exited this new normal, is now finding a higher growth equilibrium, 2.5 to 3,’” El-Erian told Bloomberg in a TV interview yesterday.

In miscellany today: Season three of Stranger Things definitely won’t be out until the summer of 2019. That’s the takeaway from Entertainment Weekly, which also says that a Netflix programming exec is promising the third season will be better than was season two. Drown your sorrows by watching the season three micro-trailer / teaser (watch, runtime: 1:26). And maybe check out the trailer for Summer of ‘84: “The movie focuses on a group of four young guy friends trying to figure out who’s responsible for killing people in their town — oh hey, it’s the plot of Stranger Things, minus one girl with superpowers,” Refinery 29 writes (watch, runtime: 1:49). The film is out in select theaters starting 10 August.

Enterprise+: Last Night’s Talk Shows

The Supply Ministry opening the door for the registration of new beneficiaries to subsidy rolls led the conversation on last night’s talk shows, with Minister Ali El Moselhy blanketing the airwaves to discuss the move.

Allowing new additions to the country’s subsidy rolls comes as part of the government’s expansion of its social safety net, El Moselhy told Hona Al Asema. The minister explained the conditions citizens must meet to be added to the ministry’s database. Unregistered citizens born between January 2006 and December 2015 will be added to the Supply Ministry’s rosters until 31 October (watch, runtime: 13:44). The ministry expects to add at least 3-4 mn new subsidy benefactors during the registration period, and is working in parallel to continue weeding out subsidy moochers, El Moselhy told Masaa DMC’s Eman El Hosary (watch, runtime: 12:11). Supply Ministry Spokesman Ahmed Kamal phoned into Yahduth fi Masr to say much of the same (watch, runtime: 7:43).

Tax Authority head Emad Samy recapped the state’s tax collection figures for FY2017-18 and explained the reasons behind the increase on Masaa DMC (watch, runtime: 3:49 and runtime: 2:33). He also noted that the tax collection target for FY2018-19 is EGP 771 bn (watch, runtime: 2:10) and that the authority is looking to widen its tax base by collecting taxes from football players and their agents, who were previously exempt (watch, runtime: 2:30).

The state’s privatization program and public debt reduction strategy were the main topics of discussion at a meeting Prime Minister Mostafa Madbouly held with CBE Governor Tarek Amer and the finance, transport, and electricity ministers yesterday, Cabinet Spokesman Ashraf Sultan told Al Hayah fi Masr (watch, runtime: 6:19).

Ten foreign correspondents were granted access to the restive North Sinai region, which shows that Egypt “has nothing to hide” from the outside world, State Information Service head Diaa Rashwan told Masaa DMC. The SIS plans to arrange another round of visits for more journalists soon, Rashwan said (watch, runtime: 6:06).

The Irrigation Ministry is apparently working on incentivizing water conservation among farmers by creating a competition that will reward farmers who use the most water-conscious irrigation methods, head of the ministry’s planning department said on Hona Al Asema. The competition is being run in cooperation with the EU and is part of a wider effort to raise awareness on water conservation (watch, runtime: 4:50).

Hona Al Asema’s Dina Zahraa also had a chat with the women behind the concept of creating a visual brand for Luxor, Yasmina Saleh, Dina Fouad and Yasmin Soliman (watch, runtime: 19:45) and the athletes who participated in the African Games (watch, runtime: 30:03).

Speed Round

Is the automotive directive still alive? The Ministry of Trade and Industry issued yesterday a statement denying our report of Monday morning that the government plans to scrap the long-delayed automotive directive, which was designed to transform Egypt’s automotive assembly industry into a manufacturing and export power. A senior government official with direct knowledge of plans drawn up by the Ministry of Trade and Industry was our source on the original story. The official spoke on condition of anonymity.

What’s the ministry saying? The statement says our report was untrue, but notes that officials are reviewing the current policy with an eye towards a vision for the industry and a strategy for its development. It added that the development of the local auto industry is a top a priority for the ministry — “as is the case with any other industry.”

What our source claims the Trade Ministry is proposing: The government is looking to replace the automotive directive with a policy of setting up special auto industry freezones that would offer a range of as-yet unspecified tax and customs breaks to assemblers, a senior government source with direct knowledge of the move told Enterprise. Among the incentives could be tax and customs exemptions for capital goods imported for local assembly, the source said. Our source noted that the ministries of trade and industry, finance, and investment are currently working on studies that would back the new policy, but did not say when the proposal might be officially unveiled. The policy will likely emulate others adopted by regional players including Morocco and South Africa.

So, where do things stand? Two well-sources with whom we spoke yesterday confirmed the proposal to scrap the directive in favour of Moroccan-style incentives and special economic zones is very much alive and has been presented to the cabinet.

How does this compare with the automotive directive? Both policy directions ostensibly aim to give local assemblers protection against less-expensive imports by giving them incentives to move up the value chain into manufacturing. The automotive directive was a blanket policy for the industry, not based on specific zones or geographies. And it would not have required direct payouts to manufacturers: The original draft of the automotive directive set a minimum production and export requirement to benefit from incentives, which include tax and customs breaks of 23.1%-57.5% of the sales price of the car, varying by engine size and proportional to the percentage of domestic components used to assemble the vehicle.

Why incentives may not be the way forward: Similar programs in Morocco and Turkey to which our source says the government has referred provide cash rebates or subsidies of 20-30% on a manufacturer’s investment cost. Industry players with whom we’ve spoken in the past day put that at a cost to the taxpayer of some USD 500 mn per plant. Moving up the component value chain to require 60% of content be domestic would required further bn’s of USD worth of investment — this at time when the industry is simply too small to support something of that size.

In any case, the clock is ticking: We have five months and one day before cars assembled in the EU enjoy customs-free access to the Egyptian market, a fact that would imperil thousands of skilled manufacturing jobs (both direct and indirect). Our take is that this is the industry’s last chance to get on a footing that could one day see our exports be regionally competitive. To lose jobs and future economic opportunity for lack of a clear policy would be a shame. Whatever cabinet plans to do with the industry, now is the time to make it clear — foreign investors won’t come pouring in until the regulatory framework and the fate of existing domestic players is clear.

EXCLUSIVE- FinMin looks into drafting a new Income Tax Act: The Finance Ministry has formed a committee to look into drafting a new Income Tax Act, Tax Authority deputy head Mohamed Abdel Sattar told Enterprise. It has become necessary to thoroughly update the current Income Tax Act, which is now a bit outdated despite the flurry of amendments seen over the past two years, he added. The move appears to be an attempt to bring the Income Tax Act up to speed with other legislation recently passed and to account for a host of new activities not covered under existing law. He added that the new law would be ready before the end of the current fiscal year.

So what’s coming with the new law? Everything is apparently on the table: The new law would be comprehensive and cover income tax rates, exemptions and tax breaks, and will factor in e-commerce, Abdel Sattar said without elaborating further on the content. Abdel Sattar noted, however, that the committee may decide to go with a seperate law to tax online ad sales on Facebook and Google. Finance Minister Mohamed Maait had told us last week that amendments coming to the act would streamline tax procedures and cut red tape.

What’s that you say? Changes to the income tax rate? All of this meshes with previous talk by ministry officials that they are looking to tax e-commerce and online ad buys. It also comes as the House of Representatives has been calling for a new tax bracket for high income earners: A proposal has been floated to raise the income tax on those earning over EGP 1 mn per annum to 30% from a current 22.5%.

LEGISLATION WATCH- The government will issue the executive regulations to the Public Contracts Act within six months’ time, Finance Minister Mohamed Maait said, Al Ahram reports. The legislation (previously known as the Auctions and Tenders Act) was approved by the House of Representatives last week after going through a second round of review following its name change. The law aims to decentralize and streamline tender procedures, Maait said.

Egypt will repay USD 6.3 bn of its foreign debt obligations in 2H2018, out of a total USD 12 bn in debt the government had said it intends to retire this year, Al Mal reports. The amount includes some USD 850 mn owed to international oil companies, of which USD 200-500 mn the EGPC plans to settle by September 2018. Egypt’s foreign debt obligations had stood at USD 82.9 bn at the end of December 2017, or around 36.1% of GDP, up from USD 67.3 bn at the end of December 2016. The government has already made a number of payments so far this year, including to the African Export-Import Bank and the UAE’s Dana Gas.

This comes as the UAE government reportedly agreed to roll over two deposits at the CBE worth USD 2 bn each. The deposits from 2013 and 2015 had been repayable in April and July this year. The earliest payment is now due in April 2019 and the last is payable in 2021; each earns the UAE an interest rate of 3.5%, according to the newspaper. CBE Governor Tarek Amer had said in April that Egypt was working on extending a number of GCC deposits, including ones from Saudi Arabia, as well as Kuwait, whose authorities had agreed in principle to roll over USD 4 bn-worth worth of deposits until September 2018 and April 2020.

EARNINGS WATCH- Edita Food Industries recorded a net profit of EGP 25.1 mn in 2Q2018, up from a net loss of EGP 1.7 mn during the same period last year, according to the company’s earnings release (pdf). Edita’s revenues also grew 29.0% y-o-y to EGP 789.2 mn, driven by “continued growth in volumes.” For 1H2018, Edita registered a net profit of EGP 85.9 mn, up 122.1% y-o-y. “Our results in the second quarter leave us confident that demand is making a recover and that consumers are adapting to the new norm with prices stabilizing,” our friend Hani Berzi, Edita’s chairman and CEO, said. “Portfolio optimization and marketing efforts saw Edita defend its market share, cementing its lead with considerable gains in the croissant segment as well as maintaining its number one positions in the cake and candy segments,” according to the statement. The company’s primary focus for the second half of 2018 will “continue to be on volume growth through portfolio optimization and innovation, as well as profitability enhancement through cost minimization and increased operational efficiencies,” Berzi said.

MOVES- Madbouly reshuffles GAFI’s board of directors: Prime Minister Mostafa Madbouly appointed Gen. Khaled Mohamed Ibrahim and international law professor Mohamed Sameh Amr as new members of the board of directors of the General Authority for Freezones and Investments’ (GAFI), according to a Cabinet statement. Banque Misr head Mohamed El Etreby and Federation of Egyptian Industries Vice Chairman Tarek Tawfik remain members.

MOVES- Prime Minister Mostafa Madbouly has named Investment Minister Sahar Nasr as Egypt’s representative to the World Bank and the Arab Fund for Economic and Social Development, Youm7 reports.

The first phase of Egypt’s 300 MW, USD 60-70 mn power interconnection project with Sudan should be operational by December of this year, Egyptian Electricity Transmission Company (EETC) sources say. India’s Larsen & Toubro had been awarded the contracts to link the two countries’ electricity grids, and should sign the final agreement “soon,” Electricity Minister Mohamed Shaker had said earlier this month. This comes as the USD 1.6 bn Egypt-Saudi power interconnection project has reportedly been pushed to 2022 from 2020 as plans have been redrawn to accommodate the development of the Neom robot city.

On a related note, the Egyptian Electricity Holding Company (EEHC) is planning to launch USD 4.8 bn a tender before the end of the year for the development of two power plants in Luxor and Qena worth a total , unnamed EEHC sources tell Al Mal. Negotiations are ongoing with international lenders to secure funding for the two stations, which would add a combined 4 GW of capacity to the national grid. The Electricity Ministry is considering establishing the projects under a build-own-operate framework with seven-year contracts. We had noted earlier that EEHC was reviewing offers from international consultants including Artelia Group, Black and Veatch, and Fichtner.

The Agriculture Ministry is considering importing barley rice from countries including the US, Russia, Australia, India, Taiwan, and the Philippines, Agriculture Quarantine Authority (AQA) head Ahmed El Attar said yesterday, Al Mal reports. Their decision will be based on quality of the rice from these countries, according to El Attar, who added that the quantity to be imported will not be determined by the AQA. Supply Minister Ali El Moselhy had previously said that Egypt would probably need to import somewhere between 500-700k tonnes of next year to meet local consumption needs. This comes as the General Authority for Supply Commodities (GASC) has reportedly contracted 38 private companies to begin supplying it with rice for a three-month period starting August, Supply Ministry sources said yesterday. GASC will be purchasing the rice at EGP 7,500 per tonne, which could be increased to EGP 7,600 a tonne if the companies stick to their delivery schedules, according to the sources.

War of words in East Med heats up as Turkey issues warning to Egypt and Israel: The cold war in the East Mediterranean between Turkey and everyone else intensified after Turkey’s foreign ministry warned against comments made by Egypt and Israel’s ambassadors to Cyprus, TRT World reports. Egypt’s ambassador, Mai Mohamed, is reported to have said that Egypt will not hesitate to take action against Turkish navy vessels off Cyprus “if necessary” during a conference last week in Nicosia, while Israel’s ambassador had reportedly said he hopes military force will not have to be used against “Turkish provocations” in the region. Egypt’s Foreign Ministry spokesperson Ahmed Abu Zaid denied to RT Arabic that Mohamed had made the remarks. Turkey’s foreign ministry said the comments “exceed their limits” and were "out of place." Turkish military has been blocking drilling efforts in Cyprus’ portion of the EEZ all year, prompting international condemnation.

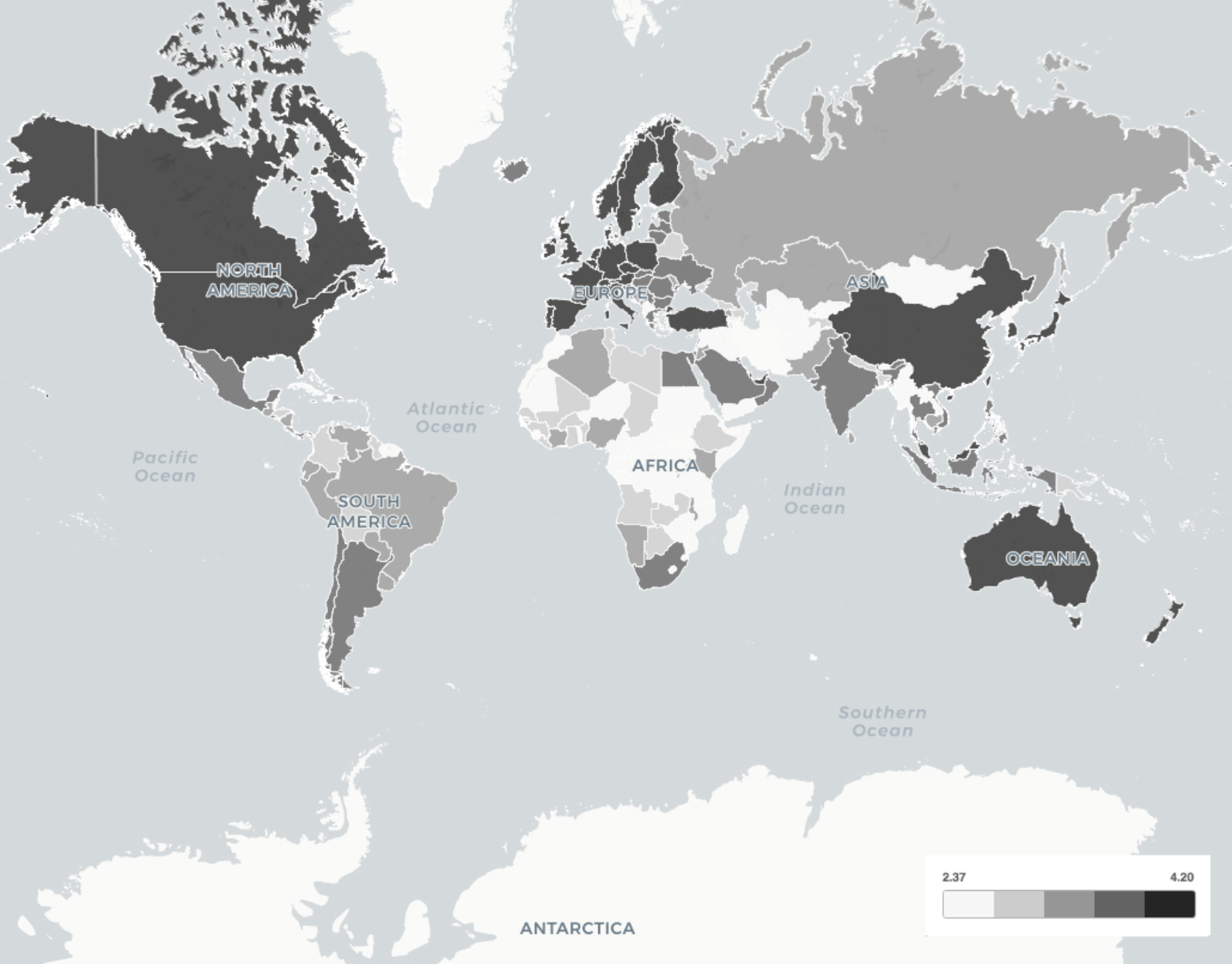

Egypt dropped 18 places to rank 67th on the World Bank’s 2018 Logistics Performance Index. The index ranks 160 countries based on their trade logistics performance, including infrastructure, quality of service, shipment reliability, and border clearance efficiency. Egypt’s performance has worsened in all of the six sub-indices compared to 2016. Germany retained its position at the top of the ranking, while Afghanistan had the lowest score of all countries included.

Up Next

It’s interest rate week in the developed nations, and bonds are taking it on the chin: The Bank of Japan reviews interest rates today, the US Fed meets on rates this Wednesday, and the Bank of England follows suit on Thursday. Bond prices have come under pressure as a result, the Financial Times says, “pushing up benchmark yields toward key levels.” (Here at home, the CBE’s monetary policy committee won’t meet until 16 August.)

The Federation of Egyptian Industries’ (FEI) tax committee will meet on Wednesday to discuss the FEI’s divisions’ remarks on the Finance Ministry’s new Customs Act, according to committee chair Mohamed El Bahey.

The CBE will be hosting the 41st annual meeting of the Association of African central banks (AACB) at Sharm El Sheikh from 5 to 9 August.

Prime Minister Mostafa Madbouly is set to select the board of directors for Egypt’s EGP 200 bn sovereign wealth fund “within days.”

Foreign Minister Sameh Shoukry should be landing in Washington next week to meet with US Secretary of State Mike Pompeo over developments in the Middle East and US-Egypt relations.

Mo Salah fans have ten more days left to make him one of FIFA’s top three men’s footballers for 2018. Cast your ballots here.

Egypt in the News

Freedom of speech in Egypt once again topped coverage in the foreign press this morning, particularly as Reporters Without Borders issued a warning against increasing hostility towards the media in countries including Egypt. “Hostility towards the media from political leaders is no longer limited to authoritarian countries such as Turkey and Egypt, where ‘media-phobia’ is now so pronounced that journalists are routinely accused of terrorism and all those who don’t offer loyalty are arbitrarily imprisoned.” The statement was covered by the Washington Post.

President Abdel Fattah El Sisi’s comments last week that “fake news” was one of the biggest threats facing the country was heavily criticized in an analysis piece by Israel’s Haaretz. It calls out the Press and Media Act, saying it would further harm civil rights. Also on human rights, Amnesty International put out a statement on Sunday criticizing the mass trial of 739 people accused of taking part in the 2013 Rabaa violence.

Former US military official backs US move to unfreeze USD 195 mn in military aid in Reuters commentary piece: The debate on whether Washington should have released the USD 195 mn in military aid to Egypt it froze last year continues, with a former senior US military commander firmly advocating in favor of the move. Retired admiral Bruce Clingan, a former commander of US naval forces in Europe and in Africa, argues that supporting Egypt’s fight against terrorism and Daesh was too important, especially as the terrorist group has seen its home bases in Syria and Iraq overrun and have stepped up attacks in the region. Beyond actually engaging with Daesh in Sinai and Libya, Egypt is also a crucial logistical facilitator for US forces operating in the region. “Despite El Sisi’s record on human rights, it is still in the United States’ interests to support Egypt. Doing so will help hold the line against IS and prevent Egypt from turning to a country like Russia for security and economic cooperation,” he said. “Washington should adopt a two-track approach with Egypt, as it has historically done with Turkey, advancing security issues at the same time it pushes for improvements in human rights and democracy,” the piece recommends.

On the flipside, the Washington Post’s Ishaan Tharoor is out with an analysis piece criticizing the release of aid to Egypt. The piece notes that detentions and allegations of human rights violations continued despite the aid being suspended. It heavily relies on quotes from former Cairo bureau chief for the New York Times David Kirkpatrick’s upcoming book on the Obama administration’s tacit acceptance of the Rabaa violence.

On Deadline

Who’s paying for Egypt’s education reform program? In light of the state’s clear policy direction to reform Egypt’s education program, the most important question to ask now is how these reforms will be financed, Soliman Gouda writes for Al Masry Al Youm. Gouda points to the example of former Moroccan Education Minister Rachid Belmokhtar, who was also faced with the daunting task of reforming his country’s education system and ultimately resorted to placing the cost burden on students and their families because he recognized that providing education without charge is simply not a sustainable model.

Worth Reading

Global banks are hosting summer programs to get in early with young heirs who will soon become “the world’s most sought-after clients” for wealth managers — a Camp Rich, if you will, Bloomberg’s Suzanne Woolley says. Banks are realizing that they cannot dismiss young heirs or the potential business they bring, so they’re working to get ahead of the “generational shift in wealth” by capitalizing on the youngsters’ impressionable nature. The camp entails a “three-day workshop for people who were born loaded. Part tutorial and part self-actualization exercise, the event is designed to stamp the UBS brand on the minds of the next generation of the ultra-wealthy — in essence, to hook them while they’re young.” The programs speak to the wants and needs of millennials: Banks are acutely aware of the uninspiring nature of droning on about the importance of investors, so they shift their content to cater to the heirs’ propensity for entrepreneurism and philanthropy. By coming off as relatable, these institutions leave their mark and plant the seeds to reel in the heirs’ business.

Worth Watching

Life appears to be returning to Al Arish: Students are back in classes, buses and taxis are back on the streets, and food is back in the market, signalling the return of life to North Sinai’s Al Arish, whose streets have been vacant over the last several months while a military campaign raged on against terrorist groups in the area. Al Arabiya and Sky News Arabia’s reporters and cameras were among the first to enter the city in almost three years as security measures begin to ease (watch here, runtime: 2:12 and here 2:57).

Diplomacy + Foreign Trade

Egypt has brokered a second ceasefire agreement between rival Syrian opposition factions, Xinhua reports, citing MENA. The agreement, which the factions signed in Cairo yesterday, comes two weeks after Egypt managed to mediate a similar reconciliation between armed groups in Syria. Under the agreement, “rival groups will join anti-terror activities in Syria as well as work to reach a peaceful political settlement to the Syrian crisis.”

Palestinian peacemaking endeavors continue: Foreign Minister Sameh Shoukry met on Sunday with the UN’s special envoy to the Middle East Nikolay Mladenov to discuss Palestinian reconciliation talks, according to a Foreign Ministry statement.

Energy

EGPC signs USD 46 mn oil and gas exploration agreement with BP

The Egyptian General Petroleum Corporation (EGPC) signed a USD 46 mn agreement with BP yesterday for oil and gas exploration the in Gulf of Suez, according to a statement picked up by Ahram Gate. The agreement also includes a USD 4 mn to cover the cost of drilling three wells. The Oil Ministry said it is currently finalizing procedures for 13 other agreements that will be announced soon. The new agreement comes as the government steps up exploration activities in FY2018-19 as Egypt marches toward natural gas self-sufficiency and bids to become a regional energy export hub.

Basic Materials + Commodities

Agriculture Ministry to launch electronic database to monitor livestock market

The Agriculture Ministry is planning to establish an electronic database and barcode system for livestock and poultry farms in a bid to tighten its oversight of the market, the ministry’s Tarek Soliman said. The system, which the ministry is also trying to implement on fruit and vegetable farmers to better track exported produce, will also allow authorities to monitor the size of the market and assess it needs, in addition to allowing them to keep track of any safety or quality violations.

Health + Education

Health Ministry agrees to look into repricing 330 meds manufactured by state-owned companies

Health Minister Hala Zayed has agreed to look into repricing 330 meds manufactured by state-owned companies, Public Enterprises Minister Hisham Tawfik tells Al Mal. According to Tawfik, the repricing will not necessarily entail an increase in the retail price, and will assess possible scenarios to reduce manufacturing costs. He did note that some of these meds are currently being sold at less than their cost of production. This comes as private pharma companies are also pushing to raise med prices, saying the most recent increases in fuel prices and electricity tariffs, along with a global rise in the cost of raw materials made raising med prices a necessity.

Tourism

Government to install 420 surveillance cameras in Hurghada

Authorities in the Red Sea are installing 420 surveillance cameras on Hurghada’s main roads and squares in a bid to tighten security around the city’s tourist hotspots, Governor Ahmed Abdalla said yesterday, Al Masry Al Youm reports.

Telecoms + ICT

MNOs renew calls for NTRA to make additional frequencies available

Mobile network operators sent another request to the National Telecommunications Regulatory Authority (NTRA) to make additional frequencies available for the current fiscal year, sources tell Amwal Al Ghad. MNOs have been making repeated requests to the NTRA, but sources say they are still waiting to hear back on NTRA’s proposed tender for a “limited set of bands” of additional 4G frequencies. Former ICT Minister Yasser El Kady had promised in June that MNOs would receive additional frequencies by August.

Banking + Finance

CBE requires banks to conduct an external quality assurance audit at least once every five years

The central bank issued a directive to banks on Sunday requiring them to conduct an external quality assurance audit by an independent auditor at least once every five years to ensure the bank’s compliance with the Institute of Internal Auditor’s International Professional Practices Framework (IPPF). The audit will also look into internal corporate governance mechanisms and the efficacy of the bank’s in-house auditing procedures, according to the directive. Banks must inform the CBE of their selected auditor before the audit is conducted and submit its findings to the CBE. Banks must inform the CBE on their plans to conduct the audit by 31 October.

Other Business News of Note

600 Egyptian, foreign companies have applied for GEM operations tender

Around 600 Egyptian and foreign companies and consortiums have expressed interest in prequalification for the tender to manage and operate the Grand Egyptian Museum’s (GEM) facilities, GEM supervisor Tarek Tawfik said. The majority of the consortia are dominated by Egyptian companies that have teamed up with one or two foreign entities, Tawfik said, without disclosing any company names. Investors have until 21 August to submit their documents for prequalification.

Egypt Politics + Economics

Bishop’s murder in Beheira was not an act of terrorism, says monk

The murder of Bishop Epiphanius inside a monastery in Beheira earlier this week was not an act of terrorism, a monk at the monastery said yesterday, Ahram Online reports. Official investigations into the incident are ongoing to track down the perpetrator, but have “ruled out” the possibility that the attack was at the hands of terrorists. The bishop was found on Sunday with a smashed skull and injuries on his back.

National Security

Sudan rescues five Egyptian soldiers that went missing on the border with Libya

Sudanese security forces helped rescue five Egyptian soldiers, including an officer, who had gone missing while on patrol in the Egypt-Libya-Sudan border area. A spokesman for Sudan’s security and intelligence agency, told reporters in Khartoum that the soldiers, including an officer, were freed Monday in a special operation by Sudanese forces, according to the AP. Egyptian Armed Forces spokesperson Tamer El Refai thanked Sudanese security forces in a statement on Monday. Neither side stated how or when the soldiers went missing.

Egypt participates in 2018 International Army Games

Egypt is participating in the fourth annual International Army Games, which kicked off in Russia on Saturday, according to an Armed Forces statement. The competition, in which a number of Arab and foreign countries are participating, will wrap up on 11 August.

On Your Way Out

The Egyptian Football Association (EFA) will announce the new national football team coach today, according to EFA head Hany Abo Rida, Youm7 reports. Mexican manager Javier Aguiire is reportedly a front-runner given that his agent arrived to Cairo yesterday for meetings with the federation. The EFA had shortlisted four coaches to replace Hector Cuper, including Colombian Jorge Luis Pinto, Spaniard Quique Sanchez Flores, and Bosnian Vahid Halilhodzic.

The Market Yesterday

EGP / USD CBE market average: Buy 17.84 | Sell 17.94

EGP / USD at CIB: Buy 17.85 | Sell 17.95

EGP / USD at NBE: Buy 17.78 | Sell 17.88

EGX30 (Monday): 15,297 (-0.5%)

Turnover: EGP 529 mn (42% below the 90-day average)

EGX 30 year-to-date: +1.9%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 0.5%. CIB, the index heaviest constituent ended up 0.7%. EGX30’s top performing constituents were Egypt Aluminum up 5.5%, CIB up 0.7%, and Elsewedy Electric up 0.4%. Yesterday’s worst performing stocks were Porto Group down 4.4%, Egyptian Resorts down 4.3%, and Amer Group down 3.6%. The market turnover was EGP 529 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +41.5 mn

Regional: Net Short | EGP -17.3 mn

Domestic: Net Short | EGP -24.1 mn

Retail: 59.2% of total trades | 58.2% of buyers | 60.2% of sellers

Institutions: 40.8% of total trades | 41.8% of buyers | 39.8% of sellers

Foreign: 28.4% of total | 32.4% of buyers | 24.5% of sellers

Regional: 5.1% of total | 3.5% of buyers | 6.8% of sellers

Domestic: 66.4% of total | 64.2% of buyers | 68.7% of sellers

WTI: USD 70.12 (-0.01%)

Brent: USD 74.94 (-0.04%)

Natural Gas (Nymex, futures prices) USD 2.80 MMBtu, (-0.07%, September 2018 contract)

Gold: USD 1,299.70 / troy ounce (-0.15%)

TASI: 8,309.37 (+0.02%) (YTD: +14.99%)

ADX: 4,846.25 (+0.29%) (YTD: +10.18%)

DFM: 2,965.51 (+0.81%) (YTD: -12.00%)

KSE Premier Market: 5,363.92 (-0.46%)

QE: 9,651.77 (+0.22%) (YTD: +13.24%)

MSM: 4,320.46 (-0.41%) (YTD: -15.27%)

BB: 1,370.50 (+0.07%) (YTD: +2.91%)

Calendar

05 August (Sunday): Egypt’s PMI reading for July released.

05-09 August (Sunday-Thursday): CBE hosts 41st annual meeting of the Association of African central banks, Sharm El Sheikh, Egypt.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

28-29 August (Tuesday-Wednesday): CI Capital’s 5th Annual Egypt Equities Conference, Cape Town, South Africa.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

10-13 September (Monday-Thursday): EFG Hermes’ 8th Annual London Conference, Emirates Arsenal Stadium, London.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

18 September (Tuesday): Cairo Economic Court to issue ruling on EGP 5.6 bn antitrust case against pharma companies including Ibnsina.

20-23 September (Thursday-Sunday): 2018 Automech Formula car expo, Cairo International Convention Center, Nasr City, Cairo.

22 September (Saturday): New academic year begins for public schools, universities.

24-25 September (Monday-Tuesday): Arqaam Capital MENA Investors Conference 2018, Four Seasons Resorts, Dubai.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

26 September (Wednesday): E-Commerce Summit, Nile-Ritz Carlton, Cairo.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

12-13 October (Friday-Saturday): Potential dates for a summit in Washington, DC, between US President Donald Trump and Arab leaders to discuss a NATO-style Arab military force.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

November or December: Potential visit to Egypt by French President Emmanuel Macron, with a delegation of business leaders in tow.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

03-05 December (Monday-Wednesday): First Egypt Defense Expo, Egyptian International Exhibition Center, Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

10-13 October 2019 (Tuesday-Sunday) Big Industrial Week Arabia 2019, Egypt International Exhibition Center.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.