- It’s interest rate day. Also: Ramadan. You may next eat at 6:43pm CLT. (What We’re Tracking Today)

- El Sisi promises tax holiday for businesses joining formal economy, says GDP needs to grow at 7.5% to raise living standards. (Speed Round)

- The House is worried about how rising oil prices will hit the 2018-19 budget. Plus: Why Morgan Stanley sees oil at USD 90. (Speed Round)

- Egypt, Sudan and Ethiopia take step toward breaking deadlocked GERD talks? (Speed Round)

- Breaking down the FRA’s new rules on licensing non-bank financial institutions. (Speed Round)

- Idku, Damietta gas export plans to run a full capacity by end of 2019? (Speed Round)

- Being an energy hub covers electricity, too. Here are the first set of milestones to watch for. (On the Horizon)

- The Market Yesterday

Thursday, 17 May 2018

Happy Ramadan, folks: It’s interest rate day.

TL;DR

What We’re Tracking Today

Good morning, friends, and Ramadan kareem. We hope those of you observing the Holy Month are doing better without your morning dose of coffee than we are.

Look for a daytime high of 36°C in Cairo on this first day of fasting, kicking off a heat wave that will see temps stuck in the 40s well into next week.

Bank hours for Ramadan will run 09:30 am to 01:30 pm for customers and from 09:00 am to 02:00 pm for employees, CBE announced.

The EGX will run shorter trading hours for the holy month. The trading session will kicks off at 10:00 am, but closes at 1:30 pm. Tap or click here for the full schedule.

The Cairo Metro system is running additional trains and is moving to extended hours for Ramadan, Al Shorouk reports. All three lines will operate from 5:30 am until 02:00 am (instead of midnight), while only lines one and two will put on extra trains. Egyptian National Railways is also tweaking its service schedule between Cairo, Alex, Mansoura and Ismailia for the month. The full schedule is here for the curious.

So, when do we eat? Maghrib is at 6:43 pm CLT today. You’ll have until 3:20 am on Friday to finish your sohour. By the last day of Ramadan, you’re looking at 3:08am for fajr prayers and 6:58pm for maghrib.

It’s not just Ramadan — it’s interest rate day: The central bank is widely expected to keep interest rates on hold when its Monetary Policy Committee meets today. Nine of 11 economists polled by Reuters expect rates to remain on hold.

A basket of factors argues in favor of stasis: The prospect of an inflationary spike this summer when the next round of fuel subsidy cuts kicks in (annual headline inflation rate dropped to 13.1% in April from 13.3% in March, while core inflation was up fractionally to 11.62% from 11.59%). Oil prices are high and could still rise, as CBE Governor Tarek Amer acknowledged earlier this week. The US Fed is still going to hike interest rates at the same time as the greenback gathers strength.

Oh, and Brazil unexpectedly left its key interest rate unchanged yesterday, with the central bank there explaining in a statement that the ongoing emerging markets rout was at the heart of its decision: “The external scenario became more challenging and volatile. … there was a reduction in risk appetite for emerging economies.”

Not to worry: Tastemaking fund managers are still bullish on EM. The founder of emerging market-focused hedge fund Pharo (which has generated double-digit annualized returns at all of its funds save one over the past five years) still likes the asset class very much, he tells the Financial Times. Meanwhile, Franklin Templeton has thrown Argentina a lifeline, snapping up more than USD 2.25 bn in Argentine bonds.

Back here at home, President Abdel Fattah El Sisi believes “Egypt’s economy needs to grow at least 7.5% a year to lift living standards for a surging population,” Bloomberg reports, picking up on remarks the president made yesterday at his latest youth conference. We have the full rundown in Speed Round, below.

Meanwhile, Reuters will make waves this morning with its investigative piece on the extent of the Armed Forces’ involvement in the economy. The story, headlined From war room to boardroom. Military firms flourish in Sisi’s Egypt, is the product of a year of interviews and includes video content and images.

In our to-be-read pile for this evening as we slip into a steak, sambousek and konafa-induced food coma:

Killing strategy: The disruption of management consulting by CB Insights is deep dive into the creation of the management consultancy industry — and why the industry that claims to have invented the very idea of disruption could now itself be disrupted. Look no further than changing corporate business models (the industry faces its own version of the “inside counsel” revolution that turned the legal world on its ear in the 1970s) and new technologies. Definitely worth a read this morning, whether you’re a consulting geek or a newbie.

The Wall Street Journal is turning heads in Saudi with its piece headlined “I am the mastermind:” Mohammed bin Salman’s guide to getting rich,” which claims to set out how MbS amassed his fortune after realizing as a teenager “that his father … was, by Saudi royal standards, a pauper.”

Speaking of partnerships being disrupted, something is happening in law, too, John Gapper writes for the Financial Times, arguing that law firm partnerships are losing their lustre.

On The Horizon

The British are celebrating a wedding on Saturday as the actor Meghan Markle marries Prince Harry. Our inner republican is aghast.

Upcoming milestones to watch on our march toward becoming a regional energy hub: It’s not only about natural gas, ladies and gentlemen. As part of the state’s drive to position Egypt as a regional energy hub, we’re also hooking our electricity grid up to those of our neighbors with a view to ultimately allowing the increasingly deregulated industry to buy and sell power regionally. Among the milestones to keep an eye on:

- Talks with Cyprus and Greece on a USD 4 bn interconnection project will kickstart within the coming month when a Cypriot delegation visits

- Contracts for an interconnection with Saudi Arabia could be signed by the end of June, sources say

- As many as eight local and global players have been invited to tender a key component of a project to hook our grid to Sudan’s. Reportedly among them: ABB, General Electric, Elsewedy, Schneider, Siemens, and State Grid Corporation of China.

The IMF should issue its progress report on Egypt’s economic reform program in two weeks’ time, Deputy Chief of Media Relations Alistair Thomson has said.

Want to sell stuff to the rest of Africa? If hawking more of your wares in Africa is on your list of things to do, pencil in the Afreximbank-backed Intra-African Trade Fair, set to run in Cairo from 11-18 December. Lots of detail on the conference’s website here.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s fifth national youth conference reigned supreme on the airwaves as the pre-Ramadan slowdown left little else for the talking heads to discuss. We have a thorough rundown of El Sisi’s most important statements from the conference in Speed Round, below.

Economy was at forefront of El Sisi’s remarks at daylong event: El Sisi’s comments on the state of the economy and reassurances that he will not put the brakes on reforms were among the most significant to come out of the conference, said Hona Al Asema’s Lamees Al Hadidi. She hailed the president’s vow to offer incentives to businesses who join the formal economy, saying that the move would be beneficial since 60% of Egypt’s economy is informal (watch, runtime: 49:56).

Lamees also showed a graph as visual evidence of the Cairo Metro’s losses over the past several years in a bid to convince viewers that the government’s decision to hike ticket prices was justified. According to Lamees’ data, the metro’s Line 1 needs around EGP 30 bn for development work, while Line 2 needs EGP 15 bn. The host also renewed her calls for commuters to apply for metro memberships (watch, runtime: 3:32).

Adib hails GERD “breakthrough”: Egypt, Sudan and Ethiopia’s latest talks on the Grand Ethiopian Renaissance Dam were a “breakthrough” but El Sisi noted that the issue has yet to be resolved, Adib told his viewers (watch, runtime: 5:32).

Lamees, Adib, and Masaa DMC’s Osama Kamal all praised El Sisi’s decision to issue a presidential pardon for 332 prisoners, including a few who were arrested for protesting. Lamees made it a point to tell viewers that none of those pardoned face charges of violence or incitement against the state (watch, runtime: 3:27 and runtime: 1:32).

Did we get punk’d by Amr Adib? The Kol Youm host announced last night he is backtracking on his decision to retire from late night television, saying that he will be back by popular demand in September (watch, runtime: 2:06). Good luck getting a nice write up from us when do eventually ride off into the sunset, Boy Who Cried “Quit”. Just for that, we’re playing your fawning Messi interview.

Also on the airwaves last night: Osama Kamal sat down with Islamic scholar Al Habib Ali Al-Jifry (watch, runtime: 8:55) and discussed Twitter activity during the holy month with Twitter’s MENA Director of Media Partnerships, Kinda Ibrahim (watch, runtime: 7:42). Lamees had a lengthy segment on the Ramadan mosalsalat lineup (watch, runtime: 2:30:36) and beacon of health Amr Adib discussed fasting and chronic diseases with a group of doctors (watch, runtime: 37:09).

Speed Round

GDP growth for 3Q2017-18 accelerated to 5.4% President Abdel Fattah El Sisi said at his fifth national youth conference yesterday. Economic conditions are improving, but challenges including a bloated public sector persist, El Sisi said. Nonetheless, the state does not plan on laying off civil servants. He urged businesses to continue investing at home, saying that delaying on investments will only slow the recovery and make the burden heavier for everyone. The president said he expects living conditions to improve within two years as the state’s projects begin to bear fruit, according to Al Shorouk.

All businesses that legalize their status and enter the formal economy will be exempt from paying taxes for five years, El Sisi also vowed yesterday, Al Mal reports. Businesses choosing to go legit will enjoy other incentives including simplified access to social insurance. El Sisi did not offer further details on these plans. The Finance Ministry had been planning to offer SMEs of a certain size full or partial tax exemptions to enter the formal economy as part of the SME Act, but has reportedly been moving towards a different proposal that would set a flat tax for SMEs based on the size of their top line, Tax Authority sources had told us earlier this month.

In the meantime, there’s no stopping reforms. Among the top priorities for the government right now is supporting domestic industry to create jobs and cut down on Egypt’s import bill, El Sisi said. The overhaul of the educational system will also move ahead and is necessary to prepare the next generation Egyptians entering the labor force, he said.

The president admitted that the government has failed to curb population growth, according to Al Shorouk. El Sisi stressed that high population growth will have an adverse effect on economic growth and make it harder to raise the standard of living for everyone. His economic reform program, he said, will not be as effective if population growth is not contained. With that in mind, Egypt needs to grow its economy 7.5% per annum to lift living standards, the president said, according to Bloomberg.

The president touched on other economic and social issues during the conference, including the recent decision to hike prices on the Cairo Metro, which he said was a difficult but necessary move to keep the trains running, Al Masry Al Youm reports. The price hikes are part of a “four-year plan across all sectors, water, electricity, and sewage,” El Sisi said, according to Reuters.

On the political front, El Sisi said that more time is needed for Egypt, Ethiopia, and Sudan to reach an understanding over the Grand Ethiopian Renaissance Dam, Reuters reports. He has invited Ethiopian Prime MInister Abiy Ahmed to visit Egypt for further talks. The president also discussed the inauguration of the US embassy in Jerusalem, which he said will have negative repercussions on the region, the newswire says. El Sisi stopped short of publicly criticizing the US for its embassy move, and instead urged Israel to be more understanding of Palestinians’ outrage over the issue.

El Sisi also ordered the release of over 330 youth prisoners yesterday ahead of Ramadan, Ahram Gate reports.

The House is worried about how rising oil prices will hit the 2018-19 budget: Meanwhile, the House of Representatives Budget Committee is debating whether to set aside more funds in case the government overshoots its 2018-19 budget deficit target, committee’s deputy chair Yasser Omar says. The committee is mulling whether to raise the effective overdraft limit to 6% of expenditures from 3-5% in the current draft of the budget, he suggested. This comes as global oil prices inch further toward USD 80. Next fiscal year’s budget assumes an oil price of USD 67/bbl and identifies rising prices as among the top risk to the government not meeting its budget targets. Pharos Research head Radwa El Swaify said that every USD 1 increase in global oil prices could see the government’s subsidy bill rise by an average of EGP 4 bn annually.

The committee plans to conclude its budget review by the start of June, committee chair Hussein Eissa said yesterday. The committee will hand its report over to the general assembly after having held 14 meetings with different ministers to discuss its details. The House of Representatives’ general assembly is now in recess until 3 June, Ahram Gate reports. House committees look set to meet during the recess to discuss pressing legislation, including the FY2018-19 state budget.

On oil prices, Morgan Stanley sees them at around USD 90 for the foreseeable future regardless of short-term political tensions. The investment bank sees this as the oil price by 2020 on the back of new shipping regulations taking effect, which should dramatically change the industry, according to Bloomberg. “We foresee a scramble for middle distillates that will drive crack spreads higher and drag oil prices with it,” wrote Morgan Stanley analysts. New International Maritime Organization rules call for ships to reduce the maximum sulfur content of their fuels to 0.5%, from 3.5% in most regions, which is expected to cause an oversupply in high-sulfur fuel. Bank of America predicts oil will get as high as USD 100 as early as next year.

El Sisi’s remarks on the GERD talks yesterday came as Egypt, Sudan and Ethiopia may have taken a step toward breaking a deadlock that had mired negotiations for several years now. The foreign ministers of Egypt and Ethiopia and Sudan’s water resources minister signed a declaration in Addis Ababa on Wednesday that charts the next path for the negotiations. The three countries agreed to set up a joint scientific committee to consult on the filling of the dam. The committee will discuss and develop “various scenarios related to the filling and operation rules in accordance with the principle of equitable and reasonable utilization of shared water resources while taking all appropriate measures to prevent the causing of significant harm,” according to a copy of the declarations posted by the Foreign Ministry. Egypt also agreed to Sudan and Ethiopia posing questions on the findings of the French consultancy, whose report over the impact of the dam on Egypt was rejected earlier this year by Sudan and Ethiopia. The leaders of the three countries commit to meeting every six months, with the next meeting taking place on 3 July.

At a time when every investment banker and his semi-numerate half-cousin wants to launch an NBFI play, the Financial Regulatory Authority issued new regulations last week on the licensing new entrants to the industry. The regulations are designed to ensure transparency in the industry — and to make sure that any NBFI has an anchor shareholder that knows NIM ≠ Nimh. (The first being one’s net interest margin, and the second being bedtime reading for the elementary school set).

What do the new NBFI regulations do? They set out stipulations on ownership structure, require regulatory approval for additional stake sales, and force minority shareholders holding stakes of up to 5% to declare their ownership status within two weeks of completing the transaction.

Who’s covered? Companies already working in (or looking to set up shop in) sectors including securities and investment banking, refinancing and valuation, financial leasing, factoring, microfinance and insurance, according a primer on the regs from our friends at Shalakany Law Office (pdf)

The basics: At least 50% of an NBFI’s equity must be owned by legal persons and at least 25% of the share capital must be held by a financial institution. New entrants will be required to submit technical and feasibility studies with their filing, as the FRA will hand out licenses for services based on the market’s need for them. Companies will have to seek regulatory approval before offering or adding any services to their portfolio.

Other highlights from the decision include:

- Shareholders owning 10% or more of capital must receive regulatory approval before acquiring an additional 5% or more of the company;

- Shareholders must also acquire approval before acquiring a third or more of a company;

- Any group or entity holding a stake of 25% or more must submit to the FRA their future investment plans, as well as their management strategy and policies;

- Companies must begin operating within six months of receiving FRA approval. The rules grant a three-month extension window, after which the permit will be considered void. Final licenses should be obtained within three months of starting operations.

Idku, Damietta gas export plans to run a full capacity by end of 2019? “The start of the third production unit at Egypt’s giant Zohr offshore gas field earlier this week, the country’s need for LNG imports is rapidly drawing to a close,” LNG World Shipping writes. It’s a good dive into recent developments in the field. The bottom line: LNG imports are on track to phase out by year’s end, and we’ll likely see LNG the liquefaction plants at Idku and Damietta running at nameplate capacity by the end of next year. Having been cheerleaders for Egypt’s emergence as a regional energy hub since we started writing back in 2014, we couldn’t be happier about this one.

LEGISLATION WATCH- House signs off on Social Housing and Mortgage Finance Support Act: The House of Representatives signed off on the Social Housing and Mortgage Finance Support Act during its plenary session yesterday, Housing Minister Mostafa Madbouly reportedly said. Under the new law, the Social Housing Fund and the Mortgage Finance Fund will be merged into a single entity to streamline mortgage financing procedures, according to the minister. The law also sets a framework for the pricing of land and state-subsidized housing, as well as the services that residents in those projects have access to. The law enshrines citizens’ rights to access safe and affordable housing and supports a government-led, countrywide urban development plan, according to Mortgage Finance Fund Chairman Mai Abdel Hamid.

Elsewedy Electric replaced Global Telecom Holding (GTH) on the MSCI Global Standard Index (pdf), while GTH and Misr Fertilizers Production Company (MOPCO) joined the MSCI Global Small Cap Index (pdf). The changes are part of the MSCI’s semi-annual index review.

EARNINGS WATCH- B Investments reported a net profit after tax of EGP 33.5 mn in 1Q2018, down from EGP 54.9 mn during the same period last year, according to an EGX filing (pdf). Net revenues for the quarter also dropped to EGP 42.6 mn, from EGP 59.8 mn in 1Q2017. The drop in net profits came as a result delayed dividends payments from key investments. The firm’s inaugural earnings release since going public was just out earlier this month, showing net profit growth of 152% y-o-y to EGP 133.2 mn in FY2017.

Careem is looking to roll out service in 250 cities across the MENA region, Turkey, and Pakistan as it works towards becoming profitable by 2020, CEO Mudassir Sheikha tells The National. “Our estimate is there’s at least 250 cities in our region that should have a service like Careem, these may not be the tier-one Cairos of the world, but they’re still important,” Sheikha says. These include as many as 10 cities in Egypt, including Assiut, as well as 25 cities in Pakistan. Expansion in Africa “is on the horizon” but remains under study, Sheikha says, adding that the company does not see the need for additional funding to support its ambitious expansion plans over the coming years. An IPO is also not in the company’s immediate plans, despite it being a “natural milestone,” the CEO said.

MOVES- Vodafone CEO Vittorio Colao is stepping down in October and handing the position over to protege Nick Read, Reuters reports. The move is being heralded in a press as a passing of the torch from a CEO who is universally acclaimed as having turned an asset laiden Vodafone ready to implode to a slender heavyweight competitor to the big Euro players and a generator of enormous shareholder wealth. The Financial Times does an excellent job summarizing Colao’s transformational impact and the large shoes left for Read to fill.

USD 5 bn merger to create Saudi Arabia’s third-largest lender: HSBC-owned Saudi British Bank (SABB) is acquiring Alawwal Bank in a USD 5 bn transaction that will create the kingdom’s third-largest lender. It’s the first bank merger in KSA since 1999; Alawwal is 40%-owned by a consortium led by the Royal Bank of Scotland, while SABB is 40%-owned by HSBC. Reuters and the Financial Times have coverage.

Egypt in the News

We kick off Ramadan with a wonderfully slow news day for Egypt in the international press.

Egyptian Liverpool star Mo Salah promotes the positive symbolism of Ramadan and embodies the values of Islam “at a time when anti-Islam rhetoric is rampant in the West,” according to Quartz Africa.

Otherwise, the pickings are slim:

- Several Armenian airlines will include Egypt in their charter flight routes this summer after receiving the required licenses, News.am reports.

- US teachers are using Egypt-set Assassin’s Creed Origins video games in the classroom to give antiquities and history lessons, the New York Times reports.

On Deadline

The CBE’s debt relief program for businesses with non-performing loans will be a breath of fresh air for industry and agriculture alike, Dorreya Sharaf El Din writes in a column lacking any real opinion or analysis. This is about the extent of the usefulness of opinion writers yesterday.

Worth Reading

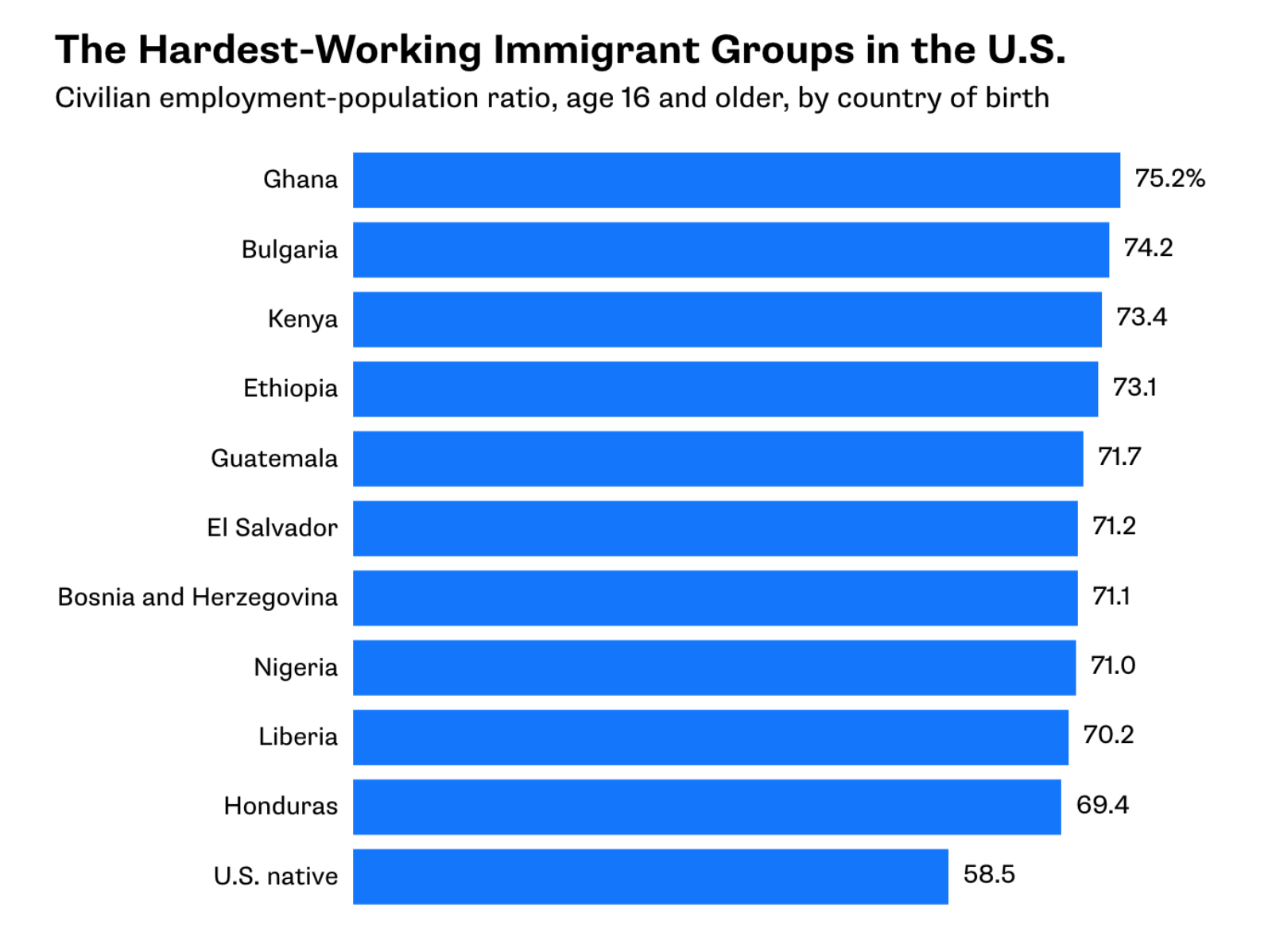

African-born immigrants to the US are more skilled, harder-working, and more ready to integrate than those who come from other parts of the world, says Bloomberg’s Justin Fox. Individuals from Mexico, El Salvador, Honduras, and Guatemala account for the lion’s share of immigrants in the US, and while they dominate the least-educated immigrant groups, they are also among the hardest-working. Other immigrant groups from countries such as India, Taiwan, Russia, and Bulgaria, are among the highest-educated but are not among those with the higher employment-population ratio. Fox notes, however, that their low employment rates are likely attributable to their being in the US to pursue further education, and not because of poor integration or laziness. Of all the immigrant groups assessed in Fox’s charts, African immigrants seem to have the best combination of characteristics: “If we want more high-skilled, hardworking, English-speaking, ready-to-integrate immigrants, it looks like the most obvious place to find them is in African countries where English is widely spoken.”

Diplomacy + Foreign Trade

Egypt and Hamas reached an agreement to keep riots in Gaza “from escalating to a fresh conflict with Israel,” Hamas leader Yahia Sinwar said, Times of Israel reports. However, Sinwar said that the group, which rules Gaza, would resort to armed resistance if “Israel goes overboard” in its violence against Palestinians. Israeli Intelligence Minister Israel Katz claimed that Egyptian authorities threatened to “not help” if Hamas did not contain the border protests and Israel decided to “take much harsher steps.”

Egypt hands over CCTV footage of Regeni to Italian prosecutors: Egyptian authorities have handed over CCTV footage retrieved from the metro station where Italian PhD student Giulio Regeni disappeared in 2016 to a team of Italian prosecutors visiting Cairo, according to Italian newspaper Il Messaggero. The footage could take as long as 12 days to review and determine whether or not it has been altered, the newspaper says. The Italian prosecutors had arrived in Cairo on Tuesday.

The Ismail government is in talks to borrow as much as USD 5 bn from the World Bank and other lenders to support development in Sinai, sources tell Al Mal. The Housing and Investment Ministries are leading the efforts to identify priority projects in Sinai, the sources add. Investment Minister Sahar Nasr had already begun talks with the World Bank last month for a USD 1 bn loan for projects in the peninsula, which the government says will cost an estimated EGP 275 bn over four years. She has also secured commitments from development finance institutions including USD 100 mn from the Kuwait Fund for Arab Economic Development, while the Ismail Cabinet signed off on USD 258.5 mn in funding from KFAED for Sinai.

Energy

Banks, including IFC, EBRD to begin disbursing Benban funding in August

International lenders, including the International Finance Corporation (IFC) and the European Bank for Reconstruction and Development (EBRD), will begin disbursing some of the USD 2 bn in foreign funding to the solar park of Benban in August, sources said. Companies who have received financing from these banks, will see an initial disbursement of some EUR 20-30 mn to finance construction of the solar plants, they added.

Automotive + Transportation

Indonesian firms looking for opportunities in Egypt’s railway sector

Indonesian firms are looking to participate in railway development projects in Egypt, including upgrades to the Cairo Metro’s Lines 1 and 2, Jakarta’s ambassador to Cairo, Helmy Fauzy, told Transport Minister Hisham Arafat in a meeting yesterday. A delegation of Indonesian executives will be meeting with Egyptian transport officials soon to decide on which projects the country can get in on, Al Mal reports.

Banking + Finance

Abu Qir mandates NBE, QNB, Banque Misr to arrange EUR 105 mn

Abu Qir Fertilizers’ board of directors agreed on Tuesday to mandate a consortium made up of the National Bank of Egypt, Qatar National Bank Ahli, and Banque Misr to manage a EUR 105 mn loan for its nitric acid project, the company said in a statement to the EGX (pdf). Germany’s ThyssenKrupp has been tapped to execute the EUR 133.6 mn project, according to the statement.

Raya’s Aman to hold talks with four banks to borrow EGP 481 mn

Raya Holding subsidiary Aman is planning to hold talks with four unnamed local banks to borrow EGP 481 mn to begin financing SMEs as of next year, CEO Hazem Moghazy tells Al Mal. Aman may sign the loan contracts within weeks, he adds.

Egypt Politics + Economics

Cabinet economic group discusses tablet, solar power, logistics projects

The Ismail Cabinet’s economic group discussed a strategy to expand local production of computer tablets used as part of the education system modernization plan during a meeting on Tuesday, according to a statement. The strategy includes setting up new production lines, raising production output, and bringing the local component of the manufactured tablets to 90%. The committee also decided to move ahead with procedures to construct a 400-feddan logistical zone in the Alexandria Port, which will be used as a trading, storage, and industrial hub. The ministers also agreed to purchase the first 200 MW of energy produced from a private solar plant in Minya in EGP, after which the rate for all subsequent energy purchased from the plant will be reassessed. No details were provided on which plant it was or who’s running it.

On Your Way Out

Everything an innovator needs to know about Cairo: Entrepreneur Maie ElZeiny compiled a guide for Singularity Hub of everything an innovator needs to know about Cairo, including the most convenient coworking spaces, the best coffee shop with free WiFi, and who to seek out to drum up some financing for a startup.

British-Egyptian scientific education fund Newton-Mosharafa is touring several universities in Egypt to offer Egyptian scientists research collaborations, PhD scholarships, and postdoctoral fellowships, according to an embassy statement. The fund “allows outstanding Egyptian scientists the opportunity to partner with or study at the UK’s leading universities.”

The Market Yesterday

EGP / USD CBE market average: Buy 17.86 | Sell 17.96

EGP / USD at CIB: Buy 17.86 | Sell 17.96

EGP / USD at NBE: Buy 17.77 | Sell 17.87

EGX30 (Wednesday): 16,993 (0.00%)

Turnover: EGP 1.1 bn (5% BELOW the 90-day average)

EGX 30 year-to-date: +13.31%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session almost flat. CIB, the index heaviest constituent ended up 1.2%. EGX30’s top performing constituents were TMG Holding up 1.8%, ACC up 1.4%, and AMOC up 1.3%. Yesterday’s worst performing stocks were Elsewedy Electric down 4.1%, GB Auto down 2.5%, and Telecom Egypt down 2.4%. The market turnover was EGP 1.1 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +26.9 mn

Regional: Net Short | EGP -4.4 mn

Domestic: Net Short | EGP -22.6 mn

Retail: 59.8% of total trades | 62.0% of buyers | 57.6% of sellers

Institutions: 40.2% of total trades | 38.0% of buyers | 42.4% of sellers

Foreign: 21.7% of total | 22.9% of buyers | 20.4% of sellers

Regional: 10.8% of total | 10.6% of buyers | 11.0% of sellers

Domestic: 67.5% of total | 66.5% of buyers | 68.6% of sellers

WTI: USD 71.70 (+0.29%)

Brent: USD 79.32 (+0.05%)

Natural Gas (Nymex, futures prices) USD 2.82 MMBtu, (+0.04%, June 2018 contract)

Gold: USD 1,292.90 / troy ounce (+0.11%)

TASI: 7,958.47 (-1.01%) (YTD: +10.13%)

ADX: 4,467.43 (-0.07%) (YTD: +1.57%)

DFM: 2,931.59 (-0.18%) (YTD: -13.01%)

KSE Premier Market: 4,775.99 (-0.1%)

QE: 8,950.60 (+0.32%) (YTD: +5.01%)

MSM: 4,653.78 (-0.66%) (YTD: -8.74%)

BB: 1,272.92 (-0.08%) (YTD: -4.41%)

Calendar

17 May (Thursday): Expected date for the start of Ramadan.

17 May (Thursday): CBE’s Monetary Policy Committee meeting.

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday (Look for possible Monday off given the first day falls on a Friday).

28 June (Thursday): CBE’s Monetary Policy Committee meeting.

16 August (Thursday): CBE’s Monetary Policy Committee meeting.

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday.

04-05 September (Tuesday-Wednesday): Euromoney Egypt Conference 2018, Cairo.

11 September (Tuesday): Islamic New Year (TBC), national holiday.

24-25 September (Monday-Tuesday): Egypt Water Desalination Forum, venue TBD.

27 September (Thursday): CBE’s Monetary Policy Committee meeting.

06 October (Saturday): Armed Forces Day, national holiday.

23-24 October (Tuesday-Wednesday): Intelligent Cities Exhibition & Conference 2018, Fairmont Towers Heliopolis, Cairo.

15 November (Thursday): CBE’s Monetary Policy Committee meeting.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25-28 November (Sunday-Wednesday): 22nd Cairo ICT, Cairo Convention Center, Nasr City, Cairo.

11-18 December (Tuesday-Tuesday): The Afreximbank-backed Intra-African Trade Fair in Cairo.

25 December (Tuesday): Western Christmas.

27 December (Thursday): CBE’s Monetary Policy Committee meeting.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas.

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC).

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.