- Does December’s uptick in car sales mean the industry has turned the corner? (Speed Round)

- M&A WATCH- Spain’s Mediterrania acquires stake in Cairo Scan as healthcare M&A activity continues to gain steam. (Speed Round)

- EFG Hermes inaugurates rep office in Bangladesh. (Speed Round)

- CI Capital’s IPO is happening, but may not be imminent, chairman signals. (Speed Round)

- Global markets in the red again yesterday. (What We’re Tracking Today)

- National Bank of Greece taps advisors for exit from Egypt. (Speed Round)

- Budget deficit to come at 9.4% of GDP this fiscal year -Maait. (Speed Round)

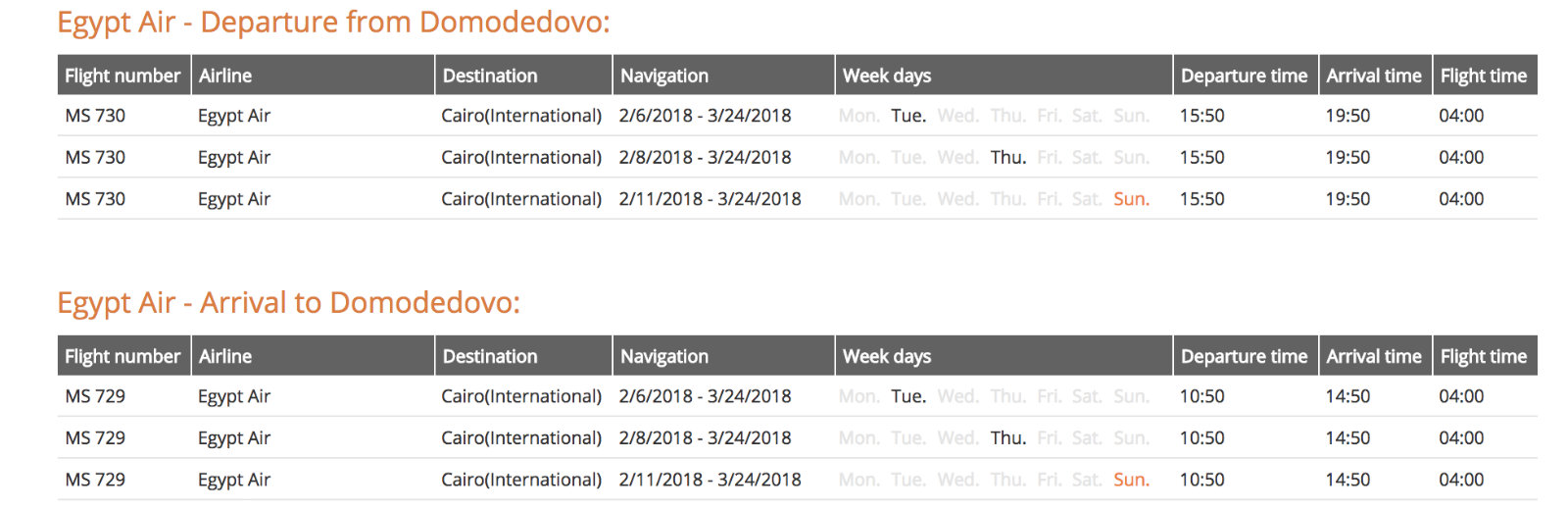

- Direct flights with Moscow to resume on 6 February. (Speed Round)

- The Market Yesterday

Wednesday, 31 January 2018

Is the nation’s car market finally turning the corner?

TL;DR

What We’re Tracking Today

Global markets closed in the red again yesterday, with US stocks falling to their lowest levels since May of 2016 “as investors worry that a long winning streak has pushed valuations too far,” the Financial Times reported overnight. The selloff in US equities and a fall in US treasury prices comes ahead of the US Federal Reserve’s Wednesday meeting. Investors are also warily looking ahead to earnings releases expected this week from Apple, Facebook, Amazon and Google, the newspaper suggests. The Wall Street Journal, meanwhile, notes that the selloff in US equities — largely echoed in markets globally, albeit on different drivers — was compounded by worries over rising oil production and an unusual announcement targeting the healthcare sector.

Here at home, the EGX30 closed down 0.4% yesterday on moderate volumes, reversing gains made on Monday.

That healthcare announcement that’s roiling global markets? The global industry is watching very warily after Amazon, Warren Buffett’s Berkshire Hathaway and JPMorgan Chase said yesterday they’re going to ‘disrupt’ the industry in the US. The three companies are partnering to find ways to lower healthcare costs and improve outcomes for their hundreds of thousands of employees by deploying tech and other tools. The not-for-profit venture will focus on delivering “simplified, high-quality and transparent healthcare” for more than 500k employees, they said. The news is all over the front pages of the global business press: Financial Times, Reuters, Bloomberg (news | analysis), Wall Street Journal and New York Times.

Closer to home:

Expect positive central bank reserves announcement: Egypt’s foreign reserves are sufficient to cover eight-months’ worth of imports, CBE Sub-governor Rami Aboul Naga said, according to Reuters. The reserves figure stood at USD 37.02 bn in December, which is roughly equivalent to a 7.8-month import cover, implying at least stability in the reserves figure month-on-month.

CI Capital’s 2018 MENA Investor Conference kicked off yesterday and will run until 1 Feb at the Four Seasons Nile Plaza. The conference brings together more than 200 investors from 75 regional and international organizations with an aggregate AUM of USD 10 tn, according to a statement carried by Al Masry Al Youm. We stopped in for day one and have highlights in this morning’s Speed Round, below.

IMF boss Christine Lagarde thinks Arab nations need to take “urgent action” to promote job growth and address “simmering discontent” among youth. “The private sector needs to step in and step up, and … government action could help [by] … combating corruption, increasing competition, and taking advantage of global trade and new technologies, the Financial Times reports.

The US Secretaries of state and defense wish we could all just get along. The two “called on all sides in the dispute between Qatar” and the Arab Quartet to “work to calm tensions, saying a united Gulf Cooperation Council bolstered regional stability,” Reuters reports. Rex Tillerson and Jim Mattis made their remarks in a joint appearances with the Qatari foreign and defense ministers.

In business news, global M&A activity has been interesting so far this week:

JAB, the folks who own the Keurig coffee pods brand, have snapped up Dr. Pepper, 7Up and Snapple in a USD 18.7 bn takeover that’s getting plenty of attention in the US for the breadth of its ambition to “create a food-and-coffee empire.” See coverage and analysis in Reuters, the New York Times and the Wall Street Journal. JAB already owns Peet’s Coffee and Krispy Kreme.

Blackstone is in “advanced talks” to acquire a controlling 55% stake in the Thomson Reuters’ Financial and Risk business, sources tell Reuters. The unit, which “contributes more than half of Thomson Reuters’ annual revenues,” is valued at around USD 20 bn, they said. The board reportedly met yesterday to review Blackstone’s offer. The F&R business unit “supplies news, data and analytics to banks and investment houses around the world.” Bloomberg Gadly wonders whether the transaction “heralds an era of offbeat megabuyouts,” while the Financial Times notes that Blackstone is now going to be going head-to-head with Bloomberg.

Donald Trump is delivering his “state of the nation” address as we write these words.

In miscellany today:

- There’s backlash against dark, slim jeans, the Wall Street Journal tells us, writing that “stylish guys” are wearing relaxed fits, stretch denim, lighter washes and jeans with less distress.

- Bloomberg is offering up After 45 Birthdays, Here Are ’12 Rules for Life.’

What We’re Tracking This Week

New railway ticket prices could be announced as early as this week, now that the Transport Ministry has signed off on the new pricing scheme.

Don’t miss the trifecta of moons tonight. The full moon will be brighter and larger than you’ve ever seen it. Best viewed at moonrise, says NASA.

On The Horizon

A delegation of 22 British companies led by UK trade envoy Jeffrey Donaldson is visiting Egypt on 10 February to form a tripartite trade agreement between the UK, Egypt and China to target exporting to African markets.

Egypt’s Emirates NBI PMI reading for January will be announced on Monday, 5 February.

Enterprise+: Last Night’s Talk Shows

The presidential elections still featured prominently in talking heads’ discussions last night but a few other topics of interest also came up.

Hona Al Asema’s Lamees Al Hadidi announced her partnership with CIB to sponsor her startup competition, Hona Al Shabab, this year. This season will be run under the theme of “empowering fintech,” per the bank’s suggestion. CIB’s sponsorship reflects its support of entrepreneurs, financial inclusion, and financial technology, Chief Digital Officer Mohamed Farag told Lamees. The bank will award the winners of each episode EGP 100k, with that amount doubling for fintech projects. Winners of the competition’s grand prize will receive funding of EGP 500k. CIB’s chief data officer told Lamees that CIB sees fintech projects as a key tool in the nation’s financial inclusion drive, noting that low bank penetration has been an obstacle to economic growth (watch, runtime: 15:31).

Shifting her attention to the political scene, Lamees expressed her dismay at the small size of the opposition bloc calling for a boycott of the elections. The host said she was expecting a much larger gathering to make the opposition’s voice heard loud and clear. She made it a point, however, to clarify that she doesn’t support the notion of boycotting elections, which would only embarrass Egypt on the world stage. She urged the opposition to start putting in some legwork as of this moment to prepare a strong presidential candidate for the elections in 2022 (watch, runtime: 3:26).

Lamees also had a chat with head of the Free Egyptians Party, Essam Khalil, who agreed that a boycott aims to embarrass Egypt. The Free Egyptians had publicly announced its support for President Abdel Fattah El Sisi’s reelection earlier this month (watch, runtime: 4:49).

Lawyer Khaled Abu Bakr phoned in to say that, while the current situation may not be ideal, El Sisi won the presidency in 2014 by a landslide and democracy says that the majority rules. He also slammed the calls for an election boycott as a “betrayal” that wants to convey an inaccurate image of the country to the world (watch, runtime: 4:59).

Kol Youm’s Amr Adib, meanwhile, declared that he will participate in the elections by voting to protect what he calls the country’s “quasi-democracy” (watch, runtime: 6:03).

Over on Masaa DMC, Osama Kamal sat down with Support Egypt Coalition head Mohamed Elsewedy for an extended conversation about the elections. Elsewedy reaffirmed that MPs were not obligated to sign endorsement forms for El Sisi, and that there are some MPs who have not given their signatures in support of any candidate. He also criticized the inactivity of the country’s political parties, saying that citizens are completely unaware that there are currently 110 active parties (watch, runtime: 1:25:51).

In non-election talk, Kamal also spoke to Public Enterprises Minister Khaled Badawy, who said that public pharma companies are, for the most part, enjoying healthy profits. Of the country’s 11 pharma holding companies, only three are incurring losses because they had been selling their products at pre-float prices. According to the minister, one of these companies recorded losses of as much as EGP 600 mn. He encouraged pharma companies to diversify their product range and cut off meds that are not doing well on the market (watch, runtime: 5:03).

Back on Kol Youm, Adib spoke to Morsi-era oil minister Osama Kamal about the recently-inaugurated Zohr gas field, which Kamal said is a symbol of political stability that played a key role in regaining investors’ trust in Egypt. The former minister reminded Adib that at some point, Egypt was importing up to 1.5 bcm of gas at a cost of EGP 10-15 mn dollars, and that the country will no longer be spending these sums on gas imports. He also suggested that it might be best to use surplus gas in petrochemical industries domestically, rather than seeking profits by exporting it to international markets (watch, runtime: 6:42).

Mansoura University paleontology professor Hisham Sallam, who headed the research team that uncovered a new species of dinosaur in the Western Desert, told Adib that the fossil was actually first discovered in the Western Desert in 2013. The research team has unearthed around 65% of the dinosaur’s skeleton, and the search is still on for its jaw, part of its skull, and some neck and back vertebrae (watch, runtime:12:57).

Speed Round

Is the car market finally turning the corner? A low base effect certainly helped, but: Car sales grew 17.3% y-o-y in December, making it the first month in 2017 in which sales rose substantially, according to a report by the Automotive Information Council (AMIC) report picked up by Al Borsa. The year-long slump in the auto industry, which saw passenger car sales decline 30% in FY2017 after the float of the EGP in late 2016, finally slowed in November, which saw a 0.4% increase in sales. Passenger car sales in December grew a sharp 21% y-o-y, with around 11,000 cars sold. Industry leader GB Auto held a 29% market share. By brand, Chevrolet cars topped sales in December with a 22% market share, followed by Hyundai (20%), and Renault (17%). AMIC member Raafat Masrooga said that 2018 should see a continuation of this rebound as the overall macroeconomic climate improves.

M&A WATCH- The nation’s healthcare sector continues to be the most interesting center of gravity for M&A. The latest news sees Spain’s Mediterrania Capital acquiring a 40% stake in Cairo Scan for a reported EGP 103 mn. Mediterrania disclosed the investment, its first in Egypt in a statement (pdf) yesterday that stopped short of putting a value on the transaction, noting that it acquired the 750-person company through its MENA-focused fund MC III. Al Mal cites unnamed sources for the c. 40% figure, saying sellers included chairman and managing director Mohamed Abdel Wahab and shareholder Ashraf Selim. “Mediterrania Capital Partners investment is aimed at supporting the group’s development plans, including the expansion of Cairo Scan’s branch network and the construction of a state-of-the-art flagship branch that will provide improved access to a significant portion of the population in Egypt,” the company said in a statement. EY provided financial due diligence to Medietrrania, while Zaki Hashem & Partners were legal counsel on the buyside.

El Nozha Int’l bucking acquisition offer from Cleopatra? Cleopatra Hospitals’ bid to acquire El Nozha International Hospital is apparently hostile, with Al Borsa reporting that it has seen a copy of a complaint El Noza has filed with the Financial Regulatory Authority (FRA) alleging that its shares were subject to stock market manipulation in the run up to Cleo’s filing of a mandatory tender offer to acquire 100% of the 110-bed Heliopolis hospital. The newspaper reports that El Nozha claims its shares dropped 25% in value to EGP 60 per share in the two months before Cleopatra Hospitals Group filed its bid. Al Borsa says Cleopatra Hospitals had nothing to do with the pre-offer transactions and emphasizes that the MTO met all requirements of the Capital Markets Act.

On a related note, FRA had apparently requested that Cleopatra Hospital Group seek approval from the Health Ministry for the MTO, according to sources close to the matter.

EFG Hermes is opening a representative in Dhaka, Bangladesh, to serve its global institutional clients. “Bangladesh is a key market as part of our drive to expand our representation in high-potential frontier emerging markets,” said EFG Hermes Holding Group CEO Karim Awad. He added that the group is “actively exploring opportunities in both Sub Saharan Africa and Southeast Asia with a view to entering one more market this year.” EFG’s presence in Dhaka comes “after several successful investor trips in recent months; which clarified that our clients demanded corporate access to explore compelling opportunities in the Bangladeshi economy and on the Dhaka Stock Exchange,” EFG Hermes Frontier CEO Ali Khalpey says. Bangladesh has consistently been one of the world’s fastest growing over each of the past seven years.

CI Capital’s IPO is happening, but may not be imminent, chairman signals: CI Capital’s IPO may not take place anytime soon, as the company has yet to decide on the transaction size, said CI Capital Chairman and Group CEO Mahmoud Attallah at the firm’s 2018 MENA Investor Conference, the kickoff of which we attended yesterday. As the company is looking to use proceeds from the listing to fund future acquisitions in non-banking financial companies, it will first decide on its acquisition targets before determining the size of the IPO, he added.

Speaking on the IPO of 24% of state energy firm Enppi, Attallah said it has cleared all legal and procedural hurdles. “All procedures to launch the IPO have been approved by the ministerial committee supervising the state IPO program,” said Attallah. He did not, however, give a timeframe for the transaction. Investment Minister Sahar Nasr had said last year that the listing, on which CI Capital is advising alongside Emirates NBD and Jefferies International, will take place in 1Q2018.

Attallah added that CI Capital has retail and healthcare IPOs in the pipeline for execution this year. The firm is also very keen and interested in the education sector, he said. Attallah tipped consumer goods, finance, real estate and healthcare as being particularly interesting to foreign investors of late.

National Bank of Greece taps advisors for exit from Egypt: The National Bank of Greece has reportedly tapped Ernst & Young as financial advisor and Matouk Bassiouny and Freshfields Bruckhaus Dinger as legal advisors its planned sale of its Cairo branches, Al Borsa reports. Reports had emerged in November that the bank was shopping around for advisors on the potential sale of its 17 branches in Egypt, which comes as part of the bank’s restructuring plan mandated by the European Commission after Greece’s government debt crisis. The plan entails scaling back the bank’s presence overseas. Unidentified sources tell Al Borsa that the bank is still drawing up its exit strategy, but expects to complete the sale of its branches sometime during 2H2018.

The budget deficit for the current fiscal year 2017-18 is expected to come in at 9.4% of GDP, Vice Minister of Finance Mohamed Maait told Reuters. The updated projection is over the initial rate of 9% and Maait attributes it to the increase in global oil prices and high local interest rates.

And speaking of the budget, Egypt was ranked 65th out of 115 countries in the bi-annual International Budget Partnership’s Open Budget Survey, which ranks countries for the transparency of their budget. Egypt was ranked 89th out 102 countries in the last Open Budget Survey which came out in 2015. The jump in rankings comes as Egypt improved its overall budget transparency points to 41 out of 100, up from 16 points in 2015. According to the report, since 2015, Egypt has increased the availability of budget information by publishing the budget proposal online in a timely manner, publishing the pre-budget statement and the citizens budget. Egypt has also increased the information provided in the Enacted Budget. The report notes that Egypt fell short in the Citizen Participation category, scoring a mere 11 points. Egypt’s overall score puts it closer to the global average of 43, and is significantly higher than the MENA regional average of 18. “This is considered the first explicit improvement since 2012,” noted Finance Minister Amr El Garhy.

You can check out the survey’s country report here (pdf), or view the Egypt landing page.

Direct flights with Moscow to resume on 6 February:The first Russian flight to Cairo since a 2015 terrorist attack downed a Russian airliner will take off from Moscow’s Domodedovo Airport to Cairo International Airport on 6 February, Al Masry Al Youm reports. We took the liberty of checking the airport’s timetable ourselves to confirm the news (you can run your own test here), which comes one day after Russian Deputy Prime Minister Arkady Dvorkovich told TASS that Russia was still waiting on Egypt to sign a security aviation agreement before flights are restored.

Egyptian-American Enterprise Fund’s annual letter is out: 2017 proved to be an important year for the Egyptian-American Enterprise Fund (EAEF): The two first-time funds it seeded — midmarket player TCV and Algebra Ventures — invested in six companies in fintech, agribusiness, and food industries, EAEF said in its annual shareholders letter (pdf). The fund also partnered with the International Finance Corporation and Egypt Ventures to provide incubator Flat6Labs with USD 500k in funding, helping graduate eight startups from its latest cycle. It’s consumer finance company, Sarwa Capital, completed its USD 68 mn securitization and launched a mortgage finance business last year.

Military Production Ministry signs MoU with Orascom Construction for infrastructure development: The Military Production Ministry signed an MoU yesterday with Orascom Construction that will see them cooperate on various major projects, including roadworks, manufacturing, and the construction of water treatment and sewage systems. Cooperation on energy projects and railway upgrades is currently being studied, Al Shorouk reports. No value has yet been given for the agreement.

Egypt to receive USD 3 bn from ITFC: Investment Minister Sahar Nasr has secured USD 3 bn in finance from the International Islamic Trade Finance Corp (ITFC), according to a ministry statement (pdf). The funding will be used to finance the purchase of basic goods and commodities, such as petroleum, wheat, and other subsidized food staples. The ITFC had extended a total USD 6.974 in financing to Egypt over the years by the end of 2017, most of which had been used to support oil refining and processing, Nasr said, according to a ministry statement (pdf). “The statement did not provide details on what form the financing would take or the terms,” Reuters notes.

EARNINGS WATCH – Eastern Company reported a net profit of EGP 2.32 bn, a 160.84% y-o-y increase for 1H2017-2018, according to a bourse filing. Revenues for the period grew 36% y-o-y to EGP 1.78 bn.

Relevant to Egypt’s ambition as a regional gas and energy export hub: Italy is the new “center of gravity in Europe’s natural gas market” and could soon find itself an exporter for the first time in its history, according to Bloomberg. The country’s favorable geography makes it “very well positioned to act as a hub,” Snam SpA CEO Marco Alvera says. New discoveries in Egypt and Israel, as well as existing connections to Libya, Algeria, Russia, and the North Sea have put Italy on the map. But Alvera says the the country is poised to become an exporter of natural gas as well. He explains that Snam is pursuing an extensive pipeline strategy that could, if successful, even reduce Europe’s high gas prices by connecting Italy to the Caspian sea through a “EUR 4.5 bn Trans-Adriatic Pipeline that it’s developing with BP Plc and the State Oil Co. of Azerbaijan.”

Saudi reaches settlement agreements worth a collective SAR 400 bn in ‘corruption crackdown’: Saudi Arabia will be collecting SAR 400 bn (c. USD 107 bn) from settlement agreements it has reached so far with businessmen who were detained on corruption charges, a statement from the country’s Center for International Communication said yesterday. The amount is made up of “various types of assets, including real estate, commercial entities, securities, cash and other assets” and heralds the release of those without sufficient evidence against them and others who admitted to the allegations brought against them. Some 56 out of 381 businessmen detained in Crown Prince Mohammed bin Salman’s move will remain in custody pending investigations into other criminal charges, Saudi’s General Prosecutor, Sheikh Saud Al Mojeb, has decided. Kingdom Holding’s Alwaleed bin Talal had been released earlier this week after agreeing to settle.

In other news from the Kingdom, Saudi Aramco’s CEO Amin Nasser tells the Nikkei Asian Review that the company is looking to expand its Asian footprint with new investments in China and India.

It may take Morocco five to 15 years to fully liberalize its currency regime, central bank Governor Abdellatif Jouahri tells Bloomberg, as floating the MAD is “dependent on other reforms including strengthening the country’s export base and reducing the current-account deficit.” Morocco began implementing a more flexible exchange rate earlier this month, widening the MAD fluctuation band to 2.5% above or below its peg from 0.3%.

CORRECTION- The Egyptian Competition Authority announced on Tuesday that officials from Qatar’s BeIN Sports, including Chairman Nasser Al-Khelaifi, had been slapped with a EGP 400 mn fine in an antitrust case the ECA brought up with the Cairo Economic Court. Some news outlets had reported on Monday that the fine was EGP 400k.

Egypt in the News

It’s a reasonably quiet morning for Egypt in the international press, with coverage focused largely on the presidential election, where the Lawfare blog spoke for the hive mind with its headline that “Egypt finds a token candidate to run against Sisi.”

Dominating a narrative is a piece from Associated Press bureau chief Hamza Hendawi noting that “a coalition of eight Egyptian opposition parties and some 150 pro-democracy public figures on Tuesday called for a boycott of the March presidential election, calling it an ‘absurdity’ and comparing the government’s handling of the vote to that of ‘old and crude dictatorships.’” Hendawi’s piece is being widely picked up.

Also making headlines: US National Public Radio is noting that “Egypt’s president moves to curb opposition as election nears,” and Reuters is getting traction from a piece bylined simply “Reuters Staff” that declares “Egypt’s ex-army officers pose growing security threat.”

Also worth noting in brief:

- Profits at Egypt’s biggest lenders are on an upward trajectory, and economic forecasts suggest a healthy 2018, Danielle Myles writes for The Banker.

- The Los Angeles Times’ Travel section is out with a short piece promoting a 13-day tour and cruise of Egypt.

- As the presidential elections draw closer, “the more the pressure and threats increase against the president’s critics,” Zvi Bar’el writes for Haaretz.

- Renewable energy is allowing Egypt’s Oriental Trade Co. is to grow better-quality, environmentally-friendly pumpkins, which are becoming “a fast-growing crop for export,” according to Freshplaza.

On Deadline

After weeks of hoping for a pluralistic election, the nation’s columnists are not at all happy with how the race is shaping up. Al Shorouk’s Emad El Din Hussein wishes that the state had pushed forward its candidate of choice into the race a little bit earlier in the game to avoid making his entry seem like such a sham. Engineering the elections in this way is a dangerously short-sighted policy that ignores the possibility of angering the populace enough to trigger another wave of political unrest, Mohamed Esmat says in the same newspaper. He also points out that the whole show was unnecessary because President Abdel Fattah El Sisi’s re-election is a foregone conclusion, despite his popularity having eased from its previous height. Ziad Bahaa El Din tries to look at the silver lining, pointing out that people’s negative reaction is reason to hope that the population will not be politically passive forever and that they could become engaged in the political scene again soon.

Worth Watching

City planners in Barcelona are rethinking the way we approach urban development and coming up with solutions for congestion and its effects, according to a video report by Vox. The idea revolves around the concept of a “superblock,” clustering several blocks together and closing them off to major forms of traffic to create more space and access to pedestrians and cyclists. Food for thought, Cairo. (watch, runtime 5:31)

Diplomacy + Foreign Trade

Egypt is ready to establish an industrial pharma city project in Iraq, Health Ministry spokesperson Khaled Megahed said yesterday, Al Shorouk reports. The announcement followed a meeting between Iraqi President Fuad Masum and Health Minister Ahmed Rady, who is in Baghdad for a three-day visit to discuss Egypt’s role in reconstruction efforts there as part of a delegation headed by presidential advisor for national projects Ibrahim Mahlab. Masum, who also sat down for a one-on-one with Mahlab, met as well with representatives from Egyptian pharma companies who are looking to cooperate with the Iraqi government on various health projects, the newspaper adds. Masum assured the delegation that Iraq will be giving priority to Egyptian companies in its reconstruction process across different fields.

Energy

Maridive wins vessel lease contracts in KSA, Tunisia worth a combined USD 14 mn

Maridive and Oil Services has landed two contracts, one each in Saudi Arabia and Tunisia, worth a combined USD 14 mn, Al Mal reports. The contract signed a contract with a Saudi client to rent one vessel for seven years beginning in February, and another contract with a Tunisian client for a three-year terms starting in March.

Infrastructure

Egypt Gas to build natural gas network for new administrative capital

Egypt Gas announced signing a contract with the New Administrative Capital Company to implement the first phase of the project’s natural gas network, according to a company statement. The contract is worth EGP 771 mn and will be executed over two years.

Real Estate + Housing

First Group to spend EGP 450 mn on Kenz project in 6 October

First Group Real Estate is expecting to spend EGP 450 mn this year on their Kenz Compound project in 6 October City, Chairman Bashir Mostafa tells Al Mal. The investment will go toward completing construction work on the project sometime mid-next year. 65% of the project has already been finished, with First selling 60% of homes since launching in 2015.

The Egyptian Company for Development to develop EGP 200 mn mall

The Egyptian Company for Development is planning to invest EGP 200 mn into the construction of a mall in 6 October City, project manager Gad Samir said in statements picked up by Al Borsa. He added that the company is to begin work in April.

Tourism

Egypt Air and Prime Tours sign MoU to fly World Cup fans to Russia in charter flights

EgyptAir signed an agreement yesterday with Prime Tours Group clearing the way for charter flights to carry passengers to and from the 2018 World Cup in Russia, Al Shorouk reports, citing the MENA state news agency.

Automotive + Transportation

Sandstorm Automotive to open a Cairo office in March

The UAE’s Sandstorm Automotive is planning on opening a regional office in Cairo in March, MEA Manager Karim Saleh said, according to Al Mal. Saleh added that Sandstorm wants to use Egypt as a hub for its African operations. The company expects to launch in the UAE by April and is hoping to launch in Egypt by August. Negotiations are underway with potential local distributors for after-sales services and their local partner should be announced in the next two months. Sandstorm claims that its car is the first that is Arab produced and the company previously stated its intention to manufacture in Egypt.

Transport Ministry receives 23 offers for high-speed electric train line

The Transport Ministry is studying offers from 23 local and international firms to build, operate and maintain a high-speed electric railway line linking Ain Sokhna to Al Alamein, Minister Hisham Arafat said yesterday, Al Mal reports. A joint committee from the ministries of housing and transport is expected to conclude its review of the offers within a month, after which the government will begin receiving financial and technical offers. The 534-km line will accommodate both cargo and passenger trains, passing through the new capital, 6 October City, and Alexandria. The winning company will be expected to finance the project, with government-backed loans being the ideal situation, Housing Minister Mostafa Madbouly said last month.

Banking + Finance

Banks to begin reporting financials under IFRS 9 starting from 2019 -CBE

Banks in Egypt will be required to begin presenting their financial statements in accordance with the IFRS 9 accounting standards starting from FY 2019, the central bank announced. The central bank is expecting all banks to present it with a plan to implement IFRS 9 with a clear timeline by the end of June 2018. Banks will trial IFRS 9 regulations with their auditors for the 2018 results, which will be presented according to current regulations. The central bank’s directive also requires banks to report to it their capital adequacy ratios on a quarterly basis after taking into consideration IFRS 9 regulations.

Other Business News of Note

Orange successfully completes capital increase to EGP 16.4 bn

Orange successfully completes capital increase to EGP 16.4 bn: Orange Egypt’s capital increase was 99.49% subscribed when it closed on Sunday, the company said in a bourse filing yesterday. The transaction brings its total issued capital to EGP 16.4 bn from EGP 1 bn in compliance with new listing requirements that could have otherwise forced it out of the EGX. The company received regulatory approval in December, a month after the board of directors signed off on the move — which also brings authorized capital up to EGP 20 bn from EGP 2 bn.

Investment Ministry okays 50 feddan investment zone in Wadi El Gidid

Investment Minister Sahar Nasr approved establishing a 50 feddan investment zone in Wadi El Gidid governorate, according to Youm7.

Egypt Politics + Economics

Kabil discusses with MPs his ministry’s strategy to spur industrial sector growth

The Trade and Industry Ministry is working to push the industrial sector’s share of Egypt’s GDP to 21%, and grow exports at an annual rate of 10% by 2020, Trade and Industry Minister Tarek Kabil said yesterday in an address to parliament, according to a ministry statement. Kabil also discussed the steps his ministry has taken to spur industrial growth through legislation such as the Public Procurement Act and Industrial Permits Act, as well as setting up industrial complexes in different governorates. The minister said that there are currently 871 idle factories in the country, blaming inaccurate feasibility studies for their dilapidation, Al Mal reports.

Dar Al Iftaa issues fatwa against boycotting elections

Dar Al Iftaa also issued a fatwa (religious edict) on Monday that boycotting the election would be a sin and a rejection of Muslims’ religious duty to participate in the democratic process, Egypt Independent reports.

Court sentences six alleged Islamists to life in prison over violence charges

The Cairo Criminal Court sentenced six alleged Muslim Brotherhood members to life in prison yesterday on charges of terrorism, the state news agency said, according to The Associated Press. Four others were also sentenced to 15 years on similar charges. The verdict is not final and can be appealed.

National Security

Egypt’s ex-army officers pose growing security threat

Former army officers are posing a greater threat to Egypt’s security than militants in the Sinai, intelligence officials tell Reuters. The network known as Ansar “is comprised of army officers and policemen who use their training in counter-terrorism and surveillance to attack the forces they once served,” they tell the newswire. They added that some 30 “captains and lieutenants” have recently joined the group, which is allegedly headed by former special forces officer-turned-jihadist Hesham al-Ashmawy, who is believed to be behind last year’s deadly Wahat attack.

On Your Way Out

Ride-hailing app Uber announced expanding to Tanta and Damanhour from its existing operations in Cairo, Alexandria, and Mansoura, according to Ahram Online. “The expansion into Tanta and Damanhour ensures the presence of more job opportunities, supporting Uber’s vision in creating economic opportunities in other cities in Egypt through Uber technology,” Uber says. “After the success of Uber in Mansoura, we have been on the lookout for other expansion opportunities and finally rested on Tanta and Damanhour as we believe these two cities hold great potential in terms of offering job opportunities for drivers and providing a convenient and accessible transportation service for riders,” GM Abdellatif Waked says.

Elon Musk is really Ernst Stavros Blofeld: In a move that only seems to cement his status as a James Bond villain, Elon Musk’s tunneling startup Boring Co. started selling flamethrowers, which he himself promoted on social media last weekend, according to Bloomberg. The move appears to be a dare, masquerading as a marketing stunt, after Musk promised to sell the weapons if promo merchandise hat slaes reached their USD 1 mn target. It gets even zanier when considering Boring wants to develop hyperloop tunnels. How is he getting away with the flamethrowers? They don’t spit enough of a flame to classify them as weapons.

The Market Yesterday

EGP / USD CBE market average: Buy 17.63 | Sell 17.73

EGP / USD at CIB: Buy 17.6 | Sell 17.7

EGP / USD at NBE: Buy 17.63 | Sell 17.73

EGX30 (Tuesday): 15,316 (-0.4%)

Turnover: EGP 1.2 bn (7% ABOVE the 90-day average)

EGX 30 year-to-date: +2.0%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.4%. CIB, the index’s heaviest constituent, closed down 0.6%. The index’s top performers were AMOC, up 3.1%; Eastern, up 1.8%; and Sidi Kerir Petrochemicals, up 1.6%. Today’s worst performing stocks were TMG Holding dow 3.0%; Porto Group down 2.6%; and Orascom Telecom Media & Technology down 2.6%. Market turnover was EGP 1.2 bn, with foreign investors the sole net buyers.

Foreigners: Net Long | EGP +52.9 mn

Regional: Net Short | EGP -1.7 mn

Domestic: Net Short | EGP -51.3 mn

Retail: 65.6% of total trades | 65.5% of buyers | 65.7% of sellers

Institutions: 34.4% of total trades | 34.5% of buyers | 34.3% of sellers

Foreign: 15.5% of total | 17.6% of buyers | 13.4% of sellers

Regional: 9.5% of total | 9.4% of buyers | 9.6% of sellers

Domestic: 75.0% of total | 73.0% of buyers | 77.1% of sellers

WTI: USD 64.34 (-1.86%)

Brent: USD 68.81 (-0.94%)

Natural Gas (Nymex, futures prices) USD 3.17 MMBtu, (+0.03%, FEB 2018 contract)

Gold: USD 1,340.2 / troy ounce (-0.36%)

TASI: 7,631.17 (+0.83%) (YTD: +5.6%)

ADX: 4,638.75 (+0.27%) (YTD: +5.46%)

DFM: 3,439.91 (-0.44%) (YTD: +2.07%)

KSE Weighted Index: 414.8 (-0.21%) (YTD: +3.33%)

QE: 9,328.24 (-1.29%) (YTD: +9.44%)

MSM: 5,007.65 (+0.1%) (YTD: -1.8%)

BB: 1,352.26 (+0.57%) (YTD: +1.54%)

Calendar

30 January-01 February (Tuesday-Thursday): CI Capital’s MENA Investor Conference, Four Seasons Nile Plaza, Cairo.

3-4 February (Saturday-Sunday): Egypt Investment Forum, Semiramis Intercontinental Hotel, Cairo.

05 February (Monday): Egypt’s Emirates NBI PMI reading for January announced.

08-11 February (Thursday-Sunday): Furnex & the Home international trade fair, Cairo International Convention Center.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

19-20 February 2018 (Monday-Tuesday): The Banking Tech North Africa, The Nile Ritz-Carlton, Cairo

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s “World of Possibilities” Conference, Cairo/Luxor.

05-07 March (Monday-Wednesday): EFG Hermes’ One on One Conference 2018, Atlantis, The Palm, Dubai, UAE.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labour Day, national holiday.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan begins (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday. (Look for possible Monday off given the first day falls on a Friday.)

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC)

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC)

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.