- Former Armed Forces chief of staff Sami Anan detained on charges he violated military law with campaign bid. Khaled Ali to hold press conference this evening. (Speed Round)

- Sweeping changes to Companies Act coming via amendment of executive regs, Investment Ministry says. (Speed Round)

- Egypt reform program gets glowing review from IMF, which urges more work on to make sure growth is inclusive. (Speed Round)

- Economists in Reuters poll see lower growth in Egypt than do gov’t, IMF. (Speed Round)

- “Blended finance” is a thing at Davos, but it’s been reality in Egypt since before 2011. (What We’re Tracking Today)

- Edita looking into overseas production, expansion. (Speed Round)

- CABINET WATCH- New regulatory agency for roadside billboards coming? (Speed Round)

- Things for which we’re grateful heading into a three-day weekend. (What We’re Tracking Today)

- The Market Yesterday

Wednesday, 24 January 2018

Sami Anan’s presidential bid ends with arrest, disqualification

TL;DR

What We’re Tracking Today

It’s a two-story news day, folks, as the business community absorbs both the arrest of would-be presidential candidate Sami Anan on charges he violated military law and the release yesterday of the IMF’s glowing report on the Ismail government’s reform agenda. Also worth your attention this morning is news of what the Investment Ministry is positioning as a sweeping (and imminent) overhaul of the Companies Act. We have more on all three stories in today’s Speed Round, below.

We can all digest the news tomorrow as we mark a national holiday. Banks and the stock exchange will be closed in observance of 25 January. Enjoy the break — our next long weekend isn’t until April, folks. Enterprise is off tomorrow, but we’ll be back first thing Sunday morning.

As we slide into the long weekend, we are grateful for: Challenging conversations with good, smart friends. Great coffee. Winter weather in Egypt. The challenge of lifting heavy things (mentally and physically). The prospect of three uninterrupted days with the people we love the most. How about you? Drop us a line at editorial@enterprise.press and we’ll run some of the best answers next Thursday—and, if things go well, every Thursday thereafter.

Further afield, the party continues in Davos, where CEOs from the finance industry report that “the party is really good.” (Yes, that’s a direct quote. Even CEOs are finance bros at heart.) Bosses of major institutions including Blackstone’s Stephen Schwarzman and Credit Susie’s Tidjane Thiam said they were bullish on the outlook for the global economy, with the FT quoting them as suggesting “the risk of global markets unravelling in the face of geopolitical risks is overstated.” Or as Schwarzman put it: “It’s a time of enormous ebullience, part of which was created by really good economic growth.” Speaking metaphorically (we think), he added that while there is the risk of a reckoning, “The party is really so good, they’re serving really good food and drink, you are making money and it’s really not hard.” Cheers, Steve.

Or is it? As the Wall Street Journal reports, there is a “strong awareness” in Davos this year that “geopolitical risks — including that of a potential conflict with nuclear-armed North Korea and a U.S. trade war with China — aren’t being adequately reflected in financial-asset prices.”

Also from Davos: What we’ve been doing here in Egypt since 2011 has a new name: Blended finance, and it’s a USD 50 bn global market right now. Blended finance, Bloomberg tells us, is when private capital is pooled with public funds to invest in projects that serve development goals spanning everything from infrastructure and clean energy to climate change to poverty alleviation. The story singles out a Chilean wind farm as its example, but we’re going to go out on a limb here and say that Egypt and our friends at (primarily European) DFIs should have been the poster children. Well before the events of 2011, Qalaa Holdings (then known as Citadel Capital) pioneered the space, mobilizing bns in equity and debt from private investors, development finance institutions and export credit agencies for its USD 3.7 bn Egyptian Refining Company. Basel El Baz is doing the same with Caron Holdings’ USD 10 bn Tahrir Petrochemical Complex. And everyone working in renewable energy here — from wind to the megaproject that is solar power in Benban — is following the same playbook.

Bloomberg’s story was spurred by the release of a report by the Blended Finance Taskforce. Their website is here, for those of you so inclined.

The prospect of Cape Town becoming the world’s first big metropolis to run out of water has crossed into the global press. Picking up where Toronto’s Globe and Mail left off earlier this week, the story made it yesterday to the Financial Times. It is absolutely a must read if you, like us, are concerned about Egypt’s approach to water conservation, from how we export it (think: rice), misuse it (washing our cars daily) to the prospect of what happened when GERD is fully up and running. There but for the grace of God, as our grandma would say.

Also in the salmon-coloured paper: Is there a risk that private equity is getting into bubble territory as competition and valuations increase? That was the subject of the FT’s Big Read yesterday, which notes that “buyout groups are not only setting new records for fundraising, they are also turning money away at their fastest ever rate.”

**PSA- As unabashed fans of the paper, we want to draw high school teachers’ attention to the fact that the Financial Times is offering students aged 16-19 access to its website without charge. The FT started the initiative in 1,400 secondary schools in the UK and is now extending it worldwide. Interested schools can register here.

In other miscellany worth noting this morning:

Eleven Pacific Rim nations including Canada have agreed on a new version of the Trans-Pacific Partnership trade agreement a year after Donald Trump pulled the US out of the pact, the Wall Street Journal reports.

The 2018 Oscar nominations are out, with “adult fairytale” The Shape of Water leading the race, followed by “Dunkirk” and “Three Billboards Outside Ebbing, Missouri.” The New York Times has the rundown.

Apple announced that online orders for its smart speaker The HomePod will start on Friday, according to Reuters. The release of the speaker comes after a one month delay that gave competitors Amazon and Google a clear playing field during the important Christmas retail season.

Finally, we’re pleased to report that our readers have a sense of humour. Thank you to everyone who emailed / messaged / made a comment in passing yesterday to point out our typo in the headline “Nile cruise shut down after 31 people suffered from food poisoning,” wherein the “u” in “shut” was replaced with an “i.”

On The Horizon

New railway ticket prices will be made public at the end of the month, Transport Ministry spokesperson Mohamed Ezz said yesterday, Al Masry Al Youm reports. Egyptian National Railways has finalized a pricing scheme, which is currently being studied by the authority’s board. Sources from ENR had said tickets will be hiked 15-150% depending on the type of train and the distance traveled, while Transport Minister Hisham Arafat had said that tickets would rise 20-25%.

Enterprise+: Last Night’s Talk Shows

The airwaves were abuzz last night with chatter about former military chief Sami Anan’s detention and the IMF’s report on its second review of Egypt’s economic reform program.

Egypt has begun reaping the fruit of its reforms, as reflected by declining inflation and the narrowing budget deficit, IMF Mission Chief for Egypt Subir Lall told Yahduth fi Masr’s Sherif Amer. He said that soaring inflation was an unavoidable side-effect of reforms, but that the CBE’s target of pushing the figure down to 13% by year’s end is “very much within reach.” Lall noted that the report (the details of which we delve into in Speed Round, below) looks into the broad strokes of Egypt’s reform program and assesses short- and long-term issues. From here on out, the private sector must be encouraged to create jobs and spur economic growth, Lall said.

Vice Minister of Finance Ahmed Kouchouk told Hona Al Asema’s Lamees Al Hadidi that the government is sticking to its timeline for phasing out fuel subsidies by the end of FY2018-19. Diesel and butane are exempted from this plan, since they are most widely used by lower-income citizens. Kouchouk also said Egypt is still studying implementing a pricing mechanism that would see global oil prices automatically reflect on domestic prices, but is not obligated to implement the scheme by the IMF (watch, runtime: 4:08).

The IMF report’s recommendation to keep interest rates stable is based on inflation rates prior to their month-on-month deceleration, and in any case these recommendations are in no way binding, Kouchouk said. He stressed that the government has its own program in place and has the liberty to decide whether or not to follow the IMF’s advice (watch, runtime: 3:42).

Finance Minister Amr El Garhy presented his ministry’s three-year strategy at yesterday’s weekly ministerial meeting, Cabinet spokesperson Ashraf Sultan told Al Hayah Al Youm’s Tamer Amin. The plan includes reducing the public debt-to-GDP ratio, achieving a primary budget surplus of 2%, increasing GDP growth, lowering inflation, and bumping up state revenues with more taxes while rationalizing expenditures (watch, runtime: 6:03).

Amin also spoke with former military prosecutor Sayed Hashem about the detention of Sami Anan yesterday, which Hashem shrugged off as something the former military chief of staff should have seen coming. He said that Anan is well-aware of military’s law, which bar its active and reserve members from engaging in political activity (watch, runtime: 9:31).

Kol Youm’s Amr Adib seemed to be on the verge of a meltdown as he came to grips with Anan’s exclusion from the presidential race, which he said has effectively guaranteed the elections will take place sans competition. He pored over foreign coverage of the arrest, which is being framed as a power struggle (watch, runtime: 54:26).

Back on Hona Al Asema, Khaled Ali campaign spokesperson Amr Abdel Rahman said that the way the state dealt with the Anan debacle is of greater concern than whether his bid was actually a violation of military law. Abdel Rahman said that he is keeping an eye on how these developments will affect turnout at the elections. He also denied that Ali is withdrawing from the race, saying that “all options are still on the table” (watch, runtime: 2:35).

Speed Round

Former military chief of staff Sami Anan was detained yesterday after the army summoned him for questioning over his bid for the presidency, campaign organizers told Reuters. The Armed Forces put out a statement on the detention that was read aloud by a spokesman, a version of which was dispatched to both the domestic and international press. The statement said the Armed Forces “will not overlook the blatant legal violations [Anan] has committed, which are a serious breach of the laws of military service.” Anan is alleged to have:

- Announced his candidacy “without seeking permission from the Armed Forces … or taking the steps necessary to terminate his service,” necessary because under law military officers (even those in the reserves) must receive permission to resign their commissions before seeking elected office;

- Forged official documents that claimed his military service was over;

- Driving a wedge between the military and the Egyptian people in his declaration of his intention to run for president.

Read and watch for yourself: The Armed Forces’ televised statement can be seen here and the statement listing its charges against Anan can be read here (pdf).

The Armed Forces also issued a gag orderforbidding the publication or broadcast of any further news in the case until it completes its investigation.

Anan’s campaign announced it was going on hiatus until further notice “out of fear for the safety and security of all citizens who dream of change.”

Anan officially disqualified from running: National Elections Committee (NEC) has officially disqualified Anan from running, citing his “non-civilian status,” Al Masry Al Youm reports. This comes as NEC Chairman Lashin Ibrahim is said to have met with a high-level delegation from the US Embassy, as well as Mexico’s ambassador to Cairo, to reassure them that the presidential election would comply with international standards, Egypt Independent reports.

Lawyer and rights activist Khaled Ali will hold a press conference at 6pm today to announce his final position on a possible presidential campaign, Al Masry Al Youm reports. Ali’s campaign has said it is struggling to secure the minimum of 25,000 voter endorsements it needs to file his nomination papers before the 29 January deadline, alleging bureaucratic hurdles at government offices at which citizens are required to register as nominators.

International media reaction to Anan’s arrest: The overall theme is that while Anan may not have been a popular candidate, both of the most viable opposition candidates to President Abdel Fattah El Sisi’s re-election bid are now off the playing field. “The elder Mr. Anan, 69, was not considered a strong challenger to Mr. Sisi … But his detention does suggest how far Mr. Sisi is willing to go to clear the field of challengers — even if doing so means crossing senior figures inside the military establishment that is his political bedrock,” writes the New York Times’ Declan Walsh. Other outlets, including the Washington Post and the Financial Times, are taking note of rate at which potential rival candidates, some of whom have been military men, have been dropping.

The Ikhwan angle: Hamza Hendawi notes for The Associated Press how a letter penned by an Ikhwan member has provided loyalist media with additional ammunition to link Anan to the Ikhwan. Annan’s spokesman, Hazem Hosny, sought to distance him from the Ikhwan but “insisted that Islamists are an integral part of Egyptian society who should be included in the political process.”

Meanwhile, President Abdel Fattah El Sisi became the first to take the medical examination required for election candidates, MENA reports, according to Ahram Online.

Deadline next week: The deadline for candidates to enter the presidential race is Monday, 29 January.

LEGISLATION WATCH- Look out for sweeping amendments to the Companies Act now in the pipeline. The Investment Ministry has finished drafting amendments to the executive regulations of the Companies Act and has forwarded a draft of the changes to the State Council for review. As such, the new rules would go into effect without discussion in the House of Representatives, needing only the be published in the Official Gazette. Among the highlights:

Companies will no longer be allowed to hold on to treasury stocks for over a year. After the year is out, companies must either divest the shares or distribute them to employees as part of a profit-sharing mechanism, according to a ministry statement. Companies can hold on to treasury shares if they undergo a capital decrease.

The amendments would also limit share buybacks to 10% of the company’s shares and allow a weighted voting system when shareholders vote on board members.

Other amendments facilitate spinning off corporations, by allowing the company greater flexibility in dividing assets and shares. They also “facilitate trading of shares in newly spun-off companies,” though the statement does not elaborate on this point.

Other features of the changes: The amendments also bar sole-proprietorship companies from establishing subsidiaries that are also sole proprietorships. Another change would mandate the establishment of a single electronic platform to provide key investor services, such as establishing companies.

The amendments are the most sweeping changes to the regs of the Companies Act in 35 years, with 51 articles being amended, said Investment Minister Sahar Nasr. The draft is currently with the Egyptian Council of State (Maglis El Dowla) and will be issued once the review is completed. Amendments to the law itself that tweak how sole proprietorships are handled and give measures of protection for companies against whistleblowers were signed into law by President Abdel Fattah El Sisi last week.

The IMF released its report on the second review of the economic reform program, and as expected, the performance review was stellar across all key indicators. “This macroeconomic turnaround at home and the supportive global economic environment provide a unique opportunity to carry the reform momentum into areas that have historically been hard to tackle. Deep and lasting structural reforms are needed to create jobs as speedily as needed for Egypt’s growing population,” said IMF Mission Chief for Egypt Subir Lall.

Read for yourself: You can catch the landing page of the report here, or read the full report directly (pdf).

The IMF board has a favourable outlook on Egypt’s economy, “provided prudent macroeconomic policies are maintained and the scope of growth-enhancing reforms is broadened.” Drilling down, the board sees:

- GDP in FY2017-18 growing to 4.8% from 4.2% in the previous year, and reaching 6% in the medium-term.

- Inflation, which peaked in July 2017 at 35%, is expected to decline to around 12% by June 2018 and to single digits by 2019, reflecting the diminishing of the impact of the EGP float, subsidy cuts, and implementing the value-added tax and supported by the tightening of the monetary policy stance.

- The account deficit is expected to narrow to about 4.5% of GDP this fiscal year and further on to about 3.5% of GDP by FY2021-22. The primary fiscal deficit is projected to turn into a surplus of 0.2% of GDP in during th current fiscal year, after narrowing from 3.5% of GDP in FY2015-16 to 1.8% of GDP in FY2016-17.

Key highlights of the IMF’s policy review include:

- On inflation targeting and interest rates, “the CBE will need focus on seasonally-adjusted monthly inflation trends, and consider gradual monetary easing only if inflation expectations and key macroeconomic indicators consistently point to the absence of demand pressures,” said the report.

- Gov’t must target public debt: “Placing public debt on a clearly downward path will remain the program’s fiscal anchor,” with the ultimate target being to reduce general government debt from 103 percent of GDP in FY2016-17 to 87 percent of GDP in FY2018-19.

- Energy subsidy reforms must continue: The ongoing energy subsidy reform will continue to play a key role in fiscal consolidation, with energy subsidy spending expected to be cut to 4% of GDP in FY2017-18.

- Strengthening the private sector further is key: Strengthening competition and addressing corruption are key to achieving greater economic efficiency, while access to land continues to be one of the main hurdles for the private sector.

The IMF made a point to note that adopting policies for further inclusive growth must be a key focal point of the reform agenda. It gave three main recommendations on this front:

- Increasing revenues by reducing tax exemptions in the value-added tax and other policies which would make the tax system “more progressive.”

- Continuing cutting fuel subsidies, which mainly benefit the rich, and shift subsidy spending towards cash transfer programs like Karama and Takaful.

- Allowing the private sector to flourish.

Economists polled by Reuters Arabic are not as optimistic as the IMF or the Ismail government on Egypt’s growth prospects. Twelve analysts say Egypt’s GDP growth would be limited to 4.2% in the current fiscal year and will rise to 4.5% in FY2018-19. They see growth topping 4.6% FY2019-20. That’s substantially below the 5.3-5.5% rate projected for this fiscal year by the government.

Edita, Egypt’s largest producer of packaged snack food, is planning to start overseas operations to offset local currency fluctuations, Bloomberg’s Tamim Elyan writes. Chairman and Managing Director Hani Berzi says Edita is seeking to expand in sub-Saharan Africa and Asia through manufacturing projects and exports. The company had already announced plans to enter the Moroccan snack food market through a greenfield investment with Dislog Group last December. “We need the foreign currency and in times of crises companies with export proceeds enjoyed decent profitability. We think of exports as a must, not a plus … If things stabilize without surprises, the trajectory is always a smooth line of increasing volume, profitability and revenues,” Berzi says. Edita is focusing on restoring pre-devaluation profit margins by cutting costs and increasing the price of its products, he says. Berzi adds that Edita will invest EGP 120 mn this year, mainly on maintenance, and will decide whether to proceed with the second phase of its newly-opened EO8 factory in 2019 if it sees signs of “decent recovery,” he said.

Al Ghurair Group’s vertically integrated sugar plant in Egypt is the biggest non-oil foreign direct investment transaction in Egypt since the EGP float, Investment Minister Sahar Nasr told Bloomberg. Al Ghurair will put in USD 333 mn of the USD 1 bn project and then will raise its stake to 51% when it is completed in three years. Egyptian companies, including Al Ahly Capital Holding, will hold the remaining stake, Nasr said. She added that “the project will benefit from a tax break for three years because it will be located in Upper Egypt,” Bloomberg notes.

Banque Misr considers lower interest rates on highest-yielding CDs, could scrap them in 2H2018: Banque Misr plans to lower yields on certificates of deposit currently carrying rates of 20% in 2H2018, bank chairman Mohamed El Etreby tells the Creature of the Blue Lag..studios of Ala Mas’oolity. The bank is also mulling over scrapping the highest yielding CDs, as the economy continues to improve, El Etreby added.

CABINET WATCH- The Ismail Cabinet approved yesterday amendments to the Income Tax Law to facilitate procedures for submitting tax declaration forms, according to an official statement. The new procedures will grant a 60-day window after declaration forms are submitted to the Tax Authority for citizens to submit the remaining necessary documents. The move is meant to reduce the rate of incomplete tax declarations.

The ministers also signed off on a draft law regulating billboards on roads and bridges. The law will give us a National Advertising Regulatory Authority to set regulations for the issuance of licenses for new billboards—and to regulate content in the ads they carry. The authority will be headed by the prime minister and its members will include the transport, local development, defense, interior, housing, environment, finance, electricity, and culture ministers.

Also approved during the weekly meeting:

- Beginning procedures for the Egyptian Electricity Transmission Company to sign a contract with Lekela Power for its USD 400 mn, 250 MW wind farm in the Gulf of Suez;

- A presidential decree amending a USD 16 mn grant agreement with the United States for the US-Egypt Science and Technology Joint Fund.

Egypt climbed six spots to rank 14th in Agility’s 2018 Emerging Markets Logistics Index (pdf), which surveys 500 supply chain executives to assess the performance of 50 emerging markets based on their economic, trade, and social data. The surge came thanks to “bold steps” taken to normalize the economy over the past two years, improvements in the country’s infrastructure, a decline in business costs associated with crime, violence, and terrorism. According to the report, Egypt’s economy is on an upwards trajectory, and the “next step is putting in place a robust regulatory environment and continuing with much-needed structural reforms.”

Egypt in the News

The only story on Egypt of interest to the international press this morning is the arrest of would-be presidential candidate Sami Anan on charges he violated military law. We have the roundup in Speed Round, above.

On Deadline

Opinion writers came out strongly in support of former Armed Forces chief of staff Sami Anan’s detention yesterday. Al Masry Al Youm’s Mohamed Amin says the former presidential candidate must have done something significant to warrant his detention, since he had announced his candidacy in 2014 but had not faced any legal repercussions from the Supreme Council of Armed Forces at the time. Hamdy Rizk rushed to the pages of the same newspaper to explain that Anan’s grave misstep was colluding with the Ikhwan, which El Watan’s Emad El Din Adib says was bound to blow up in his face, particularly when paired with his controversial political promises. Anan’s removal from the presidential race could have also been caused by corruption allegations, which he was naive to think would not affect his bid, Emad El Din Hussein writes for Al Shorouk.

Worth Reading

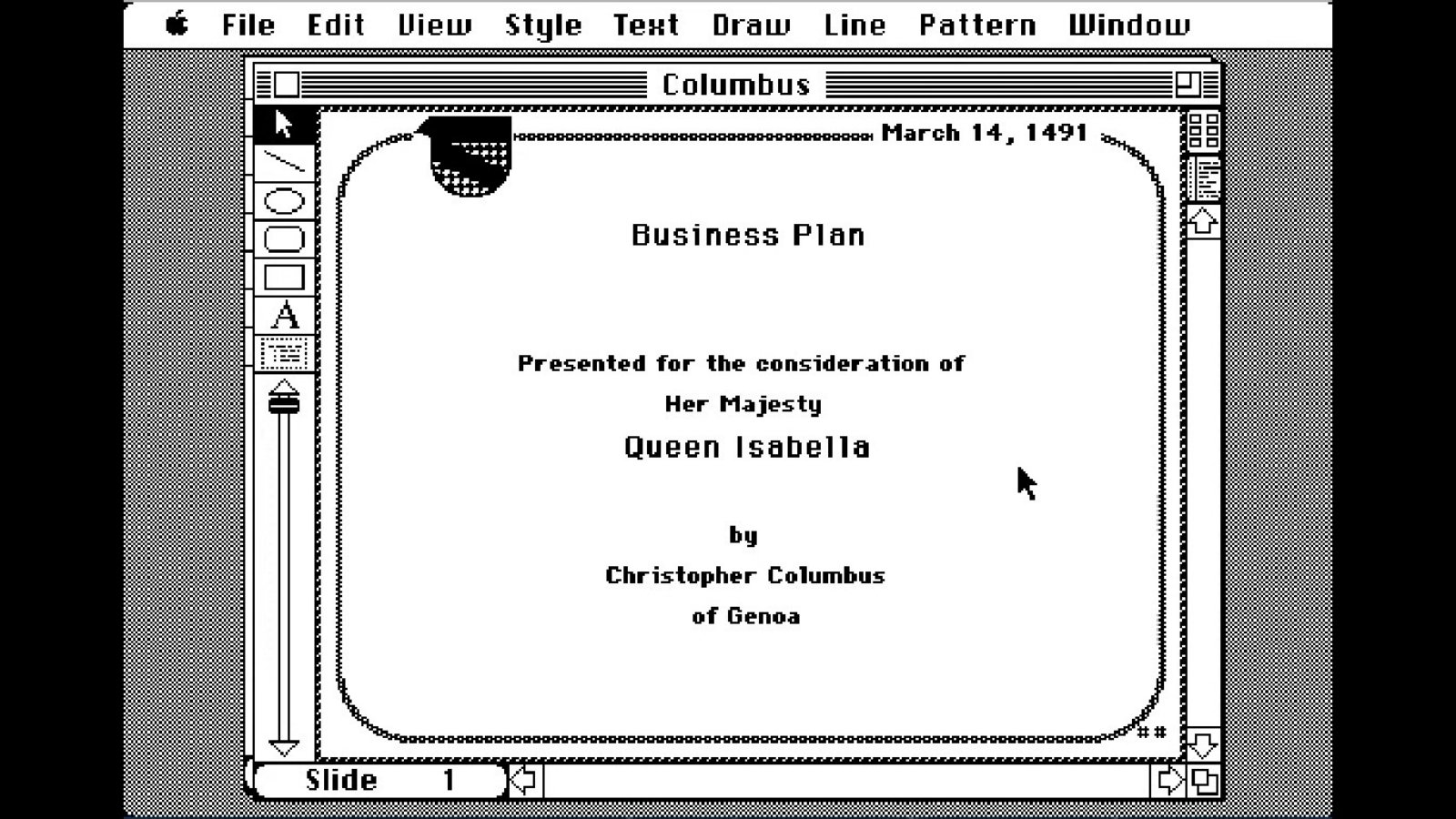

Can PowerPoint change the world? Maybe not, but the claim is that these eight presentations certainly did. The staple of advisory teams, boardrooms and classrooms has come a long way since the software was released in 1987. The pilot presentation prepared by its founders imagined how Christopher Columbus might have pitched his transatlantic voyage to Queen Isabella in 1942. Over the course of more than three decades, PowerPoints have been at the center of some of the most groundbreaking moments in history, including the unveiling of the first iPhone in 2007 (actually done in Keynote, not PPT), Elon Musk’s 2016 Mars announcement, and former US Secretary of State Colin Powell’s speech to the UN Security Council that made the case for the 2003 invasion of Iraq.

Worth Watching

Hey, Siri: Self-destruct. You would have thought this was an urban legend, but a man in China learned the hard way that a smartphone battery will explode if you bite into it, the Huffington Post reports. The inspiration for his lithium lunch seems to be a check for authenticity, a common habit when buying gold amongst the Chinese (and a common worry in China). Batteries are known to explode when positive and negative plates come into contact due to blunt force warping the battery but such instances are few and far between. Proving that God does in fact take care of drunks and fools, the man miraculously walked away from the explosion with no serious injuries (watch, runtime 0:34).

Diplomacy + Foreign Trade

Egypt is set to begin negotiations with the Eurasian Economic Union on a freetrade agreement within a few months, Trade and Industry Minister Tarek Kabil said yesterday, Youm7 reports. The two sides are currently preparing the roadmap for the negotiations, according to Kabil. The agreement between Egypt and the union, which includes Russia, Armenia, Belarus, Kazakhstan, and Kyrgyzstan, was in the final stages of drafting back in August.

The timing of a US Middle East peace initiative depends on the return of Palestinians to negotiations, US Vice President Mike Pence said, according to Reuters. “The White House has been working with our partners in the region to see if we can develop a framework for peace … It all just depends now on when the Palestinians are going to come back to the table,” Pence says. He also told Reuters that President Abdel Fattah El Sisi and King Abdullah of Jordan “had agreed to convey to the Palestinians that the United States was eager to resume peace talks.”

Energy

EGAS to issue bid round in 1H2018

EGAS is planning on having a bid round for oil and gas exploration in east Mediterranean and onshore Delta blocks in 1H2018, Chairman Osama El Bakly said, according to Al Masry Al Youm. EGAS will also move ahead with its seismic mapping of blocks in west Mediterranean before setting them up for a bid round.

Basic Materials + Commodities

China approves Egyptian dates exports, considering pomegranates

Egypt will begin exporting dates to the Chinese market after is government officially approved the Agriculture Ministry’s quality and safety checks, the Agriculture Ministry announced in a statement carried by Al Mal. Egypt, which produces up to 1.3 mn tonnes of dates annually, will now expand the cultivation of high quality date palm for export purposes, says Agriculture Minister Abdel Moneim El Banna. China has also given the green light to begin the necessary procedures and safety checks to import Egyptian pomegranates for the first time.

Manufacturing

Guangzhou Goodsense breaks ground on aluminum composite panels factory

China’s fortunately named Guangzhou Goodsense Decorative Building Materials broke ground yesterday on a USD 100 mn aluminum composite panels factory in Ataka, Suez, Al Masry Al Youm reports. Chinese investments made up 30% of the project, while Saudi Arabian investors owned a 45% stake in the project. The factory, the first of its kind in Egypt, will have an annual production capacity of 3 mn meters of panels in its first phase, according to Industrial Development Authority head Ahmed Abdel Razek. The project will cover 70% of domestic demand and will begin exporting surplus production once its production capacity reaches 5 mn meters in 2020.

Health + Education

Egypt, UK sign MoU to facilitate British universities expansion in Egypt

Higher Education Minister Khaled Abdel Ghaffar signed an MoU with the UK’s Universities Minister Sam Gyimah which would facilitate British Universities opening branches in Egypt, The National reports. The signing took place yesterday at the annual Education World Forum in London.

Real Estate + Housing

ODH to complete exit of Tamweel in 1Q2018

Orascom Development Holdings (ODH) plans to complete the sale of its 87% stake in Tamweel Financial Holding in 1Q2018, the company’s IR Director Sara El Gawahergy tells Al Borsa. ODH plans to use the proceeds of the sale to help lighten its EGP 1 bn debt burden. No word yet on which of the four offers on the table for the acquisition ODH is leaning towards or the details of those offers.

Arco expecting to invest EGP 1.7 bn and generate revenues of EGP 5 bn in 2018

Al Arabia Company For Real Estate Development (ARCO) is planning to invest EGP 1.7 bn in 2018 and is expecting sales for the year to reach EGP 5 bn this year, CEO Ayman Ibrahim said in statements carried by Al Borsa.

Tourism

Lindblad Expeditions announces return to Egypt

Lindblad Expeditions has announced its return to Egypt with a 13-day journey it is calling Passage Through Egypt. “I am so pleased to announce the resumption of our program in 2018… Things are very much on the upswing, and there is a pervasive optimism there about the future. And the resplendent antiquities remain,” CEO Sven Lindblad says. The trip includes stops in Cairo and a Nile cruise and the “program has been specially crafted to showcase Egypt’s many facets, and offers privileged access to some of the most remarkable sites,” the company says.

Telecoms + ICT

TE reaches international calls settlement with Etisalat Misr, to pay USD 48 mn

Telecom Egypt (TE) announced it has reached a final settlement agreement with Etisalat Misr in regards to a dispute on international calls services. According to the settlement terms, TE will pay Etisalat Misr USD 48 mn “to mitigate an exposure of more than USD 100 mn” and it would cover amounts relating from the start of rendering services to Etisalat Misr and until 13 June 2017. TE says the settlement marks the end of all disputes with mobile operators in Egypt.

Automotive + Transportation

Transport Ministry in talks for EUR 400 mn worth of trains from French suppliers

The Transport Ministry is in talks with a French company to buy 34 trains for Cairo Metro’s first line, sources told Al Mal. The cost of the transaction is estimated to be EUR 400 mn and the Ministry is now waiting for an official letter.

Banking + Finance

Foreign currency trading on interbank system climbs to USD 14.5 bn, Amer says

Foreign currency trading on the interbank system domestically climbed to USD 14.5 bn since the EGP float in November 2016, Central Bank Governor Tarek Amer told Bloomberg. The current volume increased from the USD 9 bn reached last September, which Bloomberg says reflects growing confidence. “The continued growth in activity in the interbank market comes as foreign holdings of Egyptian Treasury bills have stabilized around USD 19.5 bn over the past two months. The standstill suggests that foreign investors may have maximized their allocations to Egypt’s high-yield debt.”

IFC promotes cashless transactions, aims to boost financial inclusion in Egypt

The IFC discussed with banking sector representatives from Egypt “how banks can make use of new technologies that promote cashless transactions, tackle cyber risk management, and digitize their banks and digitalize their services.” IFC says the workshop is part of its efforts to boost financial inclusion and expand banking services across the country.

Export Development Bank gets USD 10 mn loan to promote SME funding

The Export Development Bank of Egypt announced receiving a USD 10 mn loan from the Sanad Fund for micro, small and medium enterprises, according to a disclosure. The funds will be used to expand financing and technical support to SMEs, the bank says.

National Security

Egypt is among four potential buyers of Russia’s S-400 air defense missile systems

Egypt is among four potential buyers of S-400 air defense missile systems from Russia, Chairman of Russia’s upper house Defense and Security Committee Viktor Bondarev tells Sputnik.

Sports

Cuper to leave Egypt after World Cup

Egyptian national football team coach Hector Cuper is likely to leave after the World Cup, team manager Eihab Laheita says, according to The Associated Press.

On Your Way Out

The Swedish film “The Nile Hilton Incident” won the Nordic nation’s equivalent of an Oscar, bagging a Guldbaggen for film of the year, according to Egyptian Streets. The film is directed by Tarik Saleh and is set in Cairo around the events of 2011. The film also picked up best actor honors for lead Fares Fares, best cinematography, best costume and best sound, capping a strong run since debuting at the Sundance Film Festival last year. Saleh had wanted to shoot the film in Cairo, but was denied permits and so moved production to Morocco.

A coffee shop in Egypt is making the rounds of social media for all the wrong reasons after putting live goldfish in the water bowl at the bottom of their shishas, according to Al Arabiya.

The Market Yesterday

EGP / USD CBE market average: Buy 17.6610 | Sell 17.7610

EGP / USD at CIB: Buy 17.65 | Sell 17.75

EGP / USD at NBE: Buy 17.65 | Sell 17.75

EGX30 (Tuesday): 15,197 (-0.3%)

Turnover: EGP 1.0 bn (11% BELOW the 90-day average)

EGX 30 year-to-date: +1.2%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.3%. CIB, the index heaviest constituent closed down 0.4%. EGX30’s top performing constituents were Amer Group up 3.1%; Ezz Steel up 1.8%; and Orascom Telecom Media & Technology up 1.4 %. Yesterday’s worst performing stocks were Sidi Kerir Petrochemicals down 2.0%; Domty down 1.5%; and Eastern Co. down 1.2%. The market turnover was EGP 1.0 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -25.6 mn

Regional: Net Short | EGP -39.5 mn

Domestic: Net Long | EGP +65.1 mn

Retail: 56.9% of total trades | 58.0% of buyers | 55.8% of sellers

Institutions: 43.1% of total trades | 42.0% of buyers | 44.2% of sellers

Foreign: 26.5% of total | 25.2% of buyers | 27.7% of sellers

Regional: 11.0% of total | 9.2% of buyers | 13.0% of sellers

Domestic: 62.5% of total | 65.6% of buyers | 59.3% of sellers

WTI: USD 64.74 (+1.84%)

Brent: USD 70.14 (+1.61%)

Natural Gas (Nymex, futures prices) USD 3.53 MMBtu, (+9.52%, February 2018 contract)

Gold: USD 1,340.7 / troy ounce (+0.66%)

TASI: 7,493.9 (+0.17%) (YTD: +3.7%)

ADX: 4,643.69 (+0.31%) (YTD: +5.58%)

DFM: 3,478.7 (-0.65%) (YTD: +3.22%)

KSE Weighted Index: 419.66 (-0.13%) (YTD: +4.54%)

QE: 9,254.61 (+0.47%) (YTD: +8.58%)

MSM: 4,978.01 (-0.22%) (YTD: -2.38%)

BB: 1,333.79 (-0.08%) (YTD: +0.16%)

Calendar

25 January (Thursday): 25 January revolution / Police Day, national holiday.

29-30 January (Monday-Tuesday): Seamless North Africa, The Nile Ritz-Carlton, Cairo.

30 January-01 February (Tuesday-Thursday): CI Capital’s MENA Investor Conference, Four Seasons Nile Plaza, Cairo.

3-4 February (Saturday-Sunday): Egypt Investment Forum, Semiramis Intercontinental Hotel, Cairo.

05 February (Monday): Egypt’s Emirates NBI PMI reading for January announced.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

19-20 February 2018 (Monday-Tuesday): The Banking Tech North Africa, The Nile Ritz-Carlton, Cairo

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s “World of Possibilities” Conference, Cairo/Luxor.

05-07 March (Monday-Wednesday): EFG Hermes’ One on One Conference 2018, Atlantis, The Palm, Dubai, UAE.

28-31 March 2018 (Thursday-Sunday): Cityscape Egypt, Cairo International Convention Centre, Cairo

08 April (Sunday): Easter Sunday, national holiday.

09 April (Monday): Sham El Nessim, national holiday.

24-25 April (Tuesday-Wednesday): Renaissance Capital’s 3rd Annual Egypt Investor Conference, Cape Town, South Africa.

25 April (Wednesday): Sinai Liberation Day, national holiday.

01 May (Tuesday): Labour Day, national holiday.

4-6 May 2018 (Friday-Sunday): International Conference on Network Technology (ICNT 2018), venue TBD, Cairo.

15 May (Tuesday): Expected date for the start of Ramadan begins (TBC).

15-17 June (Friday-Sunday): Eid Al Fitr (TBC), national holiday. (Look for possible Monday off given the first day falls on a Friday.)

21-25 August (Tuesday-Saturday): Eid Al Adha (TBC), national holiday

11 September (Tuesday): Islamic New Year (TBC), national holiday.

06 October (Saturday): Armed Forces Day, national holiday.

20 November (Tuesday): Prophet’s Birthday (TBC), national holiday.

22 November (Thursday): US Thanksgiving.

25 December (Tuesday): Western Christmas.

01 January 2019 (Tuesday): New Year’s Day, national holiday.

07 January 2019 (Monday): Coptic Christmas

25 January 2019 (Friday): Police Day, national holiday.

25 April 2019 (Thursday): Sinai Liberation day, national holiday.

28 April 2019 (Sunday): Easter Sunday, national holiday.

29 April 2019 (Monday): Easter Monday, national holiday.

01 May 2019 (Wednesday): Labor Day, national holiday.

06 May 2019 (Monday): First day of Ramadan (TBC)

05-06 June 2019 (Wednesday-Thursday): Eid El Fitr (TBC)

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.