- As expected, CBE leaves interest rates on hold. (Speed Round)

- Egypt M&A and IPO activity to peak in 2019 -Baker McKenzie. (Speed Round)

- Egypt being eyed as among riskiest bonds by EM money managers after Venezuela default. (Speed Round)

- El Sewedy to establish six logistics warehouses in sub-Saharan Africa. (Speed Round)

- Major NCMP shareholders accept Cairo Three A MTO, ADM might remain in pursuit. (Speed Round)

- Kuwait officially lifts ban on Egyptian agricultural imports, to enforce stricter inspection measures. (Speed Round)

- Nine prominent UAE investors are looking to grow their business in Egypt. (Speed Round)

- Egypt could sign agreement with France for 12 new Rafale jets in weeks; may also add to Gowind corvette fleet. (Speed Round)

- The Market Yesterday

Sunday, 19 November 2017

All eyes cast to December meeting after CBE leaves interest rates on hold

TL;DR

What We’re Tracking Today

The House of Representatives is expected to vote on two pieces of controversial legislation today, according to Ahram Online. Chief among them: the Labor Unions Act, which has been widely criticized by independent labor unions in Egypt, the International Labor Organization (ILO) and Egyptian presidential candidate and human rights lawyer Khaled Ali. Ali had said last week that law the violates workers’ constitutionally protected right to unionize, Al Mal reports. The Egyptian Federation of Independent Trade Unions had raised similar concerns at meetings with the UN-affiliated ILO last week, particularly noting that the legislation outlaws the establishment of independent trade unions. The organization relayed those concerns to the House Manpower Committee last week, which claimed to have made amendments that would make the act more palatable to the ILO.

The House is also to vote today in plenary session on the Youth Institution Act, which bans political activity at public youth clubs. House Speaker Ali Abdel Aal, wearing his ‘Defender of Democracy’ t-shirt beneath his suit, had apparently said that “the exercising of political activities should be confined to licensed political parties only.” Parliament may also decide today on a law restricting the sale and ownership of drones.

In the region and around the world:

Drama at the London Stock Exchange: Under pressure from an activist hedge fund, directors of the LSE are debating publishing a dossier on Xavier Rolet’s “hard-charging management style … to defend themselves against accusations of wrongly forcing him to resign,” the FT reports. Rolet said last month that he would step down by the end of 2018.

Saudi anti-corruption drive chills foreign investors: “Half my Rolodex is in the Ritz right now. And they want me to invest there now? No way,” said one senior investor. “The wall of money that was going to deploy into the kingdom is falling apart,” reports the Financial Times.

Zimbabwe’s ruling ZANU-PF will meet today to sack President Robert Mugabe and reinstate the vice president he dismissed, Reuters reports.

You won’t be buying (or getting) Apple’s HomePod smart speakers for Christmas — not even by Coptic Christmas, it seems. “We can’t wait for people to experience HomePod … but we need a little more time before it’s ready for our customers. We’ll start shipping in the US, UK and Australia in early 2018,” Apple said on Friday. The Verge has the story, Reuters has analysis.

“But it’s gadget season,” you cry. Don’t worry. The Verge (exhaustive) and the Financial Times (ultra-short) have got you covered with two of the best gadget guides on the interwebs.

What’s with all the focus on holiday gift-giving? It’s Thanksgiving week in the United States, which kicks off peak holiday retail season beginning with Black Friday and Cyber Monday. Thanksgiving is on Thursday, and the New York Times has got you covered if you’re in the US or otherwise planning to participate in mass consumerism with its “How to Shop Smart on Black Friday (and Cyber Monday).”

Egyptians never miss the opportunity to (a) engage in random acts of passionate consumerism or (b) celebrate a holiday (ours or someone else’s, it doesn’t matter). With that in mind: Black Friday (or White Friday, as some insist) looks set to be bigger than ever in Egypt this year, if the spend on outdoor advertising around the capital city is any gauge. (Those ads following us around the interwebs are getting rather persistent, too.) We’ll be watching to see whether this year’s lineups eclipse those on Black Friday last year, which saw shops mobbed just weeks after the float of the EGP.

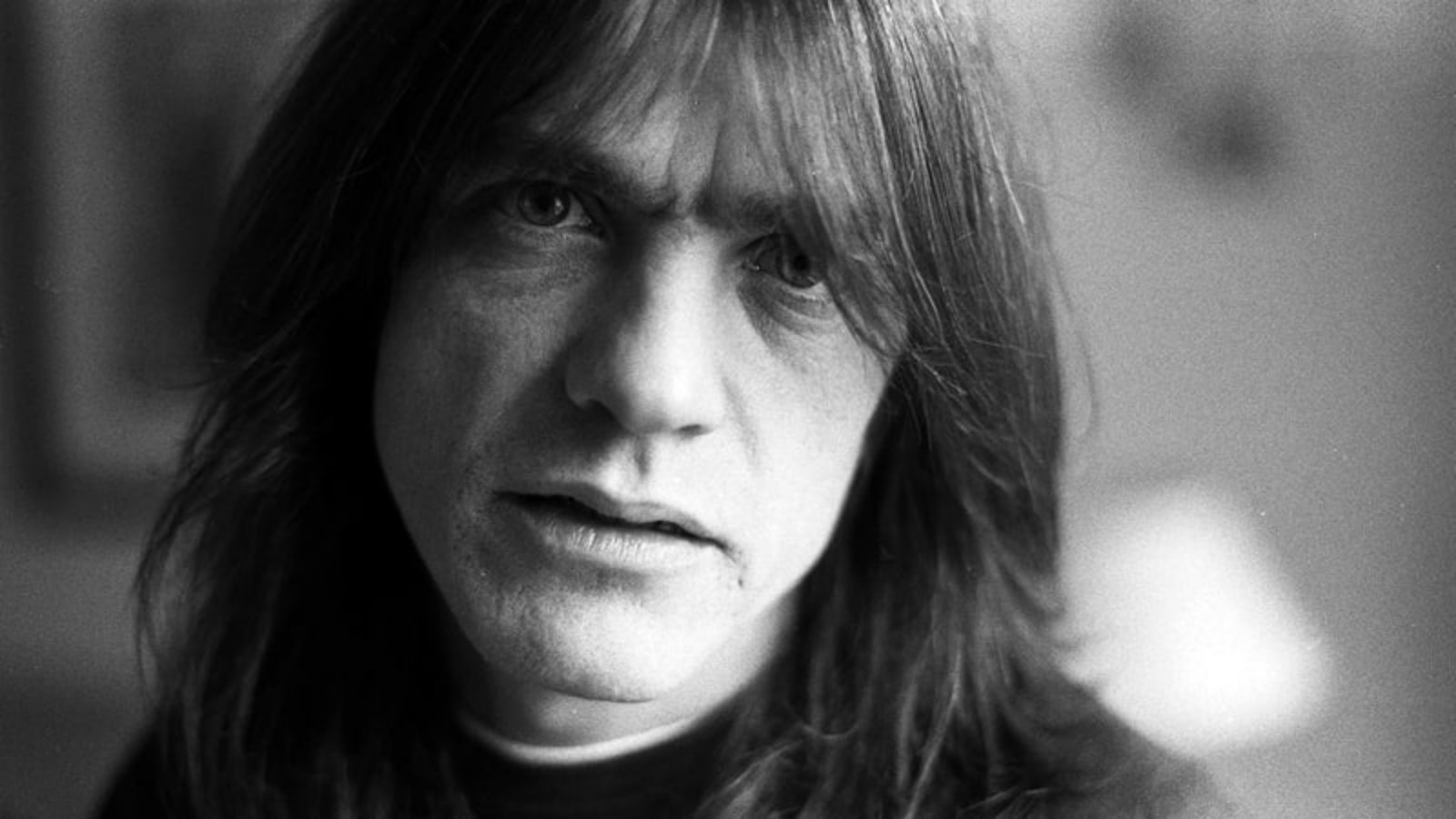

The soundtrack for this morning’s Edition: Everything AC/DC, following the death overnight of founding band member and guitarist Malcolm Young. See obits in Rolling Stone and the New York Times. We love how the faceless editors at Apple Music put it: “Their mechanized swing … is so elemental that it essentially serves as the root DNA of the unholy trinity: heavy metal, hard rock and punk.”

Among the most-clicked stories in Enterprise last week:

- Businesses need to help middle- and upper-income staff keep pace with inflation (Enterprise)

- Panelist tells off moderator at Sharm El Sheikh global youth conference (Youtube, runtime: 2:32)

- The upstart Saudi prince who’s throwing caution to the winds (for a cameo by a Mubarak-era minister said to be advising MbS) (New York Times)

- Egypt’s CIB to boost Tier 2 debt as it looks to African growth (Reuters)

- The Swiss photographer who rebranded Egypt (1843 magazine) (tie)

- Fears for Lebanese economy if Saudis impose Qatar-style blockade (Reuters) (tie)

We welcomed new subscribers last week from of companies and institutions including: Dell, EG Bank, Okaz, CIB, Sawari Ventures, Elsewedy Electric, UBS, Ripplewood Advisors, Bechtel, Hyde Park, Thyssenkrupp, HSBC, the British Council, NBK and dozens more.

What We’re Tracking This Week

President Abdel Fattah El Sisi is in to Nicosia on Monday to attend a trilateral summitwith Cypriot President Nicos Anastasiades and Greek Prime Minister Alexis Tsipras on 20-21 November. The summit will be the fifth, following a series of meetings between the heads of state that began in November 2014.

Enterprise+: Last Night’s Talk Shows

Topping the conversation on the airwaves last night was President Abdel Fattah El Sisi’s sharp warning to Ethiopia on the Grand Ethiopian Renaissance Dam (GERD) after that country, along with Sudan, failed to approve a study on its potential effects. Surprisingly, the comments led to an interesting discussion on the perils of rice cultivation.

Background: “Water is a matter of life or death,” El Sisi said, adding that “no one can touch Egypt’s share of water,” according to the Associated Press says. The remarks came after discussions over GERD reached a stalemate last week when the study confirmed the dam would cut into Egypt’s supply of Nile water. El Sisi is expected to meet Ethiopia’s prime minister in Cairo in December to further talks on the issue. House representatives last week had also declared they would not sign off on the GERD agreement until Egypt’s share of water was secure.

House rattle saber: The head of the African Relations Committee at the House of Representatives, El Sayed Felaifal, told Masaa DMC’s Eman El Hosary that Ethiopia’s actions is a deliberate provocation to Egypt (watch, runtime: 6:27).

Hona Al Asema’s Lamees Al Hadidi took President El Sisi’s comments as an urgent call to action for Egyptians to cut their use of water. She was particularly critical of rice cultivation. “82% of Egypt’s share of the Nile goes towards agriculture, with rice cultivation consuming 25% of that amount,” she said (watch, runtime: 2:26). She delved further on the subject with Irrigation Ministry spokesperson Hussam El Emam, who said that illegal rice cultivation covers an area of 650K feddans, consuming between 2.5-3 bn cubic feet of water. He added that the ministry is currently resorting to fines of up to EGP 3,000 per feddan for violators (watch, runtime: 3:43).

Kol Youm’s Amr Adib was also honed in on water conservation and the perils of growing rice. He called for halting cultivation of rice altogether and only import the crop (watch, runtime: 2:09). As we’ve said before, exporting rice is effectively exporting water.

El Sisi’s statements came during the inauguration of what the local press is calling the Middle East’s largest fish farm in Kafr El Sheikh. The EGP 4 bn project took 18 months to complete and will also be home to a fish feed factory (watch, runtime: 7:07).

Speed Round

The Central Bank of Egypt’s Monetary Policy Committee left interest rates on hold at its Thursday meeting, in line with expectations. Overnight deposit and lending rates remained unchanged at 18.75% and 19.75%, respectively, with the discount rate also steady at 19.25%. The move indicates “that further declines in inflation were needed to warrant a shift towards a looser policy,” Reuters says. The CBE is watching for inflation to cool below the 30% marker to 13% by 4Q2018 and single digits afterwards. Annual headline and core inflation rates had dropped for a third consecutive month in October to 30.8% and 30.5%, after climbing to a high of 33.0% and 35.3% in July, “supported by the combination of previous policy rate increases and the recent appreciation of the EGP against trading-partner currencies,“ the CBE said in a statement. “Against this background, the MPC decided that current policy rates remain appropriate…The baseline inflation outlook remains consistent with achieving the CBE’s inflation targets.”

Middle East and Africa M&A activity is forecast to peak at USD 41 bn and domestic IPOs at USD 7 bn in 2019, according to Baker McKenzie’s Global Transactions Forecast report. The report expects Egypt to follow suit, suggesting we’ll see USD 1.084 bn in domestic M&A transactions in 2018, growing to USD 1.551 bn in 2019, and then dropping to USD 1.051 bn by 2020. Regional cross-border M&A activity for the same years is expected to be USD 3.154 bn, USD 3.866 bn. And USD 3.794 bn from 2018 to 2020.

Egypt IPO outlook: The report sees the total value of IPOs in Egypt rising to USD 332 mn in 2018 from USD 226 mn this year. Total IPO values in Egypt will then peak at USD 549 mn in 2019 before falling to USD 275 mn in 2020, Baker forecasts. Egypt fell on Baker McKenzie’s Transaction Attractiveness Indicator to 39th from 36th in 2016. The indicator rates the attractiveness of a country’s environment for M&A and IPO activity based on 10 key economic, financial and regulatory factors that are typically associated with higher M&A and IPO activity. You can download the full report here (pdf) or browse the landing page here.

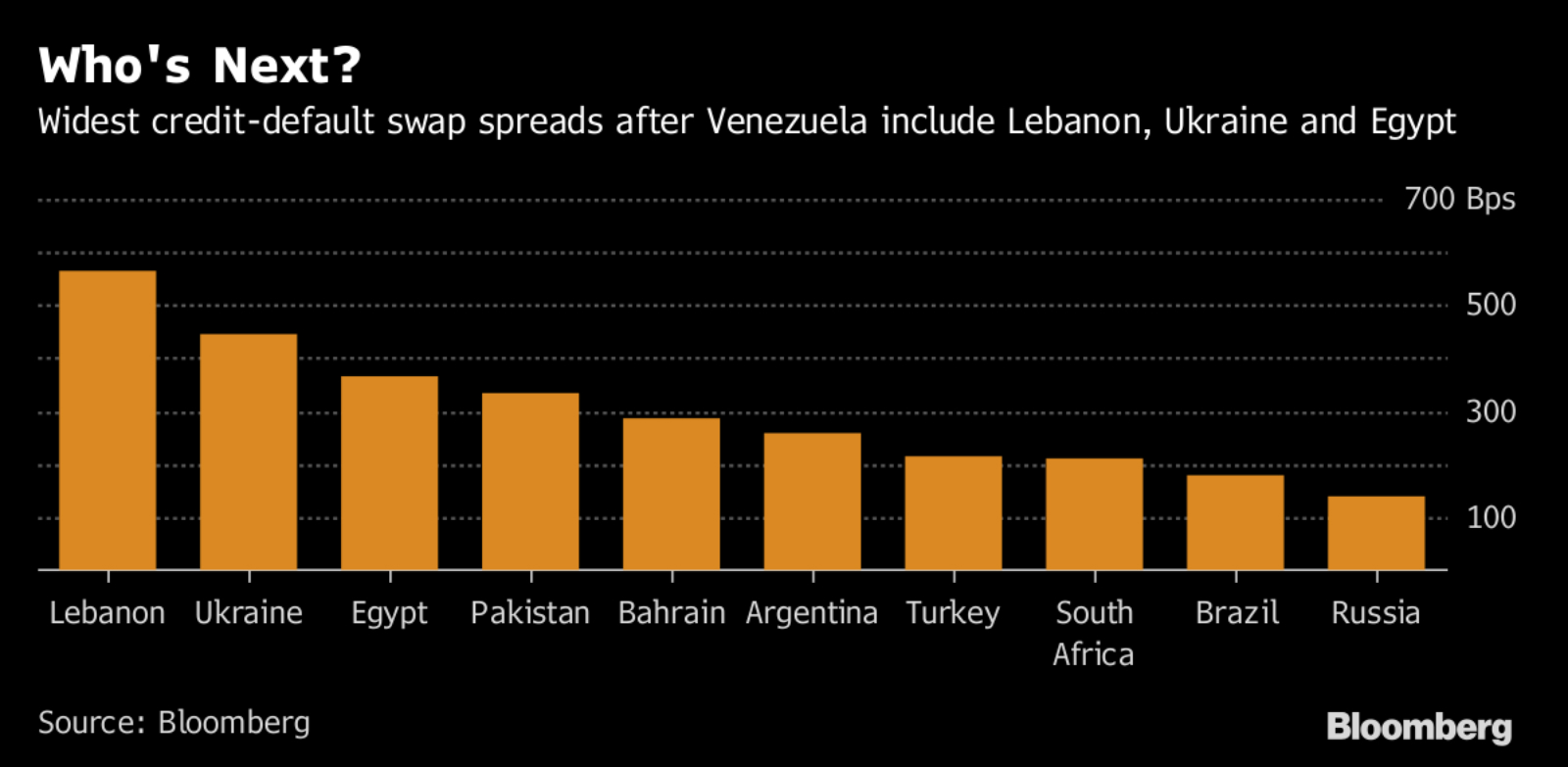

Egypt is one of several “risky” sovereign bonds being looked at more closely by emerging markets money managers as Venezuela defaults on loans and the Lebanon crisis unfolds, write Ben Bartenstein and Justin Villamil for Bloomberg. Egypt, along with Lebanon, Pakistan and the Ukraine, have the widest credit default swap spreads after Venezuela. Egypt’s credit-default swaps are hovering near their highest since September. The cost for protection surged in June as regional tensions heated up amid a push by the Saudis to isolate Qatar. “While Egypt has been able to boost FX reserves and is on course to repay USD 14 bn in principal and interest in 2018, its foreign debt has climbed to USD 79 bn from USD 55.8 bn a year earlier.” Finance Minister Amr El Garhy had long downplayed the rise in Egypt’s foreign debt, saying that they were in acceptable and manageable margins.

Elsewedy Electric is working to grow its (already prodigious) exports and aims to establish six logistics warehouses in the next five years, CEO Ahmed El Sewedy told Reuters. El Sewedy said the warehouses would be in Zambia, Djibouti, Kenya and elsewhere. “The company is also studying expanding in Latin America, Kazakhstan, Indonesia and Pakistan within two years,” he added. SWDY’s other overseas expansion plans include a 2 mn sqm state-of-the-art industrial zone that it intends to begin developing in Ethiopia during 2018, General Manager of Industrial Development Mohamed El Kammah said, according to Al Shorouk.

Here at home, the company plans to spend EGP 2 bn through to the end of 2017 to develop a 1 mn sqm area in three industrial zones, El Kammah said, according to Al Mal. The zones will be in 10 Ramadan City, 6 October and Ain Sokhna, he added. The company is “looking for opportunities to develop industrial sites in Al Alamein,” said Elsewedy. El Sewedy also noted that manufacturing in Egypt had become attractive for the domestic and export markets and that his company now exports 70% of its output to over 110 countries, buoyed by the cheaper EGP.

M&A WATCH- Major NCMP shareholders accept Cairo Three A MTO, ADM might remain in pursuit: National Company for Maize Products (NCMP) shareholders Misr Capital Investments and National Bank of Egypt have accepted Cairo Three A’s mandatory tender offer to acquire their stakes in the company at EGP 51 per share, according to a bourse statement. The shareholders own a combined 52.61% stake in NCMP. Still unresolved is the issue of why Archer Daniels Midland’s (ADM) bid for the company was rejected by the Financial Regulatory Authority. ADM has directed its counsel on the acquisition, Shahid Law, to petition the FRA for an explanation. ADM is also asking Investment Minister Sahar Nasr, with whom ADM executives had met several times to discuss the transaction, to clarify what’s going on. The global commodities player is meanwhile said to be considering upping its bid for NCMP to EGP 55 per share, sources tell Al Mal.

M&A WATCH- UAE-based private equity firm Gulf Capital is considering investing USD 110 mn in Egypt over the coming two years in the marine industries, logistics and infrastructure sectors, the firm’s Managing Director Walid Cherif tells Daily News Egypt. The company is in talks to acquire a stake worth USD 25-30 mn in port logistics company Amiral Holdings, he said. Cherif did not specify any other targets, but said his firm was targeting on-controlling interests of 10-50% for a period of between five to seven years before making an exit.

Only six suppliers presented offers in General Authority for Supply Commodities (GASC)’s wheat purchase tender on Thursday, Reuters reported. “Several major trading houses were absent with [traders] saying uncertainty about whether shipments will again be rejected because of Egypt’s food safety inspection system.” Reuters adds that Jean Philippe Everling, CEO of Italian trading house Casillo’s French subsidiary TransGrain, “said concern about ergot was a factor along with delayed payments and continued uncertainty about cargoes being rejected because they contained poppy seeds.” Everling says “people are waiting for a clearer picture.” A court ruling last Tuesday cancelled the cabinet’s decree that allows wheat shipments containing up to 0.05% ergot content, the common international standard.

The latest chapter in the Neverending Ergot Story comes as the Supply Ministry is looking to develop 75 wheat silos over the coming two years, Supply Minister Ali El Moselhy said on Saturday. Each silo will have a storage capacity of up to 5,000 tonnes, he added, according to Al Borsa. It is unclear whether any of the aforementioned silos is part of the USD 150 mn second phase of the shouna development program which was awarded to Blumberg Grain. The company is developing 300 shounas in cooperation with the Armed Forces’ Engineering Authority.

Meanwhile, the Military Productions Ministry has formed a JV with Russian agriculture conglomerate Rusagro called Rusagro Egypt, which will develop mills and silos and manufacture machinery and equipment for them, Daily News Egypt reports.

Kuwait officially lifts ban on Egyptian agricultural imports, to enforce stricter inspection measures: The Kuwaiti Trade and Industry Ministry announced on Thursday that it has lifted a ban it had imposed on Egyptian agricultural imports due to concerns over pesticide residue, Kuwait’s state news agency reports. The decision to lift the ban on Egyptian onions, lettuce, peppers, and guava was based on recommendations from the country’s main authority on food safety, which deemed the crops safe for consumption. These crops will also face stricter inspection measures for the coming three months at least, as authorities intend to sample all incoming shipments and create a database of the main importers of these crops to ensure appropriate action is taken in case of violations. Kuwait’s Health Minister denied yesterday that some shipments had been released from customs, as news reports had suggested, confirming that they are still pending the paperwork outlined in Thursday’s decision.

Bahrain, Saudi, the UAE, and Jordan are said to have also lifted their respective bans on Egyptian produce. Egypt’s ministries of trade and agriculture are working on new regulations that are expected to improve quality and boost overall exports.

Nine prominent UAE investors are looking to grow their business in Egypt, they told Investment Minister Sahar Nasr and Suez Canal Economic Zone (SCZone) chief Mohab Mamish in meetings this weekend, according to a ministry statement. The minister, who was on a roadshow to the UAE to pitch potential projects to new investors, met with various company heads, with interests ranging from renewable energy and logistical zone development in the Suez Canal area, to transport, health, education, and vocational training. Those included Abraaj Capital Managing Partner and Global Head of Private Equity Mustafa Abdel‐Wadood, Aldahra Holdings’ Egypt General Manager Sulaiman Al Nuaimi, the CEO of Abu Dhabi Future Energy Company (Masdar) Mohamed Jameel Al Ramahi, Emirates’ Steel CEO Saeed Ghumran Al Remeithi, Bin Omeir Holding Group CEO Mohammed bin Omeir, and Al Habtoor Group Chairman Khalaf Al Habtoor.

Nasr and Mamish also sat down with officials from the Abu Dhabi Investment Authority, who were invited to visit the SCZone to inspect possible projects more closely, as well as the Director General of Dubai’s Department of Economic Development Sami Al Qamzi.

Egypt could sign agreement with France for 12 new Rafale jets in weeks: Egypt could sign an agreement with France for the purchase of 12 new Rafale fighter jets in a few weeks’ time, sources close to the matter told La Tribune on Thursday. French Foreign Minister Jean-Yves Le Drian reportedly finalized the transaction with President Abdel Fattah El Sisi at the Sharm El Sheikh World Youth Forum last week. Negotiations for the agreement had reportedly started last year but stalled over financing issues, only to start again during El Sisi’s meeting with French President Emmanuel Macron in Paris last month. Sources tell the newspaper that Macron intervened on behalf of the Egyptian government, asking France’s Economy and Finance Ministry to go easier on the financing terms. The agreement could also include two new Gowind corvettes from Dassault. Egypt and France had signed a EUR 5.2 bn agreement in 2015 for 24 Rafale jets, a Fremm naval frigate, and MBDA air-to-air missiles.

EARNINGS WATCH- EFG Hermes reported a 476% y-o-y increase in net profit after tax and minority interest to EGP 237 mn in 3Q2017. Revenues also increased by 184% y-o-y to EGP 834 mn. CEO Karim Awad. “The final months of 2017 will see us make important headway in our strategic goal of expanding our product base,” CEO Karim Awad. He added: “Withstanding the inherent seasonality during the third quarter due to a slow summer season and a number of holidays, our strategy to diversify our product base and expand into newer markets continues to create significant value for our shareholders with another very strong quarter reported by the Firm, in which growth was largely driven by a suite of new initiatives under this strategy.”

Also on Thursday:

- Egyptian Resorts Company posted a net profit after tax of EGP 55.6 mn in 9M2017, compared to a loss of EGP 29.6 mn in 9M2016, according to a bourse filing.

- Credit Agricole Egypt reported an increase of 61.47% y-o-y in net profit after tax for 3Q2017, which came in at EGP 554.5 mn compared to EGP 343.4 mn in the comparable period last year.

Orascom Development is looking to acquire 2 mn sqm of land in the North Coast for a Gouna-type resort, CEO Khaled Bichara said in a statement to the press. Bichara kept details to a minimum, adding only that a contract had been signed with another private sector company to co-develop the land but that work is still very early stage. Bichara said the company’s global land bank amounted to 100 mn sqm, adding that it is one of the largest investors in Swiss property with 1 mn sqm of land, according to Al Mal.

Speaking on the sale of Tamweel Financial Holding, Bichara said that the company expects to complete the transaction in 1Q2018, and that the company was still mulling its offers. We had noted last month that the company had received four bids on Tamweel. Orascom Development had blamed rising interest rates for the sale. EFG Hermes is sell-side advisor on the transaction.

Commenting on the company’s 3Q2017 results, Bichara said in a statement to Enterprise that the quarter proved the success of our new management strategy toward a destination based model. “We will continue to build on this operational win and we foresee a positive quarter ahead of us. In parallel we are working towards reducing our debt by a further EGP 700 mn to EGP 1 bn,” he added.

The foreign ministers of the Arab quartet boycotting Qatar will meet Arab League Secretary General Ahmed Aboul Gheit in Cairo today, Reuters reports, citing the state news agency. It remains unclear what the meeting will entail, but it precedes “an urgent gathering of Arab foreign ministers to discuss Iranian actions in the region.” Will the Lebanese show or not? Lebanon’s foreign minister is leaving to the last minute his decision to attend the AL meeting, a senior Lebanese official told Reuters, and Lebanese Prime Minister (?) Saad El Hariri is in Paris, but media chatter has him in Beirut by Wednesday to take part in national day celebrations.

Egypt in the News

Topping coverage of Egypt in the international press this morning was the Rafah crossing being opened and run by the Palestinian Authority for the first time since 2007. The crossing was opened for a limited period of three days, and Egypt has not yet signalled it will keep the crossing open beyond that, Reuters notes. Some 30,000 Gazans have reportedly applied to enter Egypt since the beginning of the month, Palestinian Interior Ministry sources said. Egypt had reportedly delayed the crossing “due to internal Egyptian reasons,” Fatah Central Committee member Azzam Al Ahmad says, according to WAFA News Agency.

Egypt has no desire to be dragged into a military conflict or to see regional tensions spiral into another Saudi-Iran proxy battle, Hamza Hendawi writes for The Associated Press. Egypt’s stance comes despite Saudi Arabia and other GCC countries’ expectation that it will have their back as tensions rise with Iran. Hendawi says this reluctance on Egypt’s part could lead to frictions between Cairo and Riyadh. He writes that “Egypt’s track record under el-Sissi shows his reluctance toward military action unless its own territory is directly threatened or if the Gulf is subjected to a clear-cut aggression.”

Also worth a quick skim this morning:

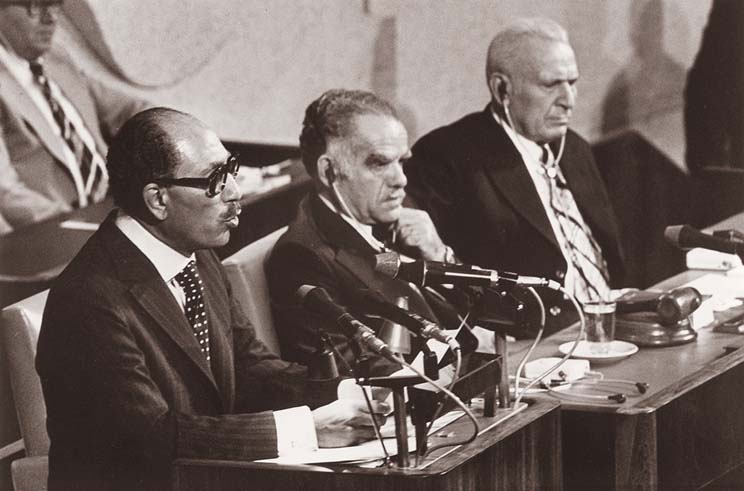

- The Palestinian-Israeli Peace Process needs another figure like Anwar Sadat, Zev Chafets writes for Bloomberg, who draws on his experience working as head of the press office for the Israeli government during Sadat’s visit to the Knesset in the ‘70s.

- While ties have been warming, Egypt still maintains a “cold peace” with Israel, Adam Abrams writes for The Algemeiner. President Abdel Fattah El Sisi has been a “warmer partner for Israel” than predecessor Mohamed Morsi, but hasn’t really deepened bilateral relations.

- Khaled Ali’s chances in the presidential elections depend on winning a unified endorsement from civil parties and forces, running a good campaign, and having international supervisors present, Khalid Hassan writes for Al-Monitor.

- British tourist Laura Plummer is going to stand trial on 25 December for bringing to Egypt meds for her husband, The Sun reports.

On Deadline

A voice of reason: A bill that would make “insulting” historical figures a jailable offense must be recognized as an attempt to stifle freedom of expression and voted down immediately, Dorreya Sharaf El Din says. She takes to the pages of Al Masry Al Youm to call for the bill to be voted down immediately to preserve people’s freedom of thought and space for critical thinking. She also points out the legislation’s many pitfalls, including the ambiguity of the term “historical figures,” which she warns could end up being a catchall category.

Diplomacy + Foreign Trade

Trade and Industry Minister Tarek Kabil will lead a delegation of businessmen to Rome in the near future, according to a ministry statement. Kabil made the announcement without specifying a date after a meeting with Italian ambassador Gianpaolo Cantini.

The Export Development Fund has agreed to increase its subsidy for shipping fees to Iraq and Libya by 50% in a bid to encourage exports to both markets, Trade and Industry Minister announced on Friday, according to Al Borsa.

The European Bank for Reconstruction and Development (EBRD) and the Investment Ministry signed a letter of intent to cooperate on fostering entrepreneurship and innovation, according to an emailed press statement.

Foreign Minister Sameh Shoukry met with Djibouti counterpart Mahamoud Ali Youssoufin Cairo yesterday. The two sides are currently studying two possible agreements: One between the Suez Canal Authority and Djibouti’s Port Authority and another that could see Egypt establish a maritime shipping training facility in Djibouti.

Shoukry also held cooperation talks with Jordanian counterpart Ayman Al-Safadi, where the discussion centered around regional developments, including the situations in Libya, Yemen, and Syria.

Egypt and Uganda sponsored the signing of a declaration of unity between two factions of the Sudan People’s Liberation Movement at Egyptian Intelligence headquarters in Cairo, Ahram Online reports.

Energy

Fugro deploys vessel for coring at Zohr

Geotechnical and survey services provider Fugro is sending its vessel MV Kobi Ruegg on it first project in the Egyptian sector of the Mediterranean, Offshore Magazine reports. “The three-year-old, 58-m (190-ft) long vessel, contracted by Saipem, will deploy a large diameter piston core system to obtain soil samples from the ultra-deepwater Zohr gas field. Its next assignments will be geophysical surveys for Pico and Shell… From its new home port of Abu Qir, it will undertake marine site characterization services for Fugro’s clients in the Eastern Mediterranean and Red Sea.” The values of the contracts were not disclosed.

Gov’t to issue maintenance and management tender for three Siemens power plants next month

The Electricity Ministry plans to issue its limited tender for the management and maintenance of the three Siemens combined-cycle power plant of the new capital, Burullus and Beni Suef next month, ministry sources tell Al Borsa. Siemens, Germany’s STEAG GmbH, an Orascom-ADERA Energy consortium, and an Elsewedy-EDF consortium have been tapped to take part in the tender, and had submitted their offers in July. The ministry will select the winning company early next year, the sources added.

ADES awarded long term contract for ADMARINE III jack-up rig

ADES International has been awarded a new contract for its ADMARINE III offshore jack-up rig from the General Petroleum Company (GPC). The contract is for an initial two-year period with an option to extend that for another two years. “ADMARINE III was originally leased out to GPC back in 2012 and marked ADES’s first steps into the offshore drilling market.” ADES CEO Mohamed Farouk says “our commitment to providing tailored solutions and superior services to our clients has enabled ADES to maintain long-term relationships with high-profile local and international energy companies, ensuring the continuity of our business during challenging climate.”

Infrastructure

Armed Forces to start work on East Port Said desalinization plant

The Armed Forces’ Engineering Authority is set to start work on a 150k cubic meters per day, USD 130 mn desalination plant in East Port Said,according to Al Borsa. We first caught wind of this as part of a broader announcement by the authority to build four different desalinization plants across four locations in June but the cost wasn’t disclosed.

Real Estate + Housing

Tower Developments invests in Port Said and Sharm El Sheikh

Tower Developments will build a EGP 5 bn in a resort in Port Said and EGP 1 bn on a Sharm El Sheikh hotel,CEO Ahmed Lashin told Al Borsa. The first phase of the ‘Tower Bay’ Port Said project, which should be completed in four years, will cost EGP 800 mn and consists of a commercial area, a 215 room Hilton hotel, 209 homes and a school. Tower Bay appears to be the same project that Port Said governor Adel Al Ghadban broke ground on at the end of October.

Tourism

EgyptAir and LOT agree to code share; Baku to Sharm El Sheikh flights resume

EgyptAir and LOT Polish Airlines signed a code sharing agreement that will open up routes between Cairo and Warsaw as of 17 November,according to Al Shorouk.The code sharing agreement will allow passengers access to the respective home ports via stops in Milan and Budapest as well as automatic transfer of luggage between flights. Both airlines are members of the Star Alliance.

Flights to Sharm from Baku to resume in March 2018

Flights to Sharm El Sheikh from Baku, Azerbaijan, will resume in March 2018, sources close to the matter told Youm7. The agreement comes after South Sinai Governor Khaled Fouda’s visit to Azerbaijan, where he met with airline officials as well Azerbaijani Foreign Minister Mohamed Yarov. Flights between the two cities had been suspended for a year on what appeared to be a lack of demand.

1 mn German and 650k Ukrainian tourists through Egypt, Polish Chamber of Tourism in Marsa Alam

1 mn German tourists have made their way to Egypt so far this year, tourism consultant Mohamed Abdel Jaber told Youm7. He added that January to mid-November saw a 90% increase in demand from German tourists which is reflected in the 190 flights between the two countries every week. Ukrainian tourists have numbered 650k so far this year despite warnings from their government about traveling here, according to Ukrinform. Abdel Jaber, who covers the Polish market as well, also said the Polish Chamber of Tourism (PIT) would hold its annual meeting in Marsa Alam between 25 November and 2 December.

Isis Temple unearthed in Qalyubia

An archaeological team excavated the foundations of a temple dedicated to Ancient Egyptian goddess Isis in the Qalyubia area, according to The Egypt Independent. The discovery was initially made by accident during construction work.

Hilton seeking management contracts in the North Coast

Hilton Worldwide is looking for hotel management contracts in the North Coast city of Alamein, the Group’s Vice President of Development Carlos Khneisser tells Al Mal. The move is part of the company’s expansion plans in the country, which sees it increasing the number of hotel rooms under its administration by 40% (or some 2,500 rooms) by the end of 2022, driven by local currency stability against the USD, as well as the gradual recovery in the tourism industry.

Legislation + Policy

Cyber Crimes Act will criminalize spreading false news on Egypt by online outlets

The Cyber Crimes Act will expand the definition of online crime to include “spreading false news on Egypt,” said Nidal Saad, chair of the House of Representatives’ ICT Committee. He tells AMAY that this would not be limited to social media platforms alone, but will encompass all other outlets. As we noted in July, the law would over social media accounts to surveillance. The law would be part of three acts the committee plans to bring to a vote, the others being the Personal Privacy Act, and the Online Media Act, said Saad who offered no details on the other laws. The committee will be looking at Egypt’s version of a Freedom of Information Act and an Intellectual Property Rights Act in the next session of the House.

Egypt Politics + Economics

Investors to discuss solution for rising natural gas bills for industry with MPs on Tuesday

Industrialists to discuss rising natural gas bills with House on Tuesday: A delegation from the Union of Egyptian Investors Association (UEIA) will meet with the House of Representatives’ Industry Committee on Tuesday to discuss challenges they’re facing due to rising natural gas bills, UEIA boss ad Oriental Weavers founder Mohamed Farid Khamis said on Thursday, Al Shorouk reports. Natural gas supply has been interrupted at a number of factories that fell behind on bill payments, which they say they are unable to make, Khamis said. We had heard last week that the House was looking into repricing gas for industry and canceling real estate taxes on factories following complaints from industry figures. Egypt’s manufacturing sector has been pushing for years to lower gas prices, but officials had hinted in August that it was unlikely the Ismail Cabinet would follow through on the decision.

Saudi embassy in US denies El Adly’s role as advisor

The Saudi Arabian embassy in Washington DC denied former Interior Minister Habib El Adly’s involvement as an advisor to their government in a tweet last week. The statement comes in response to a claim made by the NYT on Tuesday.

Sports

All Egyptian squash finals at the Hong Kong Open

Another squash tournament turns into all Egyptian competition (and in some cases the same family) in both the men and women’s finals at the Hong Kong Open, King Fut reports. The tournament concludes today and will see World Number One Nour Al Sherbini take on Raneem Al Weilely in the women’s final. On the men’s side Mohamed Al Shorbagy dispatched his brother Marwan El Shorbagy in the semifinals to meet Ali Farag in the finals.

On Your Way Out

ON THIS DAY- On this day in 1977, President Anwar Sadat began his historic trip to Israel during which he offered Israel’s Knesset a peace plan a day later. Sadat was the first Arab leader ever to visit Israel. In 1863, US President Abraham Lincoln delivered the brief but renowned Gettysburg Address at the dedication of the National Cemetery in Pennsylvania during the American Civil War. The crew on board the second Apollo mission landed on the moon in 1969 as astronauts, Commander Charles "Pete" Conrad and Lieutenant-Commander Alan Bean, made a perfect landing on smooth ground between craters in the Ocean of Storms, four days after takeoff. Former Indian Prime Minister Indira Gandhi was born on this day in 1917. The EGP fell to a 19-month low of EGP 7.70 per USD 1 this time in 2014. A year later, we were reporting on Daesh’s claims that it downed the Metrojet flight 9268 using an IED.

The Market Yesterday

EGP / USD CBE market average: Buy 17.6 | Sell 17.7

EGP / USD at CIB: Buy 17.57 | Sell 17.67

EGP / USD at NBE: Buy 17.59 | Sell 17.69

EGX30 (Thursday): 13,847 (-1.3%)

Turnover: EGP 910 mn (8% below the 90-day average)

EGX 30 year-to-date: +12.2%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 1.3%. CIB, the index heaviest constituent closed down 1.6%. Cairo Oils and Soap was the only stock that closed in positive territory, up 0.4%. Today’s worst performing stocks were: Oriental Weavers down 5.3%; Amer Group down 2.9%; and Arab Cotton Ginning down 2.7%. The market turnover was EGP 910 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -103.9 mn

Regional: Net Long | EGP +37.4 mn

Domestic: Net Long | EGP +66.5 mn

Retail: 60.8% of total trades | 65.0% of buyers | 56.7% of sellers

Institutions: 39.2% of total trades | 35.0% of buyers | 43.3% of sellers

Foreign: 18.9% of total | 13.1% of buyers | 24.5% of sellers

Regional: 10.8% of total | 12.9% of buyers | 8.8% of sellers

Domestic: 70.3% of total | 74.0% of buyers | 66.7% of sellers

WTI: USD 56.55 (+2.56%)

Brent: USD 62.72 (+2.22%)

Natural Gas (Nymex, futures prices) USD 3.10 MMBtu, (+1.44%, DEC 2017 contract)

Gold: USD 1,296.5 / troy ounce (+1.43%)

TASI: 6,913.46 (+0.02%) (YTD: -4.12%)

ADX: 4,327.58 (-0.22%) (YTD: -4.81%)

DFM: 3,460.21 (-0.21%) (YTD: -2.00%)

KSE Weighted Index: 402.96 (+0.17%) (YTD: +6.02%)

QE: 7,825.77 (+0.83%) (YTD: -25.02%)

MSM: 5,105.67 (-0.11%) (YTD: -11.71%)

BB: 1,269.90 (+0.38%) (YTD: +4.05%)

Calendar

19-21 November (Sunday-Tuesday): 11th Annual INJAZ Young Entrepreneurs Competition, Four Seasons Nile Plaza, Cairo.

01 December (Friday): Prophet’s Birthday, national holiday.

01-03 December (Friday-Sunday): RiseUp Summit, Downtown Cairo.

03-05 December (Sunday-Tuesday): Solar-Tec, Cairo International Exhibition & Convention Center.

03-05 December (Sunday-Tuesday): Electrix, Cairo International Exhibition & Convention Center.

05 December (Tuesday): Egypt’s Emirates NBD PMI reading for November to be announced.

03-06 December (Sunday-Wednesday): 21st Cairo ICT, Cairo International Convention Center, Nasr City, Cairo.

07-09 December (Thursday-Saturday): The Africa 2017 forum: “Business for Africa, Egypt and the World” Conference, Sharm El Sheikh.

19 December (Tuesday): Village Capital’s Financial Health Competition: Middle East and Egypt (applications close 3 November)

28 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee to review policy rates.

12-14 February 2018 (Monday-Wednesday): Egypt Petroleum Show 2018 (EGYPS), New Cairo Exhibition Center.

17-21 February 2018 (Saturday-Wednesday): Women For Success – Women SME’s "World of Possibilities" Conference, Cairo/Luxor.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.